Cryptocurrencies have been around for over a decade now, but there has been a recent surge in their popularity during the last few years. This is partly due to the volatility of markets, which can see currencies and assets rise and fall in value by huge percentages in a very short period.

At the same time, cryptocurrency is an intrinsically risky type of digital asset. For example, the Bitcoin price rose by over 300% in just 5 years and then lost over 70% of its value in just over a year.

This volatility is also the reason why most cryptocurrencies are not used for everyday commerce. Enter stablecoins.

In this article, we will explore what stablecoins are, how they work, and the roles they play in decentralized finance (DeFi).

What is a stablecoin?

A stablecoin is a type of cryptocurrency that aims to maintain a steady value by pegging its price to another asset such as the US dollar or euro. The primary goal of stablecoins is to minimize the price volatility that is prevalent in other cryptocurrencies like Bitcoin or Ethereum.

Stablecoins aim to achieve this stability through various mechanisms, including collateralization (backing by assets) and algorithmic controls that manage the supply and demand of the coin. Their versatility means they can be used in a wide range of financial applications, from everyday transactions to advanced decentralized finance (DeFi) protocols.

How do stablecoins work?

A stablecoin's attempted stability is achieved by pegging its value to a reference asset, such as a fiat currency or a commodity. One of the most common pegs used is the US dollar, where one unit of a stablecoin is designed to be worth $1 USD.

But how is this peg actually maintained?

Stablecoin mechanisms

Depending on the type of stablecoin in question, issuers will employ a combination of collateralization, algorithmic controls, and reserve systems.

Collateralization involves backing the stablecoin with assets that hold value. These assets can include fiat currencies, cryptocurrencies, or other types of financial assets.

For example, a fiat-collateralized stablecoin like Tether (USDT) is backed by a reserve of US dollars held by the issuer, Tether Limited. If the reserves are accurate, each unit of the stablecoin can be redeemed for a corresponding unit of the fiat currency, thereby maintaining its stable $1 value.

In some cases, stablecoins are over-collateralized, meaning the value of the collateral exceeds the value of the stablecoins issued. Though it requires greater reserves, it provides an additional layer of security, helping the stablecoin to maintain its peg even in times of market stress and instability.

Minting and burning

Stablecoins are typically issued (minted) and redeemed (burned) through a process that involves smart contracts—self-executing contracts with the terms of the agreement directly written into code.

For instance, if a user wants to obtain a stablecoin, they deposit the corresponding amount of collateral, and the smart contract mints the token. Conversely, when a user wants to redeem their stablecoins, they return the coins to the smart contract, which then burns them and releases the corresponding amount of collateral.

The minting and burning process is necessary to help maintain the balance between the supply of stablecoins and the amount of collateral, helping the stablecoin to remain pegged to its underlying asset.

Smart contracts

As previously mentioned, smart contracts play a crucial role in the operation of stablecoins, particularly in decentralized stablecoins. Some of their functions include automating the issuance and redemption processes, enforcing the rules of the stablecoin system, and ensuring that the system operates transparently and without the need for a central authority.

The role of oracles in stablecoin pricing

Oracles like Chainlink (LINK) are external services that provide real-world data to blockchain networks. In the context of stablecoins, oracles are used to provide accurate and up-to-date price data for the reference asset to which the stablecoin is pegged.

For example, if a stablecoin is pegged to the US dollar, an oracle will provide the current exchange rate between the stablecoin and the dollar. This data is then used by the smart contracts to adjust the supply of the stablecoin, if necessary, to maintain its value.

Reliable data feeds

The reliability of oracles is key to the stability of stablecoins. Inaccurate or delayed data can lead to a loss of the stablecoin's peg, resulting in potential losses for users. For this reason, stablecoin issuers often use multiple oracles and aggregate their data to ensure accuracy and reduce the risk of manipulation.

What are the different types of stablecoins?

Stablecoins can be categorized into three general types: fiat-collateralized, crypto-collateralized, and algorithmic, each with its own unique mechanisms and characteristics.

Note: Europe’s MiCA (Markets in Crypto-Assets) regulation requires stablecoins to comply with strict authorization standards. Unlike USDC, neither USDT nor DAI currently hold MiCA approval, limiting their ability to serve the European market. As more platforms in the region move toward MiCA-compliant assets, both face regulatory challenges compared to authorized alternatives.

Fiat-collateralized stablecoins

Fiat-collateralized stablecoins are backed by fiat currencies held in reserve by the issuer. These are the most common and widely used type of stablecoins, with USDT and USDC dominating in terms of market capitalization and volume.

Tether (USDT)

Tether (USDT) is the leading fiat-backed stablecoin by market cap, and one of the first to be released. USDT is backed by US dollars held in reserve by Tether Limited, with each USDT meant to be worth exactly $1. Tether can be traded on many cryptocurrency exchanges and used in decentralized applications (dApps) as a stable trading pair or in liquidity pools.

USD Coin (USDC)

USD Coin (USDC) is second by market capitalization among fiat-backed stablecoins, trailing only USDT. It was first developed by the Centre Consortium, although it is currently issued by Circle and Coinbase. Like Tether, USDC is pegged to the US dollar and fully backed by dollar reserves. USDC has gained popularity for its transparency and compliance with regulatory standards, particularly in comparison to Tether.

Crypto-collateralized stablecoins

Crypto-collateralized stablecoins are backed by reserves that include other cryptocurrencies, rather than fiat currencies. These stablecoins are typically over-collateralized to account for the volatility of the underlying digital assets.

Dai (DAI)

DAI is a decentralized stablecoin issued by the MakerDAO protocol, and is possibly the most prominent example of a crypto-collateralized stablecoin. Dai is pegged to the US dollar, though it is backed by a variety of cryptocurrencies, primarily Ethereum (ETH). Dai's price peg is maintained through smart contracts that manage the stablecoin collateral and ensure that the system remains solvent even during periods of market volatility.

Wrapped tokens are another type of crypto-collateralized cryptocurrency, though they are not actually stablecoins themselves. For example, Wrapped Ether (wETH) and Wrapped Bitcoin (WBTC) function in a similar manner to stablecoins because they are backed in a 1:1 ratio to other crypto assets (ETH and BTC, respectively).

Algorithmic stablecoins

Algorithmic stablecoins utilize algorithms and smart contracts to control the supply of the stablecoin and maintain its peg to a reference asset. Unlike collateralized stablecoins, algorithmic stablecoins do not rely on reserves.

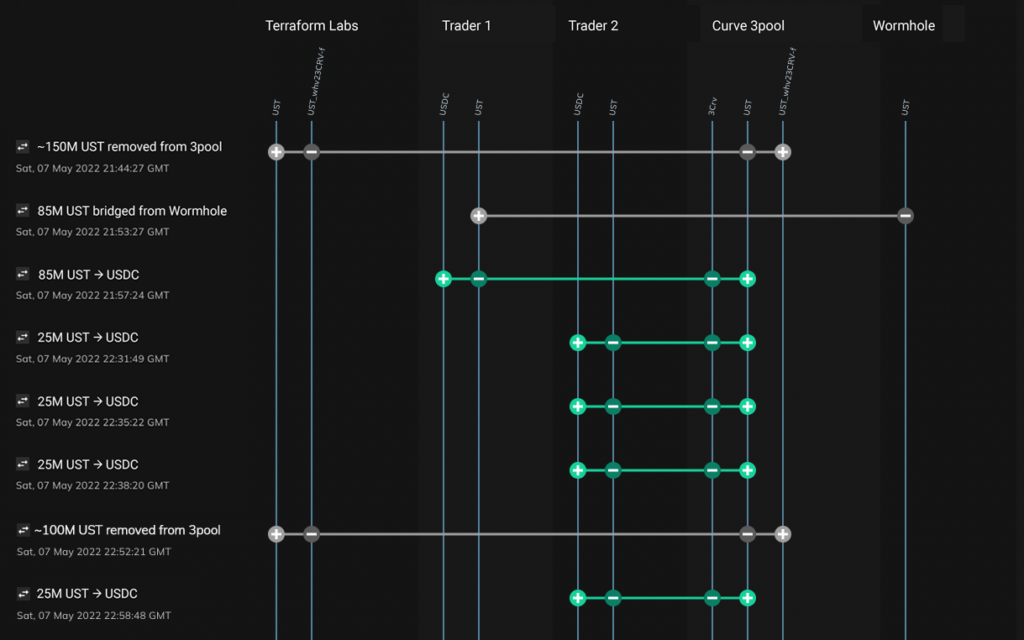

UST: An algorithmic stablecoin tragedy

UST (TerraUSD) was perhaps the most well-known algorithmic stablecoin, developed by the Terra blockchain. UST maintained its peg to the US dollar through a mint-and-burn mechanism involving another cryptocurrency, a governance token called LUNA. However, UST faced significant challenges and after losing its peg, both cryptocurrencies and the Terra blockchain collapsed.

Algorithmic stablecoin challenges

Algorithmic stablecoins have faced numerous challenges, primarily due to their reliance on market mechanisms rather than tangible collateral. The collapse of UST highlighted some of the risks associated with these types of stablecoins. This includes the potential for rapid devaluation and loss of investor confidence, even though the blockchain has since rebranded as Terra Classic (LUNC).

.png)

Benefits of stablecoins

Stablecoins offer a range of advantages that make them a viable option for both individual users and institutions.

Price stability

In a crypto market characterized by high volatility, stablecoins are intended to provide a way for investors to park their funds without worrying about sudden price fluctuations. Stability helps make stablecoins a preferred choice for traders who want to avoid the risks associated with holding more volatile cryptocurrencies like Bitcoin or Ethereum.

Cross-border transactions

Stablecoins facilitate seamless cross-border transactions, offering a faster and cheaper alternative to traditional banking systems. Unlike traditional fiat transfers, which can take several days and incur high fees, stablecoin transactions are nearly instantaneous and cost a fraction of traditional transfer fees.

Accessibility and inclusion

Stablecoins are playing a crucial role in promoting financial inclusion, particularly for the unbanked in regions with limited access to traditional banking services. With just a smartphone and internet connection, individuals across the globe can access stablecoins and participate in the global economy.

DeFi and traditional finance integration

Stablecoins are integral to the DeFi ecosystem, where they are used in various financial applications such as lending, borrowing, and yield farming. Their stability makes them a more reliable medium of exchange than other crypto tokens within DeFi protocols. Through them, users can earn yield, provide liquidity, and engage in other financial activities with lesser risk of price volatility (though they still carry risk of loss).

Stablecoins also serve as a bridge between crypto and traditional financial systems. They provide a way for users to move in and out of the crypto market without having to convert their assets back into fiat currency. Their ease of conversion enhances the liquidity of the cryptocurrency markets and enables smoother integration with traditional financial services.

What are stablecoins used for?

Understanding how to use stablecoins can help unlock their versatility in applications like payments, DeFi, and trading within the digital economy.

Buying and holding

Stablecoins can be purchased on most cryptocurrency exchanges using fiat currencies or other cryptocurrencies. They can also be bought via on-ramp providers like MoonPay using a card or bank transfer. It's important to choose a reputable exchange and follow best practices to secure your digital assets.

Hardware wallets, such as Ledger or Trezor, are considered some of the safest options for long-term storage. For short-term use, software wallets or exchange wallets can be convenient, but users should always be aware of the security risks and take steps to mitigate them. This includes regularly updating their software, keeping private keys safely offline, and learning how to avoid phishing attacks and other crypto scams.

Payments and transfers

Stablecoins like USDT and USDC are increasingly being used for everyday transactions like purchasing goods and paying for services. Their stability makes them a potentially viable option for merchants who want to accept cryptocurrency payments without exposing themselves to the volatility of other cryptocurrencies.

Stablecoins can also be used for international remittances, providing a faster and cheaper alternative to traditional remittance service. Individuals can send money across borders in minutes, with significantly lower transaction fees than some traditional methods. This could be particularly beneficial for people in developing countries who rely on remittances as a source of income.

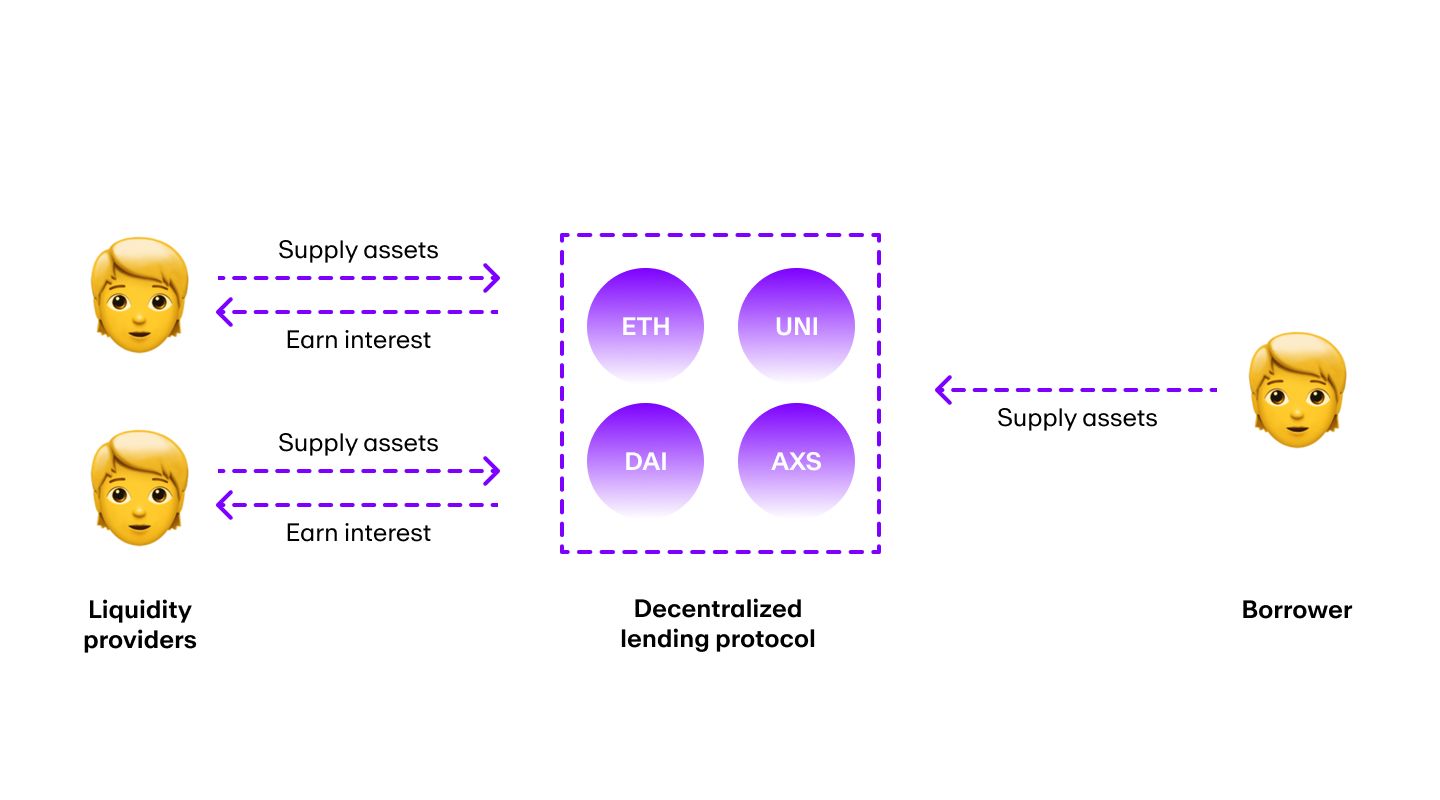

Decentralized finance (DeFi)

Users can deposit their stablecoins into DeFi platforms and earn interest through staking and yield farming. They can also be used in DeFi as collateral for borrowing other assets or lending to earn interest.

For instance, decentralized applications (dApps) like Aave and Compound allow users to deposit stablecoins into lending pools, which are then borrowed by other users. The interest earned from these loans is distributed to the lenders, providing passive rewards for stablecoin lenders.

%20(1)-2.png)

You can trade stablecoins like USDC (SOL) on MoonPay for any supported Solana token in seconds and low fees. Trade for coins like Solana (SOL), meme coins like OFFICIAL TRUMP (TRUMP) and Bonk (BONK), stablecoins like USDT (SOL) and PYUSD (SOL), and much more.

Trading and swapping

Stablecoins can be traded or swapped for other crypto tokens on many cryptocurrency exchanges. For example, during a period of market volatility, traders can convert their digital assets into stablecoins to preserve their value.

This added flexibility makes stablecoins an essential tool for both short-term traders and long-term investors, since anyone can move in and out of positions without having to convert their assets back into fiat currency.

Risks and challenges of stablecoins

While stablecoins offer many benefits, they are not without risks and challenges.

Centralization and trust

Many stablecoins, particularly fiat-collateralized ones like Tether (USDT), are centralized, meaning they are controlled by a single entity. This centralization raises concerns about transparency, as users must trust that the issuer is holding sufficient reserves to back the stablecoins in circulation.

If a stablecoin issuer lacks such transparency, it can lead to doubts and mistrust about the stability of the stablecoin. To address these concerns, stablecoin issuers must provide regular audits and transparent reporting of their reserves. Tether was initially reluctant to publish such audits, though they have since released consolidated financial and reserve reports several times per year.

Regulatory scrutiny

Stablecoins have attracted significant attention from regulators worldwide. Certain governments have expressed concern about the potential for stablecoins to disrupt traditional financial systems, evade regulations, and facilitate illegal activities. As a result, stablecoins have faced increasing regulatory scrutiny, with some countries considering new laws and regulations to govern their use.

Regulation can have both positive and negative impacts on stablecoin adoption. On one hand, clear regulatory guidelines can provide legal certainty and encourage broader adoption by institutions. On the other hand, overly restrictive regulations could stifle innovation and limit the adoption of the tokens in certain markets.

De-pegging risks

What happens when a stablecoin loses its peg?

De-pegging occurs when a stablecoin loses its fixed exchange rate with its underlying asset, and can occur for several reasons. Some of the main de-peg causes include a lack of sufficient collateral, technical issues, or market manipulation. When a stablecoin de-pegs, its value can fluctuate significantly, leading to potential losses for holders.

Although the most notable case of de-pegging was the collapse of TerraUSD (UST), other popular stablecoins like USDC and USDT have also been known to suffer de-pegging events (though with much less severe consequences). De-pegging events such as these highlight the risks associated with all stablecoins and the importance of robust mechanisms to maintain a stable value.

Market and liquidity risks

Liquidity risk arises when there is not enough demand to buy or sell a stablecoin at its pegged value. This can happen during periods of market stress or when there are concerns about a stablecoin's backing. When this occurs, it can cause the stablecoin to deviate from its peg and create challenges for users trying to trade or redeem their stablecoins at the correct value, if at all.

To help combat disruptions, liquidity providers (LPs) play a crucial role in maintaining the stability of stablecoin markets. Capitalizing on the decentralized nature of cryptocurrency, LPs serve to supply sufficient liquidity to support stablecoin transactions and help maintain the peg during periods of high demand.

However, liquidity providers face the additional risk of impermanent loss. This can occur when the price of one cryptocurrency diverges from the other paired token by the time the user withdraws funds from the liquidity pool (thus making the loss permanent). This risk is more prevalent when using stablecoins, since there is more likely to be a price divergence when one digital asset is restricted in price movement.

Where to buy stablecoins

Owning stablecoin assets allows users to remain in the cryptocurrency ecosystem without needing to cash out to fiat money during periods of market volatility.

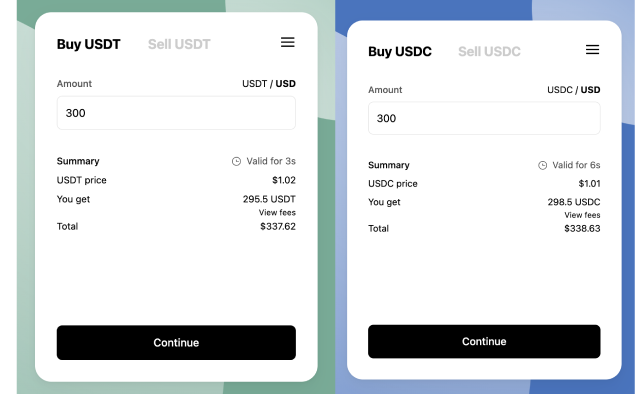

MoonPay allows you to easily buy stablecoins including USDT, USDC, DAI, and PYUSD using your credit card or any other preferred payment method.

You can also add funds to your wallet in euros, pounds, or dollars and use your MoonPay Balance to purchase USDC, USDT, DAI, and more stablecoin assets. Make your transactions smoother and more affordable, all with higher approval rates. And when cashing out, enjoy zero-fee withdrawals directly to your bank account.

How to sell stablecoins?

MoonPay also makes it easy to sell stablecoins like USDT and USDC for fiat currency when you decide it's time to cash out your crypto.

Simply enter the amount of USDT, USDC, or another stablecoin you'd like to sell and enter the details where you want to receive your funds.

Swap stablecoins for more tokens

Want to exchange stablecoins like USDT and USDC for other cryptocurrencies such as Ethereum and Bitcoin? MoonPay allows you to swap crypto cross-chain with competitive rates, directly from your non-custodial wallet.

.png)

.png?w=3840&q=90)

.png?w=3840&q=90)

.png?w=3840&q=90)

.png?w=3840&q=90)