What is ALGO? An introduction to Algorand

Learn how Algorand is helping to achieve mass crypto adoption and greater end-to-end blockchain participation with the Pure Proof of Stake (PPoS) model.

By Corey Barchat

In the competitive landscape of blockchain technology, Algorand has emerged as a noteworthy player (and an intriguing competitor to Ethereum).

This altcoin has attracted the attention of both developers and enthusiasts alike with its unique approach to network consensus, and its innovative ability to address some of the key challenges faced by traditional blockchain networks.

In this article we explore Algorand’s fundamental principles, core features, and the native cryptocurrency that powers its ecosystem, ALGO.

What is Algorand?

Algorand is an open, public, and permissionless (decentralized) blockchain with a unique Pure Proof of Stake (PPoS) model. Its native token is ALGO, which serves as both a cryptocurrency and a means to propagate new blocks.

By owning ALGO you can use it to participate in smart contracts on the blockchain, stake it to earn interest and rewards, or send it to another cryptocurrency wallet.

How is Algorand different from other blockchains?

Bitcoin famously uses an energy-intensive Proof of Work (PoW) system in which miners compete with each other to solve mathematical puzzles in order to produce blocks and earn mining rewards.

Ethereum has also used this method for most of its existence, although the recent Ethereum Merge meant a drastic switch to a Proof of Stake model. With Proof of Stake, users that own a certain amount of the native token are the ones that verify the blockchain. Ethereum’s minimum stake, for example, is 32 ETH.

Since amounts like these price out most users (1 ETH has ranged between $1000 and $4000 in 2021), Algorand uses Proof of Stake in a more “pure” form.

Let’s explore this further.

What is Algorand’s Pure Proof of Stake?

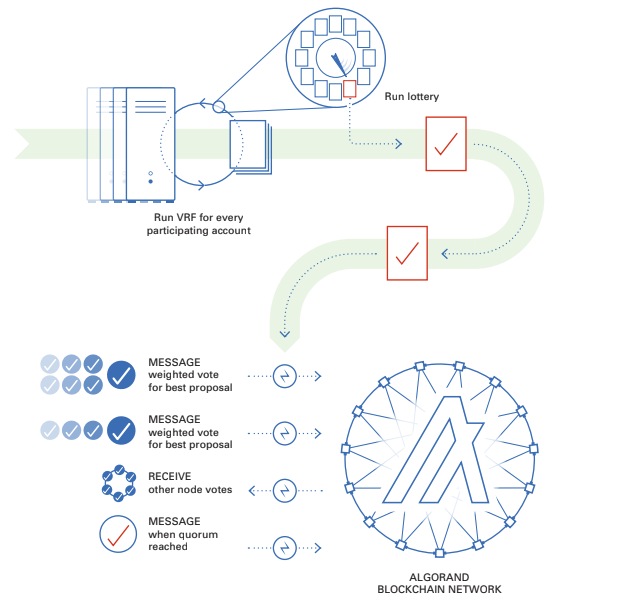

Algorand’s Pure Proof of Stake (PPoS) is a protocol for validating new blocks in which users’ influence is directly correlated to how much they stake. With PPoS, every ALGO coin can be randomly selected to be staked.

The minimum needed to stake is 1 ALGO. For reference, Ethereum’s price peaked at nearly $5,000 while ALGO has hit just above $3. Algorand is therefore more accessible because they have lower minimum requirements to stake.

To stake your ALGO, you’ll need to declare your availability and send tokens to Algorand’s wallet in a process known as going “online”.

There are also other ways to receive ALGO rewards for holding, other than participating in the formal staking process. Algo Optimizer is a tool that makes it easier for users to compound ALGO staking rewards.

Who created Algorand?

Algorand is the brainchild of Silvio Micali, the Italian-born MIT professor and winner of the 2012 Turing award for his work that helped to establish cryptography as a science.

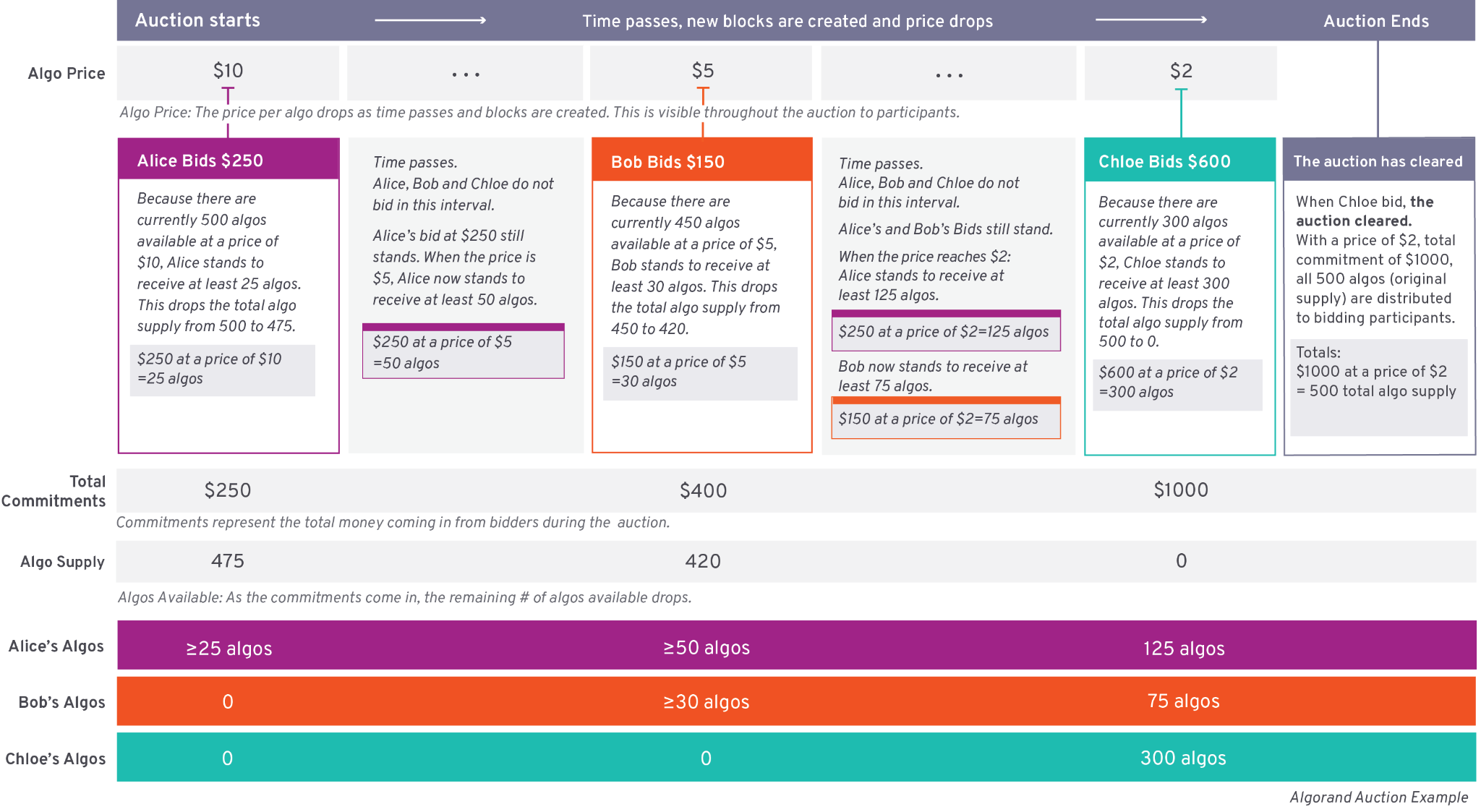

Launched as a Dutch Auction in June 2019, Algorand was inspired by the Bitcoin revolution. “Just like how the internet democratized the exchange of information,” said Algorand’s COO W. Sean Ford on the Paul Barron Network, “Algorand saw the same opportunities to remove friction in the exchange of value.”

One of Algorand’s main objectives was to solve the Blockchain Trilemma of accounting for security, scalability, and decentralization.

If you’re a former or current university student, you may be familiar with the similarly famous trilemma of getting good grades, enough sleep, and having a social life. In the case of crypto, Algorand has sought to balance the pyramid through their signature PPoS and cryptographic sortition lotteries.

Algorand also relies on Paul Milgrom as an advisor, winner of the 2020 Nobel Prize in Economics.

Algorand features

In a world of many competing altcoins, here are a few things that make Algorand stand out:

Blockchain security

On the Algorand blockchain, block validators are widely distributed across the network, making it more difficult for malicious actors to plan ahead and potentially attack accounts or wallets.

Since only 1 ALGO coin is needed to certify new blocks, this drastically increases the pool of potential validators, making it nearly impossible for hackers to know which user to corrupt.

With this minuscule probability of any given user being chosen as a validator, being selected once does little to tip off would-be hackers from attacking the correct account in the future.

Transaction speed

It takes on average 4.5 seconds to send Algo, with no settlement or reconciliation necessary. “Our agreement on the block is so fast – essentially a few seconds – that, say in 4.5 seconds, we already have produced the block, circulated it and agreed on it,” says Silvio Micali.

Low fees

Algorand fees cost only fractional cents per transaction. Compared to blockchains like Ethereum, where gas prices can range widely depending on the network activity at the time, Algorand transaction fees are consistently low.

Environmental impact

On other blockchains, miners compete with one another to validate blocks in an energy-costly process. With the PPoS model of each ALGO coin being randomly selected to build the next block, a much lower computational power is required for validating the blockchain, resulting in a significantly lower environmental impact.

Who is building on Algorand?

With their easy scaling solutions and open, public, and permissionless blockchain, Algorand is attracting a diverse range of projects to their network.

Algorand’s main focus is working with regulated DeFi projects, bridging the worlds of traditional and digital finance. In addition to partnering with formal entities such as governments and central banks, Algorand is also home to a range of projects from digital securities exchanges, music royalties marketplaces, as well as serving as the hub for the hemp industry’s blockchain, among many others.

The Algorand Foundation awards grants to developers who are building the next cutting-edge apps on the platform.

Where to buy Algorand

You can buy Algorand (ALGO) via MoonPay or through any of our partner wallet applications with a credit card, bank transfer, Apple Pay, Google Pay, and many other payment methods. Just enter the amount of ALGO you wish to purchase and follow the steps to complete your order.

Users can also top up in euros, pounds, or dollars and use MoonPay Balance when buying Algorand (ALGO) and other cryptocurrencies. Use your balance to enjoy lower transaction fees, quicker processing times, and better approval rates.

Swap Algorand for more tokens

Want to exchange ALGO for other cryptocurrencies like Ethereum and Bitcoin? MoonPay allows you to swap crypto cross-chain with no processing fees (network fees apply), directly from your non-custodial wallet.

.png)