Disclaimer: The following is for informational purposes only and should not be construed as financial advice.

The rise of decentralized finance (DeFi) has presented an opportunity for individuals to diversify their portfolios and pursue passive income through strategies known as staking and yield farming.

These two methods of generating revenue function independently and serve different types of investors. They also present different risks, which should be considered before either strategy is pursued.

While the allure of earning passive income is one of DeFi’s biggest draws, it’s important that newcomers understand how these two ways of doing that differ and the risks accompanying each strategy.

This article takes a closer look at yield farming and staking, explaining their key similarities and differences.

What is yield farming?

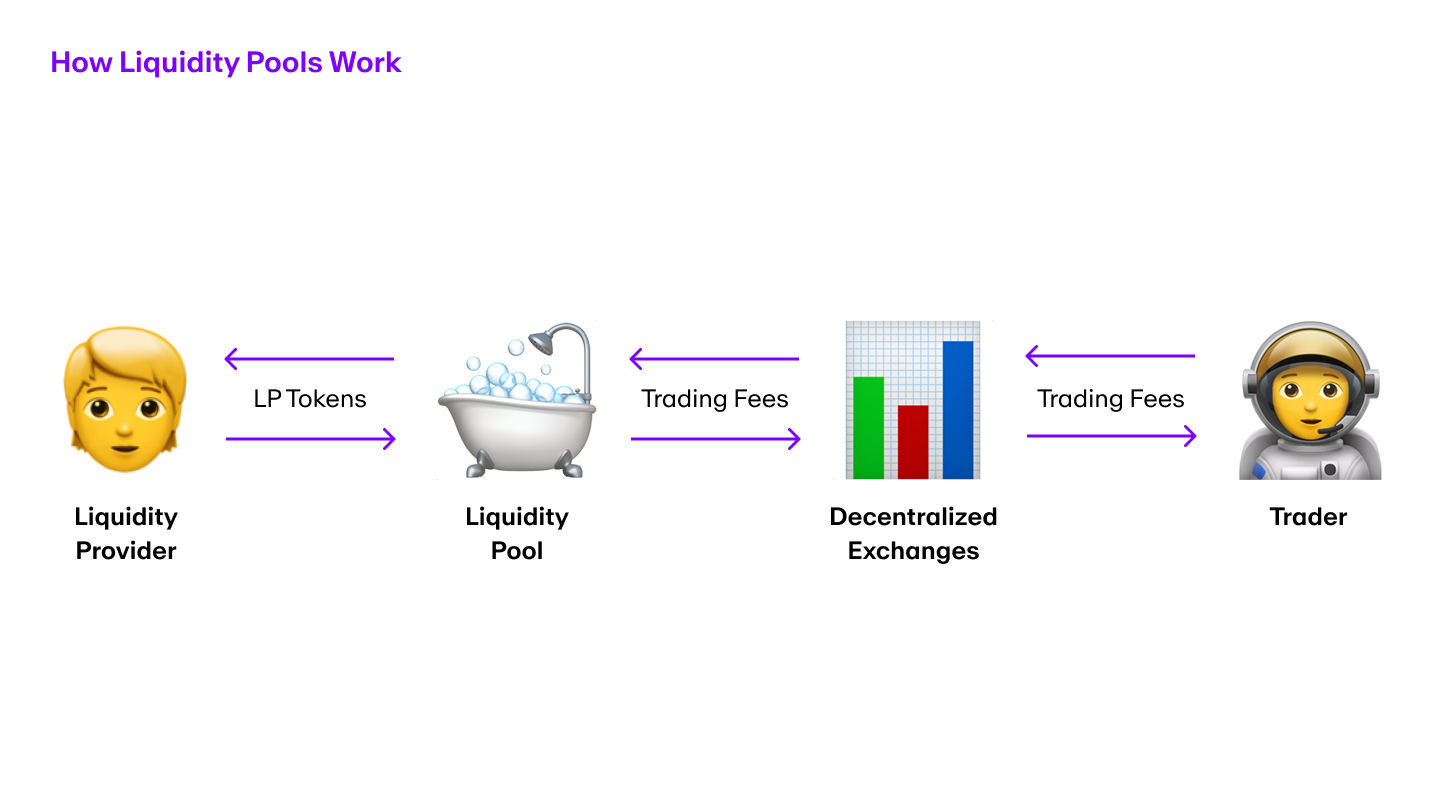

Yield farming is the process of providing liquidity to DeFi protocols such as liquidity pools. It offers rewards in the form of interest, with a portion of transaction fees given to each yield farmer.

DeFi platforms like smart contract-enabled decentralized exchanges (DEXs) facilitate crypto trading through automated market makers (AMMs).

Liquidity providers can deposit crypto assets into a liquidity pool and leverage AMMs to execute automated trading. In return, they get rewards like liquidity provider (LP) tokens.

What is staking?

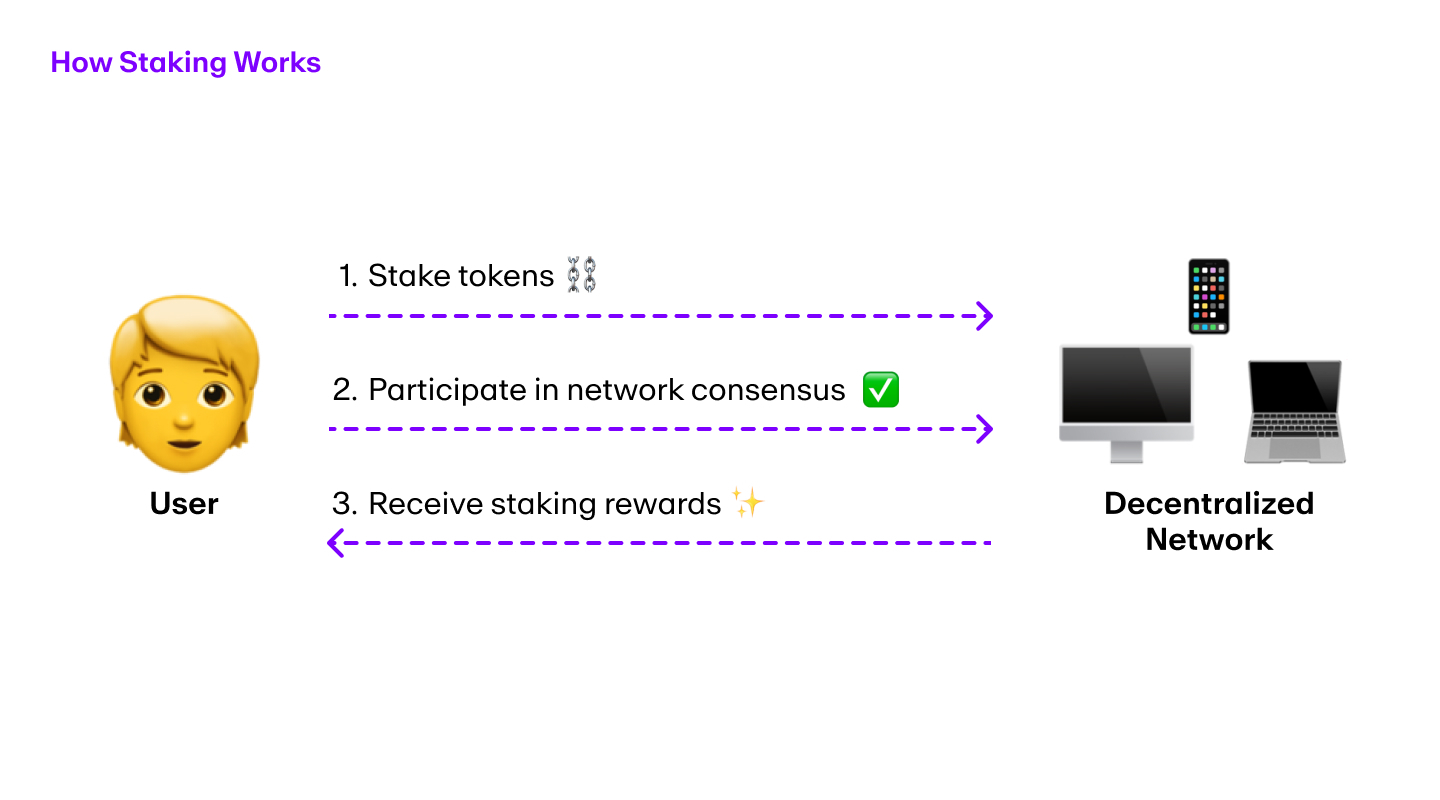

Staking is the process by which users pledge to lock their crypto assets to secure a Proof of Stake (PoS) blockchain network. Stakers set up individual nodes for validating transactions and adding new blocks to the blockchain (or use nodes someone else has set up).

Users who lock their crypto funds into a staking pool earn staking rewards for securing blockchain networks from malicious actors. The blockchain network randomly selects a validator node, with high-stake nodes having a greater chance to validate transactions.

With the addition of each new block, users can earn governance tokens and a percentage of the platform’s fees.

Differences between yield farming and staking

While both yield farming and staking are innovative methods for generating passive income, they differ in several ways.

Complexity levels

Yield farming and staking differ in their ease of access and associated learning curves. Yield farming is usually more complicated because it requires intensive research to identify potentially profitable liquidity pools.

Liquidity providers need to identify a liquidity pool that offers good interest rates for providing liquidity. Then, they must decide on a token pair and select a DeFi platform that either offers a customizable liquidity pool or an equilibrium liquidity pool.

Staking is often much easier to learn since users simply need to select a staking pool in a Proof of Stake network to stake crypto.

As staking usually involves a lock-up period in which stakers cannot withdraw their deposit for a given time period, the process is mostly passive after users stake their crypto assets.

Unlike yield farming, which requires active management to generate returns, staking requires little effort from users after assets are staked.

Deposit periods

Flexibility is a considerable factor in any yield farming vs staking decision.

Yield farmers don’t need to lock their crypto in a liquidity pool for a set period of time to earn rewards from yield farming protocols. They are free to provide liquidity to any liquidity pool and withdraw their tokens at any time.

In the absence of a minimum lock-up pool, yield farmers can even move their funds from one pool to another.

Staking, on the other hand, may involve fixed lock-up periods in which users cannot withdraw their stake, which can range from a few days to a few weeks (or possibly months), depending on network traffic.

The smart contracts of staking protocols programmatically ensure users cannot withdraw funds before the unbonding period ends. No matter the market conditions, you cannot unstake crypto until the unbonding period ends.

Transaction fees

When deciding between yield farming and staking, transaction fees (gas fees) should also be considered.

When yield farmers switch between liquidity pools, they need to pay transaction fees to execute those transfers. Users on the Ethereum network may have to pay high gas fees for a simple on-chain transaction.

Yield farmers must consider the possibility of paying high gas fees when determining whether to shift assets between liquidity pools.

Since staking requires locking up user assets with no opportunity to switch pools, stakers don't have to pay gas fees.

Instead, they earn a percentage of network fees when they validate transactions. When compared to liquidity pools, staking has much lower maintenance costs.

Token requirements

Yield farming and staking differ in the number of tokens users need for their investments.

Yield farming requires a pair of tokens like USDT-USDC or ETH-DAI for providing liquidity to liquidity pools. Users can provide a flexible ratio of these tokens to the trading pair for customizable pools. However, they must supply tokens in a 50-50 ratio to equilibrium pools with trading pairs holding equal value.

Staking involves only one token that users can lock up in the staking pool, so stakers don’t need to buy two tokens of equal or variable value to provide liquidity. This could reduce the overall expense of participating in staking for certain tokens.

However, certain tokens require a staker to commit a minimum amount of tokens to stake; for example, every validator node must stake a minimum of 32 ETH.

Revenue generation

Revenue generation is yet another differentiating factor between yield farming and staking.

Yield farming offers a dynamic Annual Percentage Yield (APY) that varies with each liquidity pool, depending on several market metrics: available liquidity, arbitrage options, and overall volatility.

Staking, on the other hand, offers a fixed APY so users can calculate future returns and plan accordingly. Although the interest rate is frequently lower than yield farming, a stable percentage often suits low-risk investors.

Moreover, those who lock up their tokens for longer durations earn higher APYs compared to short-term lock-up periods.

Investment risks

Users must also be aware of the security infrastructure and associated risks when comparing yield farming vs staking.

Yield farming protocols are subject to a variety of risks that can lead to loss of user funds.

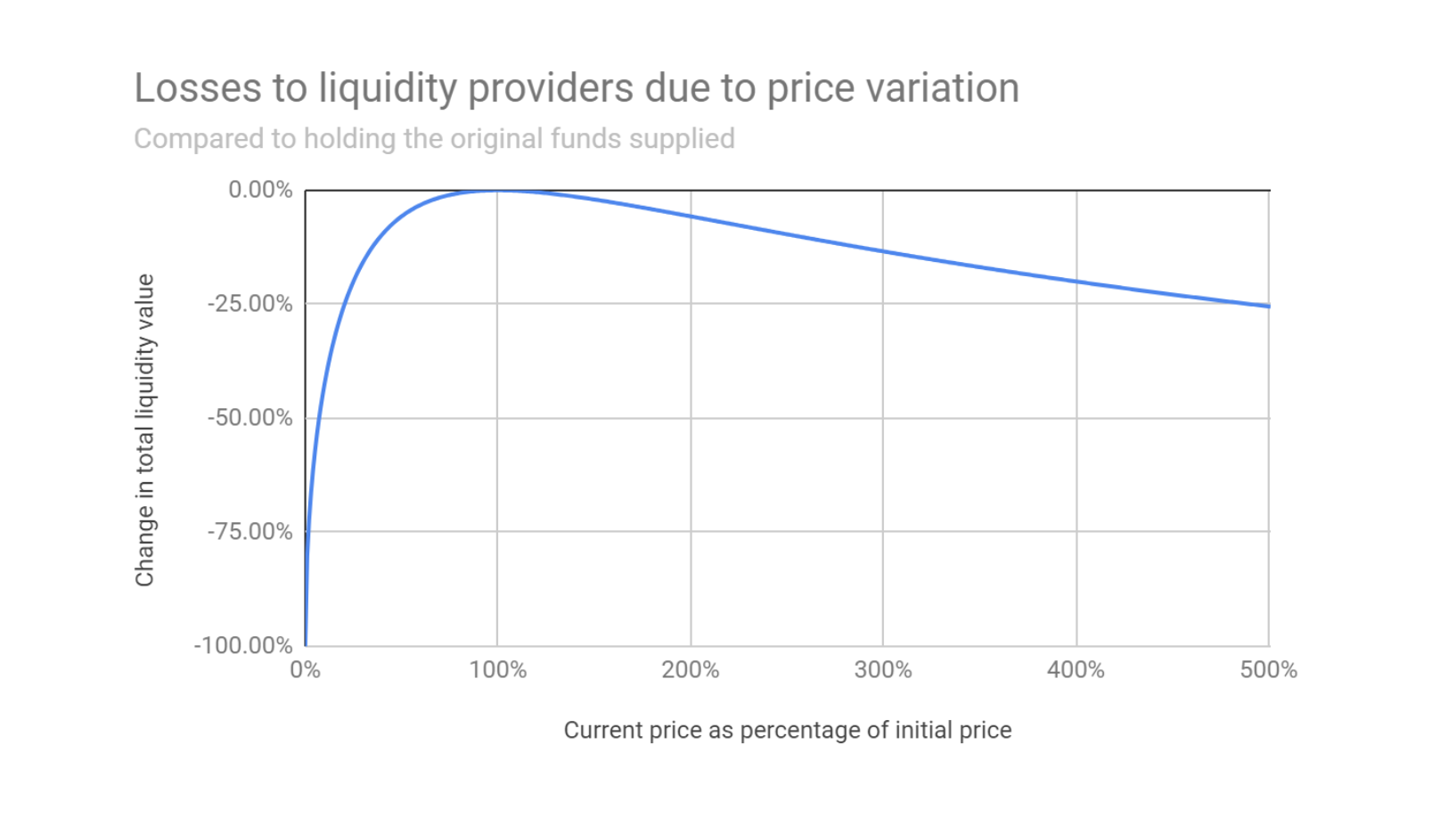

Losses could occur due to price fluctuations of tokens, including impermanent loss, when the price of one token changes in relation to the other during the time that the coins are locked in a liquidity pool.

View our Bitcoin Price and Ethereum Price pages for live price and market data for these leading cryptocurrencies.

There are also bugs or errors in smart contracts that can lead to a smart contract risk, making the protocol vulnerable to hacking.

Rug pulls are another common risk for new yield farming projects with shady, anonymous developers at the helm. Research has shown that users lost more than $10 billion from rug pulls and DeFi hacks in all of 2021. More recently, estimates attribute $158 million to DeFi hack losses for the month of November, 2023, compared to $184 million for CeFi hacks.

Staking is comparatively more secure since stakers have to follow strict guidelines to participate in a blockchain’s consensus mechanism. In a Proof of Stake blockchain, malicious users can lose their staked assets via slashing if they try to manipulate the network for greater rewards. More on that later.

Lastly, unlike yield farming, staking is better protected from hacks and scams.

Impermanent loss and slashing

When yield farmers provide liquidity to liquidity pools, they’re prone to suffer from something called “impermanent loss”. This is when the price of the tokens change from when they were first deposited.

Liquidity pools maintain equilibrium and adjust for token prices during volatile market conditions. If users decide to withdraw their assets when token prices have deviated from their time of deposit, impermanent loss becomes permanent.

Staking, however, is not subject to any kind of impermanent loss. Users may lose out if the token prices of their staked assets fall due to a bear market, but since there is no adjustment of the total value in liquidity pools, stakers won’t lose money to impermanent loss.

There is, however, the additional risk of slashing, which deducts a validator’s supply of staked tokens. This can occur when a validator participates in activity that harms the network, such as failing to validate legitimate transactions, double-signing transactions, or otherwise maliciously attacking the network.

Yield farming and staking similarities

Despite their differences, yield farming and staking share a few common characteristics.

Passive income

Yield farming and staking are both ways to earn passive income. Users who do not wish to trade crypto may be able to generate revenue on their holdings through yield farming and staking. Although each strategy offers different benefits and risks, both can be used to generate returns.

Volatility risk

Users who decide to invest in yield farming and staking platforms are subject to the usual volatility in crypto markets. Tokens held in staking and liquidity pools may depreciate and both yield farmers and stakers can lose money when prices go down overall. Yield farmers may face an additional liquidation risk if their collateral depreciates in value and the protocol liquidates assets to recover costs.

Who is yield farming suitable for?

Not all investors are suitable to participate in yield farming protocols. Yield farming is only viable for those with a very high-risk tolerance because there is always a risk in yield farming of losing your initial investment.

Yield farming platforms may offer high returns but the required initial investment is usually also higher than staking platforms. This is what makes yield farming ideal for investors who have the necessary liquidity and risk tolerance to invest in these protocols.

Yield farming is also suitable for generating passive income for traders holding low trading volume tokens, providing the opportunity to earn interest on otherwise idle assets.

Who is staking suitable for?

Investors with a low-risk appetite may want to avoid yield farming and focus instead on staking their assets.

Staking is a predictable method to generate passive income by validating crypto transactions and enhancing sufficient transaction throughput. Additionally, the initial investment in staking is usually much lower than in yield farming.

It’s important to note, however, that staking is not a flexible strategy since the protocols lock up user assets for a fixed time period. If users need continuous access to their crypto assets, staking might not be suitable for them.

Buy crypto for yield farming and staking

To get started on your yield farming or staking journey, simply buy crypto via MoonPay using a card, mobile payment method like Google Pay, or bank transfer.

MoonPay's widget offers a fast and easy way to buy Bitcoin, Ethereum, and more than 50 other cryptocurrencies.

MoonPay also makes it easy to sell crypto when you decide it's time to cash out. Simply enter the amount of the token you'd like to sell and enter the details where you want to receive your funds.