What are crypto whales and how to track them?

Ever wondered the meaning behind the term 'crypto whale'? Learn what crypto whales are, how to track them, and how they influence the market.

By Corey Barchat

Cryptocurrency, with its decentralized nature, aims to be accessible to everyone across the globe. At the same time, the distribution of funds among holders is anything but equal.

Just as in traditional finance, there are some players in the marketplace with a significant amount of holdings, known as "whales."

Whether engaging in stocks or cryptocurrency, understanding whales and tracking their movements can provide valuable insights into the crypto market's dynamics, helping users make more informed decisions.

In this guide, we'll explore what crypto whales are, how to identify and track their movements, and examine the significance of their presence in the digital asset ecosystem.

What is a crypto whale?

A crypto whale is an individual or entity that holds a large enough amount of cryptocurrency to significantly influence market prices. They can execute large trades or transfers that cause price fluctuations, making their movements closely watched by traders and investors alike.

For example, a Bitcoin whale refers to individuals or organizations with substantial Bitcoin holdings, often considered holders with a significant stake compared to smaller participants. Whales can also be prominent figures, celebrities, or even corporations that own a significant amount of a stock or cryptocurrency.

The term "whale" originates from traditional finance, where it refers to individuals or institutions with significant financial resources and ability to influence the market. In the context of cryptocurrency, the term has been borrowed to describe entities with cryptocurrency holdings large enough to influence the entire marketplace, sometimes with millions or even billions of dollars worth of digital assets.

Much like their oceanic counterparts, crypto whales are among the largest and most influential entities in the cryptocurrency ecosystem. Their actions can cause significant short term price movements and volatility, akin to the powerful movements of whales affecting life in the ocean.

How much crypto do you need to be a whale?

Although there is no exact threshold to become a whale, understanding the general tiers for cryptocurrency whale status provides valuable insight into the distribution of wealth within the crypto ecosystem.

Let's stay with the nautical theme and explore the various levels of the whale scale, ranging from the modest "shrimp" to the towering "humpback."

The Whale Scale: Different levels of holdings

1) Shrimp

These are the newcomers, the casuals, the beginners dipping their toes into the crypto waters. With relatively small portfolios, they're just starting their crypto journey and may be exploring acquiring various cryptocurrencies with caution.

- Number of entities: Millions

- Bitcoin holdings: < 1 BTC

- Percentage of total supply held: 5-7%

2) Crab

As investors gain a bit more confidence and acquire more cryptocurrency, they ascend to the level of crabs. These holders have increased their crypto holdings, venturing deeper into the market and diversifying their investments beyond Bitcoin ownership to include altcoins, stablecoins, NFTs, and more.

- Number of entities: Hundreds of thousands

- Bitcoin holdings: 1-10 BTC

- Percentage of supply held: 8-10%

3) Octopus

With growing expertise and a more substantial crypto portfolio, octopuses have expanded their reach beyond the base tiers. They're actively engaging in trading and investment strategies, seeking to maximize their returns in the ever-changing crypto landscape.

- Number of Entities: Tens of thousands

- Bitcoin holdings: 10-50 BTC

- Percentage of supply held: 8-10%

4) Fish

Fish represent a significant step up the hierarchy, with larger holdings and greater influence than smaller entities. These investors have accumulated considerable wealth in cryptocurrencies, positioning themselves as notable players in the ecosystem.

- Number of entities: ~ Ten thousand

- Bitcoin holdings: 50-100 BTC

- Percentage of supply held: 3-5%

5) Dolphin

Dolphins possess moderate-sized portfolios, giving them more influence than shrimp but less than sharks and larger whales. They can impact the prices of smaller coins but may not have the power to significantly affect larger cryptocurrencies.

- Number of entities: ~ Ten thousand

- Bitcoin holdings: 100-500 BTC

- Percentage of supply held: 10-12%

6) Shark

Sharks are formidable creatures in the crypto ocean, wielding substantial power and influence. With significant holdings, they can sway market sentiments and initiate large-scale trading activities, making waves in the crypto market.

- Number of entities: Hundreds to thousands

- Bitcoin holdings: 500-1,000 BTC

- Percentage of supply held: 7-10%

7) Whale

Whales are the largest players and apex predators in the cryptocurrency ecosystem. With massive portfolios, they can significantly impact the prices of even the largest cryptocurrencies, such as Bitcoin and Ethereum. Their actions are closely monitored and tracked by other market participants, often garnering widespread attention.

- Number of Entities: Hundreds to thousands

- Bitcoin holdings: 1,000-5,000 BTC

- Percentage of supply held: 12-15%

8) Humpback whale

At the peak of the crypto hierarchy, we find the humpbacks. These entities possess colossal crypto holdings, dwarfing even the largest of traditional whales. Their movements have profound impacts on the entire cryptocurrency ecosystem, shaping marketplace dynamics and investor sentiments.

- Number of Entities: Hundreds

- Bitcoin holdings: > 5,000 BTC

- Percentage of supply held: 12-15%

*This hierarchy does not include miners or exchanges, though they factor as a significant player in crypto holdings, with 20-25% of the total Bitcoin supply held among them.

How to identify and track a crypto whale?

Anyone looking to gain insights into the dynamics of crypto markets and anticipate price movements should consider tracking cryptocurrency whales. Here are a few methods and tools used to monitor these influential entities:

Whale wallet address holdings

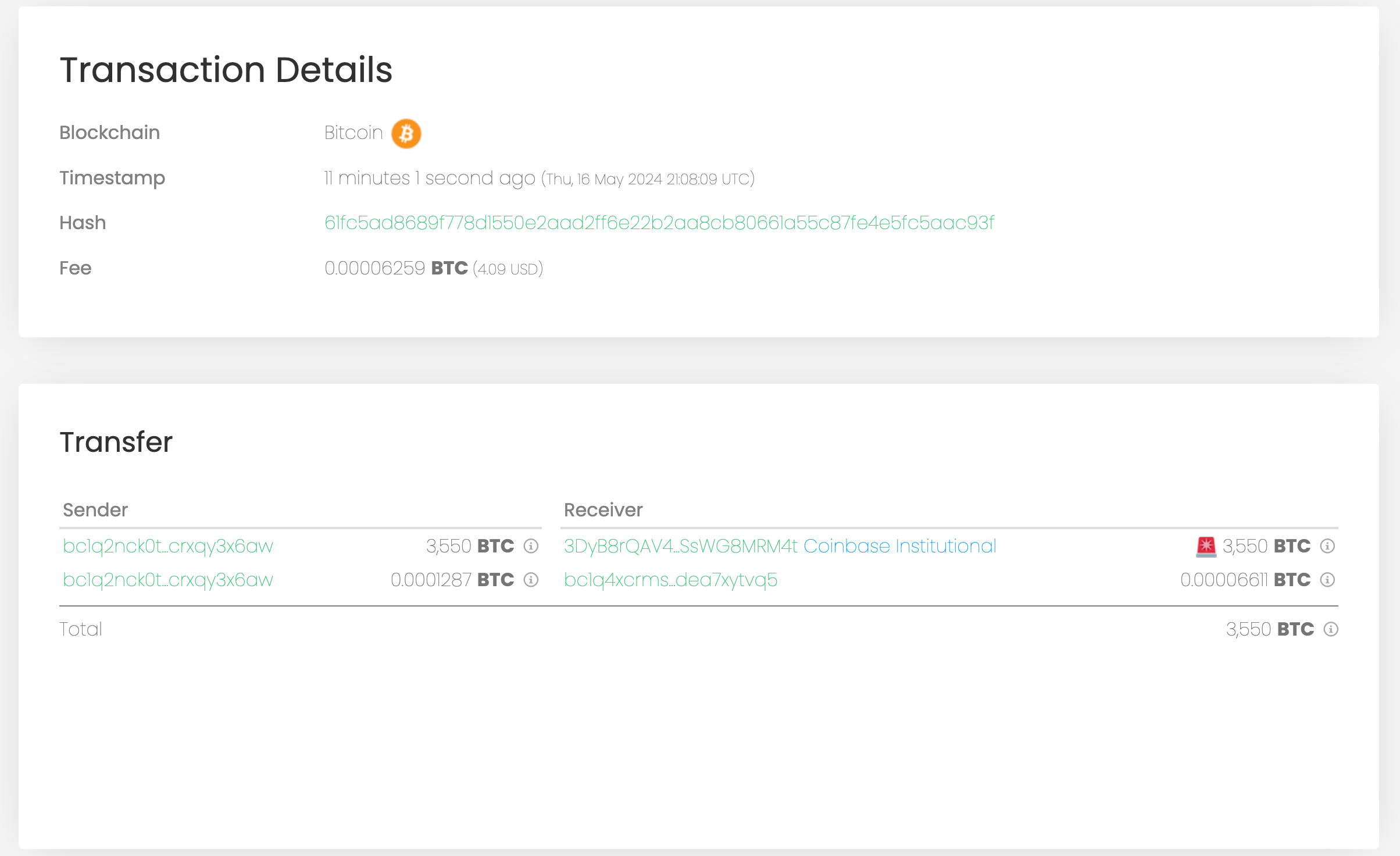

Whales often consolidate their holdings in a few select crypto wallets. Luckily, blockchain technology like Bitcoin's public ledger ensures that any wallet address and its content can be viewed by anyone who knows the address.

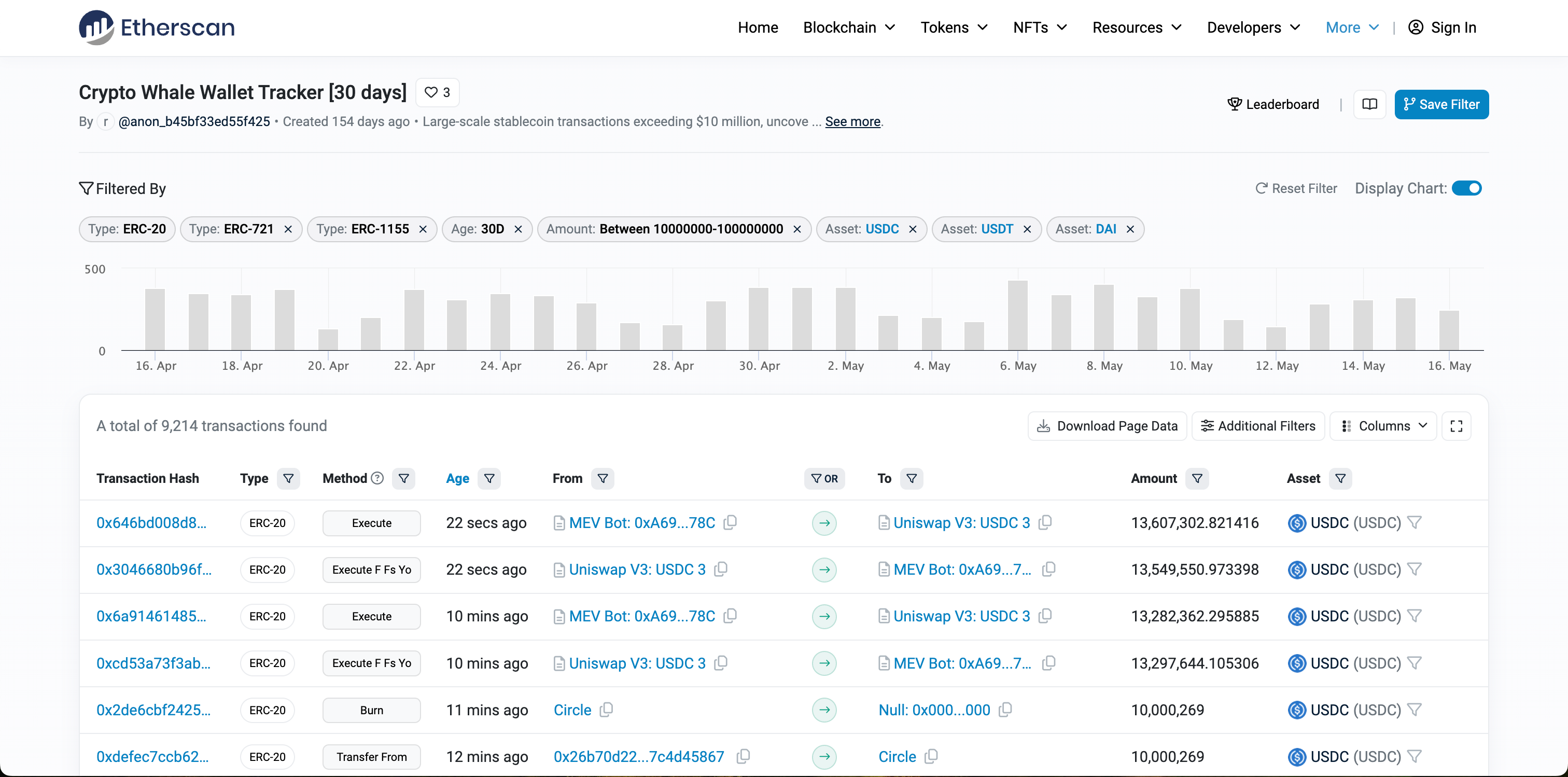

Blockchain explorers like Etherscan, Solscan, and BscScan are websites that provide tools for users to explore wallet addresses and view transaction histories across different blockchain networks. Users can take advantage of these platforms to identify wallets belonging to whales, track their activity, and observe significant movements of funds.

Transaction patterns and volume analysis

Analyzing transaction volumes and patterns on the blockchain can provide insights into whale activity. Large transactions or sudden spikes in trading volume may indicate whale involvement.

In addition to the block explorers mentioned above, traders and investors can also use tools like trading terminals and charting platforms to analyze transaction data and identify potential whale activity. This could allow trackers to potentially anticipate large movements and adjust their trading strategies accordingly.

Whale activity on exchanges and trading platforms

Whales frequently conduct their trades on cryptocurrency exchanges. Monitoring order book movements and large trades on these platforms can help identify whale activity in real-time.

Cryptocurrency exchanges like Binance and Coinbase provide access to live order book data and trading volume metrics. These tools allow users to track whale activity and behavior, and enable them to potentially make more informed trading decisions.

Whale tracking resources and data sources

Several online platforms and tools specialize in tracking whale activity. These resources offer data visualization, analytics, and alerts, empowering investors to stay informed about market dynamics.

Whale tracking websites like Whale Alert and Cryptocurrency Alerting provide real-time updates on large cryptocurrency transactions for the purpose of monitoring whale activity across multiple blockchains.

Additionally, blockchain analytics tools like Glassnode offer advanced metrics and insights into whale behavior and wallet balances, enabling users to conduct their own in-depth analysis and research.

Famous crypto whales

Who are some of the big crypto and Bitcoin whales? You may recognize a few.

One famous Bitcoin holder is its earliest adopter and founder, Satoshi Nakamoto, whose identity remains anonymous. Similarly, Ethereum founder Vitalik Buterin could be considered an ETH whale, as he holds hundreds of millions of dollars in Ether tokens (although he has also donated even more towards noteworthy causes).

If you're noticing a trend, other prominent crypto holders include more founders and CEOs like Brian Armstrong of Coinbase, the Winklevoss twins of Gemini, and CZ, formerly of Binance.

Companies like MicroStrategy and Tesla, known for their substantial BTC holdings, are entities considered influential whales in the cryptocurrency space. Their founders, Michael Saylor and Elon Musk, respectively, are known for being notably vocal advocates of Bitcoin. However, while Microstrategy's BTC holdings total hundreds of thousands of tokens worth billions of tokens, Tesla has since backed off BTC somewhat in recent years.

.webp)

While some famous whales make their trades publicly known, it may be difficult to track their activity and determine their exact positions, unless their wallet addresses become public.

How crypto whales impact crypto prices & market dynamics

Let's dive deeper into the various ways that crypto whales exert their influence over crypto markets.

Bull and bear markets: whale participation

Whales play a significant role in driving both bull and bear markets. Their buying or selling activities can trigger market-wide trends, influencing investor sentiment and market direction.

During bull markets, whales often accumulate large positions, driving up prices and attracting retail investors. Conversely, during bear markets, whales may sell off their holdings, causing prices to decline further and instilling fear among investors.

Market cycles and price trends

The actions of whales can influence market cycles and price trends. Their large trades or transfers and vast holdings often result in increased volatility, leading to rapid price fluctuations and market uncertainty.

Whales may strategically time their activity to capitalize on market trends or manipulate prices for their own gain. Certain whales could also engage in dishonest tactics such as spoofing or wash trading to distort prices and deceive other market participants.

Effect on liquidity

Whale activity can impact market liquidity, especially in smaller cryptocurrencies. Large sell-offs or purchases by whales can cause sudden price swings and create imbalances in supply and demand.

In particular, illiquid markets are more susceptible to manipulation and price volatility making them riskier for investors. This is because whales can exert greater influence, taking advantage of a lack of participants and informational efficiency, wide bid-ask spreads, and limited order book depth.

Regulatory measures aimed at promoting trading transparency and integrity can help mitigate liquidity risks and price manipulation, helping to protect investors from market abuse.

Whale wars and trading battles

Instances of whales engaging in large-scale trading battles can disrupt market stability.

These battles often involve significant buying and selling pressure, leading to intense price fluctuations and trading volatility. Whales may compete for market dominance or seek to manipulate prices for their own gain.

One potential way to counter these effects is by monitoring whale activity, using the resources mentioned above. Traders that identify potential opportunities as well as risks may be better suited to navigate volatile market conditions more safely and effectively.

How to deal with crypto whales

Let's explore some key ways to navigate the turbulent waters created by crypto whales.

Risk management techniques for traders and investors

Users can employ some basic risk management to counter the presence of whales and reduce the impact of their activity:

- Portfolio diversification protects against the presence of whale traders by spreading investments across various assets, reducing the impact that the manipulation of any single cryptocurrency or digital asset can have on the overall portfolio.

- Stop-loss orders (if available for cryptocurrency) automatically sell once a predetermined price is reached, helping to limit potential losses caused by large, sudden price movements.

- Position sizing: Limiting the size of individual positions relative to the overall portfolio can reduce the impact of a significant price movement in any single asset caused by other traders.

- Market monitoring: Continuously monitoring market conditions and news for signs of unusual trading activity can provide early warnings of potential manipulation by whale traders.

- Staggered orders: Placing staggered buy or sell orders at different price levels (and practicing dollar-cost averaging) can prevent large orders from being executed all at once, reducing the impact of whales and other traders.

Long-term objectives

Taking a long-term approach can help reduce the impact of short-term price fluctuations caused by high trading activity.

Staying focused on individual objectives and avoiding short-term price noise can help to avoid being swayed by whale-induced price fluctuations and make decisions that align with long-term financial interests.

Community governance and decentralization efforts

Promoting community governance and decentralization within cryptocurrency projects can help reduce the influence of whales on market dynamics. Empowering the community to participate in decision-making processes can make projects more resilient to manipulation and create trust among stakeholders.

Decentralized governance models such as DAOs (Decentralized Autonomous Organizations) enable community members to vote on project proposals and allocate resources based on consensus. DAOs that embrace transparency and inclusivity can also mitigate the risk of centralized control to ensure that decisions are made in the best interests of the community as a whole.

Grow your crypto portfolio like a whale

No one can become a crypto whale overnight. But if you want to purchase crypto in smaller amounts, MoonPay has got you covered.

MoonPay makes it easy to buy Bitcoin, Ethereum, and other crypto assets that whales hold in their portfolios.

Just enter the amount of crypto you wish to buy, and follow the steps to complete your order.