Canada Cryptocurrency Statistics 2024: Trends and Insights

We cover the current state of crypto in Canada in 2024, with key stats, trends, and insights into adoption, popular tokens, regulation, and the future.

By Corey Barchat

.png)

In just over a decade, cryptocurrency has transformed from a niche digital asset to a mainstream investment class. What began as a tech-savvy experiment has now become a global phenomenon, attracting the attention of individual investors, institutional players, governments, and regulators worldwide.

As we enter 2024, Canada stands out as a potential major player in the digital revolution, with a growing base of cryptocurrency users and an evolving regulatory landscape.

Canada’s cryptocurrency market revenue is forecast to reach $1.7 billion in 2024, and projections suggest it will grow at an annual rate of 8.37%, hitting $2.4 billion by 2028. [1] While they are by no means guaranteed, these figures illustrate not only the rise in adoption, but also the integration of digital currencies into the broader Canadian financial ecosystem.

In this article, we explore the facets of cryptocurrency in Canada, including crypto ownership trends, popular tokens, the regulatory environment, and future prospects for digital currencies in the country.

What are cryptocurrencies?

Cryptocurrencies are digital currencies that use blockchain technology and cryptography for security and transaction verification. Unlike physical money, these currencies exist entirely online, and do not rely on centralized authorities to operate.

While fiat currencies such as the Canadian dollar or euro are issued and regulated by governments, cryptocurrencies operate on decentralized networks. This means they aren't controlled by a central authority like a bank or government, allowing for greater autonomy in financial transactions.

Blockchain is the underlying technology that powers most cryptocurrencies. It acts as a public ledger whose function is to record transactions across a distributed network, providing transparency, security, and immutability. In addition to public visibility, each transaction is permanently recorded, making it nearly impossible to alter or tamper with the data.

Cryptocurrencies have become more popular due to their decentralized nature, which allows for peer-to-peer transactions without the need for a central intermediary like a bank. This feature makes them ideal for international transfers (like remittances), online transactions, and investments in a digital-first world.

Types of cryptocurrency

Cryptocurrencies can be grouped into different categories based on their purpose and functionality within the digital ecosystem:

Payment tokens

These are designed to act as digital assets that can be sent to transfer value between users and merchants.

Payment token examples:

- Bitcoin: BTC is the original cryptocurrency, seen as "digital gold" and used by some as a long-term store of value.

- Litecoin: LTC is faster alternative to Bitcoin, commonly used for smaller transactions.

Utility tokens

These support decentralized applications (dApps) and smart contracts, while serving a specific function within their respective blockchain platforms.

Utility token examples:

- Ethereum: ETH is the leading platform for smart contracts and dApps, popular for DeFi and NFTs.

- Cardano: ADA is a research-driven blockchain focused on scalability and sustainability.

- Polkadot: DOT is a multi-chain platform enabling cross-chain data transfers and blockchain interoperability.

Stablecoins

Cryptocurrencies pegged to stable assets like fiat currency to reduce volatility while allowing users to remain in the cryptocurrency ecosystem.

-1.png)

Stablecoin examples:

- Tether: USDT is a popular stablecoin pegged 1:1 to the US dollar and collateralized via fiat currency.

- USD Coin: USDC is another stablecoin tied to the US dollar, used in decentralized finance (DeFi). Check out our list

Check out our list of 20+ must-know stablecoins.

Meme coins

Light-hearted crypto assets that derive value from community engagement and social media hype.

Meme coin examples:

- Dogecoin: DOGE is a fun, community-driven token, originally created as a joke but now widely adopted with significant market cap.

- Shiba Inu Coin: SHIB is a meme coin inspired by Dogecoin, gaining popularity through social media.

Global cryptocurrency statistics

The global adoption of cryptocurrencies has been on an incline. From 2023 to 2024 alone, the number of crypto users has grown from 420 million to an expected 562 million by the end of the year. This 33% growth rate signals the expanding role of digital currencies in reshaping the global financial ecosystem. [12]

As of 2024, approximately 6.8% of the world's population owns some form of cryptocurrency, with adoption spreading across continents. [12] Per the Triple A Global Cryptocurrency report:

- Asia: Ownership increased from 268.2 million in 2023 to 326.8 million in 2024 (+21.8%).

- North America: Ownership climbed moderately from 52.1 million to 72.2 million (+38.6%).

- South America: Ownership soared from 25.5 million to 55.2 million (+116.5%).

- Europe: The number of crypto owners rose from 30.7 million to 49.2 million (+60.3%).

- Africa: Ownership saw a modest rise from 40.1 million to 43.5 million (+8.5%).

- Oceania: Interest more than doubled, growing from 1.4 million to 3.0 million (+114.3%).

.png)

These figures show how cryptocurrency is gradually becoming part of mainstream global finance, with growing interest in both developed and emerging markets.

Why do people invest in cryptocurrency?

There are several common factors that influence users to invest in crypto assets, both in Canada and across the globe:

Diversification

Cryptocurrencies offer a way to diversify investment portfolios beyond traditional assets like stocks and bonds. With over 42.3% of Canadians owning some form of crypto asset, including tokens, coins, or NFTs, digital assets are becoming an integral part of contemporary investment strategies. [4]

Technological enthusiasm

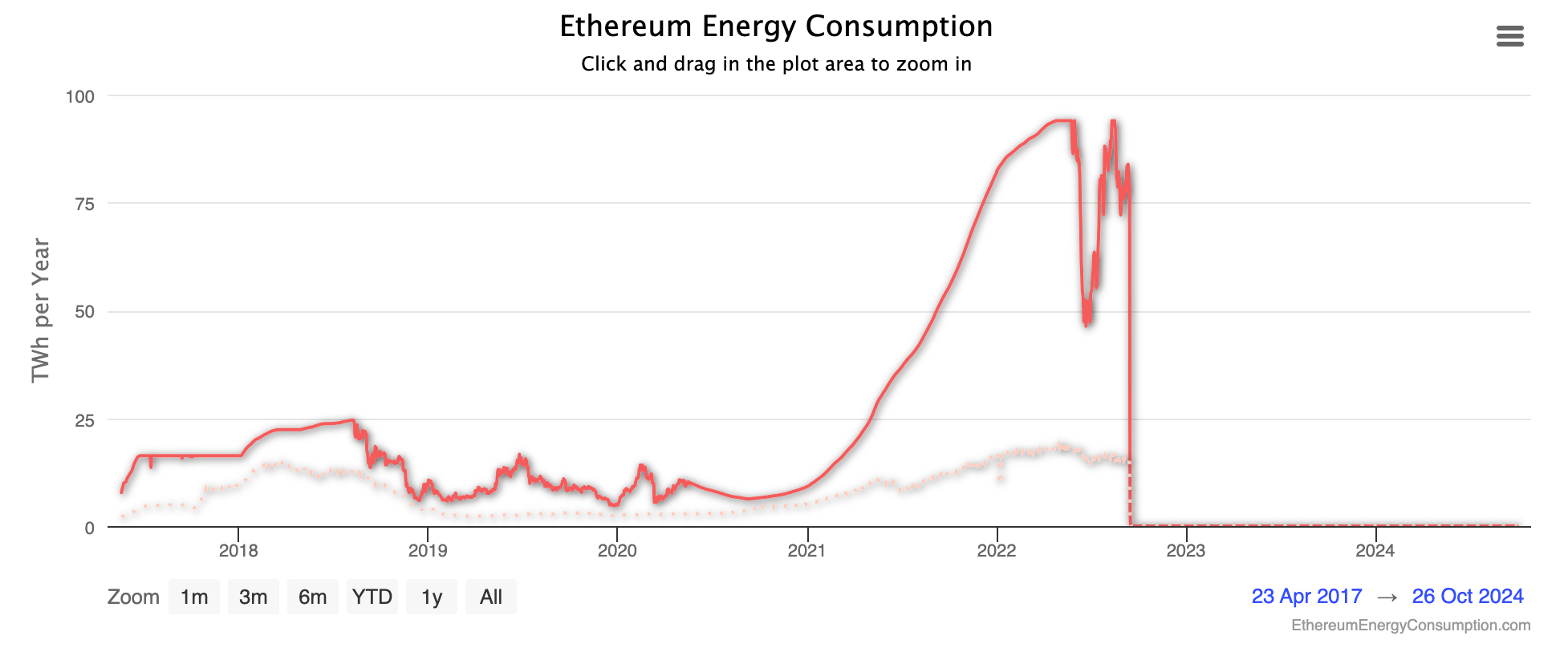

Blockchain—the backbone of cryptocurrencies—holds the potential to revolutionize various industries, from finance to healthcare. Younger Canadians, particularly Gen Z and Millennials, are drawn to the technological possibilities, such as Ethereum’s recent shift to Proof-of-Stake (PoS).

This event, known as the Ethereum Merge, has helped to reduce carbon emissions by up to 99.99%, aligning closely with ESG (Environmental, Social, and Governance) investing values. [5]

Institutional investing

Institutional investors in Canada have increasingly allocated funds to cryptocurrency assets. As the crypto market matures, investors are increasingly treating crypto as an innovative asset class that complements traditional investments.

Decentralization and autonomy

Cryptocurrencies enable transactions without the need for traditional banking systems, offering greater financial independence. Interestingly, 62% of Canadians have expressed interest in receiving their salaries in cryptocurrency, indicating growing acceptance and trust in digital assets. [2]

Regulatory developments

With the introduction of more robust regulatory frameworks, crypto assets are becoming more accessible and secure. The approval of spot-based Bitcoin ETFs by the SEC in January 2024 is a key example, and it has positively impacted the Canadian market. [3] Since Canadian investors have actually had access to spot Bitcoin and Ether ETFs since 2021, the country's market share in global spot crypto ETFs has grown to 46%. [16]

Crypto in Canada through the lens of MoonPay

MoonPay, a popular cryptocurrency payments platform, offers a unique window to view cryptocurrency adoption in Canada.

In 2024, Canada ranks as MoonPay’s 5th most popular country by the number of transacting customers and 8th by completed volume.

.png)

Below are some key insights into the Canadian crypto landscape through MoonPay data:

- Product popularity: 97% of Canadian MoonPay transactions are to buy crypto assets, with 2% dedicated to NFTs and just 0.11% for off-ramping (selling crypto).

- Most popular cryptocurrencies: Ethereum (ETH) leads the way for Canadian users, representing 32% of total completed volume. Bitcoin (BTC) follows closely at 29%, with Solana (SOL) at 22%.

- Age demographics: The 20-24 age group is the most active, accounting for 21% of completed transactions in 2024.

- Regional breakdown: 42% of MoonPay's Canadian customers come from Ontario, followed by Quebec (21%) and British Columbia (14%).

- Payment methods: Cards dominate payment preferences, making up 92% of the total volume, with Apple Pay at 7% and Google Pay at 1%.

- Volume trends: While 2021 saw the highest completed volume to date, 2024 is projected to surpass both 2022 and 2023 in terms of transaction volume in Canada.

.png)

These numbers highlight how cryptocurrency is becoming more integrated into the Canadian economy, with Canadiens from all age groups and provinces starting to embrace it more.

Is crypto big in Canada?

Cryptocurrency adoption in Canada has seen steady growth in recent years, with user numbers expected to reach 12.95 million by 2028, representing a user penetration rate of 32.07%. [1] This upward trend reflects a broader global shift towards digital currencies as an acceptable part of the financial system.

.png)

Several key statistics help explain this growth:

- Millennials: Make up the largest group of crypto owners in Canada. [2]

- Generation Z: Has the highest number of completed crypto transactions in 2024 using MoonPay.

- Gender disparity: Men in Canada are 2.6 times more likely to own crypto than women. [2]

- New users: 31% of Canadians have been using cryptocurrencies for less than a year, signaling a surge in first-time adopters. [2]

- Ownership rate: Canada ranks 20th out of 26 countries in terms of crypto adoption, with a 10% ownership rate. [2]

- Average revenue: In 2024, the average revenue per user in the Canadian crypto market is expected to reach US$152.1. [1]

- Young enthusiasts: While only 4.1% of Canadians consider crypto among their top investment options, younger generations show a much higher level of enthusiasm. [9]

- Ownership totals: More than four million Canadians currently own digital assets. [14]

What is the status of cryptocurrency in Canada?

Cryptocurrencies are not considered legal tender in Canada, but they are legal to buy and sell. [2] The Canadian government has established a framework of regulations designed to ensure transparency and security in crypto transactions.

Each province’s securities regulator oversees crypto-related activity to ensure it aligns with securities laws. In 2024, lawmakers are advocating for a nationwide strategy that would provide more regulatory clarity and foster growth within the digital currency sector.

Canada’s Standing Committee on Industry and Technology has also highlighted how blockchain technology is transforming the country’s digital landscape, with implications for finance, governance, and other key sectors. [5]

How tax rules apply to crypto assets in Canada

Disclaimer: Nothing contained herein is intended to be, nor should it be construed as, tax or legal advice. Please seek the advice of a tax or legal professional if you have any questions.

The Canada Revenue Agency (CRA) treats cryptocurrency transactions as barter transactions, meaning any resulting gains or losses must be reported as either income or capital gains.

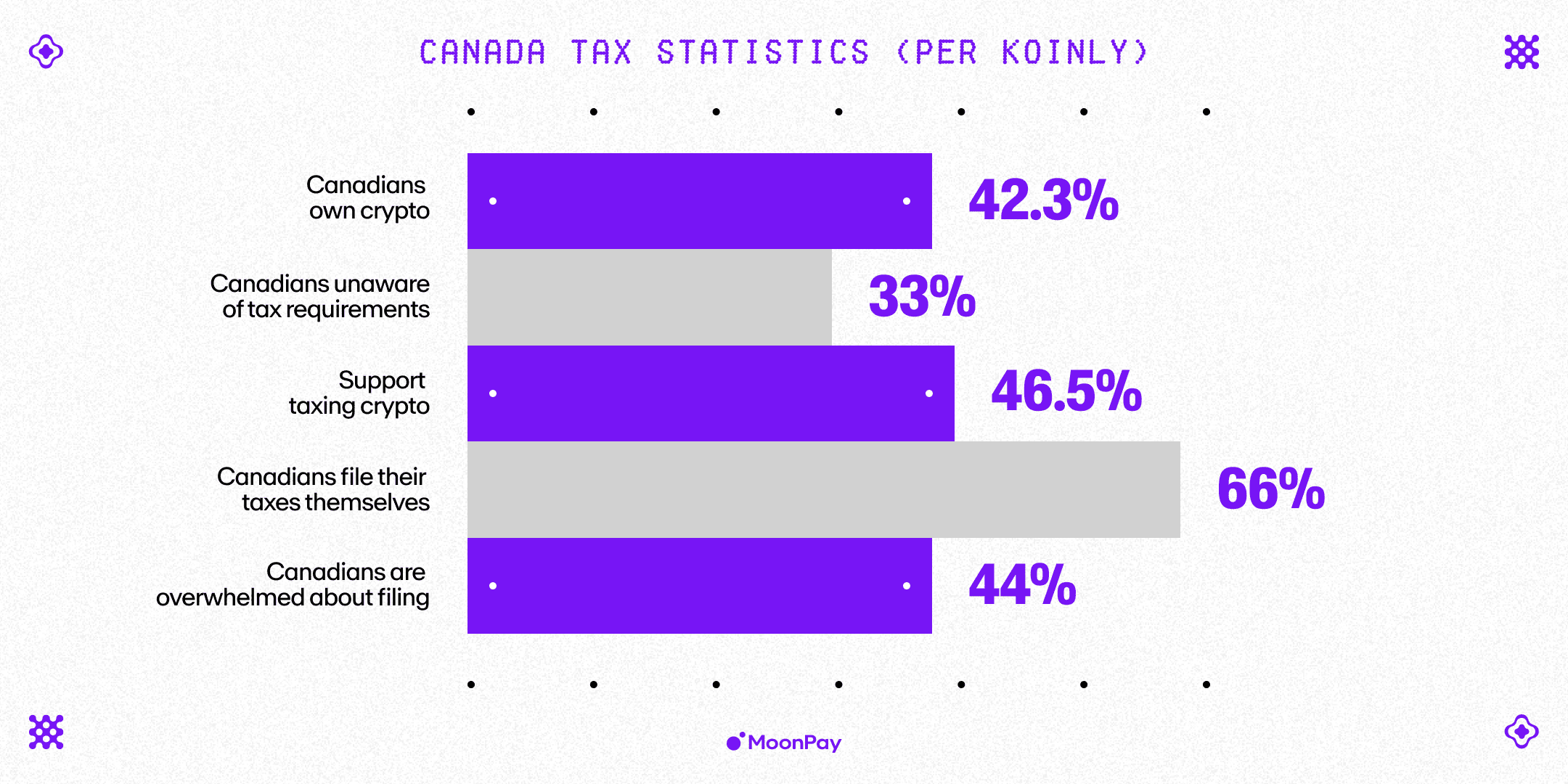

Here are some relevant statistics from a Canada Crypto Tax report by Koinly [4]:

- Ownership: 42.3% of Canadians own some form of cryptocurrency.

- Awareness: 33% of Canadian taxpayers were unaware of their crypto tax reporting requirements shortly before the tax deadline.

- Taxation support: 46.5% of survey respondents support taxing crypto, while 34.3% disagree, and 19.2% remain undecided or neutral.

- Filing methods: 66% of Canadians file their taxes themselves, but 20% use tax software not specifically designed for handling crypto tax regulations.

- Overwhelming: 44% of respondents reported feeling overwhelmed and unsure about the tools needed to accurately file their crypto taxes in compliance with CRA guidelines.

Cryptocurrency risks

While cryptocurrencies offer the potential for growth and innovation, they also come with a set of risks that investors should be aware of.

Volatility

Cryptocurrencies are known for their extreme price fluctuations. Their value can rise or fall dramatically in a short period, which can lead to potential losses for investors. For instance, Bitcoin has seen rapid surges followed by sharp declines, making it a high-risk investment for those unprepared for its volatility. This volatility is even greater for altcoins, meme coins, and also exists for stablecoins.

Security

Although cryptocurrencies use advanced cryptography to secure transactions, they are not immune to hacks and fraud. Crypto exchanges and wallets can be vulnerable, leading to the theft of assets.

It's recommended for users to store crypto assets in non-custodial wallets, with an emphasis on cold storage hardware devices. You should never share your private keys with anyone, and always store secret recovery phrases safely offline.

Regulatory uncertainty

The legal status of cryptocurrencies varies across the globe, and the regulatory environment is constantly evolving. Changes in laws and regulations can impact the value of cryptocurrencies or even limit their usage in certain jurisdictions. This uncertainty may pose risks for investors unsure of the long-term legality of crypto assets in their region.

Lack of understanding

Cryptocurrency and blockchain are complex subjects, and a significant portion of the population lacks a deep understanding of how they work. This knowledge gap can lead to poor investment decisions, making people vulnerable to scams or uninformed price speculation.

Fraud

Fraudulent schemes in the cryptocurrency world are not uncommon. In 2021, the RCMP received reports of cryptocurrency-related fraud totaling $75 million. [5] Scammers often exploit the lack of regulation and understanding around digital assets to deceive investors.

Illicit transactions

Cryptocurrencies have been used in illegal activities due to their pseudonymous (and sometimes anonymous) nature. In 2022, illicit cryptocurrency transactions reached an all-time high, valued at approximately USD 20.6 billion. [6] While most cryptocurrency use is legitimate, this association with criminal activity can affect the market's perception and regulatory responses.

A future with reduced risks?

Though these risks are real, some are being addressed through increased regulation, improved security measures, and better education. Governments and financial institutions are working toward clearer regulatory frameworks, in a move towards cryptocurrencies a safer investment option.

FAQs about crypto in Canada

Which cryptocurrency is the most commonly owned by Canadians?

Bitcoin remains the most popular cryptocurrency among Canadians, with 34% of crypto users "HODLing" BTC. [2] Ethereum is also widely owned, primarily due to its smart contract functionality, which carries appeal to both developers and investors. [3]

Other popular crypto assets in Canada include XRP (XRP), Dogecoin (DOGE), and Shiba Inu Coin (SHIB).

Which is the most crypto-friendly city in Canada?

Vancouver is the most crypto-friendly city in Canada, hosting the highest number of businesses that accept cryptocurrency payments. [15] Toronto, however, boasts the most crypto ATMs, making it easier for residents to buy and sell digital assets at physical locations. [2]

Can Canadians be paid in crypto?

Yes, Canadians can choose to be paid in cryptocurrency, if their company of employment permits it. In fact, 62% of Canadians have expressed interest in being paid in cryptocurrency, highlighting a shift toward digital-first financial solutions. [2]

Ride the crypto wave in 2024 with confidence

Cryptocurrency in Canada is on the rise, and its future looks promising. With increasing adoption rates, greater regulatory clarity, and growing public interest, Canadians are poised to play a significant role in shaping the future of digital finance.

Users in Canada can use MoonPay to easily buy Bitcoin , buy ETH and more cryptos using a credit card, debit card, Apple Pay, or bank transfer. Just enter the amount of crypto you wish to purchase and follow the steps to complete your order.

References

- Cryptocurrencies - Canada (Statista)

- Cryptocurrency Statistics In Canada (Made in CA)

- With rising cryptoasset adoption in Canada, there’s reason for optimism (KPMG)

- Canada Crypto Tax Statistics (Koinly)

- BLOCKCHAIN TECHNOLOGY: CRYPTOCURRENCIES AND BEYOND (Report of the Standing Committee on Industry and Technology)

- Investigating the Use of Blockchain to Authenticate Data from the Statistics Canada Website (Statistics Canada)

- Industry fears Ottawa's 'overreach' could limit crypto access after Budget 2024 (Yahoo!Finance)

- Should Canadians Invest in Bitcoin in 2024? (MarketWatch)

- Top cryptocurrencies in Canada revealed (Wealth Professional)

- Share of respondents who indicated they either owned or used cryptocurrencies in 56 countries and territories worldwide from 2019 to 2024 (Statista)

- Cryptocurrency Statistics 2024 (Forbes Advisor)

- Cryptocurrency Ownership Data 2024 Report (Triple A)

- Canadian Crypto Laws: What You Need to Know (CIP)

- What to Know About the Rise of Crypto Adoption in Canada (Nasdaq)

- Businesses in the 15 biggest cities in Canada that either have a cryptocurrency ATM or offer crypto as an in-store payment method (Statista)

- US Captures 83% of Spot Bitcoin ETF Market, Overtaking Canada (CoinGecko)