What are ERC-404 tokens and how do they work?

Learn about ERC-404, the experimental token standard that is helping to add key features to Ethereum digital assets that improve liquidity and fungibility.

By Corey Barchat

Ethereum is the standard-bearer when it comes to groundbreaking use cases with cryptocurrency. Decentralized finance (DeFi) and non-fungible tokens (NFTs) stand out as two fields in particular that Ethereum has helped revolutionize with features like smart contract capabilities.

Bolstered by its consistent status as the #2 cryptocurrency by market cap behind Bitcoin (BTC), Ethereum (ETH) represents over 59% of total locked value (TVL) in DeFi across all blockchains.

Despite its success, as the Ethereum blockchain ecosystem continues to evolve, new token standards are being developed to address specific needs and enhance functionality of the network. They ensure interoperability, security, and functionality of digital assets, making it easier for developers to build applications and for users to interact with various blockchain-based systems.

One such emerging standard is the ERC-404 token, which was created to expand upon the functionality of previous ERC tokens. But what is ERC-404?

In this article, we'll dive deep into what ERC-404 tokens are, how they work, and their potential impact on the cryptocurrency and blockchain space.

What is the ERC-404 token standard?

The ERC-404 token standard is an experimental protocol that combines the characteristics of both fungible and non-fungible tokens, introducing semi-fungible features to the Ethereum blockchain. Though it is an unofficial token standard, ERC-404 improves upon previous standards like ERC-20, ERC-721, and ERC-1155, offering a versatile framework for digital assets.

Like many Ethereum token standards, the ERC-404 token standard was developed by members of the Ethereum community. Specifically, it was created in February, 2024 by two pseudonymous creators named “ctrl” and “Acme” in EIP-404.

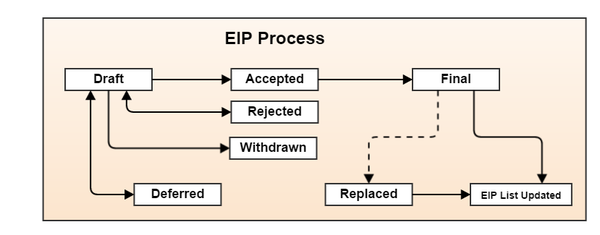

Token standards are typically proposed, discussed, and refined through a collaborative process involving developers, researchers, and other stakeholders within the Ethereum ecosystem. The proposals are often submitted in an Ethereum Improvement Proposal (EIP), which are then reviewed and commented on by the community.

To understand ERC-404, it helps to examine some Ethereum token standards that came before:

ERC-20 tokens like Wrapped Bitcoin (WBTC) and Wrapped Ethereum (WETH) are purely fungible, meaning each token is identical and interchangeable with another. ERC-721, meanwhile, represents non-fungible tokens (NFTs), meaning each token is unique and cannot be exchanged on a one-to-one basis.

In contrast, ERC-404 represents semi-fungible tokens. This allows parts of a non-fungible asset to be traded as fungible tokens, while preserving the unique nature of the underlying digital asset.

This semi-fungibility makes ERC-404 tokens versatile for a range of applications that require both interchangeable and unique properties, such as fractional real estate ownership, event tickets, and in-game assets for blockchain gaming.

How do ERC-404 tokens work?

ERC-404 tokens operate on the Ethereum blockchain, using smart contracts to enforce the rules and functionalities defined by the ERC-404 standard. Here’s a breakdown of how they work:

1) Token creation

Creating an ERC-404 token involves deploying a smart contract that adheres to the ERC-404 specifications. This contract defines the token's properties, such as its name, symbol, and the total supply of tokens. Additionally, it can include functions for managing fractionalized ownership, multi-signature approvals, and other advanced features.

2) Token management

Once created, digital assets can be managed through interactions with their smart contract. This includes transferring tokens, splitting them into smaller fractions, and setting up multi-signature approval mechanisms. Users are able to interact with the smart contract via a compatible wallet or decentralized application (dApp) interface.

3) Fractional ownership of digital assets

The ERC-404 token standard allows assets to be divided into smaller units, enabling multiple parties to own fractions of a single asset. For example, a real estate property worth $1 million could be represented by 1 million tokens, each worth $1. Investors could then buy and sell these fractional, fungible tokens on a marketplace, thereby providing enhanced liquidity and accessibility for non-fungible assets.

4) Multi-signature transactions

To enhance security, ERC-404 tokens can require multiple signatures for transactions. This means that a predefined number of approvals from different parties are needed before a transaction is executed. This feature is particularly useful for corporate governance and collaborative ownership structures.

5) Compliance and regulatory features

ERC-404 tokens can incorporate programmable compliance features, ensuring that all transactions adhere to relevant legal and regulatory requirements. For instance, the smart contract can be programmed to restrict transfers to only approved wallets or to require additional verification steps for certain types of transactions.

What can ERC-404 tokens be used for?

The versatility of ERC-404 tokens opens up a wide range of potential applications across various industries. Here are some key use cases:

Real estate

The ERC-404 token standard can revolutionize real estate investment by allowing properties to be tokenized and sold in fractional units. This makes it easier for individuals to invest in real estate without needing to purchase entire properties, thus lowering the barrier to entry in the real estate market.

Art and collectibles

Tokenizing art and collectibles with ERC-404 tokens allows for collective ownership of high-value items. This means that multiple investors can own shares of a single artwork or collectible, increasing accessibility and investment opportunities in the art market.

Decentralized finance (DeFi)

In the DeFi space, ERC-404 tokens can be used to create more complex financial products and services. For example, they can enable fractionalized ownership of assets in lending or NFT staking platforms, enhancing liquidity and risk management.

Gaming and virtual assets

In the gaming industry, ERC-404 semi-fungible tokens can represent fractional ownership of in-game assets and virtual properties. This means a better community gaming experience in which players can buy, sell, and trade fractions of valuable in-game items that are owned by users.

What are the benefits of the ERC-404 standard?

The ERC-404 token standard brings a suite of advanced features and capabilities that address various limitations of earlier token standards like ERC-20 and ERC-721. Here are some key advantages:

Flexibility and functionality

The ERC-404 token standard offers new flexibility, allowing developers to create tokens with a wide range of functionalities tailored to specific use cases. This flexibility extends to the customization of semi-fungible token properties, transaction rules, and governance mechanisms, making it possible to design tokens that meet the unique needs of blockchain projects like decentralized autonomous organizations (DAOs).

Interoperability

Designed to work seamlessly with the existing Ethereum infrastructure, ERC-404 tokens ensure smooth integration with other smart contracts, decentralized applications (dApps), and other platforms. This interoperability promotes the development of interconnected ecosystems and enhances the usability of ERC-404 tokens within the broader blockchain ecosystem.

Fractional ownership

One of the most significant advantages of ERC-404 tokens is in enabling shared ownership. This allows high-value assets, such as real estate, art, and collectibles, to be divided into smaller, more accessible units. Investors can buy, sell, and trade these fractions, democratizing access to valuable assets and increasing market liquidity.

Security features

Multi-signature security in some ERC-404 tokens requires multiple parties to approve a transaction before it is executed, reducing the risk of fraud and unauthorized transfers. Additionally, programmable compliance ensures that transactions adhere to different legal and regulatory requirements that can vary by region.

Increased liquidity

ERC-404 tokens facilitate the trading of fractional assets, increasing liquidity and efficiency in markets that have traditionally been illiquid. Through fractional ownership, ERC-404 allows assets like non-fungible tokens (NFTs) to be divided into smaller units that can be easily bought and sold as fractionalized NFTs.

Improved transparency

Blockchain technology inherently provides a high level of transparency, and the ERC-404 token standard capitalizes on this advantage. Its reliance on smart contracts stipulates that all transactions and digital ownership changes are recorded on the blockchain, providing a transparent and immutable record that can help with asset management and reduce fraudulent activity.

Limitations of the ERC-404 token standard

While the ERC-404 token standard is promising, its adoption comes with its own set of challenges and limitations that need to be carefully considered.

Technical complexity

The advanced features of ERC-404 tokens introduce a level of complexity that can be daunting for some developers and users. Creating, managing, and interacting with these tokens may require a deep understanding of smart contract programming and blockchain technology.

Market adoption

As with any new token standard, achieving widespread adoption can be challenging. Market participants need to see clear advantages and practical applications of ERC-404 tokens to embrace them fully. Though it has its share of early adopters, mass adoption requires user education, awareness, and a track record of successful projects.

Security concerns

While ERC-404 tokens incorporate some advanced security features, they also present new attack vulnerabilities. Ensuring the security of these tokens and their underlying smart contracts is paramount, as lapses could lead to significant financial losses and erosion of trust.

Blockchain compatibility

Ensuring compatibility with existing blockchain infrastructure and other token standards is crucial for the success of ERC-404 tokens. This includes interoperability with popular wallets, cryptocurrency exchanges, and decentralized applications (dApps).

Availability and liquidity

Although the ERC-404 standard aims to increase liquidity, achieving this in practice can be challenging. Marketplaces, exchanges, and trading platforms need to support these tokens and provide adequate liquidity and market efficiency for fractional ownership assets.

Regulatory uncertainty

Navigating the regulatory landscape can present a significant challenge for ERC-404 tokens. The legal status of fractional ownership and advanced token functionalities can vary by jurisdiction, requiring careful consideration and compliance before implementation.

Examples of ERC-404 projects

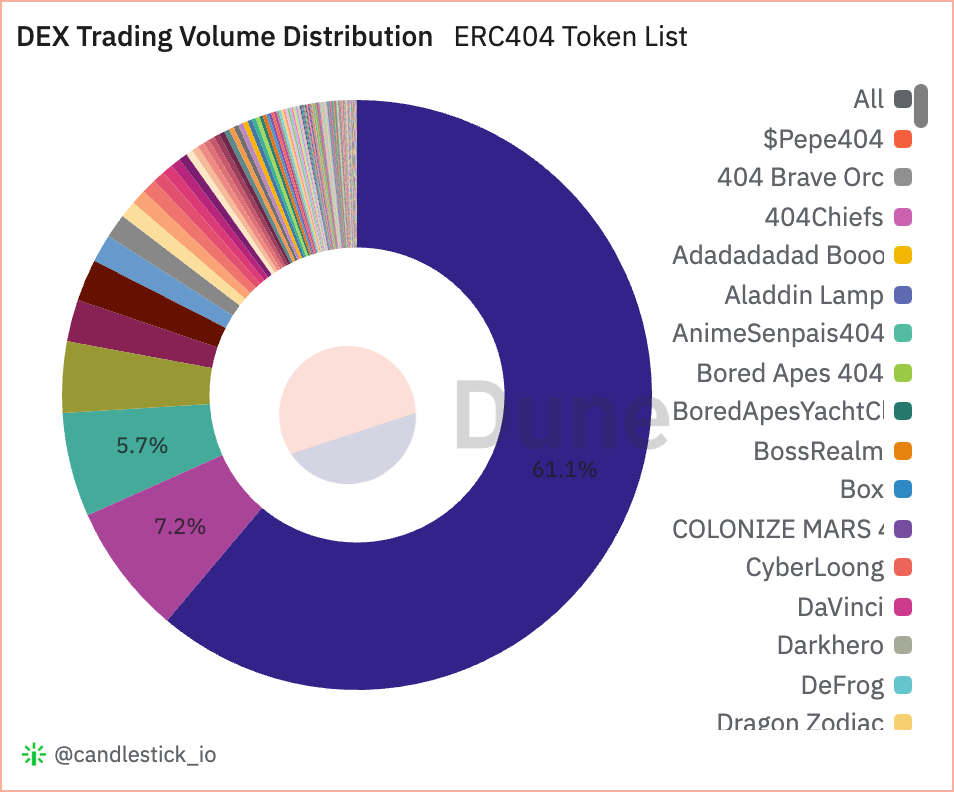

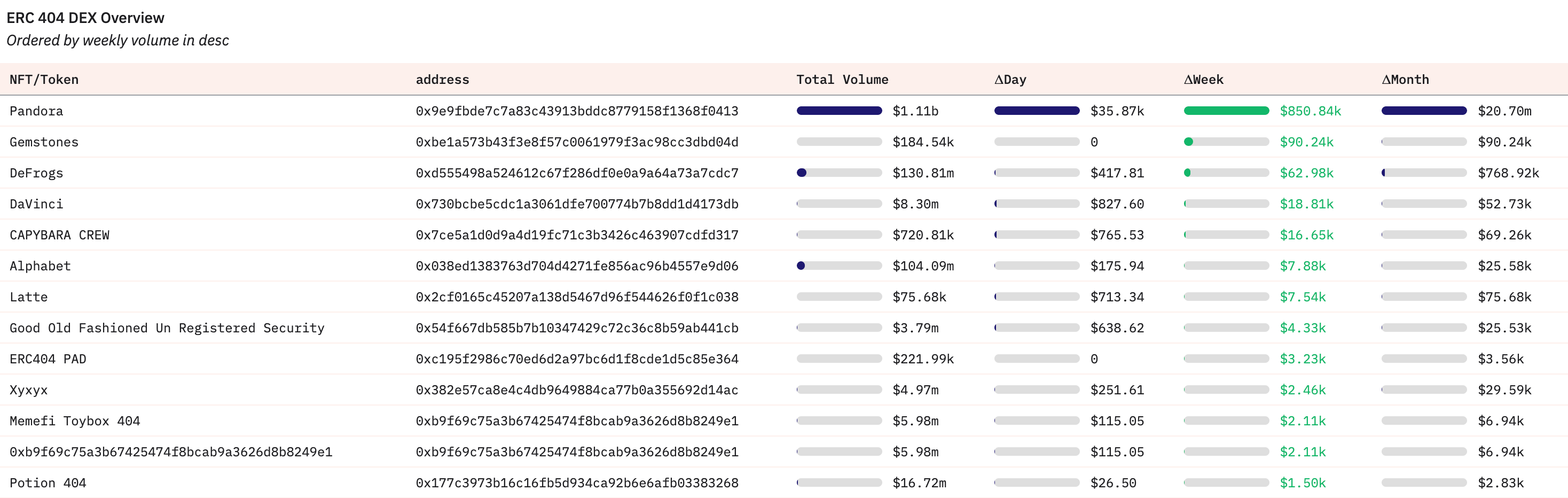

The ERC-404 token standard has rapidly gained traction in the blockchain ecosystem due to its unique semi-fungible nature. Here’s a look at some common ERC-404 tokens by market cap:

- Pandora (PANDORA)

- DeFrogs (DEFROGS)

- Asterix Labs (ASTX)

- Sheboshis (SHEB)

- Pundi X PURSE (PURSE)

Getting started with the Ethereum ecosystem

There are several necessary steps for users that wish to create an ERC-404 semi-fungible token. This can involve developing compliant smart contracts, interfacing with dApps, managing the token's state, and integrating the token with existing blockchain systems and protocols.

Luckily, for users that want to get involved with ERC-404 tokens, there are easier ways to enter the Ethereum and NFT space.

MoonPay simplifies the process of buying tokens like Ether (ETH), USD Coin (USDC), Tether (USDT), Polygon (MATIC), Dai (DAI), and many more ERC-20 tokens that can be used to engage with dApps and non-fungible tokens.

Just enter the amount of crypto you wish to purchase, and choose from supported payment options like card, bank transfer, Apple Pay, and more payment methods.

.png)