What is USDC? A complete guide to Circle’s stablecoin

USDC (USD Coin) is one of the most popular stablecoins out there. Here are some things you need to know about what it is and how it works.

By Corey Barchat

Cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) demand most of the attention within the crypto space, and for good reason: these two leading tokenscoins alone account for a combined 72% market dominance.

But there are hundreds more cryptocurrencies and blockchain projects. And though most people choose to invest in BTC or ETH, one concern with the largest cryptocurrencies is the often considerable price volatility.

Price volatility is nothing new, however, and has been commonplace since the birth of crypto. For seasoned investors and crypto newbies alike, wild fluctuations in price can represent an opportunity for big returns. But for some they might make cryptocurrency assets seem too risky because of potential losses.

Stablecoins were created as a digital asset attempting to maintain a stable price that presented an alternative to other more volatile cryptocurrencies.

In this article, we'll explore this type of digital currency and look at USDC, one of the most popular stablecoins on the market today.

What is USDC?

USDC is a stablecoin created by Coinbase and Circle. Also called USD Coin, it attempts to maintain a constant value relative to the US dollar, though it has occasionally suffered from de-pegging. USDC operates as an ERC-20 token, meaning it runs on the Ethereum blockchain.

After being managed by the Centre Consortium for most of its existence, Centre announced in 2023 that they would be shutting down.

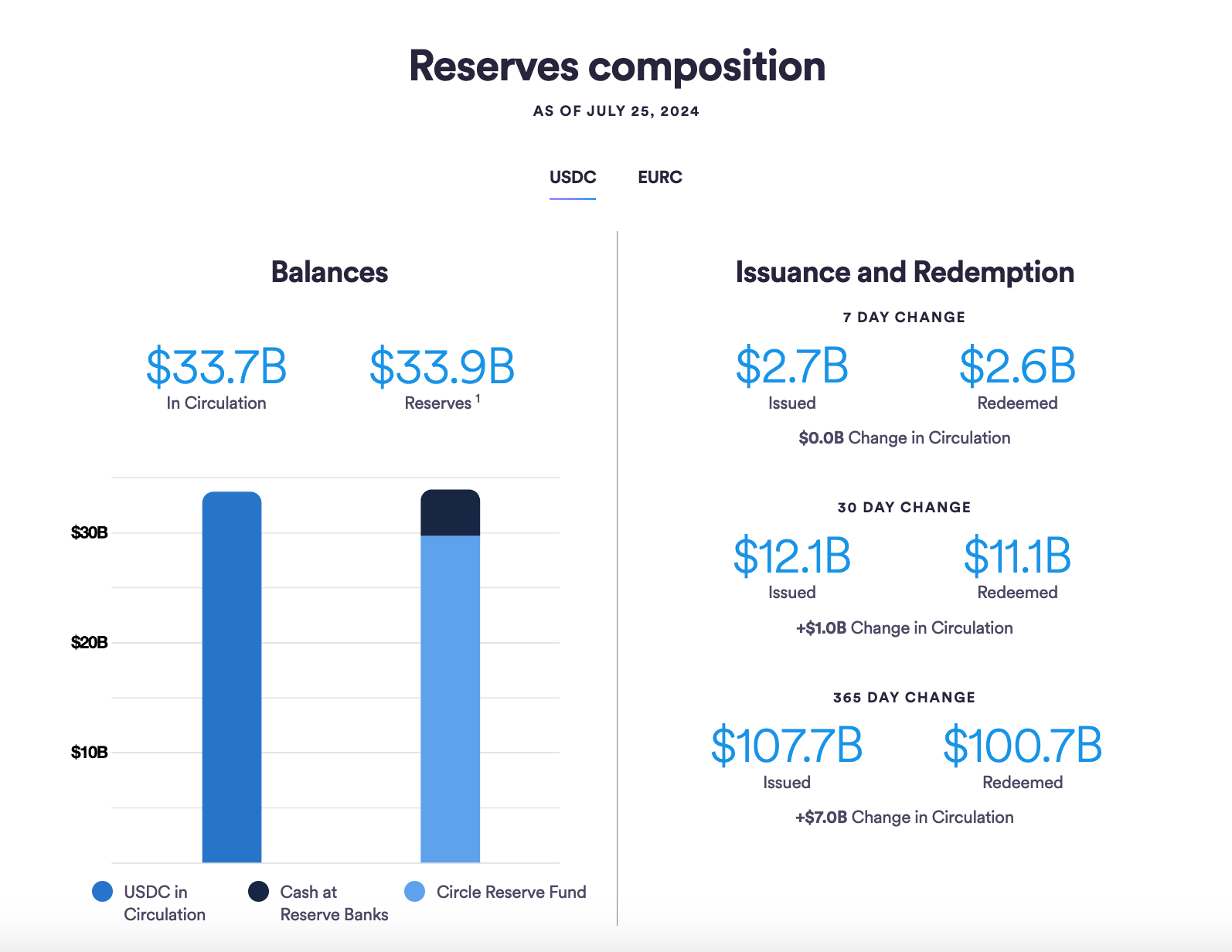

As a result, Coinbase took an equity stake in Circle, which governs and oversees the technical and financial standards for the USDC stablecoin. Circle aims to provide transparency around a 1-to-1 backing of USDC. This means that for every USDC created, there should be $1 USD worth of assets held in reserve.

Created in 2018, there is a total supply of 34 billion USDC (at the time of writing). USDC can be issued by approved regulated financial institutions, which allows for the growth of the USDC ecosystem. The token can be bought and sold on a variety of cryptocurrency exchanges and cryptocurrency providers, including via MoonPay by using a credit card.

Additionally, you can transfer USDC across the world by any Ethereum wallet or crypto exchange that is ERC-20 compatible. But it's not just limited to the Ethereum network: USD Coin is compatible with other major blockchain networks such as Algorand (ALGO), Solana (SOL), Stellar (XLM), Tron (TRX), and Flow (FLOW).

What are stablecoins?

Stablecoins are a specific subset of cryptocurrencies which aim to peg their value to the value of a real-world asset (usually fiat) to ensure price stability. With many types of stablecoins in existence, there are several different methods used to attempt to maintain a stable value.

One common method is for a stablecoin issuer to maintain a reserve of assets. For example, in the case of USDC, for every one coin in existence, there should be one dollar of corresponding assets held in reserve.

The intention behind this is that the supply of USDC should be directly correlated with an equivalent amount of USD held in reserve backing USDC. Other stablecoins can be backed by crypto, additional commodity assets, or other fiat currencies—not just US Dollars.

How does USDC work?

So how does USD Coin work on a technical level, given it is both a stablecoin and a cryptocurrency?

Essentially, whenever a dollar is deposited, a USDC token is created. Then, when a customer wishes to redeem USDC back for dollars, the USD Coins are permanently destroyed with a view to keeping a consistent backing.

Here's how the financial institution responsible for oversight of USDC explains the technical process.

Redemption follows the reverse sequence: a customer requests a redemption from an issuer, and upon successful verification and validation, the appropriate USDC tokens are irrevocably deleted from circulation ("burned"), and funds from underlying reserves are transferred back to the customer's external bank.

For stablecoins like USDC to operate as intended, there needs to be trust and transparency from the overseeing parties to ensure that there is actually a 1 to 1 backing, which is why Circle provides routine updates from accounting firms Grant Thornton and Deloitte.

The entire concept of fiat-backed stablecoins is premised on there being a 1-to-1 backing of fiat assets to stablecoins, which is why the USDC issuers strive for transparency.

USDC use cases

So what can USDC actually be used for? Given its status as a fiat-backed stablecoin that is less volatile than other digital assets, USDC can be used in unique ways compared to other cryptocurrencies.

1. Easier access to crypto markets

USDC allows you to buy, sell, and transfer funds while remaining in the cryptocurrency ecosystem. Instead of going through many steps to cash out to your traditional bank or card, you can swap crypto to USDC. USD Coin is accepted on virtually every major cryptocurrency exchange, both centralized and decentralized, giving users plenty of custodial options.

2. Cross-border payments

Transferring your local fiat currency to other businesses or individuals around the world can be incredibly costly, not to mention inconvenient. Some bank payments can take days to process, on top of hefty fees.

With USDC, you’re able to make cross-border payments, also known as remittances, to anyone with a cryptocurrency wallet for just a fraction of the cost of traditional remittances.

3. Get paid in crypto

Another useful benefit of USDC is that it can help make it easier to pay employees in crypto. While far from being a common request, professional athletes and startup employees are beginning to negotiate to be paid in cryptocurrency.

While being paid in Bitcoin and Ethereum can certainly have upside, the volatility in price makes it a difficult option to consider for many. Using USDC, employees can get paid in crypto while potentially being protected against the downside of price swings. With USDC users can then purchase the cryptocurrency of their choice with ease.

4. Decentralized finance (DeFi)

Stablecoins like USDC are a common choice to use in decentralized finance (DeFi) and its many applications.

For example, USDC can be used to provide liquidity in pools to earn rewards in the form of LP tokens that generate interest when other users participate in the pool. Let’s say you own both USDC and Ethereum, and want to earn interest on your holdings via yield farming. You could provide equal amounts of USDC and ETH in a liquidity pool, to earn a percentage of transaction fees when others swap between that pair.

Of course, there are always risks involved in participating in DeFi, such as smart contract hacks and impermanent loss, which is when the price of one token pair in a liquidity pool fluctuates in comparison to the other when a user withdraws their liquidity.

5. Government aid

USDC and other stablecoins are also seeing more usage in the case of government policy as well. Given its ability to transfer to individuals and businesses who have access to the internet, USDC makes it easier for governments to transfer relief funds.

It also facilitates international donations, bypassing the roadblocks that accompany transfers between banks in different countries.

USDC Pros

USDC has some intrinsic benefits that make it appealing to users over other crypto tokens:

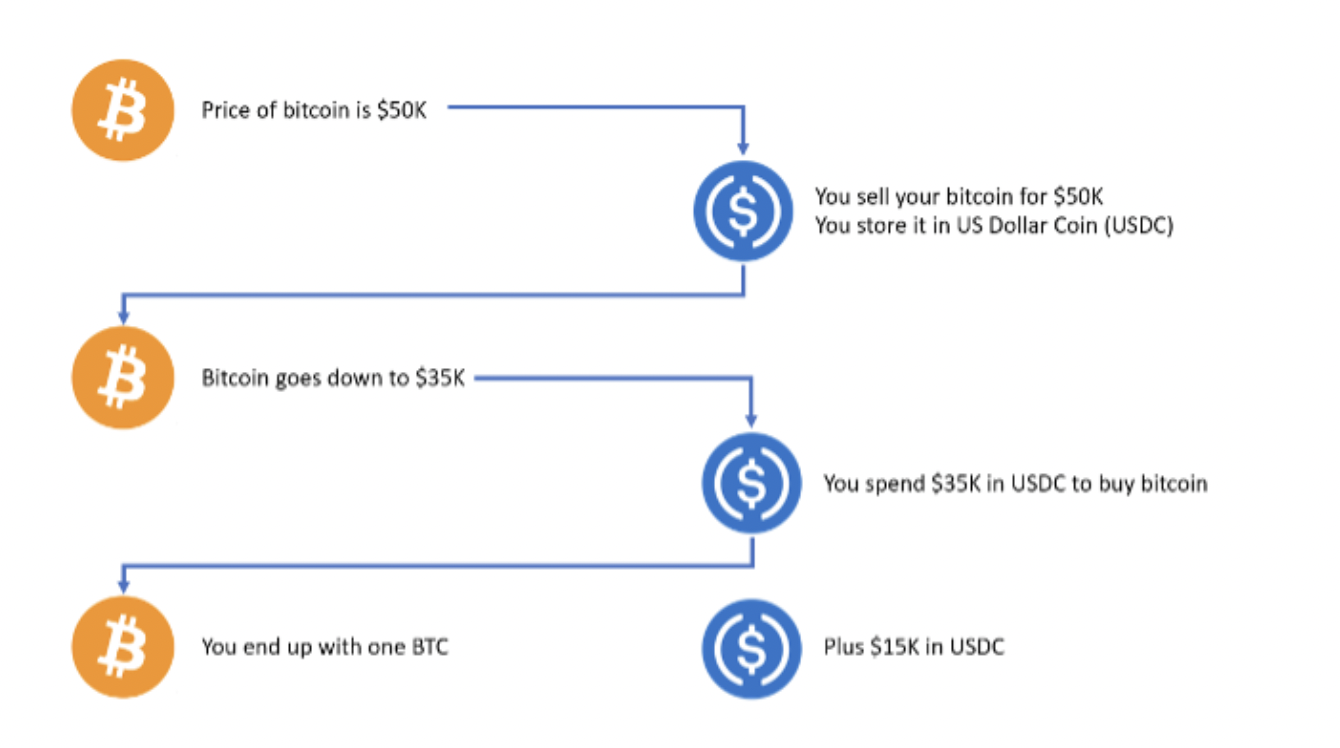

Hedge against volatility

Instead of holding a cryptocurrency that fluctuates wildly, investors can swap to a potentially less volatile asset like USDC.

For those trying to time the top of the market and buy back in later, USDC can be held until the time comes to swap back to a more volatile cryptocurrency of your choice.

Staking to earn interest

USDC can be staked to provide additional reward. It can also be used in trading pairs on DeFi platforms to earn a percentage of total network fees.

Multi-chain compatibility

You can quickly and cheaply send your USDC to a variety of blockchain ecosystems like Ethereum and Solana, and then use it to purchase a variety of cryptocurrencies and NFTs.

Fully-backed reserves

Circle consistently publishes audited reports of its reserves held in the Circle Reserve Fund, and is generally seen as a trusted parent company of the stablecoin.

USDC Cons

Despite its advantages, USDC also carries some inherent limitations and risks:

Depegging risk

Although stablecoins like USDC are meant to hold a stable price and 1:1 backing with its reserves, there have been instances where stablecoins have depegged, or lost their stable price, and there is no guarantee this may not happen again in the future.

Limited price appreciation

Due to its stable value, USDC lacks the price appreciation that investors come to expect from other cryptocurrencies. However, this limited upside is offset by DeFi functionality such as staking, liquidity pools, and yield farming.

Stablecoin competition

USDC is not the only stablecoin, and actually ranks second in market cap among stablecoins pegged to the dollar. USDT (Tether) is currently in the top spot, with a market cap 61% higher than USDC’s. While Tether was released with a four-year head start on USD Coin, the latter has gained ground and is vying to be the top stablecoin.

USDC Frequently Asked Questions (FAQs)

Is it safe to buy USDC?

As with any investment or cryptocurrency purchase, you should always do your own research. It’s also important to buy only from trusted exchanges and services, and store your crypto in the right wallet.

That being said, stablecoins like USDC are not immune to the risk factors that affect all digital assets and cryptocurrency investments. Even though the price of stablecoins is intended to remain stable, these assets have experienced depegs, hacks, and even total collapse.

Even though Circle releases regular audits of its reserves, there is no guarantee that the coin will always maintain its $1 value.

Why use a digital dollar?

Dollar-denominated assets like USDC open a realm of possibilities to investors inside the United States and around the world. It can be sent anywhere at any time and used to stay within the crypto ecosystem without cashing out to fiat.

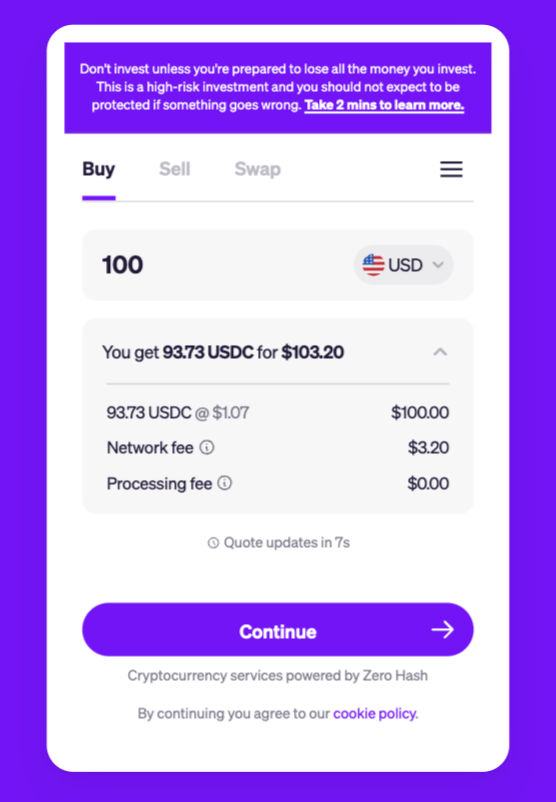

How can I buy USDC stablecoins with fiat currency?

MoonPay Balance is an easier way to purchase USDC using fiat currency. Begin by funding your wallet with euros, pounds, or dollars and use your MoonPay Balance that can be used to purchase stablecoins like USDC. With MoonPay Balance, you'll enjoy faster transactions, lower fees, and higher approval rates. Plus, when it's time to cash out, take advantage of zero-fee withdrawals straight to your bank account.

Will USDC hold its value?

There is no guarantee that USDC will always hold its intended value of $1. As we have seen, USDC has experienced depegging (in both directions), so users should be aware of more potential depegs in the future.

At the same time, Circle regularly publishes reports of its backed reserves with attestations from Grant Thornton LLP and Deloitte, with the intention of demonstrating that there is an equivalent value of USDC reserves and circulating supply.

Is USDC the only stablecoin?

Although it is one of the most widely used stablecoins, USDC is not the only one in existence. Stablecoins can be pegged to any asset, and other national currencies such as the Brazilian Real (BRL).

There are also many other dollar-backed stablecoins, such as USDT (Tether), Dai (DAI), and TrueUSD (TUSD).

For a more detailed explanation of stablecoins, see our article USDT vs USDC: Which stablecoin should you use?

Is USD Coin divisible?

Like the fiat currency it’s pegged to, USD Coin is divisible to the cent. It’s actually even more divisible than the dollar and transactions can be sent for as low as 0.000001 USDC.

How to buy USDC (USD Coin)

You can buy USDC via MoonPay or through any of our partner wallet applications with a credit card, bank transfer, Apple Pay, Google Pay, and many other payment methods.

Just enter the amount of USDC you wish to purchase and follow the steps to complete your order.

How to sell USDC?

MoonPay also makes it easy to sell USDC when you decide it's time to cash out. Simply enter the amount of USD Coin you'd like to sell and enter the details where you want to receive your funds.

Swap USDC for more tokens

Want to exchange USDC for other cryptocurrencies like Ethereum and Bitcoin? MoonPay allows you to swap crypto cross-chain with competitive rates, directly from your non-custodial wallet.