Picture this: you wake up to find a bunch of new tokens sitting in your cryptocurrency wallet, without having spent a cent. Free money seems too good to be true, but with crypto airdrops, but that's the idea behind crypto airdrops.

Airdrops are becoming a popular way for blockchain projects to spread the word about new tokens, reward loyal users, and build communities around their platforms. Between 2020 and 2023 alone, crypto airdrops accounted for more than $25 billion worth of tokens to users!

But what is a crypto airdrop, how does it work, and why should you care?

In this guide, we break down what crypto airdrops are, how they work, their benefits and risks, and how to safely participate in legitimate opportunities.

What Is a Crypto Airdrop?

A crypto airdrop is when a blockchain project gives away free cryptocurrency tokens to users. Typically, these tokens are distributed directly to crypto wallets as a way to create community buzz around a project, reward early supporters, or get people excited about a new token launch.

In some cases, users may need to complete simple tasks like joining a Telegram group or sharing a post on social media to receive their crypto coins. Other times, you just need to hold a specific cryptocurrency in your wallet, and voila! Hello free tokens.

But why give away free crypto?

Well, airdropping tokens is a common way for projects to encourage new users to engage with their platforms. They’re like a free sample, allowing users to test out the ecosystem or use the tokens on decentralized apps (dApps) before committing further.

Projects have several reasons for distributing airdropped coins, including:

- Promoting a new token launch to spread awareness.

- Rewarding early adopters or loyal community members.

- Increasing decentralization by putting tokens in the hands of many different users.

- Kickstarting trading and liquidity by giving people an incentive to use the token.

How Does a Crypto Airdrop Work?

While specific crypto airdrops work in different ways with varying means of distributing tokens, the process is usually pretty straightforward. Here’s how it typically goes:

- Announcement: The project announces an airdrop via social media, its official website, or other crypto community platform.

- Eligibility: Some airdrops are automatic if you meet certain requirements, like holding a specific token for a determined amount of time. Others might require signing up or completing simple tasks.

- Verification: If certain tasks are involved, they are often verified manually or automatically. Eligibility could also involve wallet snapshots at specific times.

- Distribution: After you’ve met the requirements, the project distributes the tokens directly to your crypto wallet.

Some airdrops are super easy to get, often requiring users to simply hold a certain cryptocurrency in a wallet when the project takes a “snapshot”. Others may require a bit more work, like filling out forms or sharing project updates on social media.

Always verify the legitimacy of airdrops through official sources, and never share your private keys or confidential personal information. Real airdrops will never ask for sensitive information.

Types of Crypto Airdrops

Not all airdrops are created equal. There are several different types, each with its own unique way of distributing tokens. Let’s take a look at the most common types:

Standard airdrops

In a standard airdrop, tokens are distributed to a large number of users with little to no effort on the recipient’s part. Sometimes all you need to do is hold tokens in a wallet, register for the airdrop, or provide your wallet address.

Bounty airdrops

A bounty airdrop requires participants to complete certain tasks in exchange for tokens. These tasks can range from sharing social media posts, writing blog articles, or creating video content. Once the project verifies that you’ve completed the required tasks, you receive the tokens.

Exclusive airdrops

An exclusive airdrop is a targeted distribution model meant for a specific group of people, such as early adopters, loyal community members, or influential users. Exclusive airdrops reward those who have supported a project from the beginning or have a significant stake in it.

Holder airdrops

In a holder airdrop, all you need to do is "HODL" a specific cryptocurrency in your wallet at a certain time. A snapshot is generally taken of eligible wallets, and tokens are distributed based on the wallet's balance. This type of airdrop is common when new projects want to reward users who are already invested and hold existing tokens in certain blockchain ecosystems.

Forked airdrops

When a blockchain forks—splits into two chains—holders of the original cryptocurrency often receive tokens on the new chain. A famous example is the Bitcoin Cash fork, where Bitcoin holders received an equivalent amount of Bitcoin Cash when the fork occurred.

Reward-based airdrops

These airdrops provide ongoing rewards for users who engage with a project. For example, decentralized finance (DeFi) platforms might reward users for providing liquidity or participating in governance votes.

Some projects also offer raffle-based airdrops, where tokens are distributed to winners selected through a lottery system. Users might need to meet specific criteria to enter the raffle, such as holding a certain token or completing tasks.

Crypto airdrops can take many forms depending on the project’s goals and distribution method. The table below highlights the most common types and what makes each one unique:

Airdrop Type | How It Works | Who It’s For |

Standard Airdrop | Free tokens sent to users with minimal effort. Just sign up or provide a wallet address. | Beginners and casual users. |

Bounty Airdrop | Earn tokens by completing tasks like sharing posts or writing reviews. | Active community participants. |

Exclusive Airdrop | Distributed to loyal or early users who supported the project. | Long-term community members. |

Holder Airdrop | Tokens distributed based on holdings in eligible wallets during a snapshot. | Existing crypto holders. |

Forked Airdrop | Tokens given to holders of the original cryptocurrency after a blockchain split. | Long-time blockchain users. |

Reward-Based Airdrop | Continuous rewards for staking, governance, or liquidity participation. | DeFi users and project supporters. |

Raffle Airdrop | Tokens given to randomly selected participants who meet entry conditions. | Users who enjoy chance-based events. |

Benefits of Crypto Airdrops

Crypto airdrops offer plenty of perks, both for users and the projects that distribute them. Let’s explore the key benefits.

Free crypto for users

The biggest and most obvious benefit is free cryptocurrency. Whether it’s a small amount or something substantial, getting free tokens without spending any money can be an incentive for many users.

Access to new projects

Airdrops offer an opportunity for users to explore innovative blockchain projects they might not have discovered otherwise. After receiving tokens, holders can dive deeper into new platforms, ecosystems, and technologies. This can open the door to experimenting with decentralized applications (dApps), governance protocols, or even unique NFT marketplaces.

Potential price appreciation

Some airdropped tokens can increase in value, making them worth more than when you initially received them. For example, Uniswap’s airdrop of UNI tokens turned out to be hugely valuable for early users, with tokens eventually worth thousands of dollars.

Note: While some airdropped tokens may increase in value, there's no guarantee of future gains, and the value of tokens can fluctuate or even become worthless.

Strengthening the ecosystem

Airdrops help distribute tokens more widely, fostering greater decentralization, community involvement, and ecosystem growth. Projects that put tokens in the hands of everyday users do so with the intention of building stronger, more engaged communities.

Liquidity boost

Airdrops often inject fresh liquidity into the market by distributing tokens to a wide range of users. When recipients start trading their tokens on crypto exchanges, it increases the overall trading volume, making it easier for others to buy and sell the token, and use it in dApps.

Brand exposure

Airdrops are a common marketing tool that attempts to boost a project's visibility. When people receive free tokens, the idea is that they become more likely to talk about the project, whether through social media, forums, or crypto communities.

Risks and Challenges of Crypto Airdrops

While airdrops can be exciting, they’re not without their downsides. There are several risks and challenges that both users and projects face.

Security risks

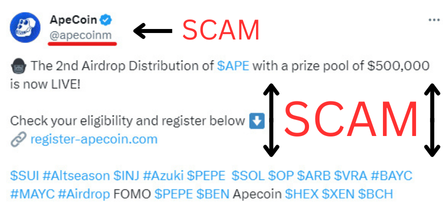

One of the biggest risks with airdrops is security. Scammers often create fake airdrops to steal users’ funds, private keys, or personal information. Always double-check the legitimacy of an airdrop and the social media account or website domain before participating. Some scams may involve creating fake accounts with slightly different usernames or domains.

Over-saturation

With so many airdrops happening, it’s easy for the market to become flooded with new tokens. This increased supply can result in some airdropped tokens having little to no value, especially if the project fails to gain traction.

Legal and regulatory risks

Airdrops may run afoul of local regulations, especially in jurisdictions with strict cryptocurrency or securities laws. Legitimate projects should perform due diligence to ensure compliance, and users must be aware of the legal landscape in their own countries before participating.

Time commitment

Some airdrops require users to spend time completing tasks, signing up for newsletters and communities, or promoting the project on social media. While the commitment can be worth it for valuable tokens, it can also become a chore for projects and tokens that don’t pan out.

Spam overload

Some users find themselves bombarded with spam emails and promotional content after signing up for airdrops. Spam can lead to a cluttered inbox and, in some cases, phishing attempts or fraudulent offers disguised as legitimate projects.

Pump-and-dump schemes

In some cases, projects pump the value of a token with an airdrop, only for it to crash after users sell off their tokens. Such scams create an artificial price spike, leaving late buyers holding their bags with significantly devalued tokens once the price collapses.

While crypto airdrops can be rewarding, they also come with potential downsides. The table below outlines the key benefits and risks to help you weigh whether participating in an airdrop is right for you:

Airdrop Benefits | Airdrop Risks |

Free crypto with no upfront investment | Fake or scam airdrops stealing data or funds |

Introduces users to new blockchain projects | Oversaturation and worthless tokens |

Increases decentralization and adoption | Legal or tax implications depending on region |

Potential for token price growth | Time-consuming to qualify for some drops |

Examples of Notable Crypto Airdrops

Over the years, some airdrops have achieved legendary status for the impact they’ve had on the community, providing recipients with significant value and creating lasting interest in the projects themselves.

Here are some of the most notable crypto airdrops that demonstrate the power of this strategy.

Uniswap (UNI) airdrop

In September 2020, Uniswap surprised its early adopters by distributing a minimum of 400 UNI tokens to anyone who had interacted with the platform before the snapshot. At its peak, these airdropped tokens were worth over $17,000, making it one of the most profitable airdrops in crypto history.

Bitcoin Cash (BCH) airdrop

When Bitcoin forked in 2017 to create Bitcoin Cash, holders of BTC were rewarded with an equal amount of BCH tokens, giving them a stake in this new digital currency. The BCH airdrop gained attention because it highlighted the phenomenon of forks and set a precedent for other blockchain projects that followed suit.

Stellar Lumens (XLM) airdrop

Stellar, a payment-focused blockchain platform, conducted several large-scale airdrops to raise awareness and adoption of its XLM token. One of its most notable airdrops was in partnership with Keybase, where 2 billion XLM tokens were distributed to users of the Keybase messaging platform, though malicious actors used the opportunity to prey on unsuspecting airdrop recipients.

Flare XRP airdrop

In 2020, Flare Network introduced the Spark (FLR) token (now called Flare) and announced an airdrop for holders of XRP. Designed to bring smart contract capabilities to the XRP Ledger, this airdrop was highly anticipated within the XRP community and helped create excitement around Flare's platform and its interoperability potential.

DeFi and NFT airdrops

Airdrops have also taken off in the DeFi and NFT sectors, where platforms often reward early participants and loyal users with governance tokens or unique assets.

For example, platforms like Aave, Compound, and SushiSwap have distributed tokens that provide holders with voting rights on project decisions. In the NFT space, marketplaces, creators, and collections have offered exclusive NFTs to early supporters, adding a layer of collectible value to the airdrop.

How to Participate in Crypto Airdrops

Participating in a crypto airdrop is simple once you're familiar with the process, but knowing where to find legitimate opportunities and how to claim them safely can make all the difference.

Finding legitimate airdrops

Stick to trusted sources when looking for airdrops, to find legitimate opportunities and avoid scams. You can start by following official channels of established projects, such as their websites, verified social media accounts, and reputable cryptocurrency forums or communities.

There are also dedicated airdrop platforms like CoinGecko that curate and verify upcoming airdrops, making it easier to discover safe options. Lastly, always double-check announcements and avoid offers that ask for excessive personal information or private keys, as legitimate airdrops will never request such details.

Steps to claiming an airdrop

Ready to participate in your first airdrop? Follow these steps to claim a crypto airdrop:

- Stay updated: Follow crypto news, verified social media accounts, and official project websites for airdrop announcements.

- Meet eligibility requirements: Some airdrops are automatic, while others require you to hold certain tokens or complete tasks.

- Secure your wallet: Make sure you have a compatible wallet to receive your tokens.

- Complete tasks: If necessary, follow through with tasks like signing up for newsletters or sharing social posts. Note: If you feel uncomfortable at any point while performing the required tasks, it's okay to stop and forfeit the airdrop opportunity.

- Receive tokens: Once verified, your free tokens should appear in your wallet.

Tips to avoid airdrop scams & fraud

Here are some practical tips to help you safely navigate airdrop opportunities:

- Never share private keys: Legitimate airdrops will never ask for your private keys, passwords, or wallet seed phrases.

- Use a separate wallet: Consider setting up a dedicated wallet just for crypto airdrops to minimize security risks and protect your main assets.

- Verify through official channels: Check for announcements on the project’s official website, verified social media accounts like X (formerly Twitter), and trusted crypto communities.

- Be cautious of large promises: Airdrops that offer unusually high rewards or ask for payment upfront are often scams.

- Research each project: Look up the crypto project and team's reputation in the cryptocurrency community before participating in an airdrop.

Managing claimed airdrops

After receiving your crypto airdrop, you can hold the additional tokens, trade them for other cryptocurrencies, or use them within the project’s ecosystem. Keep an eye on market conditions and project updates to decide the strategy that's right for you.

While crypto airdrops can be a great way to earn free tokens, it’s important to stay cautious. Scammers often create fake airdrop sites that mimic legitimate projects, aiming to steal your personal information or even your funds.

FAQs About Crypto Airdrops

How do dirdrops affect token prices?

Airdrops can potentially increase demand for a token, driving up prices in the short term. However, some airdrops do this intentionally to artificially inflate the token price, and if too many users sell off their tokens right away it can actually lead to a price drop.

Are crypto airdrops legal?

The short answer is that it depends on the country. Some jurisdictions may classify airdrops as securities, subject to regulation. As always, be sure to check the legal status in your region before participating in a crypto airdrop.

Are crypto airdrops taxable?

In certain countries, airdrops may be considered taxable income. If this is the case, you may need to report the value of the tokens when you receive them, and pay capital gains tax if their value increases over time. However, tax treatment depends on your country of residence. You should seek the advice of a tax or legal professional in your area before participating in a crypto airdrop.

Why do crypto projects offer airdrops?

At the end of the day, airdrops are a crypto marketing strategy to raise awareness. They help projects spread the word, reward early users that own existing coins, and decentralize token ownership in the hopes of creating a stronger, more engaged community.

Start Participating in Airdrops

Crypto airdrops can be an exciting way to explore new projects, earn more tokens, and diversify your crypto wallet portfolio. With a bit of research and awareness, you can take advantage of these opportunities while staying safe from scams.

Before you can claim airdrops though, you’ll often need to hold eligible cryptocurrencies tokens first. MoonPay makes it easy to buy crypto you need to qualify for upcoming airdrops, using your preferred payment method like credit/debit card, bank transfer, PayPal, Venmo, Apple Pay, and more.

Happy airdropping!

.svg)

.png?w=3840&q=90)

.png?w=3840&q=90)

.png?w=3840&q=90)