What is tokenization? A guide to tokenized assets in crypto

Discover how asset tokenization works, its benefits, and the challenges it faces. From real estate to NFTs, traditional asset ownership is changing.

By Corey Barchat

The term tokenization has gained significant traction within the financial and technological sectors.

Businesses and individuals constantly seek innovative ways to represent and trade assets. In this sense, tokenization stands out as one potential solution to combine the benefits of tangible assets with digital functionality.

But what is asset tokenization and how has it revolutionized the way we perceive and manage assets?

This article dives into the intricacies of tokenization, its various forms, benefits, real-life applications, challenges, and how it contrasts with traditional asset ownership.

What is tokenization?

Tokenization refers to the process of converting rights to a tangible asset into a digital token, making them more liquid and accessible. It encapsulates the key features of the asset and allows it to be represented, traded, and managed on a decentralized network such as a blockchain.

Asset tokenization operates on the principles of blockchain technology, which ensures transparency, security, and immutability of transactions. With digital tokens, ownership rights can be transferred, managed, and even divided with greater efficiency.

Although it is a relatively new technology, asset tokenization holds the potential to disrupt various industries, including finance, real estate, and art, to name a few.

How does the tokenization process work?

The token creation process typically involves several key steps:

- Asset identification: The first step in tokenization is identifying the asset that will be tokenized. This could range from physical assets like real estate and commodities to digital assets like art and intellectual property.

- Legal structuring: Before tokenizing assets, it’s crucial to determine applicable legal or regulatory frameworks. This will help ensure that the token is built in compliance with relevant laws and regulations governing asset ownership and transfers.Note: Token issuers should seek legal advice to determine the proper legal structure before tokenizing a chosen asset.

- Creation of digital tokens: Once the legal framework is in place, tokens can next be created on a blockchain platform. These tokens represent the ownership rights of the asset and can be designed to include specific attributes, such as voting rights.

- Smart contracts: A smart contract is programmed to automate the terms of the tokenized asset. These self-executing contracts define the rules for ownership transfer, payments, and other conditions, helping to minimize the need for intermediaries while reducing costs.

- Listing and trading: After creation, certain tokens can be listed on various cryptocurrency exchanges or trading platforms, depending on local laws and regulations, the desire for ease-of-transfer, and liquidity. Investors can buy, sell, or trade tokens that represent fractional ownership of the underlying asset.Note: Token issuers should seek legal advice before listing assets on exchanges or trading platforms.

- Asset management and compliance: Post-tokenization, ongoing asset management and compliance monitoring may be required. This could include ensuring that transactions adhere to legal requirements and that token holders receive any entitled benefits, such as access to services.

Types of tokens in tokenization

Asset tokenization encompasses various types of tokens, each serving distinct purposes and functions. Here are the primary types:

Utility tokens

Utility tokens are cryptocurrencies designed to provide users with access to a product or service within a specific ecosystem. With the specialized functionality, they are often used to incentivize user engagement and facilitate transactions within a platform. Utility tokens do not intrinsically represent asset ownership but rather serve as a means of accessing functionalities within a decentralized application (dApp) or other blockchain platform.

Examples include Basic Attention Token (BAT), Ethereum (ETH), Uniswap (UNI), and Binance Coin (BNB).

Security tokens

Security tokens represent ownership in a traditional asset, such as shares in a company, commercial real estate, or bonds. They are subject to regulatory frameworks, as they are classified as securities. Security tokens can provide holders with rights to features like dividends, profits, and voting privileges, making them a potential option for those seeking traditional asset exposure in a digital format.

Non-fungible tokens (NFTs)

Non-fungible tokens (NFTs) are unique digital tokens that represent ownership of a specific asset. Unlike cryptocurrencies, which are interchangeable (fungible), NFTs are unique (non-fungible) and cannot be exchanged on a one-to-one basis.

NFTs have gained popularity as a means of tokenizing digital art, music, videos, and other unique creations. Each NFT contains metadata that distinguishes it from others, providing proof of ownership and authenticity. This innovation has empowered artists and creators to monetize their work in unprecedented ways, allowing them to retain ownership rights while reaching global audiences.

Stablecoins

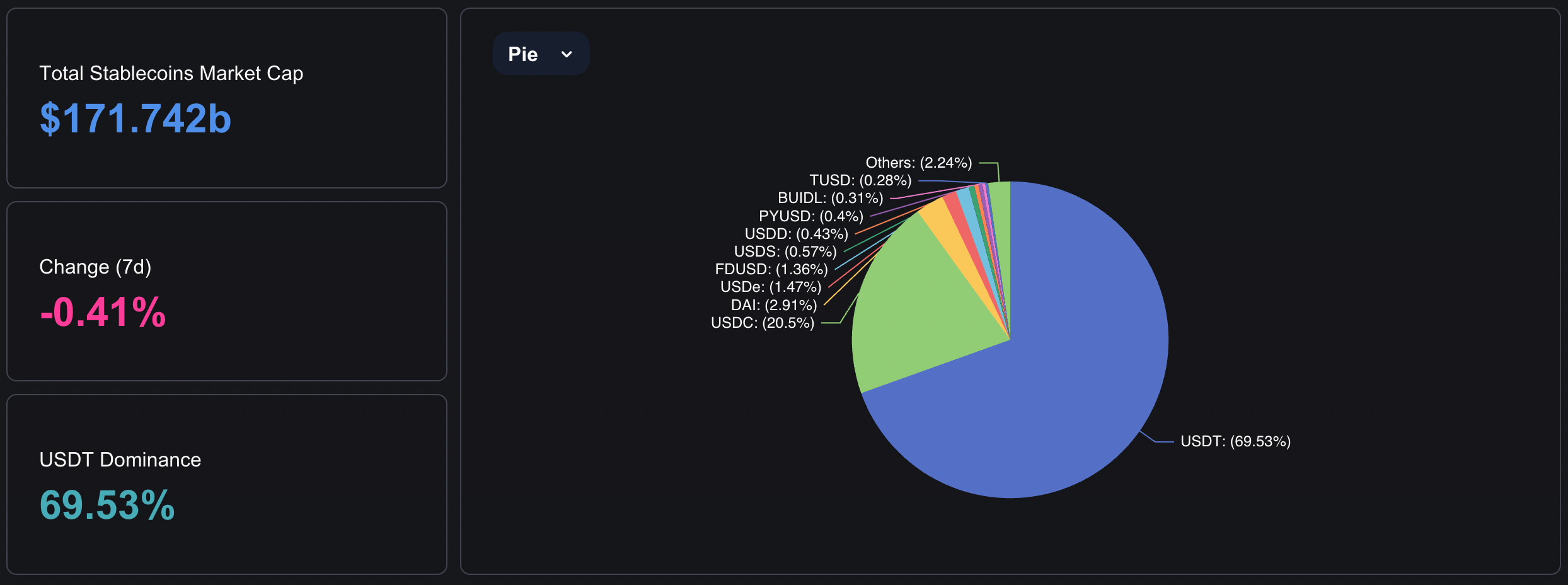

Stablecoins are digital currencies pegged to a stable asset—typically fiat currencies like the US dollar—aiming to provide price stability in the often volatile cryptocurrency market.

Stablecoins play a crucial role in asset tokenization by facilitating transactions and providing a reliable medium of exchange. They allow users to enter and exit tokenized markets and the cryptocurrency ecosystem with reduced volatility risk, helping to bridge the gap between traditional finance and the emerging sector of decentralized finance (DeFi).

Examples include USDT (Tether), USD Coin (USDC), Dai (DAI), and more stablecoins.

Benefits of asset tokenization

Tokenization offers several advantages that can enhance the efficiency, accessibility, and security of asset management. Here are some of the key benefits:

Increased liquidity

Tokenization enables fractional ownership and tradability of traditionally illiquid assets. This allows retail investors to buy and sell smaller portions of assets, making previously illiquid investments more accessible to a broader audience.

Enhanced transparency

Asset tokenization is blockchain technology, which inherently offers enhanced transparency. Each transaction involving a tokenized asset is recorded on a public ledger, providing clear and immutable asset ownership records, as well as transfer history. This transparency helps reduce fraud, increases trust among investors, and allows for easier audits and compliance checks.

Improved accessibility

Tokenization democratizes investment opportunities by lowering barriers to entry. Through asset tokenization, investors can access previously exclusive investment opportunities, such as high-value real estate or art pieces. Additionally, the ability to invest in fractional shares means that individuals with smaller amounts of capital can participate in markets that were once inaccessible.

Greater cost efficiency

In eliminating intermediaries and automating processes, tokenization can help transaction costs associated with buying, selling, and managing assets. Increased efficiency means that more of the investment returns can flow directly to investors.

Added security

Asset tokenization can provide enhanced security features via blockchain technology and its cryptographic security measures that serve to protect digital and intangible assets. Additionally, the decentralized nature of blockchain reduces the risk of fraud and hacking, making it a more secure environment for asset management.

Real world asset tokenization examples

Tokenization has already begun transforming various industries, with some notable use cases of real-world assets that highlight its potential for disruption:

Tokenized real estate

Real estate is perhaps one of the most promising sectors for asset tokenization. Through tokenization, properties can be divided into shares represented by digital tokens.

Investors could then purchase fractional ownership in a property, enabling them to benefit from rental income and appreciation. Such a model not only increases liquidity in the real estate market but also allows investors to diversify their portfolios without the need for larger capital outlays.

Tokenized financial instruments

The financial industry is increasingly exploring asset tokenization for traditional instruments. For instance, tokenization could allow for the issuance and trading of bonds, equities, and other financial instruments on decentralized blockchain platforms.

Some intriguing side effects of the asset tokenization process include streamlined settlement times, enhanced transparency, and reduced costs associated with trading traditional financial assets. With tokenization, investors could also enjoy quicker access to their funds with improved market efficiency.

Tokenized commodities

Commodities like gold and oil are also being tokenized. Imagine, as an investor, if you could buy and sell fractions of commodities through digital tokens? This would provide much easier access to the commodities market, rather than going through the burden of purchasing strictly larger quantities and dealing with storage.

For example, gold-backed tokens give investors digital assets equivalent to a specific amount of gold, providing a more modern approach to commodity trading.

NFTs and digital art

Lastly (though there are sure to be further innovative use cases in the future), the rise of NFTs has revolutionized the art world. Through NFTs, artists and collectors can tokenize unique artworks and collectibles, creating an easier and more direct path to sell and trade their creations.

This model has not only transformed the way in which art is valued and sold, but also enables artists to set and retain royalties on secondary sales while providing collectors with verifiable ownership records.

Challenges of asset tokenization

Despite its numerous advantages, asset tokenization also comes with some challenges and risks that should not be overlooked.

Regulatory and legal issues

Much like cryptocurrency, the regulatory landscape surrounding asset tokenization is continually evolving.

Governments and regulatory bodies around the world are still grappling with how to classify and regulate tokenized assets. Such uncertainty can also create challenges for businesses looking to enter the blockchain space, potentially leading to compliance issues, legal hurdles, and hindered innovation.

Security concerns

Asset tokenization—and the blockchain technology that underpins it—is not without its security risks.

As with any digital asset, tokenized assets are susceptible to fraud, hacking, and technical glitches. Investors must remain vigilant and take certain steps to minimize risk, such as following best security practices and conducting due diligence.

Further reading: Crypto security basics: Staying safe in Web3

Market volatility

The cryptocurrency market's inherent volatility can have a great impact on tokenized digital assets. Any asset linked to cryptocurrencies may experience significant price fluctuations, due to factors including technological and regulatory developments, market sentiment, "whale" activity, liquidity, and speculation.

Investors should be prepared for potential volatility and assess their risk tolerance before making any investment decision.

Adoption and technological barriers

Blockchain technology is undeniably complex to many people. And though asset tokenization has seen increased usage and use cases, there are still some technological and infrastructural challenges standing in the way of true widespread adoption.

For instance, most traditional markets lack the technological infrastructure necessary to support asset tokenization fully. Furthermore, resistance from established financial institutions and governments, along with a lack of understanding about the technology, can also prove to be hindrances to adoption.

For asset tokenization to truly thrive, all stakeholders must collaborate to build the proper frameworks, while also educating users and consumers about its tangible benefits, as well as its risks.

Tokenization vs. traditional asset ownership

Tokenization represents a transformative approach to asset ownership, with key advantages over traditional asset ownership models:

Criteria | Tokenized Assets | Traditional Assets |

Cost-Effectiveness | Lower transaction costs due to elimination of intermediaries. | Higher costs due to multiple intermediaries (brokers, lawyers). |

Ownership | Fractional ownership allows for smaller investments. | Full ownership is often required for participation. |

Speed | Instant transactions with quick settlements via blockchain and smart contracts. | Transactions can take days or weeks due to paperwork and multiple parties. |

Flexibility | Increased flexibility through fractional ownership and programmable rights in smart contracts. | Limited flexibility; full ownership required for benefits, and buyers must be found for entire assets. |

Legal and Regulatory | Evolving regulatory landscape. | Governed by established legal frameworks. |

Technological Risks | Vulnerable to digital risks such as hacking and technical failures. | Risks not directly tied to technology. |

Cost-effectiveness

Tokenized assets: Tokenization often reduces costs associated with asset ownership and transactions, helping to reduce transaction fees by eliminating intermediaries and utilizing smart contracts. Additionally, fractional ownership allows investors to access high-value assets without needing substantial capital upfront.

Traditional assets: Traditional asset ownership typically involves multiple intermediaries, such as brokers, lawyers, and banks, each adding fees to the transaction process. This can lead to higher overall costs for buying, selling, and managing assets.

Speed

Tokenized asset: Transactions involving tokenized assets can be executed almost instantaneously on blockchain networks. The automation provided by smart contracts further accelerates the process, allowing for quick settlements and reducing the time required to transfer ownership.

Traditional asset: In contrast, traditional asset transactions may take days or even weeks to finalize due to the involvement of multiple parties and the often need for extensive paperwork. This lag can hinder liquidity and frustrate potential investors seeking quick access to their funds.

Flexibility

Tokenized assets: Offer increased flexibility in terms of ownership structures and trading options. Enabling fractional ownership also allows investors to buy and sell portions of assets, catering to a different range of investment strategies and risk appetites.

Traditional assets: Traditional asset ownership requires full ownership for participation in benefits like rental income or dividends. Selling or trading a traditional asset typically requires finding a buyer for the entire asset.

Legal and regulatory considerations

Tokenized assets: The regulatory landscape for tokenized assets is still evolving, with various jurisdictions considering and implementing different frameworks. While this can introduce uncertainty in the short term, asset tokenization has the potential to streamline compliance through transparent and immutable blockchain records.

Traditional assets: Traditional asset ownership is governed by well-established legal frameworks that provide clear guidelines for transactions and ownership rights. However, navigating these regulations can be time-consuming, especially in complex transactions.

Technological risks

Tokenized asset: While asset tokenization offers significant advantages, it also introduces technological risks, such as vulnerabilities to hacks, fraud, and scams in digital environments. The reliance on blockchain technology means that any technical glitches or failures can impact the integrity and security of tokenized assets.

Traditional asset: Traditional assets do not face the same technological risks but are subject to other vulnerabilities, such as physical theft or damage. Additionally, the administrative and governing systems can also be susceptible to human error or inefficiencies.

Explore tokenized assets today

Through blockchain technology, asset tokenization can offer a wealth of opportunities for investors, businesses, artists, and creators. If you’re ready to explore the benefits of tokenization, you can start by acquiring cryptocurrency and digital assets.

Platforms like MoonPay serve to bridge the world of fiat currency with tokenized, digital assets. You can easily buy Bitcoin (BTC), Ethereum (ETH), and other crypto tokens by using a credit card, Apple Pay, PayPal, and many other preferred payment methods. Just enter the amount of crypto you wish to buy, and follow the steps to complete your order.

.png)

.png)