What is Dai (DAI)? An introduction the MakerDAO token

MoonPay explains Dai (DAI), a cryptocurrency generated by MakerDAO with all the benefits of decentralization and less volatility than many other tokens..

By Milly Fox-Jones

Volatility in crypto refers to the degree to which a cryptocurrency’s price moves over a period of time.

High volatility occurs when prices move rapidly up or down. Low volatility occurs when prices are relatively stable.

It’s this potential for volatility that inspired the creation of stablecoins; a type of cryptocurrency that seeks to maintain a more stable price through some type of mechanism, such as attempting to peg its value to another asset.

In this article we explore DAI, one of the more unique stablecoins.

What is Dai?

Dai (DAI) is an Ethereum-based stablecoin first introduced in December 2017 by the Decentralized Autonomous Organization (DAO), MakerDAO. Dai is a decentralized, collateral-backed cryptocurrency that attempts to maintain a stable value by being indirectly pegged to the US Dollar.

DAI attempts to maintain a value equal to the US dollar through an automatic system of smart contracts known as Collateralized Debt Positions (CDPs), created by MakerDAO.

What sets Dai apart from other stablecoins is the way in which it is collateralized. Rather than being backed by a single fiat money-backed asset like USDC (which is backed by the US dollar), for example, Dai is backed by a combination of Ethereum-based assets.

What is a stablecoin?

Stablecoins are cryptocurrencies that attempt to maintain a stable value by having their price fixed (or “pegged”) through some type of stabilization mechanism.

One popular mechanism is to attempt to have the stablecoin’s value pegged to another asset such as the US Dollar or Euro or, in the case of Dai, cryptocurrencies on the Ethereum blockchain.

Fixing their value to a traditional or “fiat” currency is an attempt to give these cryptocurrencies more stability than other cryptocurrencies (hence the name “stablecoin”).

Even though the value of a stablecoin attempts to maintain a stable value by being fixed to another asset, the value will still be relative to other assets.

For instance, a token that is designed to always be equal to the value of one US dollar may successfully manage to maintain a stable value relative to the US dollar, but volatile with respect to other currencies like the British pound or Euro or even other cryptocurrencies like Bitcoin.

Stablecoins may also not always be successful in maintaining a stable value relative to the asset they are pegged to and may “de-peg”.

For more information about the risks of stablecoins, read our stablecoin guide.

What is MakerDAO?

MakerDAO is an open-source project on the Ethereum blockchain established in 2014 by Rune Chirstensen, a Danish entrepreneur.

MakerDAO is managed by people all over the world who hold its governance token, MKR. These holders manage the Maker Protocol (one of the largest dApps on the Ethereum blockchain, and the protocol that enables users to create Dai) and the risks of Dai in an attempt to maintain stability, transparency and efficiency.

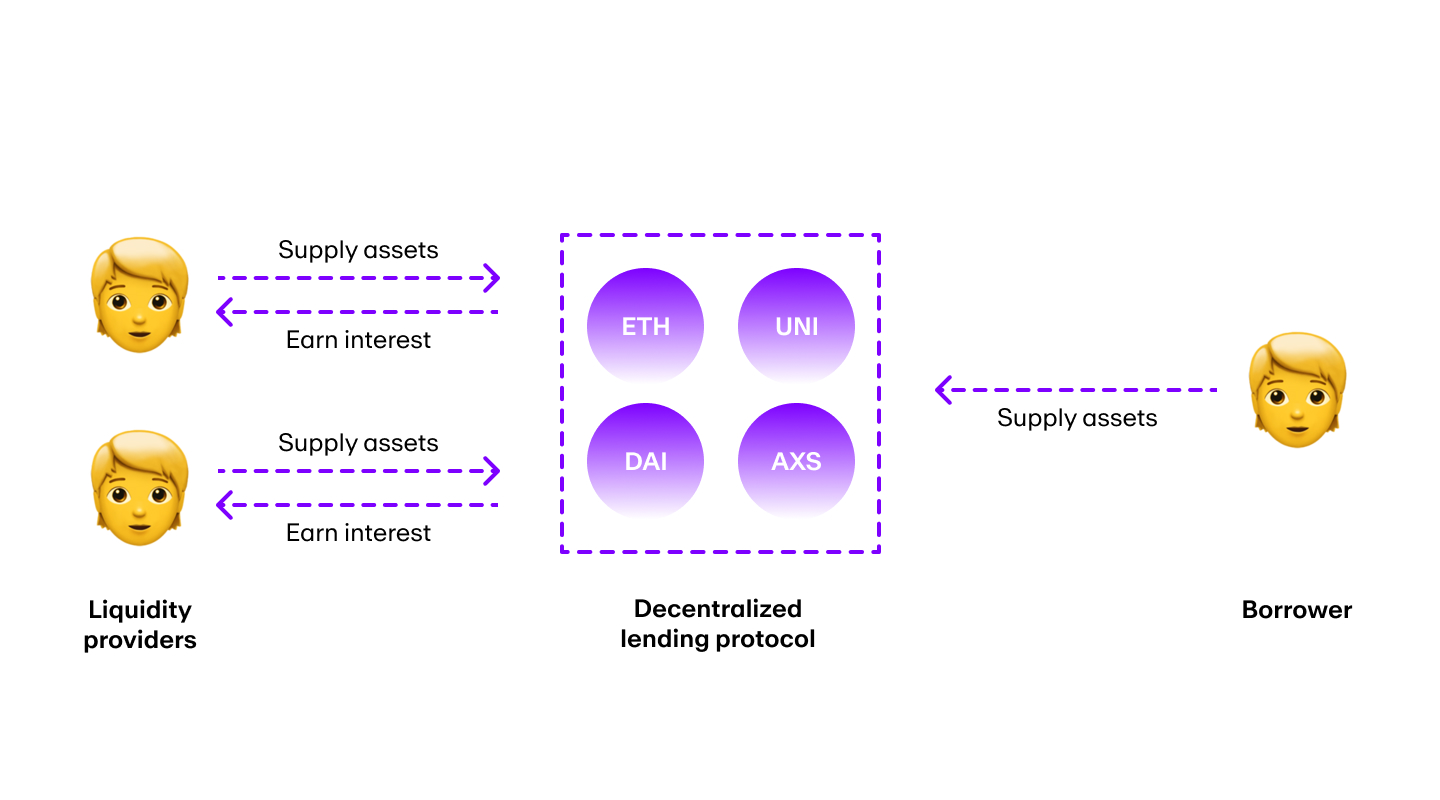

The devs behind MakerDAO created the Collateralized Debt Position (CDP) smart contract that allows users to borrow Dai by providing collateral. When a user opens a Maker Vault (the facility that houses CDPs) they deposit a certain amount of collateral.

They can then borrow Dai using the collateral as security. The collateral in the CDP is also an attempt to ensure that the value of the Dai in circulation is always backed by a greater value of other assets.

The CDP is a critical aspect of the MakerDAO system, as it allows users to leverage their assets to generate Dai.

How does DAI work?

DAI is generated when users deposit collateral assets into Maker Vaults within the Maker Protocol. The equivalent USD value in Dai is generated from the collateral, which can then be used in the same way as any other cryptocurrency – for sending money, payments, or even for savings (through the Dai Savings Rate, a feature of the Maker Protocol).

Accepted collateral assets can be any digital asset that MKR holders have voted to accept into the protocol. At the time of writing, this includes any Ethereum-based asset.

When a user repays the DAI they have generated, the collateral assets are released from the Maker Vaults back to the user, and the DAI is destroyed. This is one of the many mechanisms in place that attempts to maintain a stable value between DAI and its pegged currency, the US Dollar.

The other mechanisms DAI uses to attempt to maintain a stable value include its collateralization – Dai’s collateralization ratio (the amount of collateral required per Dai created) aims to ensure that the value of collateral always exceeds the value of circulating Dai – and a system of autonomous feedback known as TFRMs (Target Rate Feedback Mechanisms).

The TFRM adjusts the stability fee, which is charged to users when they borrow Dai, and is a critical tool for trying to maintain Dai’s stability, as it helps to better align the supply of Dai to its demand.

When the value of Dai is above the target rate (1:1 with USD), the TRFM increases the stability fee, making it more expensive to borrow DAI. This serves as a disincentive for users to borrow Dai, which helps to reduce the supply and bring its value back in line with the target rate.

When the value of Dai falls below the target rate, the TRFM decreases the stability fee, making it cheaper to borrow Dai. This encourages users to borrow Dai, which helps increase the supply and return its value to the target rate.

Did you know? You can pay with DAI

DAI’s goal: to be the world’s first unbiased currency

The main goal of Dai is to revolutionize the world of personal finance by offering people financial freedom without volatility.

Dai offers an alternative to traditional currencies while maintaining all the decentralized aspects of crypto.

How to buy Dai (DAI)?

You can buy Dai (DAI) via MoonPay or through any of our partner wallet applications with a credit card, bank transfer, Apple Pay, Google Pay, and many other payment methods. Just enter the amount of DAI you wish to purchase and follow the steps to complete your order.

Users can also top up in euros, pounds, or dollars and use MoonPay Balance when buying Dai (DAI) and other stablecoins like USDT, USDC, and PYUSD. Use your balance to enjoy lower transaction fees, quicker processing times, and better approval rates.

Note: Dai (DAI) purchases are available for MoonPay customers in all supported regions and countries except Canada. Additionally, Dai (Palm) is not supported for users in the United States.

Swap DAI for more crypto

Want to exchange DAI for other cryptocurrencies like Ethereum and Bitcoin? MoonPay allows you to swap crypto cross-chain with competitive rates, directly from your non-custodial wallet.

.png)