Qu'est-ce que le XRP ? Une introduction au jeton natif de Ripple

Découvrez tout sur la cryptomonnaie XRP, ses cas d'utilisation dans les paiements, son fonctionnement, ses avantages et les défis auxquels elle est confrontée dans le paysage crypto en évolution.

By Corey Barchat

Cryptomonnaies bousculent le monde financier, offrant de nouvelles façons de transférer de l'argent, d'éliminer les tiers, et d'ouvrir de nouvelles opportunités. Parmi les nombreuses devises numériques existent, XRP est l'un de ceux qui se démarquent en raison de sa technologie unique et de ses cas d'utilisation.

Si vous avez entendu parler d'XRP, vous avez probablement aussi entendu parler de Ripple. Bien que les deux soient étroitement liés, ils ne sont pas exactement les mêmes. Ripple, la société derrière XRP, a remué le pot dans l'espace crypto plus d'une fois, et est soutenue par une communauté de fans très passionnés et une gamme d'opinions sur la manière dont elle devrait se développer.

En même temps, il y a une résistance massive de la part des puristes de la crypto qui considèrent XRP, initialement développé par Ripple Labs, comme un projet contrôlé de manière centralisée.

Dans cet article, nous explorons ce qu'est XRP, comment cela fonctionne, à quoi il sert, ainsi que certains des défis auxquels il fait face.

Qu'est-ce que XRP ?

XRP est une monnaie numérique conçue pour des paiements transfrontaliers rapides et peu coûteux. Il fonctionne sur le XRP Ledger, une blockchain décentralisée qui utilise un mécanisme de consensus unique pour valider les transactions. Bien que Ripple promeuve l'adoption du XRP, la cryptomonnaie fonctionne indépendamment de l'entreprise.

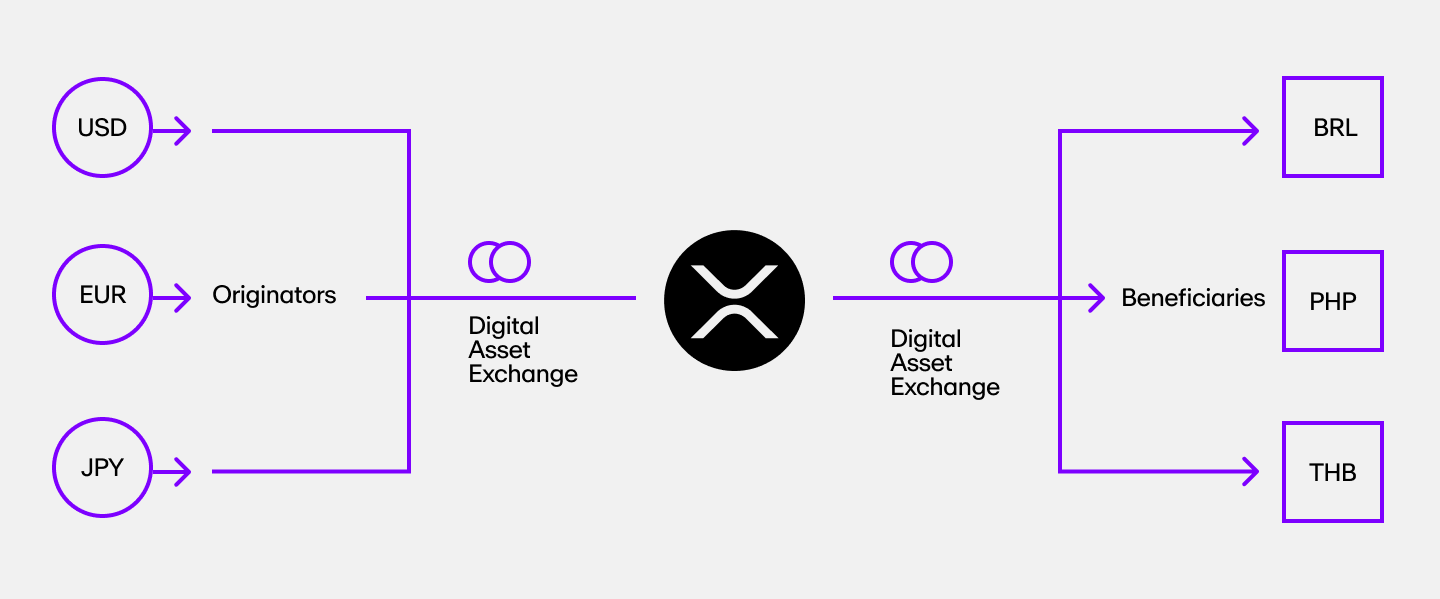

XRP est conçu pour fonctionner comme une monnaie de pont, permettant un transfert rapide et fluide entre d'autres devises. Cela signifie qu'il peut être utilisé pour convertir de l'argent d'une devise à une autre sans passer par le processus habituel d'achat et de vente sur les bourses.

Mais pourquoi se concentrer sur les solutions de paiement international ? Eh bien, envoyer de l'argent à d'autres pays peut être ardu et prendre du temps, la livraison des fonds nécessitant souvent jusqu'à plusieurs jours ouvrables. XRP Ledger (XRPL) a été fondé avec la vision de résoudre ce problème d'une manière adaptée aux banques et aux grandes institutions.

XRP vs Ripple : Quelle est la différence ?

Beaucoup de gens confondent XRP et Ripple, alors clarifions cela :

- XRP: XRP est la monnaie numérique qui fonctionne sur le XRP Ledger, un logiciel blockchain conçu pour gérer des transactions rapides.

- Ripple: Ripple est une entreprise qui a créé et promeut XRP et développe également des solutions de paiement pour les banques et autres institutions.

Encore une fois, il convient de rappeler : XRP n'est techniquement pas Ripple. Mais comme Ripple Labs a créé XRP et détient une quantité significative de jetons XRP, on l'appelle souvent "Ripple".

XRP Ledger Foundation, une organisation à but non lucratif, joue également un rôle important dans la promotion du projet XRPL. Bien que Ripple Labs soit toujours un acteur dans le développement de la blockchain, avec d'autres membres de la XRPL Foundation, le projet est désormais décentralisé et open source.

Histoire de XRP

Ripple Labs et XRP ont eu un parcours intéressant, commençant par la création de XRP en 2012 par Jed McCaleb, Arthur Britto et Chris Larsen. Lancement initial sous le nom de NewCoin (et ensuite Opencoin), leur objectif était de créer un système de règlement brut en temps réel (RTGS) qui pourrait être utilisé par les banques et les institutions financières pour transférer rapidement de l'argent entre pays, plus rapide que Bitcoin transactions et leurs confirmations de transaction lentes.

Ainsi, le XRP Ledger a été créé comme un système de règlement brut en temps réel, un échange de devises et remise réseau. XRP, son jeton natif, a principalement servi d'intermédiaire entre d'autres crypto-monnaies et devises fiduciaires.

Comment fonctionne XRP?

XRP Ledger: La technologie derrière XRP

Au cœur de XRP se trouve XRP Ledger (XRPL), une blockchain conçue pour prendre en charge des transactions rapides et sécurisées. Contrairement à d'autres blockchains qui reposent sur le minage (comme le système Proof-of-Work de Bitcoin), XRP utilise une méthode différente et plus efficace pour traiter les transactions.

Le registre XRP n'est pas uniquement pour le XRP. Contrairement à d'autres blockchains qui sont conçues pour transférer de la valeur uniquement dans leur token natif, le registre XRP peut transférer de la valeur sous n'importe quelle forme d'actif numérique.

Solutions d'entreprise

Alors que la blockchain XRP est adaptée aux utilisateurs individuels, le registre XRP offre également aux entreprises et aux institutions financières plusieurs avantages par rapport aux réseaux de paiement existants. L'avantage le plus important est que les transactions XRP peuvent être complétées rapidement (moins de cinq secondes) et efficacement, réduisant le temps nécessaire pour déplacer de l'argent à travers les frontières.

Le réseau Ripple offre également des coûts de transaction faibles (0,00001 XRP par transaction), ce qui signifie que les entreprises et les institutions peuvent transférer de l'argent à moindre coût qu'avec les méthodes traditionnelles. Cela pourrait être particulièrement utile pour les transferts plus importants, tels que ceux entre les banques ou d'autres grandes organisations.

Le mécanisme de consensus de XRP

Le algorithme de consensus qui alimente XRP est unique.

Contrairement à la plupart des cryptomonnaies qui utilisent la Preuve de Travail ou la Preuve d'Enjeu comme modèle de consensus, XRPL utilise ce qu'on appelle une Liste de Nœuds Uniques (UNL). Avec UNL, essentiellement une liste de nœuds validateurs de confiance est approuvé par Ripple pour vérifier les transactions et maintenir le registre distribué.

Bien que ce modèle soit plus rapide et moins énergivore que d'autres crypto-monnaies, le XRPL a été fortement critiqué pour son niveau de centralisation; les nœuds UNL sont détenus par Ripple Labs, leur permettant d'avoir un contrôle total sur les personnes qui valident les transactions. Cela va à l'encontre de l'éthique de décentralisation de la blockchain, rendant de nombreux crypto-puristes méfiants à l'égard de XRP.

Vitesse et évolutivité

XRP est bien connu pour sa rapidité. Les transactions se règlent en 3 à 5 secondes, et le XRP Ledger peut traiter jusqu'à 1 500 transactions par seconde (TPS). Pour mettre cela en perspective, Bitcoin ne peut traiter qu'environ 7 TPS, et Ethereum peut gérer environ 25-30 TPS.

Comment les transactions XRP réduisent les coûts

Une autre chose à propos de XRP est qu'il est bon marché pour tout le monde. Les méthodes de paiement traditionnelles—surtout pour transactions transfrontalières—sont lentes et coûteuses car elles dépendent de multiples intermédiaires. XRP élimine ces intermédiaires du processus. Son coût de transaction moyen est inférieur à $0.001, ce qui est bien inférieur aux frais que vous paieriez pour des virements internationaux ou même certains paiements par carte de crédit.

À quoi sert XRP ?

XRP a une large gamme d'applications pratiques, à la fois à l'intérieur et à l'extérieur de l'écosystème web3 :

Paiements transfrontaliers

La principale raison pour laquelle XRP a été créé est de rendre les transferts transfrontaliers et les paiements plus rapides et moins chers. Normalement, envoyer de l'argent à l'international implique plusieurs banques, des conversions de devises, et de longs délais d'attente.

XRP simplifie cela en agissant comme une devise intermédiaire. Par exemple, disons que quelqu'un aux États-Unis veut envoyer de l'argent à quelqu'un au Portugal. En choisissant d'utiliser une cryptomonnaie comme XRP, il pourrait convertir l'USD en XRP (ouacheter simplement du XRP), transférer les jetons à son ami, puis les convertir en euros. Ce processus prend quelques minutes, comparé aux intermédiaires lents et coûteux et aux services de transfert d'argent.

Fournisseur de liquidité pour les institutions financières

XRP sert également de liquidité à la demande (ODL) fournisseur pour les institutions financières. Ripple s'est associé à des banques, des fournisseurs de paiement et des entreprises comme Amazon à travers son réseau RippleNet. En utilisant XRP, les banques n'ont pas besoin de conserver de grandes quantités de devises étrangères dans divers pays. Au lieu de cela, elles peuvent utiliser XRP pour obtenir des liquidités en temps réel, libérant ainsi du capital qui serait autrement immobilisé dans des réserves. réseau RippleNet. En utilisant XRP, les banques n'ont pas besoin de conserver de grandes quantités de devises étrangères dans divers pays. Au lieu de cela, elles peuvent utiliser XRP pour obtenir des liquidités en temps réel, libérant ainsi du capital qui serait autrement immobilisé dans des réserves.

Actif numérique et cryptomonnaie

Au-delà de son utilisation dans les paiements, le XRP est également un actif numérique qui peut être détenu dans un portefeuille XRP portefeuille de cryptomonnaie. Over the years, it has maintained a steady presence within the broader crypto ecosystem, boosted by a capitalisation boursière en milliards.

Cependant, avant d'investir dans le XRP ou toute cryptomonnaie, les utilisateurs doivent être conscients que les cryptomonnaies sont soumises à la volatilité des prix, à la fois à court et à long terme.

Finance décentralisée (DeFi)

Le XRP a également trouvé sa place dans finance décentralisée (DeFi). Plusieurs plateformes DeFi permettent aux utilisateurs d'échanger XRP, de l'utiliser comme garantie ou prêter et emprunter contre celui-ci. En plus de cela, le XRP Ledger dispose d'échange décentralisé intégré ( DEX) fonctionnelle, permettant aux utilisateurs d'échanger des actifs sans dépendre d'uneplateforme centralisée .

Avantages de XRP

XRP offre plusieurs avantages clés qui le distinguent des autres jetons crypto :

Règlements de transactions rapides

L'un des avantages les plus significatifs de XRP est sa vitesse. Les transactions se règlent en quelques secondes seulement, ce qui les rend plus rapides que les virements bancaires traditionnels ou d'autres cryptomonnaies. Si vous avez déjà attendu qu'une transaction Bitcoin ou Ethereum soit confirmée, vous saurez à quel point la vitesse peut être importante.

Frais de transaction bas

Un autre avantage du XRP est ses faibles frais. En moyenne, une transaction coûte moins de $0.001, ce qui le rend adapté à tout, des micropaiements aux transferts internationaux à grande échelle.

Efficacité énergétique

Contrairement à Bitcoin ou Litecoin, L’algorithme de consensus de XRP ne nécessite pas de minage intensif, ce qui signifie qu'il est beaucoup plus économe en énergie. Cela fait de XRP une option plus viable pour ceux qui sont soucieux de l'environnement ou qui recherchent des solutions blockchain plus durables.

Évolutivité

Le registre XRP est hautement évolutif, traitant jusqu'à 1 500 transactions par seconde. As the demand for faster payment systems grows, XRP’s ability to process large volumes of transactions fits within its goal of usage for international transfers.

Interopérabilité

XRP fonctionne avec d'autres réseaux de paiement et blockchains, ce qui facilite son intégration dans les systèmes existants. Cette interopérabilité permet aux entreprises et aux institutions d’adopter XRP sans remanier leur infrastructure existante.

Support multi-devises

Vous pouvez transférer une variété de devises sur le registre XRP, pas seulement XRP. Cette fonctionnalité simplifie les transactions transfrontalières avec des transferts fluides entre différentes devises, réduisant le besoin d'intermédiaires dans le processus d'échange.

Défis et risques de XRP

Malgré ses nombreux avantages, XRP fait face à plusieurs risques et défis qui pourraient affecter son adoption future et sa stabilité.

Incertitude réglementaire

L'un des plus grands obstacles auxquels XRP est confronté est incertitude réglementaire. Les gouvernements du monde entier cherchent encore à déterminer comment classer et réglementer les cryptomonnaies, et XRP s'est retrouvé au centre de certains procès, notamment aux États-Unis.

Le procès de la SEC contre Ripple

Dans Décembre 2020, the U.S. Securities and Exchange Commission (SEC) a accusé Ripple Labs d'avoir vendu des jetons XRP dans une offre de titres non enregistrée. Ripple a répliqué en disant que le XRP n'est pas un titre mais plutôt une monnaie numérique.

Après plusieurs années de va-et-vient, un jugement de 2023 par la juge Analisa Torres du tribunal de district des États-Unis pour le district sud de New York a déclaré que les ventes secondaires de XRP aux investisseurs particuliers ne constituaient pas des transactions de titres. Cependant, la même juge a estimé que les ventes de XRP de Ripple aux investisseurs institutionnels conformément à des contrats écrits constituaient des contrats d'investissement non enregistrés, entraînant une amende civile de 125 millions de dollars pour Ripple.

Malgré les espoirs d'une résolution rapide, le procès Ripple reste en cours, avec de nouveaux développements continuant de façonner l'avenir de Ripple et du XRP. Le résultat est particulièrement critique aux États-Unis. Si le XRP est classé comme un titre, il pourrait faire face à des régulations plus strictes, limitant sa disponibilité et son utilisation.

Préoccupations concernant la centralisation

Bien que le registre XRP soit décentralisé en termes de validation des transactions, certains critiques soutiennent que le contrôle de Ripple sur l'offre de XRP suscite des inquiétudes concernant la centralisation. Ripple détient une quantité significative de XRP dans des comptes sous séquestre et le libère périodiquement, ce qui a amené certains à se demander si le XRP est vraiment aussi décentralisé que d'autres crypto-monnaies.

Volatilité du marché

Comme d'autres tokens de cryptomonnaie, XRP est très volatil. Le prix du XRP peut changer radicalement en fonction des nouvelles, des mises à jour réglementaires ou du sentiment général du marché. Cela en fait un actif risqué pour les investisseurs prudents, car sa valeur peut fluctuer considérablement en peu de temps.

Concurrence

XRP affronte d'autres acteurs dans l'espace blockchain, notamment les fournisseurs de systèmes de paiement mondiaux. Stellar (XLM) et même les solutions financières traditionnelles agissent comme des concurrents qui offrent des solutions similaires, limitant potentiellement le succès ultime de Ripple.

Barrières d'adoption

Bien que Ripple se soit associé à de nombreuses entités financières, l'adoption plus large du XRP dans les transactions quotidiennes est encore limitée. Le défi réside dans la conviction des entreprises et des consommateurs d'intégrer XRP dans leurs opérations financières quotidiennes, où les méthodes de paiement traditionnelles dominent toujours.

L'objectif final du registre XRP : « Internet de la valeur »

Le concept de "internet de la valeur" provient de l'hypothèse selon laquelle tout ce qui a de la valeur peut être échangé. Dans le contexte du registre XRP, cela est illustré par la capacité de XRPL à permettre tout type de actif numérique commerce à travers les frontières.

Cela a conduit le XRP Ledger à devenir une plateforme largement utilisée pour les transferts internationaux, le token XRP se classant généralement dans le top 10 de toutes les crypto-monnaies par capitalisation boursière. Avec son mécanisme de consensus décentralisé, ses faibles coûts de transaction et ses temps de règlement rapides, la plateforme est utilisée par des particuliers, des entreprises et des organisations financières du monde entier.

Aujourd'hui, la plupart des banques dépendent d'une entité centralisée, la Society for Worldwide Interbank Financial Telecommunication (SWIFT), pour le règlement transfrontalier. Mais SWIFT peut être lent, prenant souvent des jours avant que le compte de la partie réceptrice reçoive ses fonds.

Avec le XRP Ledger, les acteurs institutionnels peuvent économiser temps et argent en transférant de la valeur rapidement et à moindre coût, leur permettant d'être plus compétitifs sur le marché mondial. Cela pourrait transformer la façon dont les banques fonctionnent aujourd'hui et rendre les transactions plus rapides, moins chères et plus pratiques.

Cependant, tant que les tensions entre Ripple Labs et la SEC ne se seront apaisées, l'adoption généralisée du projet par les entreprises sera probablement freinée.

Explorez l'écosystème XRP avec MoonPay

XRP offre un mélange unique de rapidité, d'efficacité et de scalabilité, en faisant un acteur précieux dans le monde des actifs numériques et des paiements transfrontaliers. Que vous cherchiez à envoyer de l'argent à l'international, "HODL" XRP dans un portefeuille XRP, ou à plonger dans la finance décentralisée, XRP pourrait avoir beaucoup à offrir.

MoonPay vous facilite l'achat de XRP, gérez vos jetons, et ensuite vendre XRP quand vous décidez qu'il est temps d'encaisser. Entrez simplement le montant de XRP que vous souhaitez acheter, en utilisant une carte de crédit, Apple Pay, PayPal, et bien d'autres méthodes de paiement préférées.

Vous voulez recharger votre XRP encore plus vite ? Achetez simplement du XRP directement depuis votre compte MoonPay XRP pour une expérience de paiement plus fluide en un seul clic! Vous pouvez également acheter du XRP avec MoonPay Balance pour des transactions encore plus rapides, des taux d'approbation plus élevés, et des retraits sans frais vers votre compte bancaire lorsque vous encaissez.