Solana vs Ethereum: What’s the biggest difference between SOL and ETH?

Can Solana become a true Ethereum killer? Find out the main differences between Solana and Ethereum as cryptocurrencies and blockchain networks.

By Corey Barchat

Over the last decade, many cryptocurrencies have been created in an attempt to counter the dominance of Bitcoin (BTC). Through thousands of altcoin challengers, Ethereum (ETH) and Solana (SOL) have emerged as two prominent contenders in terms of market capitalization and adoption.

Ethereum, the pioneer of smart contracts and decentralized applications (dApps), has been one of the most revolutionary platforms in the blockchain space. With its robust infrastructure and widespread adoption, Ethereum remains a dominant force, continuously evolving through upgrades like Ethereum 2.0 to address performance and scalability issues.

Solana, a high-performance blockchain platform designed for dApps, is known for its exceptional transaction speed and low fees. Solana aims to provide a scalable solution without compromising decentralization.

Both Solana and Ethereum are essential blockchain networks leading the charge in Web3 innovation, each with unique approaches to solving key challenges like scalability, network security, and decentralization. Understanding their differences helps users and developers make informed decisions about which platform suits their needs.

This article features a comparative analysis of these two blockchain giants, exploring their unique features, strengths, and main differences.

What is Ethereum?

Ethereum is a decentralized blockchain platform built for creating and executing smart contracts and decentralized applications. Launched in 2015 by Vitalik Buterin, it introduced the concept of programmable blockchain, allowing developers to build and deploy decentralized applications on its network.

Ethereum's native cryptocurrency, Ether (ETH), is used to power decentralized protocols and pay for transaction fees on the Ethereum network.

What is Solana?

Solana is a high-performance blockchain designed to provide fast, secure, and scalable decentralized applications and cryptocurrencies. Launched in 2020 by Anatoly Yakovenko, Solana uses a unique consensus mechanism called Proof of History (PoH) combined with Proof of Stake (PoS) to achieve high throughput and low latency.

Solana's native token, Solana (SOL) powers the Solana network as one of the fastest blockchain platforms available.

Ethereum vs Solana: Key differences

Here are some key differences that separate Solana and Ethereum:

Feature | Ethereum | Solana |

Launch Year | 2015 | 2020 |

Consensus Mechanism | PoS (Previously PoW) | PoH + PoS |

Transaction Speed | ~30 TPS | Up to 65,000 TPS |

Transaction Fees | Higher | Lower |

Programming Language | Solidity | Rust |

Smart Contract Ecosystem | Yes | Yes |

Network Stability | Strong | Improving |

Centralization Concerns | Lower | Higher |

Market Capitalization | Top 2 | Top 7 |

Consensus mechanisms

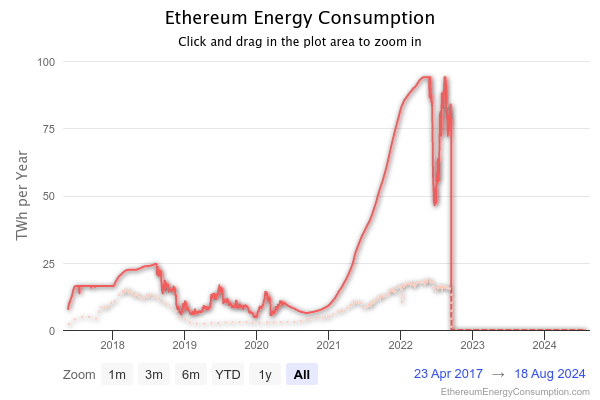

For most of its existence, Ethereum has relied on a Proof of Work (PoW) consensus mechanism. Although this is a reliable way to validate transactions and secure the network, it often led to long transaction wait times and high gas fees. To address this, Ethereum underwent a transition to Proof of Stake (PoS) via the Ethereum Merge. This shift to Ethereum 2.0 aims to resolve scalability issues, and has already helped to significantly reduce energy consumption.

Solana, on the other hand, employs a Proof of History (PoH) mechanism in combination with PoS. PoH timestamps transactions, enabling the Solana blockchain to process transactions in parallel and achieve high throughput, without sacrificing network security. This unique approach allows Solana to validate transactions much faster and more efficiently than traditional PoW systems.

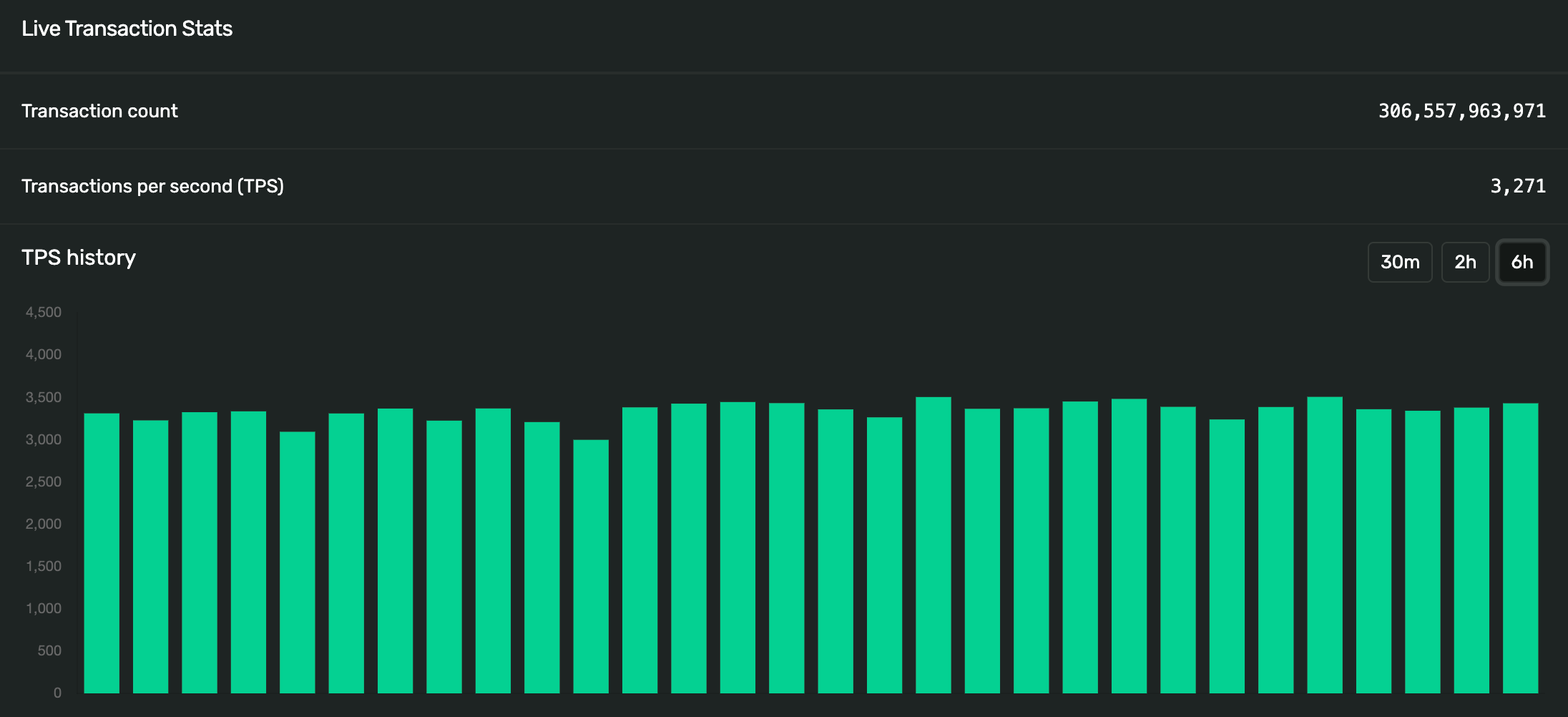

Transaction speed and scalability

Solana is designed to handle a high volume of transactions quickly, boasting a potential capacity of up to 65,000 transactions per second (TPS), though the daily average generally hovers around 3,300 TPS. This high speed is facilitated by its PoH consensus mechanism, which orders transactions before they are processed by the network, significantly reducing the time required for validation.

Post-Merge Ethereum can still only process around 30 TPS, which can lead to congestion and slower transaction times during peak usage periods. The full transition to Ethereum 2.0 is expected to help improve this, potentially increasing Ethereum's transaction speed and scalability to keep up with high-performance blockchains like Solana.

Transaction costs and fees

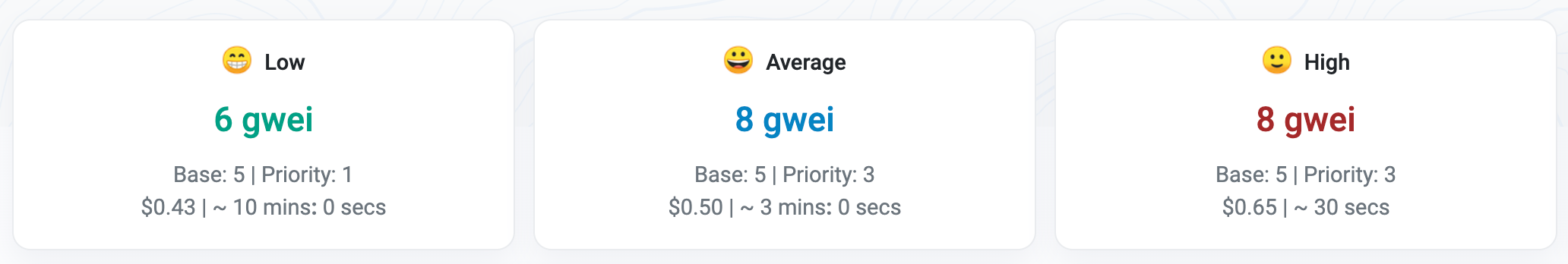

Ethereum's transaction costs, often referred to as gas fees, can vary widely and tend to be high, especially during times of network congestion. While these transaction fees are necessary as Ethereum processes and prioritizes transactions on the network, high costs can be a barrier for users and micro-transactions.

Solana, in contrast, offers extremely low transaction costs, typically a fraction of a cent, making it more cost-effective for both developers and users. This low-cost structure is a significant advantage for applications that require frequent or high-volume transactions, such as DeFi platforms, NFT marketplaces, and gaming applications.

Programming languages

Ethereum uses Solidity, a programming language specifically designed for developing and writing smart contracts to be deployed on the Ethereum Virtual Machine (EVM). It has become the standard for smart contract development, with extensive documentation, community support, and a wide range of development tools.

Solana, on the other hand, primarily uses Rust, a general-purpose programming language known for its performance and safety features. While Rust may be more complex, with a steeper learning curve compared to Solidity, it offers robust performance benefits that align with Solana’s high-speed, scalable architecture.

Smart contract ecosystem

Both Ethereum and Solana have flourishing ecosystems of decentralized protocols and applications. Here is a comparison of the two:

Ethereum’s smart contract dominance

Ethereum has long been the leader in the smart contract space, having pioneered the concept when it launched in 2015. Its smart contract functionality has enabled the development of a vast ecosystem of decentralized applications (dApps), ranging from decentralized finance (DeFi) protocols to non-fungible token (NFT) marketplaces.

The platform's dominance is further reinforced by the widespread adoption of its ERC-20 and ERC-721 token standards, which have become the de facto norms for creating fungible and non-fungible tokens, respectively.

Solana’s smart contract capabilities

Solana, although a newer entrant in the blockchain space, has quickly made a name for itself with its impressive smart contract functionality. Solana's high throughput and low transaction fees provide a fertile ground for developing and deploying scalable decentralized applications, NFT marketplaces, and gaming platforms.

Its unique Proof of History (PoH) and Proof of Stake (PoS) hybrid consensus mechanism enables fast and cost-effective execution of smart contracts, attracting developers looking for performance and efficiency.

DeFi on Ethereum

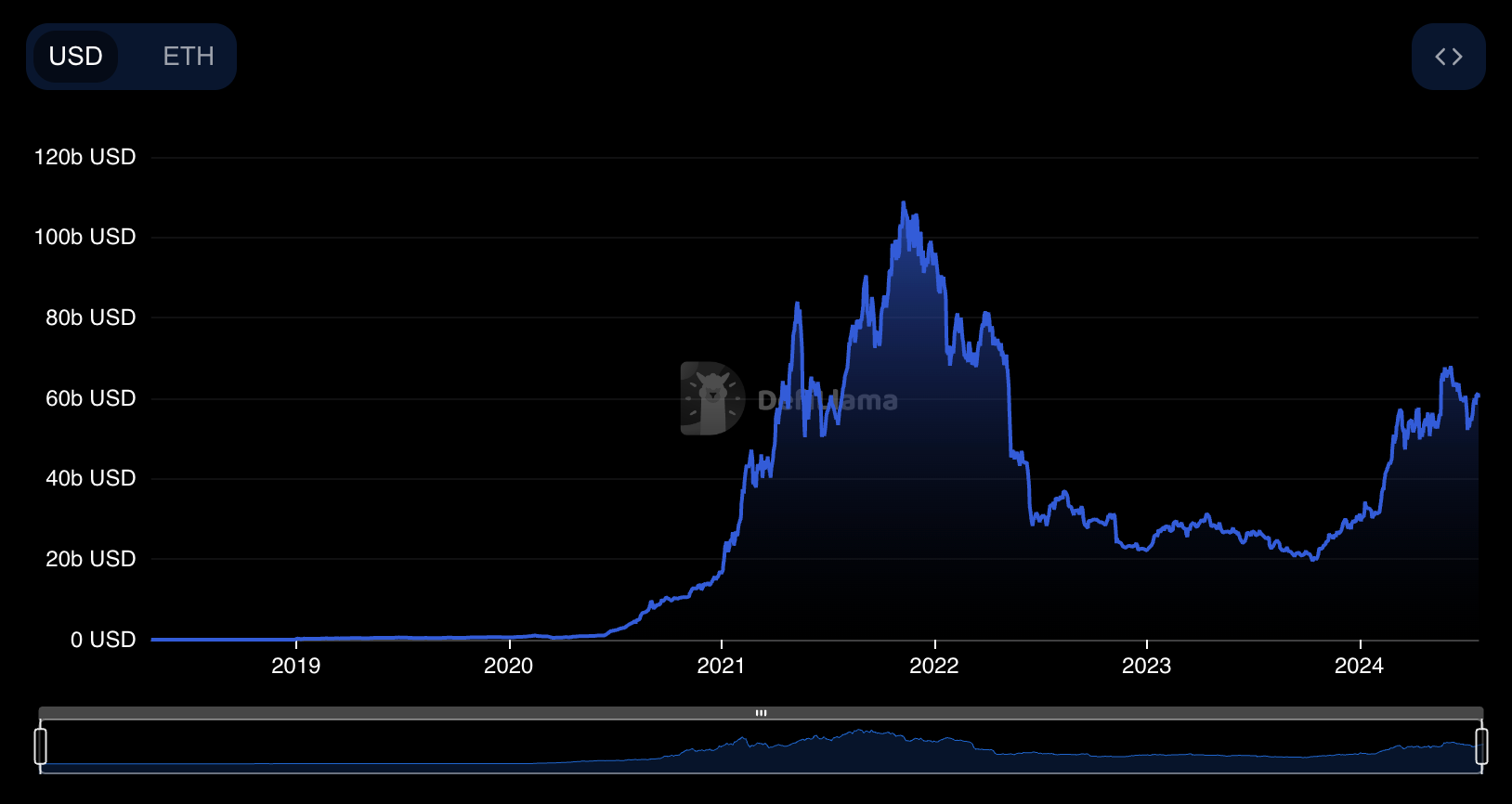

Ethereum’s robust infrastructure and extensive developer resources have fostered a thriving ecosystem with thousands of dApps and over $60 billion in total value locked (TVL) in DeFi protocols, nearly 11x that of Solana.

Some of the most popular decentralized applications on Ethereum include:

DeFi on Solana

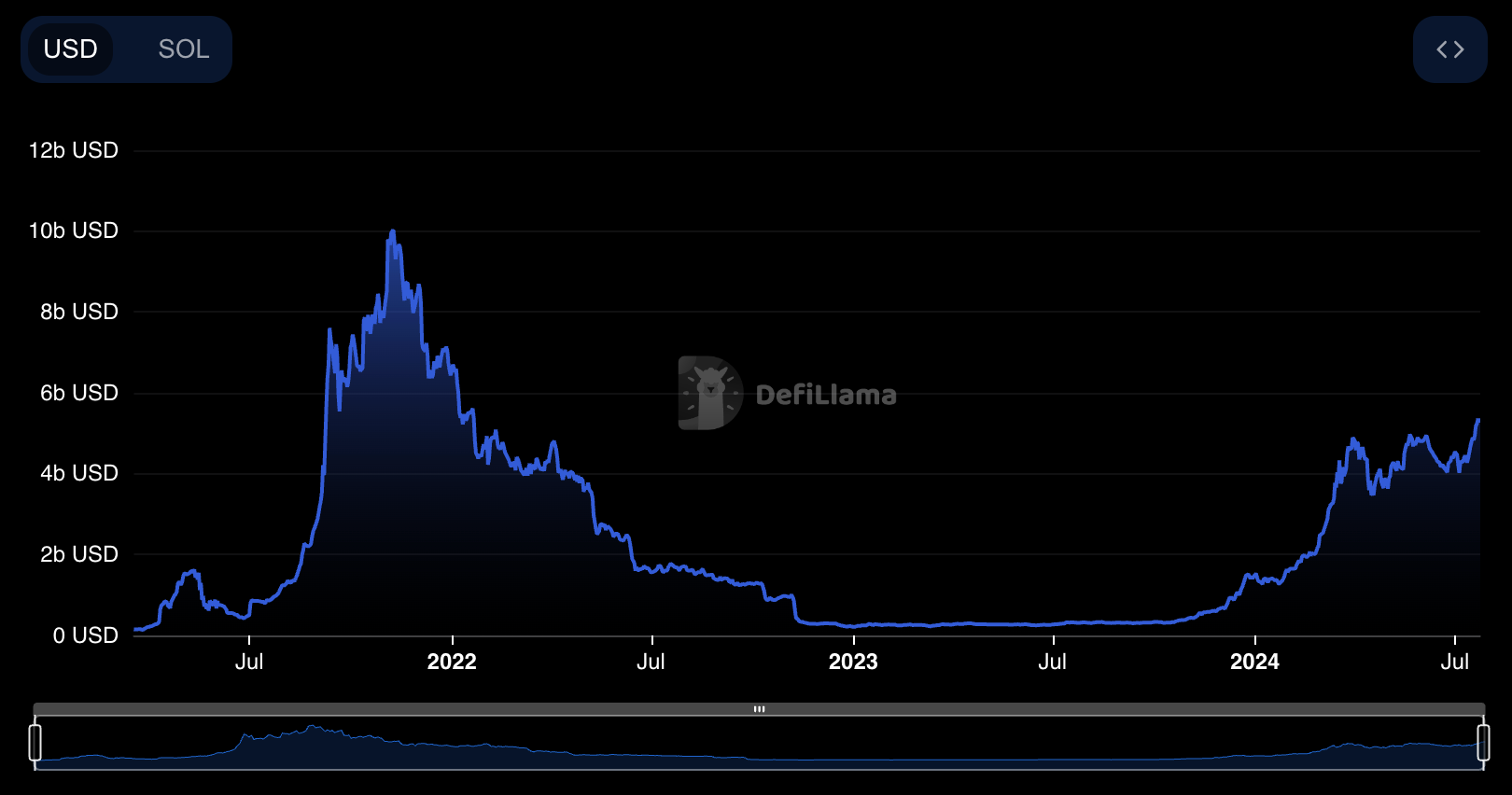

While Solana's ecosystem is not as extensive as Ethereum’s, it is rapidly expanding with a growing number of DeFi protocols that account for over $5.3 billion in TVL.

Here a few common dApps that are built on Solana:

NFTs on Ethereum and Solana

Ethereum is the original platform for NFTs, housing popular marketplaces like OpenSea, LooksRare, and SuperRare. It is also home to some of the most highly traded NFT collections of all time, such as CryptoPunks, Bored Ape Yacht Club, and Pudgy Penguins.

Although it didn't have quite the same head start as Ethereum, Solana has gained significant traction in the NFT space. Solana offers a more scalable and cost-effective alternative for creators and collectors, who have flocked to Solana NFT marketplaces include Magic Eden, Tensor, and SolSea.

While some NFT marketplaces are blockchain-specific, there are some that support both SOL and ETH NFTs like OpenSea, Magic Eden, MOOAR, and Rarible.

Developer community, support & partnerships

Developer tools and resources

The Ethereum blockchain has a mature and well-established ecosystem with an extensive range of developer resources and tools. Devs can utilize comprehensive documentation, a variety of development frameworks like Truffle and Hardhat, and testing environments such as Ganache.

Additionally, Ethereum’s robust community support is bolstered by numerous forums, tutorials, and educational resources, making it accessible for developers of all levels. The Ethereum Foundation and various other organizations actively contribute to the ecosystem, providing grants and funding for innovative projects.

The Solana blockchain, meanwhile, is rapidly building its developer ecosystem, offering a growing array of tools and resources designed to support high-performance decentralized application development. The Solana Foundation provides detailed documentation, guides, and a range of developer tools like the Solana Command Line Interface (CLI).

The Solana ecosystem also supports programming in Rust, C, and C++, catering to developers who prefer these languages for their performance and safety features. Hackathons, grants, and community initiatives further incentivize and support developers in building on Solana.

Partnerships and collaborations

Ethereum has established numerous high-profile partnerships and collaborations across various industries. These include partnering with major companies like Microsoft, which integrates Ethereum into its Azure cloud platform, Amazon for its AWS blockchain template, and ConsenSys, a blockchain software technology company that develops infrastructure and applications for Ethereum.

Solana is also actively forming strategic partnerships and collaborations to expand its ecosystem and increase adoption. Notable partnerships include integration with Visa for payments and stablecoin settlement, as well as collaborations with leading DeFi projects and NFT marketplaces.

Ecosystem growth and innovation

The development of the Ethereum ecosystem is heavily influenced by community participation through Ethereum Improvement Proposals (EIPs). This primary mechanism for proposing changes to the Ethereum protocol is transparent and inclusive, allowing anyone to submit an EIP and contribute to the discussion and refinement of proposals. Some of the most notable EIPs include EIP-20, which standardized the ERC-20 token standard, and EIP-1559, which introduced a new fee structure to improve transaction pricing and reduce volatility.

Solana's ecosystem, while newer, has experienced rapid growth and attracted significant interest from developers and institutions alike. Solana's focus on high throughput and scalability has spurred the development of numerous DeFi projects, NFT platforms, and other decentralized applications seeking a high performance platform. Solana also encourages community participation through its Feature Proposal Program, which allows users to vote on new proposals that are weighted via SPL token validator stake.

Security, decentralization, and network stability

Historical incidents and responses

Ethereum has faced some notable security incidents throughout its brief history. The most famous of these was the DAO hack in 2016, which resulted in the theft of 3.6 million ETH (worth around $50 million at the time). This incident led to a hard fork, splitting the network into Ethereum (ETH) and Ethereum Classic (ETC).

Solana has experienced its share of security challenges, including network outages and congestion issues. For example, in September 2021, Solana’s network went offline for approximately 17 hours due to a surge in transaction volume that overwhelmed the network's capacity. The Solana team responded by collaborating with validators to restart the network and implement upgrades to prevent similar issues in the future, though these outages have still been known to occur in 2024.

Network stability and downtime

Ethereum has demonstrated strong network stability with minimal downtime over its nearly 10 years of operation. Its decentralized nature, supported by thousands of nodes distributed globally, helps ensure resilience against failures and attacks. Ethereum’s recent transition to Ethereum 2.0 aims to further enhance network stability by introducing danksharding to reduce the load on the main blockchain.

Solana, while offering fast transactions with low fees, has faced network stability issues, including outages and periods of high congestion. The network’s architecture and high throughput capabilities can sometimes be a double-edged sword, occasionally leading to instability under extreme loads.

Solana centralization concerns?

One of the concerns surrounding Solana is its degree of centralization. Compared to Ethereum, which has a large number of nodes distributed worldwide, Solana validators are much fewer in number. This raises questions about how decentralized Solana truly is. Centralization can pose certain risks, such as potential validator collusion and censorship, increased vulnerability to coordinated attacks, and reduced network resilience.

However, Solana is taking steps to address these concerns by encouraging more distributed validators to join the network and improving the decentralization of its validator set. Solana applications like Marinade are also pitching in to curb centralization, by creating a staking optimizer platform that encourages users to spread staked SOL amongst many different validators and not just in the hands of a few concentrated nodes.

Market performance and adoption

Historical market performance of ETH

Ethereum (ETH) has experienced significant growth over the years. Since its launch in 2015 when the Ethereum price was around $0.30 per token, ETH has since reached an all-time high above $4,000 back in 2021. This growth is partially driven by Ethereum’s pioneering role in enabling smart contracts and decentralized applications (dApps), as well as its central position in the growing fields of decentralized finance (DeFi) and non-fungible tokens (NFTs).

Ethereum’s market capitalization, consistently ranking second only to Bitcoin, underscores its significance and widespread adoption in the crypto space.

Historical market performance of SOL

Starting at less than a dollar in 2020, the Solana price has experienced rapid appreciation, peaking at over $200 in 2021. This rise can be attributed to Solana’s high transaction speeds, low costs, an increasing adoption within the DeFi and NFT sectors.

Although newer than Ethereum, Solana’s ability to handle a high volume of transactions efficiently has positioned it as a strong competitor in the blockchain industry. Its market capitalization has generally fluctuated between the top 5 and 10 of all cryptocurrencies, reflecting the potential of its technology in the crypto community.

User and institutional adoption

Ethereum’s established presence and extensive ecosystem make it a popular choice for retail and institutional investors seeking additional exposure to blockchain technology and cryptocurrency besides just Bitcoin.

Following the successful launch of Spot Bitcoin ETFs, Ethereum ETFs have recently gained traction, providing investors with a regulated way to gain exposure to ETH without directly holding the cryptocurrency. Several Ethereum ETFs have been launched in various jurisdictions, including the United States. This potentially reflects and increasing regulatory acceptance and demand for such investment vehicles, though some initial reports say the demand hasn't been quite as high as that of Bitcoin.

Solana is also attracting attention from institutional and retail investors due to its high performance and scalability. However, given its history with outages and centralization, Solana’s adoption ultimately depends on its ability to balance large-scale applications with transaction fees and speeds that are acceptable to users.

Although approval by regulatory bodies is not guaranteed, the potential for Solana ETFs is becoming more plausible. ETFs for SOL would provide investors with a more accessible way to invest in Solana, similar to existing Bitcoin and Ethereum ETFs.

Conclusion: Can Solana flip Ethereum?

The question of whether Solana can surpass Ethereum is a frequent topic of debate. While Solana offers impressive speed and lower fees, Ethereum's established ecosystem, proven upgrades, and extensive developer community provide strong competition to any potential Ethereum killer. The long-term performance of both platforms will depend on how well each one addresses their respective challenges while continuing to innovate.

Although no one can predict the future, here are some key metrics that provide a current snapshot of Solana vs Ethereum:

Market capitalization

- Solana: $83+ billion

- Ethereum: $415+ billion

Daily active users

- Solana: 1.8 million

- Ethereum: 416,000

Daily transactions

- Solana: 45 million

- Ethereum: 1.1 million

Monthly addresses

- Solana: 31.7 million

- Ethereum: 9.6 million

How to buy Ethereum and Solana

Now that you know what separates Solana and Ethereum, you can explore the vast ecosystems of both cryptocurrencies for yourself.

You can buy Ethereum (ETH) and Solana (SOL) via MoonPay with a credit card, bank transfer, Apple Pay, Google Pay, and many other payment methods. Send your newly purchased crypto directly to your preferred Solana or Ethereum wallet, like Ledger, MetaMask, Phantom, Trust Wallet, Exodus, and more. Just enter the amount of ETH or SOL you wish to purchase and follow the steps to complete your order.

Users can also top up in euros, pounds, or dollars and use MoonPay Balance to buy cryptocurrencies like ETH and SOL. Once funded, use your balance for faster, cheaper transactions and higher approval rates. When you're ready to withdraw, enjoy zero-fee transfers straight to your bank account.

How to sell ETH and SOL

MoonPay also makes it easy to sell Ethereum and Solana when you decide it's time to cash out your crypto.

Simply enter the amount of SOL or ETH to sell in the MoonPay widget and enter the details where you want to receive your funds.

.png)