What are Optimistic Rollups and how do they work?

The Optimistic Rollup is one of the most exciting scaling solutions that seeks to increase transaction throughput on Ethereum. Learn more here.

By Corey Barchat

Blockchain technology has been evolving rapidly, seeking to address scalability issues without compromising on security and decentralization. One scaling approach that's gaining traction in the crypto space is the blockchain rollup.

Blockchain rollups emerged as a Layer-2 scaling solution to alleviate the burden on the Ethereum network and other blockchains experiencing congestion due to high transaction volumes. The main types of rollups are Optimistic Rollups and ZK-Rollups, though for a rapidly growing technology, they surely won't be the last.

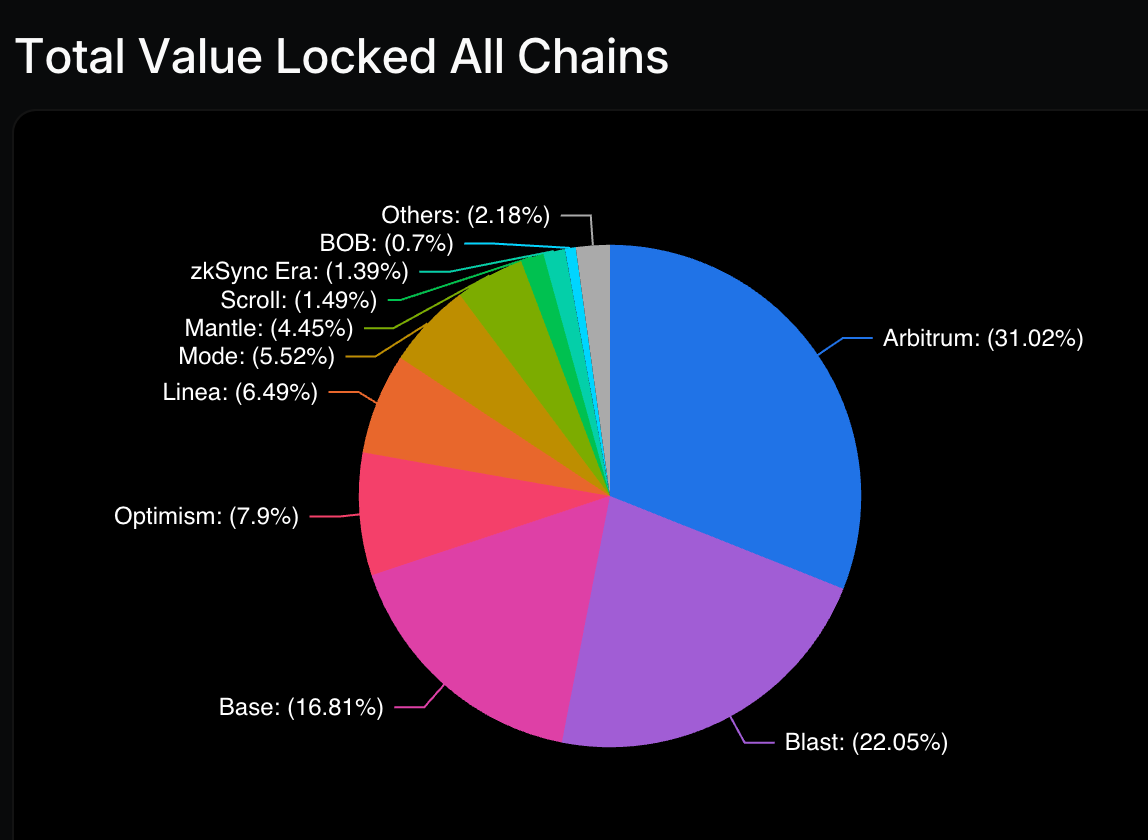

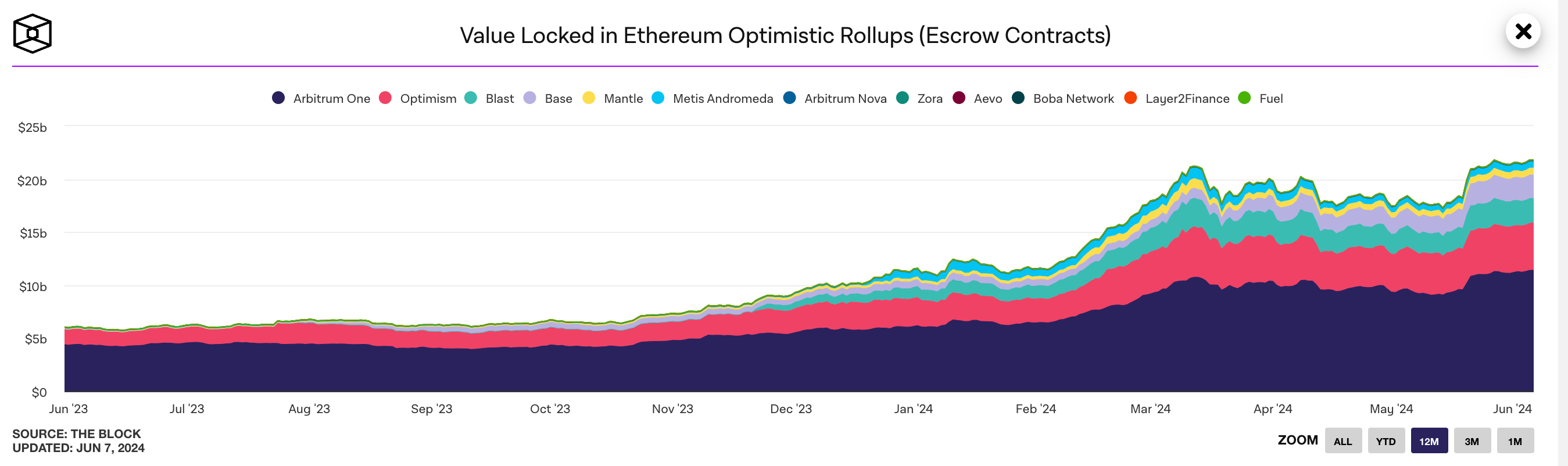

Optimistic Rollups tend to dominate the market, with the top four services alone accounting for more than 75% of all total value locked (TVL) in blockchain rollups, totaling over $7.5 billion in value. As the name suggests, an Optimistic rollup is indeed optimistic in nature, as it carries a key intrinsic feature that relies on optimism when dealing with large batches of multiple transactions.

But what exactly are they and what makes them so positively effective?

This article aims to dissect all things Optimistic Rollups, covering everything from this intriguing technology's inception to its potential limitations and comparisons with ZK-Rollups.

What is an Optimistic Rollup?

Optimistic Rollups are a type of blockchain rollup that operates on the assumption that all batched transactions are valid. Transactions are processed off-chain and then submitted to the main blockchain with a "challenge period" that allows users to dispute potentially invalid transactions.

If no challenges are raised, the transaction is considered valid, but if a challenge is successful, the invalid transaction is reverted, ensuring the integrity of the rollup. This approach allows for a significant reduction in on-chain congestion.

The challenge-based security mechanism provides a balance between speed and security, with the risk of invalid transactions mitigated by the challenge period. This approach makes Optimistic Rollups well-suited for a variety of applications, including DeFi, gaming, and other blockchain use cases where scalability and cost efficiency are essential.

How do Optimistic Rollups work?

Optimistic Rollups operate via a unique mechanism, incorporating a crucial phase known as the challenge period. But what is the challenge window and where does it fit into the greater process?

Let's examine the key phases.

Transaction aggregation

Transaction batches are amassed off-chain by a designated entity, often referred to as a sequencer or aggregator. This aggregator assumes the responsibility of bundling multiple off-chain transactions into a compact batch, optimizing efficiency and minimizing computation and data storage.

Validation

The heart of Optimistic Rollups lies in their optimistic validation model. Once transactions are aggregated, they undergo a preliminary validation check, executed by the aggregator or a designated validator.

This validation is performed off-chain, utilizing computational resources to maintain transactional integrity and compliance with predefined protocols. Optimistic by design, this validation process operates under the assumption of transactional validity, laying the groundwork for swift off-chain processing.

Transaction submission

After successful validation, the transaction batch is ready to be submitted to the Ethereum mainnet. Leveraging the Ethereum Virtual Machine (EVM), the aggregator sends the compiled data, representing multiple transactions, to the main blockchain. This process acts as a bridge, enabling the smooth integration of off-chain transactions into the on-chain ledger.

Challenge period

The challenge period is a critical component of Optimistic Rollup platforms, and is the main feature that sets it apart from other Layer-2 scaling solutions. Essentially, it provides a mechanism for dispute resolution and attempts to ensure the validity of transactions.

- Purpose: The challenge period allows validators and users to challenge transactions they believe to be invalid, acting as a safety net to prevent invalid or fraudulent transactions from being permanently recorded on the main blockchain. If a fraud proof is successfully challenged, the invalid transaction can be reverted, maintaining the integrity of the rollup.

- Length: The duration of the window can vary, typically ranging from a few hours to a few days. A longer challenge period provides more time for dispute resolution but may slow down the finalization of rollups, while a shorter challenge window can increase throughput but may reduce the chances to detect invalid transactions.

- Security and decentralization: During the designated challenge period, anyone can submit evidence to challenge a transaction. This open approach helps ensure that the rollup process remains secure, transparent, and decentralized. Operators that submit incorrect transactions may face penalties, incentivizing actors to act honestly.

Arbitration and resolution

Incorporating a challenge period allows Optimistic Rollups to add an extra layer of accountability and resilience to the validation process, reducing the risk of fraudulent or erroneous transactions. This iterative validation model aims to enhance trust and transparency while strengthening the underlying blockchain infrastructure, advancing the ecosystem towards greater scalability and security.

In the event of a challenge, the Ethereum mainnet serves as an arbiter, adjudicating the dispute during the challenge window. Validators, attesters, and other network participants can present compelling evidence to substantiate their claims, prompting the main chain to undertake a thorough examination of transactional history.

Upon conclusion, the verdict is rendered. This can either affirm the authenticity of transactions or invalidate them, though in both cases arbitration preserves the sanctity of the blockchain ledger.

Benefits of Optimistic Rollups

Optimistic Rollups provide several key advantages over other rollup protocols:

Scalability

By processing transactions off-chain and assuming they are valid, Optimistic Rollups can achieve high throughput and reduce on-chain congestion for the main blockchain.

Lower gas fees

The off-chain processing and challenge-based security model contribute to lower gas fees, making Optimistic Rollups a potential option for users and platforms that require frequent transactions.

Compatibility

Optimistic Rollups are generally compatible with existing smart contracts and decentralized applications (dApps), enabling seamless integration within the greater Ethereum ecosystem.

Interoperability

In addition to Ethereum, Optimistic Rollups can be implemented across different blockchains, fostering interoperability and collaboration within the crypto economy.

Limitations of Optimistic Rollups

Despite their promise, Optimistic Rollups have certain limitations:

Latency

Due to the validation process, there may be a delay before transactions are confirmed on the main chain, potentially impacting real-time applications and transactions.

Security trade-offs

While Optimistic Rollups aim to preserve security, there's always a risk of vulnerabilities or attacks, albeit minimized compared to other scaling solutions.

Data availability

In the event of a dispute, all transaction data must be available on-chain, which could pose challenges for large-scale applications with extensive data requirements.

Examples of Optimistic Rollups

Several projects have embraced Optimistic Rollups to enhance scalability and user experience.

Some notable examples of Optimistic Rollups include:

Arbitrum

Arbitrum is an Optimistic Rollup solution for Ethereum designed to improve scalability by processing transactions off-chain while maintaining security. It leverages a challenge period during which transactions can be disputed to ensure correctness. By doing so, it reduces congestion and lowers fees on the Ethereum mainnet, making decentralized applications more efficient and affordable.

Arbitrum TVL: Over $11 billion

Optimism

Optimism is another Optimistic Rollup protocol for Ethereum that aims to enhance transaction throughput and reduce gas fees by moving most computations off-chain. It operates under the assumption that transactions are valid, with a challenge period allowing for fraud proofs if needed. Optimism focuses on maintaining Ethereum's security while offering faster and cheaper transactions for users and developers.

Optimism TVL: Over $4 billion

Base

Base is an Optimistic Rollup platform, developed by Coinbase to provide scalability solutions similar to other rollups. Base Chain enhances Ethereum's capability by handling a significant portion of transaction processing off-chain, thereby reducing the load on the Ethereum mainnet and decreasing transaction costs. Base also employs a challenge mechanism to maintain the integrity and security of transactions.

Base TVL: Over $2 billion

Blast

Blast is an Optimistic Rollup that aims to improve Ethereum's scalability by processing transactions off-chain and only submitting summaries to the mainnet. This process increases transaction speed and reduces costs while relying on a challenge period to verify transaction validity. Blast ensures that the Ethereum network remains secure and efficient, catering to high-demand decentralized applications.

Blast TVL: Over $2 billion

Optimistic Rollups vs. ZK-Rollups

While both Optimistic Rollups and zk-Rollups aim to address scalability challenges, they differ in their approach and trade-offs. Here's a brief comparison:

- Optimistic Rollups: Prioritize scalability and cost-efficiency, relying on optimistic assumptions with periodic validation and the addition of the challenge period.

- ZK-Rollups: Focus on privacy and security, utilizing zero-knowledge proofs to ensure transaction validity without revealing sensitive information of the underlying data.

For a greater comparison of ZK-Rollups vs Optimistic Rollups, we can use a table:

Feature | Optimistic Rollups | ZK-Rollups |

Transaction Speed | Processes transactions faster than the main chain but with added waiting period for dispute resolution | Quickly verifies transactions using cryptographic proofs |

Security | Relies on a fraud-proof system, offering moderate security | Strong security backed by zero-knowledge proofs |

Privacy | Offers limited privacy protection | Provides enhanced confidentiality through cryptographic methods |

Resource Usage | More efficient with lower computational demands | Requires significant computational power for cryptographic processes |

Compatibility | Works with smart contracts and existing blockchain tools | Supports smart contracts, though some modifications may be needed |

Challenge Mechanism | Implements a dispute resolution period to verify transactions | No need for a challenge system |

Access Optimistic Rollups today

To fully experience Optimistic Rollups firsthand, you'll need to acquire the proper cryptocurrency.

MoonPay makes it easy to buy crypto that can be used for Optimistic Rollups like Ethereum (Optimism), USDC (Optimism), and Worldcoin (Optimism). You can pay using your preferred payment option like credit card, bank transfer, Apple Pay, Google Pay, and many other payment methods.

Note: Users in Canada, New York, and Texas are prohibited from purchasing USD Coin (Optimism).