Africa is among the least financially inclusive regions in the world, with almost 60% of sub-Saharan Africans lacking access to basic financial services.

For these “unbanked” people, cryptocurrencies like Bitcoin offer a convenient alternative to traditional banking systems. In places like Kenya, South Africa, and Nigeria, cryptocurrency may be appealing due its low barrier to entry, convenience, and other advantages arising from use of a blockchain.

As the dominant force behind today's cryptocurrency market, Bitcoin is gaining a lot of traction in Africa. The most popular cryptocurrency is allowing Africans to transact across borders at any time of day and without the need for intermediaries like central banks or governments.

In this article, we explore the state of Bitcoin in Africa, the cost of remittances, and how you can buy Bitcoin today.

The state of Bitcoin in Africa

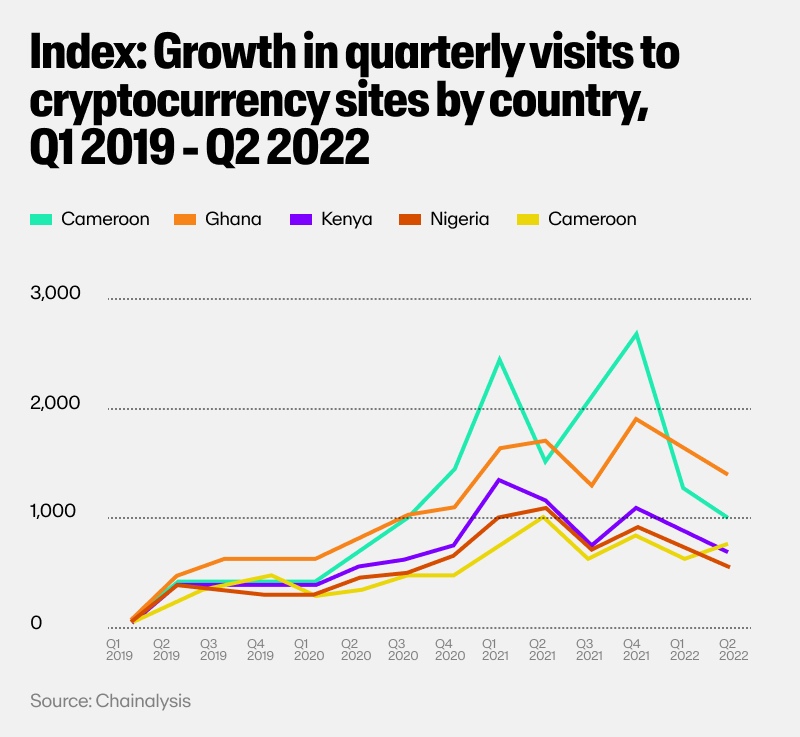

According to a report by blockchain research firm Chainalysis, African countries such as Nigeria, South Africa, and Kenya have seen significant cryptocurrency adoption. The report also highlights that 2% of the world's Bitcoin trade volume takes place in Africa.

This is partly driven by the fact that people in these countries have limited access to traditional banking systems but a relatively high internet penetration rate. South Africa, for example, has an internet penetration rate of 68%, which is well above the world average.

Nigeria in particular has emerged as a major hub for Bitcoin trading. In 2020, the country ranked third globally in BTC trading volume on peer-to-peer platforms. According to a Statista report, Nigerians are the most likely demographic out of 74 surveyed countries to possess or use cryptocurrency.

A report by the International Monetary Fund explains the uneven distribution of financial infrastructure in Africa. Remote areas struggle to be included financially, making cryptocurrency a viable option for transacting and storing value.

While Nigeria, South Africa, and Kenya are leading in Bitcoin adoption, other African countries such as Ghana, Tanzania, and Uganda are also seeing significant growth in cryptocurrency usage.

Fiat currency devaluation

One of the key factors driving the growth of cryptocurrencies like Bitcoin in Africa is the devaluation of fiat currencies.

Many African countries have been plagued by inflation, currency instability, and economic crises, leading to the loss of value in their national currencies. This has resulted in a lack of trust in traditional banking systems, prompting individuals to seek alternative means of preserving their wealth.

For instance, Zimbabwe experienced hyperinflation in 2008, which caused the value of the Zimbabwean dollar to collapse. As a result, residents may have turned to alternative currencies like the US dollar and Bitcoin to preserve their wealth.

In Nigeria, the value of the Naira has been declining steadily (the inflation rate at the time of writing is over 21%), which may lead to increased demand for Bitcoin and other cryptocurrencies.

Costly remittances

“TradFi” refers to traditional financial services such as banks, credit unions, and insurance companies. Sending money across borders through TradFi channels can be costly, time-consuming, and subject to high transaction fees and exchange rate fluctuations.

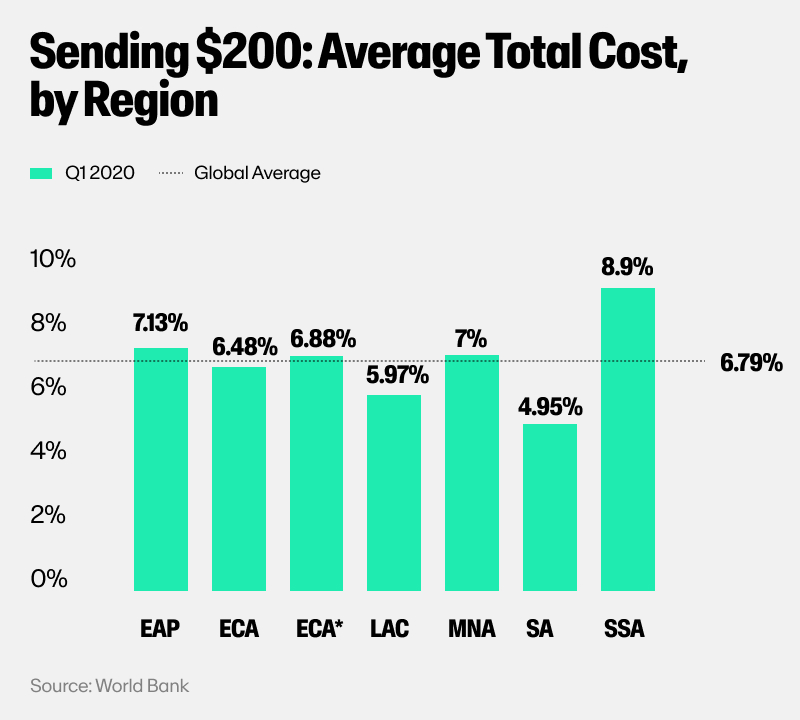

According to a paper published by the Bank for International Settlements, the average cost of sending remittances to sub-Saharan Africa in 2020 via TradFi was around 8.90% of the amount sent. This was higher than any other region in the world.

Cryptocurrencies offer a cheaper and faster alternative to traditional remittance services. For example, BitPesa, a Kenyan Bitcoin exchange, allows users to send money to other African countries and around the world at a 75% lower cost compared to TradFi remittance services like PayPal or Western Union.

Slow settlements

The slow settlement times of traditional banking institutions is another factor driving the growth of cryptocurrencies in Africa. Traditional banking systems can take several days or even weeks to process cross-border transactions, which can be inconvenient and costly for businesses and individuals.

In contrast, cryptocurrencies like Bitcoin offer faster and more efficient settlement times. Transactions can be processed within minutes, and funds can be transferred directly to the recipient's digital wallet without intermediaries like banks.

According to a report by Quartz Africa, the use of Bitcoin for cross-border transactions is becoming increasingly popular in African countries such as Kenya, Nigeria, Ghana, and South Africa. This is due to the convenience, speed, and lower transaction costs offered by Bitcoin compared to traditional banking systems.

Why should you buy Bitcoin in Africa?

Bitcoin has several benefits over traditional currencies, making it an attractive option for people living in Africa. Here are just a few of the reasons why you should consider buying Bitcoin.

Lower fees

Sending money internationally through traditional banking systems can be costly, time-consuming, and subject to high transaction fees and exchange rate fluctuations. In contrast, Bitcoin offers a faster and cheaper alternative for cross-border transactions.

While traditional banking systems charge transaction fees and other hidden costs, Bitcoin transactions are free of these charges. Users only have to pay a small fee for using the Bitcoin network, which is significantly lower than fees charged by traditional remittance services. This makes Bitcoin an attractive alternative for those who want to send money across borders.

According to Bitinfocharts, the average transaction fee for Bitcoin is lower than $5. This is much smaller than the 8.90% fee levied on international transactions in Sub-Saharan Africa.

Mobile-friendly transactions

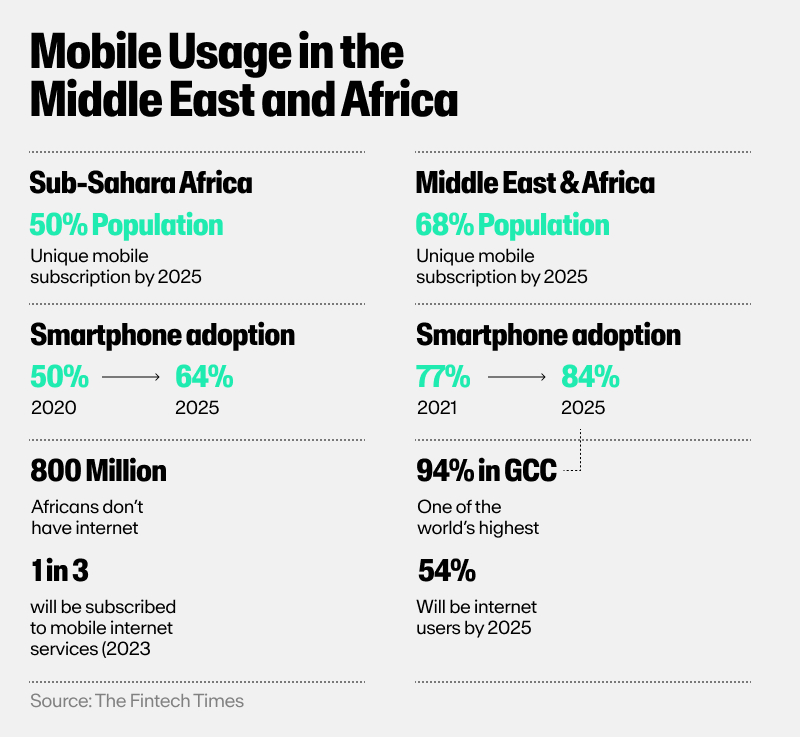

Bitcoin transactions are mobile-friendly, making it easy to carry out remittances and other transactions on the go. This is especially beneficial for people in African countries, where access to banking services can be limited or nonexistent in remote areas.

The Bitcoin network does not require a bank account or physical location in order to send and receive funds, allowing users to make transactions quickly and securely without having to visit a bank.

According to a 2020 report by the GSM Association, the number of mobile internet users in sub-Saharan Africa is expected to grow by over 200 million by 2025.

The increasing access to mobile internet services in this region could help drive the use of Bitcoin for remittances, payments, and other transactions.

Faster transactions

While payment processors like Visa and Mastercard have a throughput of thousands of transactions per second, intermediaries like banks can make cross-border payments time-consuming.

Bitcoin, on the other hand, only has a throughput of four to seven transactions per second, yet the absence of intermediaries makes Bitcoin transactions faster than those made with traditional payment processors.

According to data from Bitinfocharts, the average confirmation time for a Bitcoin transaction was around nine minutes in February 2023. This will be improved further with the help of scaling solutions like the Lightning Network (LN). Banks, on the other hand, can take several days or even weeks to process cross-border transactions.

How to buy Bitcoin in Africa

If you are looking for an easy and straightforward way to buy BTC in Africa, MoonPay has you covered. With MoonPay, you can buy Bitcoin instantly with a credit or debit card, bank transfer, Apple Pay, Google Pay, and more.

Sell Bitcoin in Africa

MoonPay also makes it easy to sell Bitcoin in many African countries when you decide it's time to cash out your crypto.

Simply enter the amount of BTC you'd like to sell and enter the details where you want to receive your funds.

.png)