Solana staking: How to stake Solana (SOL)?

Did you know Solana has a mechanism to let users lock up tokens to secure the network and earn rewards? Learn more about staking Solana here.

By Corey Barchat

Solana is a high-performance blockchain designed for decentralized applications (dApps), non-fungible tokens (NFTs), and other crypto-native projects.

Solana's high throughput, low latency, and relatively cheap transaction fees have helped it to stand out among a crowded field of Ethereum competitors.

As a Proof-of-Stake blockchain, Solana also offers users the opportunity to earn passive rewards via staking. But what is staking and how do you do it on Solana?

In this guide, we examine Solana's staking mechanism, its benefits and risks, and how you can start staking Solana (SOL) today.

What is Solana staking?

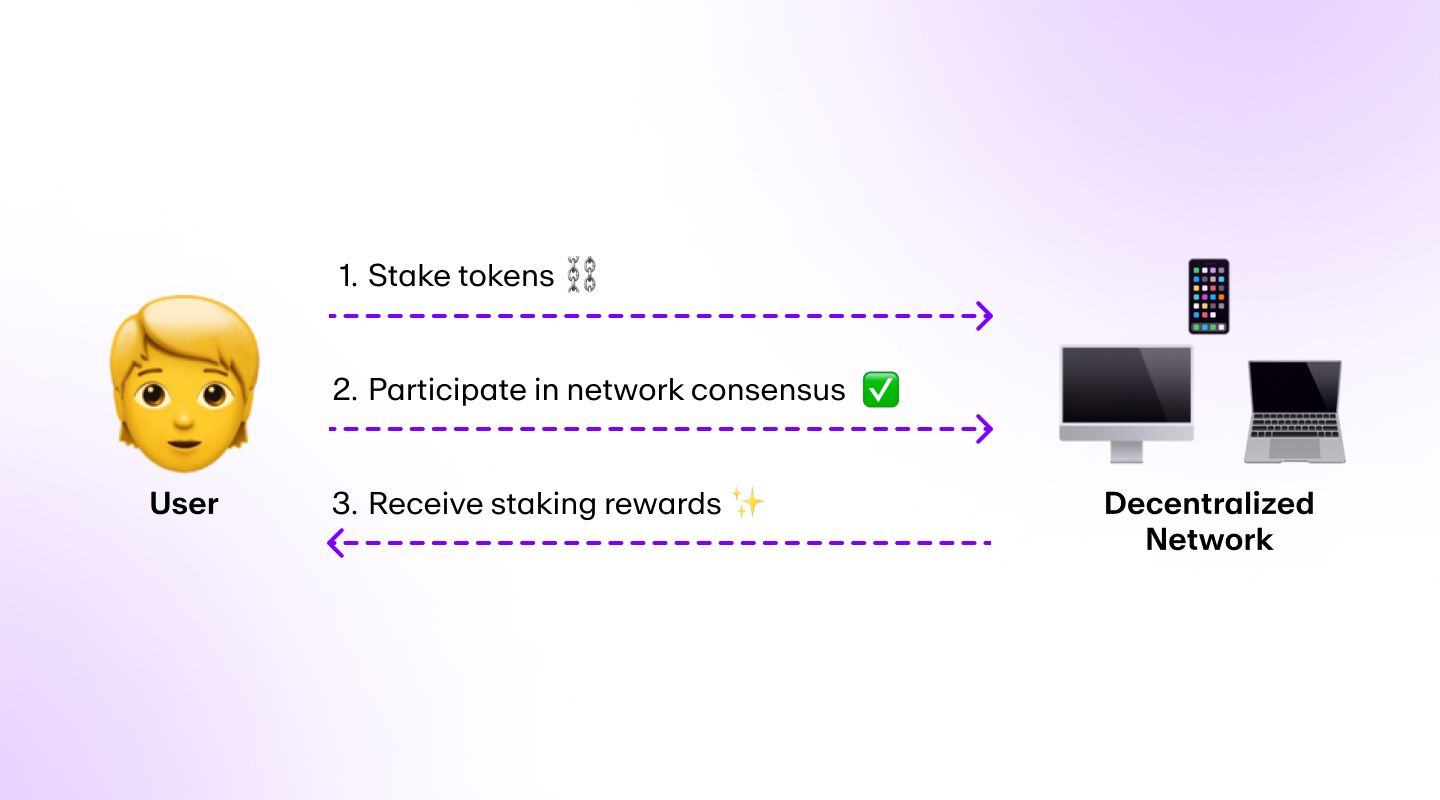

Solana staking refers to the process of participating in the Solana network's consensus mechanism by locking up SOL tokens as collateral. Validator nodes secure the network by validating transactions and producing new blocks, using delegated tokens to earn staking rewards.

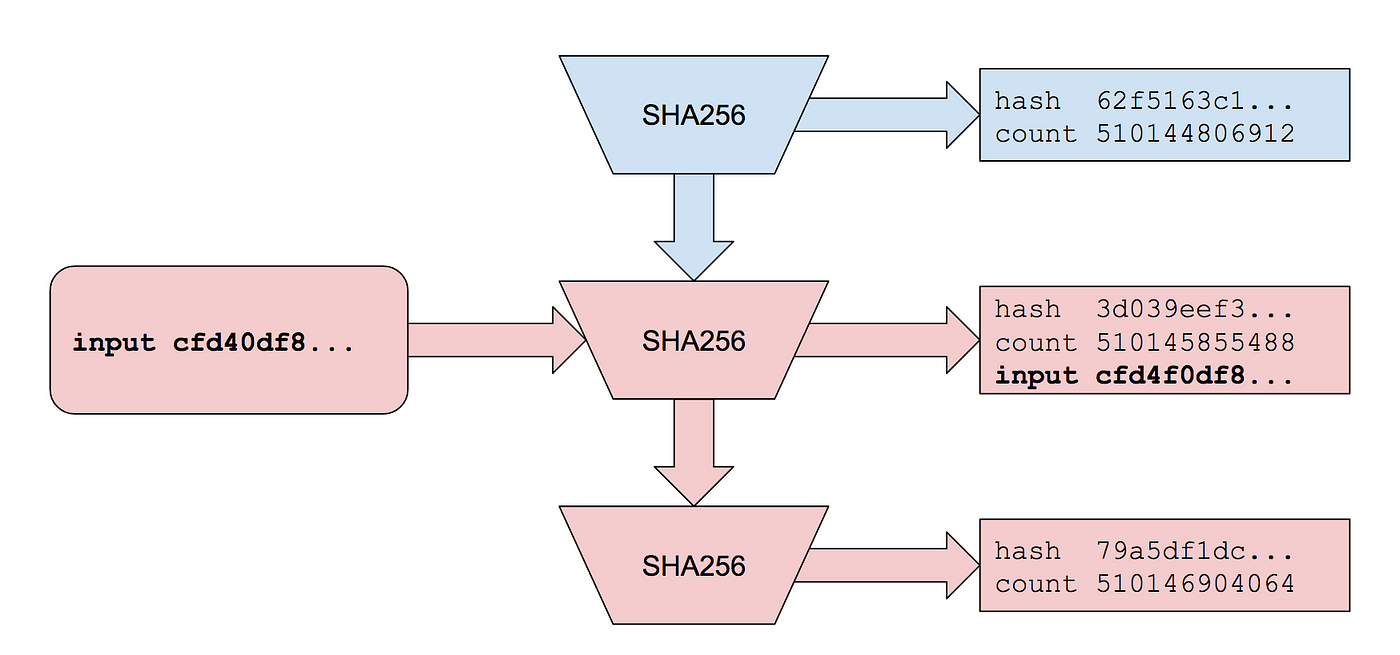

Solana uses a combination of Proof of Stake (PoS) and Proof of History (PoH) to achieve consensus efficiently and securely. Solana's unique Proof of History consensus method is a cryptographic technique that provides a verifiable record of time to improve the efficiency and scalability of the blockchain, which is able to process up to thousands of transactions per second.

Staking on the Solana blockchain (and most Proof-of-Stake networks) can be performed independently as a validator, or via delegation:

- Validators serve as nodes in a PoS network that validate transactions and create new blocks.

- Delegators are participants that pledge tokens to a validator to perform this network validation on their behalf.

Both types of participants earn rewards in the form of additional SOL tokens for their contributions to the network, with delegators receiving a share of the validators' reward.

There are many staking services that offer various options to stake Solana tokens, catering to different preferences and risk appetites. Some of these include decentralized exchanges (DEXs), crypto wallets, and dedicated staking platforms.

You can use Solana blockchain explorers like Solscan, Solana Beach, or the Solana Explorer to view staking activity on the entire Solana network, as well as for individual wallet addresses.

Benefits of Solana staking

While never guaranteed, staking Solana can provide some distinct advantages for those who participate in its consensus process. Here are a few:

Passive rewards

Staking SOL tokens can provide a way to earn passive rewards for participating in Solana network consensus. Staking rewards can be earned by staking independently as a validator node, or through delegated tokens.

Contribution to Solana network security

By staking SOL tokens, individuals contribute to the security and decentralization of the Solana blockchain, enhancing its resilience against attacks and censorship.

Flexibility of staked tokens

Staked SOL tokens remain partially liquid, allowing participants to unstake and transfer them at any time, subject to the network's unstaking period. However, this period can take up to several days, during which tokens will be unavailable for users to send or trade.

Risks of staking Solana

While Solana staking presents an opportunity for earning rewards, it's necessary to be aware of potential risks:

Network security risks

While Solana's consensus mechanism is designed to be secure, no system is immune to potential vulnerabilities or attacks. Users should employ best security practices while managing cryptocurrency assets, whether they use a custodial or non-custodial platform to stake SOL.

Validator slashing

There is a unique risk of loss associated with staking, in the form of slashing penalties for validators who fail to perform their duties properly. This could include malicious behavior, approving false or incorrect transactions, and excessive downtime between transaction validation.

Regulatory and tax implications

Participants should consider the regulatory and tax implications of staking SOL tokens in their jurisdiction to ensure compliance with relevant laws and regulations.

SOL token price instability

Like any cryptocurrency, the value of SOL tokens can fluctuate due to factors like market volatility and macroeconomic factors. If the price of SOL decreases while your tokens are staked, you may experience a reduction in the value of your investment when the time comes to unstake.

Lockup period while staking

When you stake SOL tokens, they are typically locked up for a predetermined period, during which you cannot access or transfer them. If you need liquidity or want to sell your tokens during this lockup period, you may face limitations or additional penalties for early unstaking. Furthermore, the Solana network has been known to periodically experience significant downtime, which could further delay access to staked tokens.

Requirements and eligibility for staking

Here are some things to keep in mind to decide whether staking SOL may be right for you:

- Minimum stake requirements: The Solana blockchain does not have an official minimum staking requirement, though certain staking platforms may enforce a hard minimum for the amount of SOL that must be staked.

- Daily validator fee: Although Solana does not have a minimum staking requirement, validators must pay a fee of 1.1 SOL per day. Any potential validator should weigh this cost vs how much SOL they have available to stake.

- Technical specifications: Staking Solana (SOL) requires a compatible wallet, access to the Solana network, and sufficient technical knowledge to manage staking activities effectively.

- Specific role considerations: Validators must maintain high uptime and adhere to network protocols, while delegators should carefully select trustworthy validators to whom they stake their tokens.

Different ways to stake Solana

There are three primary methods for staking Solana: independent staking, custodial staking, and non-custodial staking. Let's take a closer look at each:

Independent staking

Independent staking allows you to stake SOL assets directly as a validator node, without relying on a third party.

This method provides full control over your staked tokens and ensures greater decentralization of the Solana blockchain.

Custodial staking

Custodial wallet staking involves staking SOL tokens through a third-party custodial service or exchange.

While it may be more convenient, delegating via custodial services requires entrusting your tokens to the third party custodian, which may pose security and decentralization concerns.

Non-custodial staking

Non-custodial wallet staking enables you to stake SOL tokens through a non-custodial wallet or decentralized finance (DeFi) platform.

This method of delegating offers a balance of convenience and control, allowing you to stake your tokens while retaining ownership of your private keys.

Considerations when staking Solana

No matter which method you choose to stake SOL, there are some additional criteria to consider:

- Security: Participants should prioritize cybersecurity measures to protect their staked tokens and personal information from potential threats. This is just as true for validators as it is for custodial and non-custodial delegation.

- Staking fees: Staking services may charge fees for their services, which can impact the overall rewards from staking SOL tokens.

- Validator uptime: Validators with high uptime are more reliable and likely to generate consistent rewards for delegators.

How to stake Solana? A step-by-step guide

Now that you know a bit more about how staking Solana works, you may wish to experience it firsthand.

There are many wallets and platforms that allow staking, but for the sake of this guide, we will show you how to stake Solana by delegating tokens to a validator node in the Phantom mobile wallet.

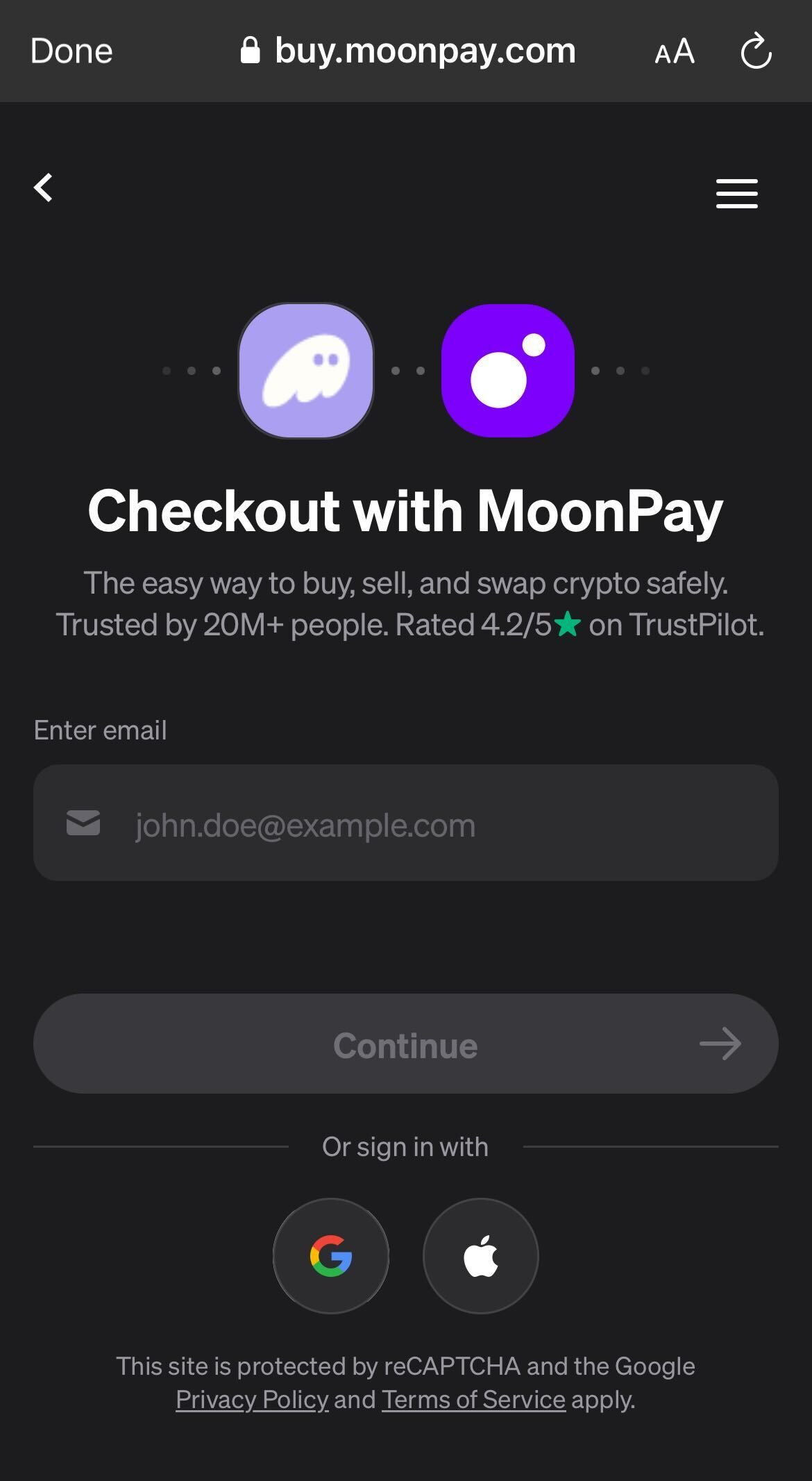

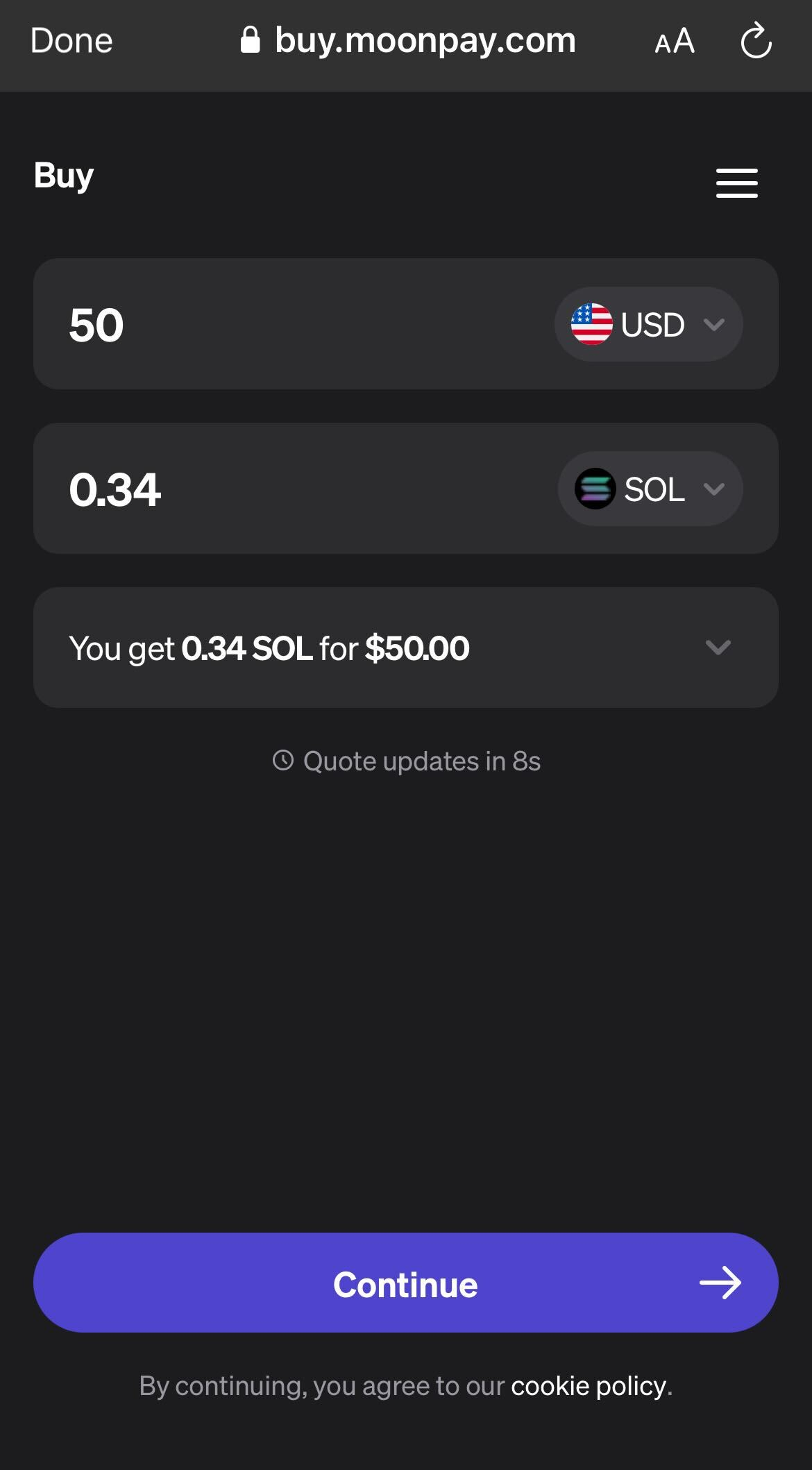

Step 1: Obtain SOL tokens

Acquire Solana tokens through a cryptocurrency exchange or other crypto on-ramp. Phantom conveniently has integration with MoonPay to buy SOL directly in the app.

Pro tip: MoonPay allows you to buy SOL in minutes using fiat currency, through payment methods like credit/debit cards and bank transfers.

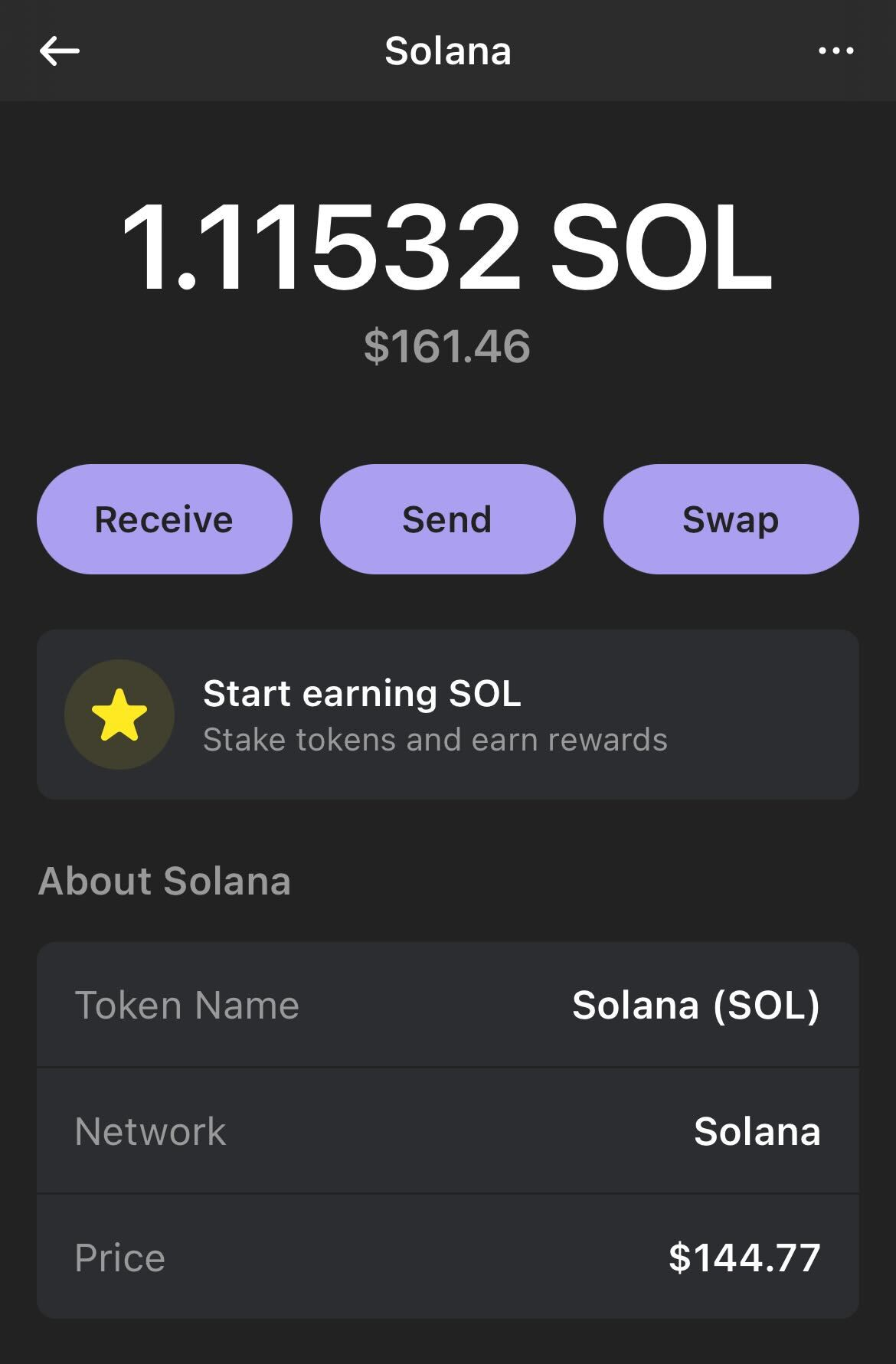

Step 2: Choose a staking method

Decide whether to stake independently or delegate your tokens to a validator. For this example, we will choose to delegate to a validator in the Phantom app.

To do so, select "Start earning SOL" by clicking on the Solana token in your wallet.

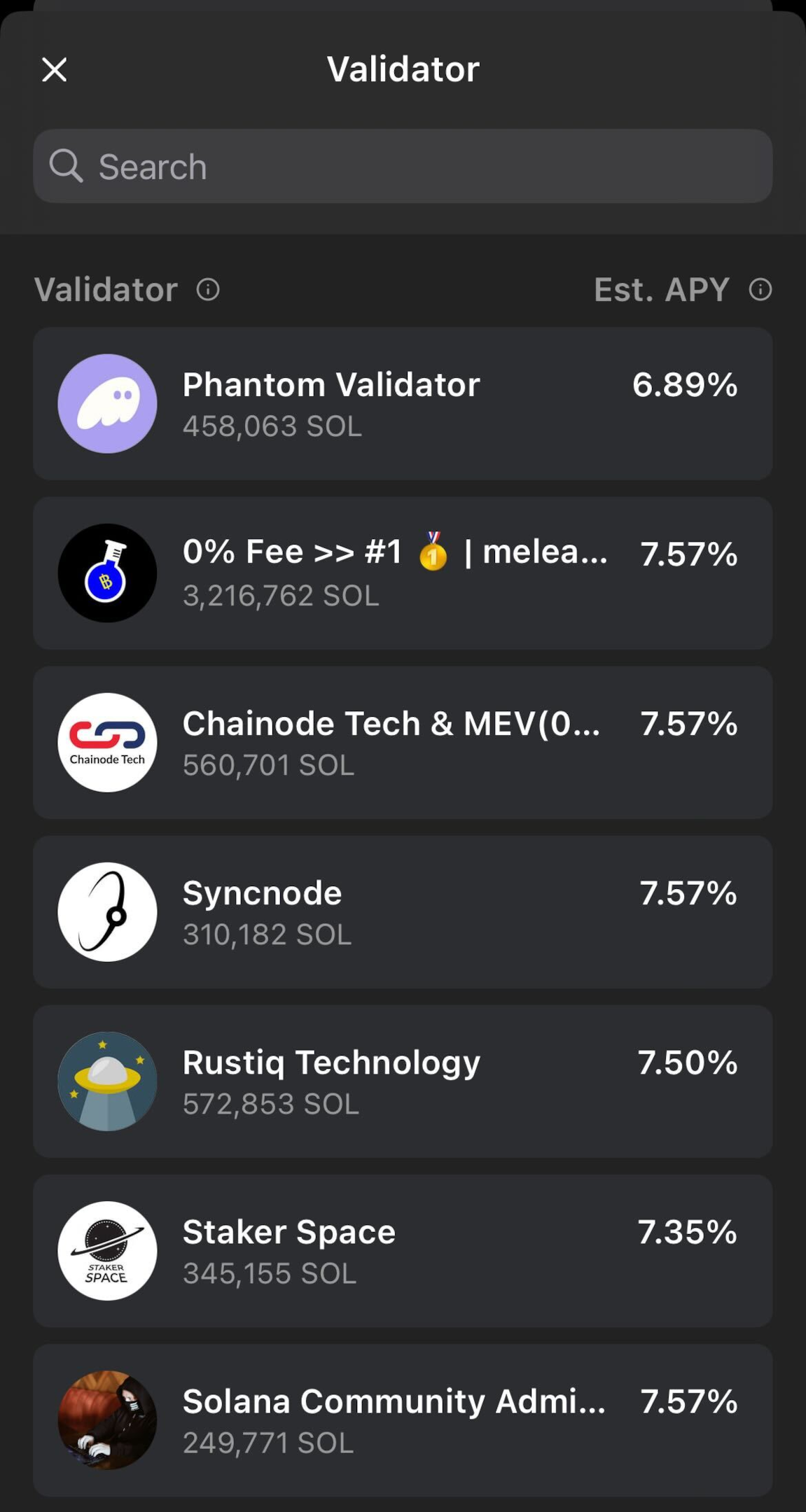

Step 3: Select a validator

Select a reputable validator with a track record of high performance and reliability. Most staking platforms will allow you to view metrics like total staked SOL, as well as the expected earning rewards.

Note: Although you may be inclined to trust the validators listed in your chosen staking platform, you should perform additional research on the selected validator before delegating tokens.

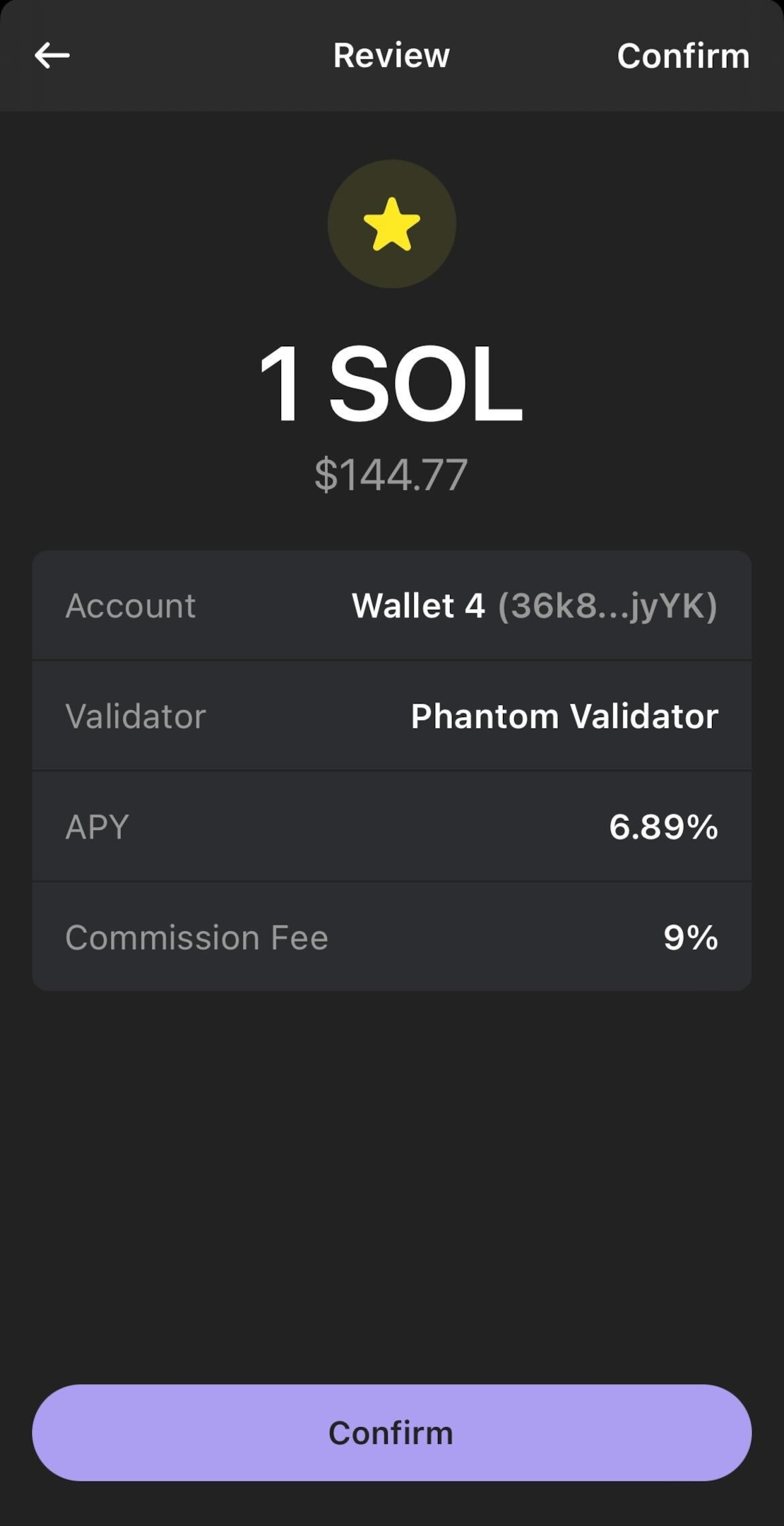

Step 4: Delegate tokens

Follow the instructions provided by your chosen staking service to delegate your SOL tokens for staking.

Before confirming the staking transaction, make sure that the quantity of staked SOL is correct, and that you have enough SOL in your wallet to cover any transaction fees.

In addition, double check the name of the validator to ensure that you have selected the correct one to delegate your SOL tokens.

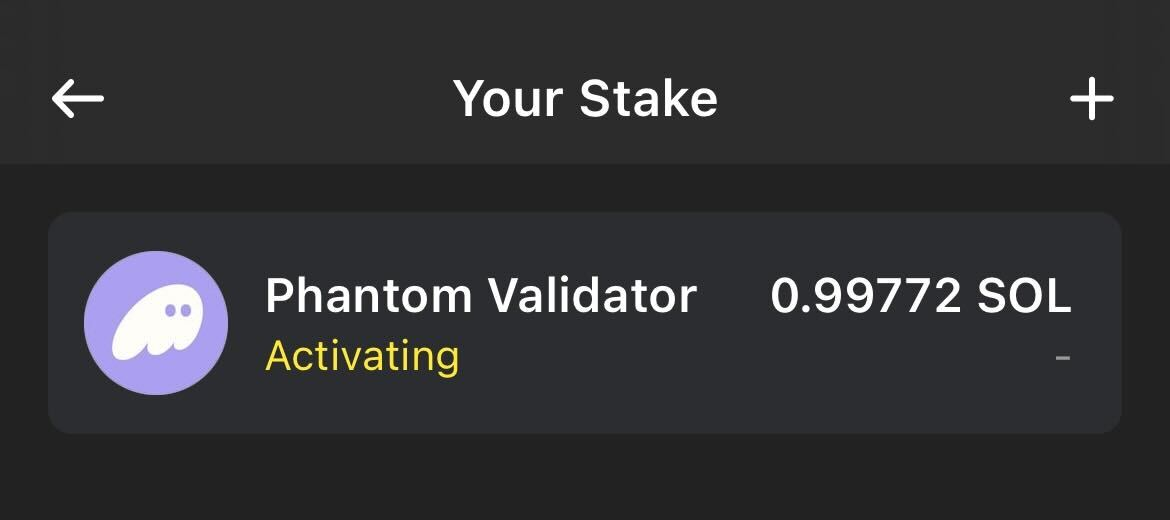

Step 5: Monitor and manage

Keep track of your staked tokens, rewards earned, and any relevant updates or announcements from the Solana network.

Note: Your staking account may not activate right away. You may need to check back in your wallet after a few days to confirm that the stake account is active.

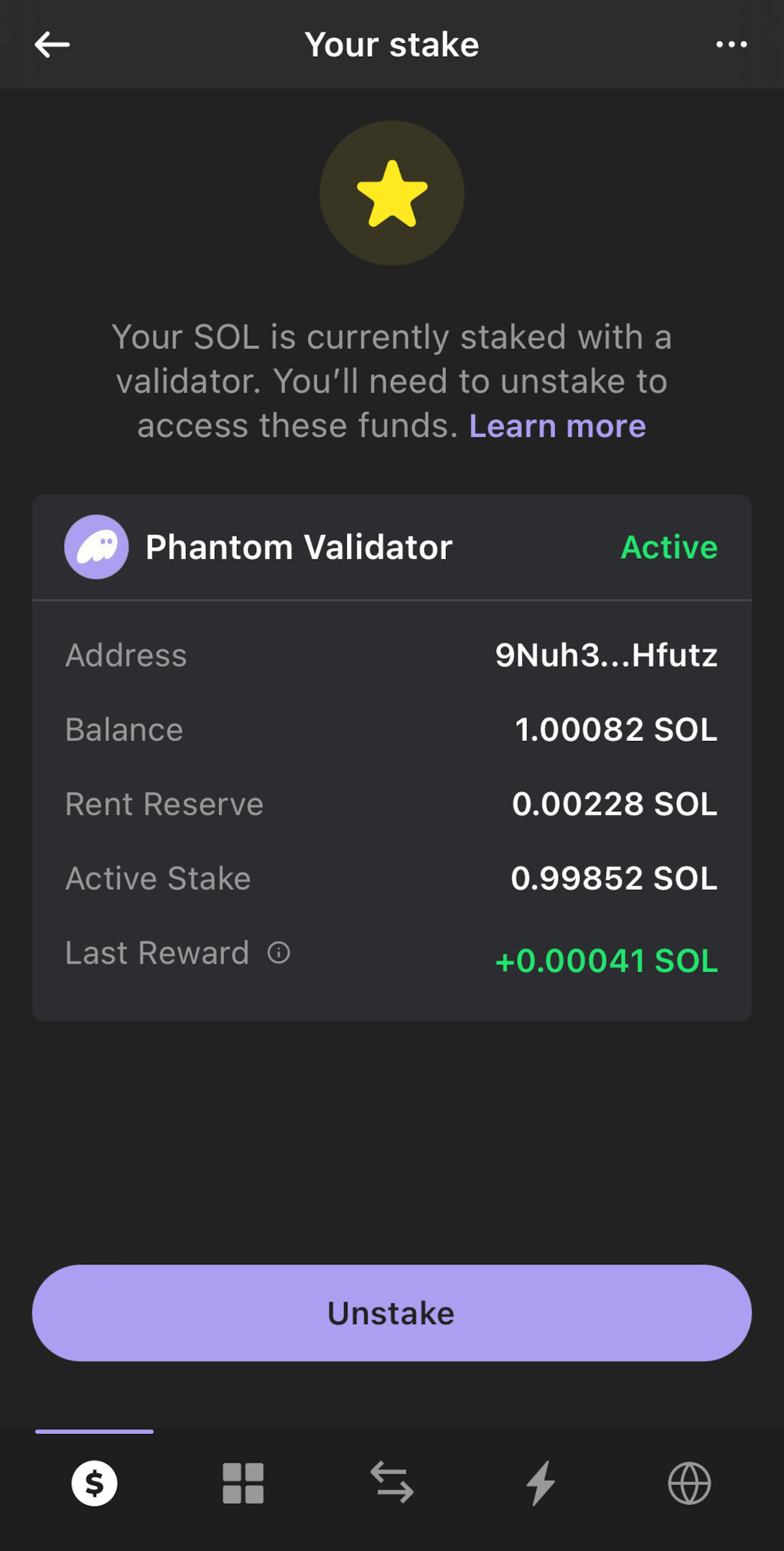

Step 6: Earn rewards

Once your stake account is activated, your staked SOL will continue to earn rewards in the form of more Solana tokens.

Step 7: Unstaking

When you decide that you'd like to unstake your tokens, click "Unstake" in your wallet. It may take up to several days once you request to do so, though some staking platforms might take even longer.

Note: In the Phantom wallet, you'll need to withdraw SOL from your staking account first, in order to receive the tokens back in the wallet you staked from.

FAQs about staking Solana (SOL)

How long does it take to earn rewards from staking SOL?

Rewards are distributed regularly, typically every epoch (approximately 2-3 days), depending on network conditions and protocol parameters.

Is staking SOL safe?

Participants should always be aware of the associated risks and take appropriate precautions to protect their assets, especially when considering staking SOL. Staking carries unique risks to other methods of managing cryptocurrency.

Is staking SOL profitable?

The staking rewards earned from Solana will never guarantee profitability. Staking rewards depend on various factors, including network participation, market dynamics, and the current staking rate.

Can I stake Solana in a wallet?

Yes, there are many non-custodial crypto wallets that allow staking. Some of them include:

Note: Users should perform their own research and due diligence before selecting a crypto wallet or SOL staking service.

Where do I receive SOL staking rewards?

Staking rewards are typically distributed directly to the staking wallet or account used for staking.

What is the unstaking period for Solana (SOL)?

Solana has a dynamic unstaking period, which varies based on network conditions and can range from a few hours to several days. However, the exact time will depend on the service used, and may take even longer.

How long can I stake Solana for?

Theoretically you could stake Solana in perpetuity. However, it's recommended to regularly check your stake account to ensure that it is functioning properly. Additionally, some platforms and wallets have been known to phase out staking services, so it's worth checking in every so often.

What other tokens can I stake?

In addition to Solana (SOL), there are many Proof-of-Stake cryptocurrencies are available for staking. Some other tokens you can stake include:

- Ethereum (ETH)

- Cardano (ADA)

- Avalanche (AVAX)

- Polkadot (DOT)

- Polygon (MATIC)

- Near Protocol (NEAR)

- Cosmos (ATOM)

- Tezos (XTZ)

Concluding thoughts on staking Solana

Solana staking offers the potential to earn passive rewards while supporting a high-performance blockchain network. By staking SOL, individuals contribute to the security and decentralization of the Solana network while potentially benefiting from earning more Solana tokens.

However, staking involves risks that participants should carefully consider before getting started. With the right knowledge, tools, and precautions, staking Solana can be a potentially rewarding experience for crypto users.

Start staking Solana

Whether you wish to use Solana for staking, DeFi, NFTs, or if you just want to "HODL", you'll need to acquire SOL first.

MoonPay makes it easy to buy Solana (SOL) with a credit card, bank transfer, Apple Pay, Google Pay, and many other payment methods.

Just enter the amount of Solana (SOL) you wish to purchase and follow the steps to complete your order.