Disclaimer: The following is for informational purposes about crypto assets only and should not be construed as financial or investment advice.

In recent years, the cryptocurrency world has exploded with a new, unique phenomenon: meme coins. While traditional cryptocurrencies like Bitcoin and Ethereum were created with serious technological ambitions and real-world applications, meme coins take a different approach.

Though they started as jokes, meme coins such as Dogecoin and Shiba Inu have amassed huge followings and market capitalizations in a short period of time.

But what exactly are meme coins, and are they legitimate?

In this guide, we explore the origins, technology, risks, and driving factors behind meme coins, as well as what the future might hold for this unique corner of the crypto market.

What is a meme coin?

Meme coins are a type of cryptocurrency primarily inspired by internet memes, jokes, or social media trends. Unlike traditional cryptocurrencies designed with a clear purpose or utility, meme coins often lack a specific use case. Instead, their value is largely driven by community support, social media virality, and price speculation.

Perhaps the most famous example of a meme coin is Dogecoin, which was initially created as a joke in 2013. Despite its humorous origin, Dogecoin has gained widespread popularity over the years, particularly after endorsements from Elon Musk and other social media personalities.

Meme coins typically have a massive supply and low price, making them accessible to a broader audience. However, these factors often lead to wild price swings fueled by hype, market sentiment, and speculative traders.

How do meme coins work?

Meme coins may be rooted in internet jokes, but they operate much like any other serious cryptocurrency. Let’s explore the underlying technology and how these coins derive their value.

The technology behind meme coins

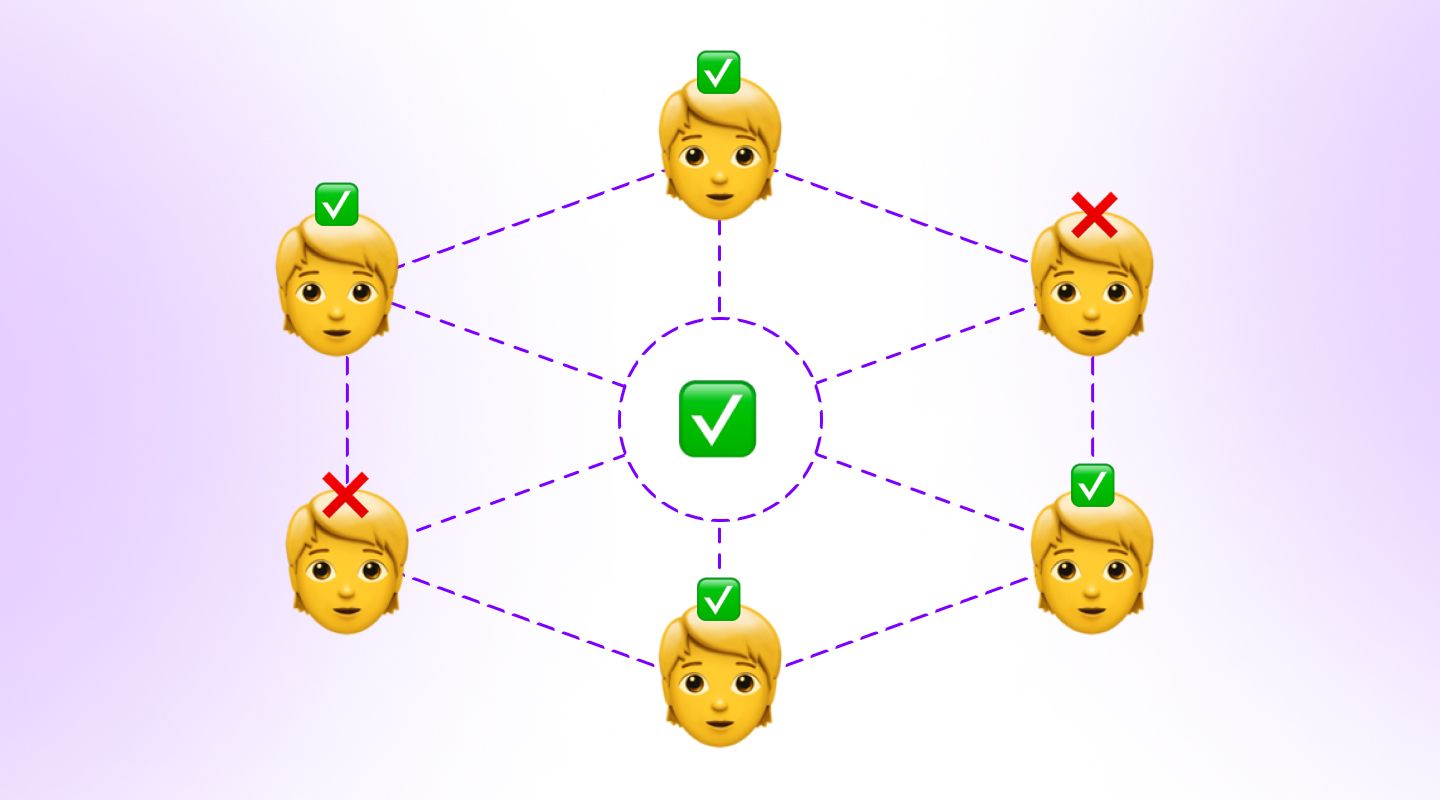

Like other cryptocurrencies, meme coins are built on blockchain technology—a decentralized ledger that records transactions publicly.

Meme coins such as Dogecoin and Shiba Inu are powered by blockchain networks that ensure security, transparency, and immutability. For instance, Dogecoin (DOGE) is based on the same Proof-of-Work (PoW) consensus algorithm as Bitcoin, where miners solve complex mathematical puzzles to validate transactions and secure the network.

In contrast, Solana-based meme coins like Bonk (BONK) and dogwifhat (WIF) embrace the more energy-efficient consensus method known as Proof of Stake (PoS). PoS involves validators that are selected to confirm transactions based on the number of coins they "stake" or hold. This mechanism is less energy-intensive than PoW but still provides a secure framework for verifying transactions.

Community-driven value

One of the defining features of meme coins is their community-driven value, which sets them apart from more traditional cryptocurrencies. Meme coins thrive on the collective enthusiasm of their communities, especially across social media platforms like Reddit, X (Twitter), and Discord.

These communities often engage in posts and campaigns to promote their favorite coin, creating a viral effect. For example, Dogecoin’s 2021 rally was largely driven by Reddit's r/dogecoin and r/WallStreetBets communities, which encouraged users to buy and "HODL" coin as part of a broader meme stock movement.

As the name hints, viral memes are central to the value proposition of meme coins. These cryptocurrencies become popular in part through humor, shareable content, and celebrity endorsements. Although it may not reflect sustainable tokenomics, meme coin prices often spike when they capture the attention of a community, or when meme-related content goes viral.

Volatility and speculation

Meme coins are notorious for their extreme volatility, with prices often fluctuating dramatically based on external factors. This makes meme tokens highly speculative assets, with prices that are influenced more by community hype and speculation than by any underlying value or utility. Investors may choose to purchase meme coins hoping to capitalize on short-term price surges, but this speculative nature makes these digital assets particularly volatile and risky.

Market sentiment and celebrity endorsements can also have an outsized impact on meme coins. High-profile figures like Elon Musk have significantly influenced Dogecoin’s price over the years with their social media posts and endorsements. This reliance on external influence makes meme coins vulnerable to sudden shifts in sentiment, leading to rapid price spikes and often, crashes.

Why do people buy meme coins?

Despite their volatility and speculative nature, meme coins continue to attract a growing number of users. But why are people so drawn to them?

Accessibility and low entry barriers

Although some of these digital tokens may possess a high market cap, meme coins are often priced much lower than traditional cryptocurrencies. This helps make them a more affordable alternative to new investors who may not have the capital to buy a whole Bitcoin (BTC) or Ether (ETH) token.

For instance, someone could purchase Dogecoin by the thousands, for the same price as a fraction of a Bitcoin. While no one would say that DOGE will ever be equivalent to BTC, a lower Dogecoin price helps to make it a potentially appealing asset to those seeking low-cost entry points into the cryptocurrency market.

Fun and cultural relevance

Meme coins have deep ties to online culture, often being inspired by internet memes, jokes, and other viral content. For example, Dogecoin is based on "Doge", the popular meme featuring a Shiba Inu dog, while the SHIB token is its own meme tribute to DOGE. This light-hearted nature of DOGE and other meme coins resonates with a digital generation that values humor and internet trends.

In addition to simply providing inspiration for token names and logos, pop culture trends also allow meme coins to stay relevant and generate buzz. By associating themselves with internet and cultural phenomena, meme coins gain attention and build larger communities.

It's no coincidence that Shiba Inu and Dogecoin, the top two meme coins by market cap, often benefit from pop culture references and collaborations that boost their visibility and appeal. At the same time, potential investors should be wary of putting money into any cryptocurrency project due to peer pressure or FOMO.

Risk appetite

Some investors are drawn to meme coins by stories of rapid financial gains. Those people who invested early in Dogecoin or Shiba Inu (and held) likely saw their investments multiply exponentially during bull markets. Although they are rare and involve luck, stories like these fuel the belief that meme coins, though risky, offer the chance for high rewards.

At the same time, while meme coins present the possibility of substantial returns, they also come with significant risks. Their speculative nature means that investors can just as easily lose their entire investment if the market turns against them, or in cases where the project founders disappear with funds.

This risk-reward balance is a key consideration for investors who view meme coins as a high-risk, high-reward bet.

Popular meme coins in 2025

Even more so than other cryptocurrencies, meme coins are volatile investments that often have short-lived longevity. That being said, here are some digital tokens that have demonstrated longer shelf-life than others:

Dogecoin (DOGE)

Dogecoin is the original meme coin, created in 2013 as a joke, though it has become the most well-known meme token since. With a dedicated community and widespread recognition, Dogecoin has achieved a notable place in the crypto market.

Though many have doubted its seriousness and sustainability, DOGE's playful branding and active community have continued to drive interest and value. While it started as a meme coin itself, DOGE has inspired a whole host of spinoff tokens like Shiba Inu (SHIB), Baby Doge Coin (BabyDoge), ShibaDoge (SHIBDOGE), and Dogelon Mars (ELON).

Shiba Inu (SHIB)

Shiba Inu is often referred to as the "Doge killer," emerged in 2020 as a rival to Dogecoin. Built on the Ethereum blockchain as an ERC-20 token, SHIB has gained significant popularity and support from its community. Shiba Inu owes its popularity in part to its association with Dogecoin, as well as its own viral marketing efforts.

Though it started as a spinoff of DOGE, Shiba Inu now has an extensive ecosystem of utility tokens like BONE, LEASH, TREAT, and SHI, that serve various functions in DeFi and governance.

Floki (FLOKI)

Floki is named after Elon Musk’s dog, and combines elements of meme culture with ambitious plans for development and growth. It aims to create a robust ecosystem and capitalize on its association with popular figures and memes.

Bonk (BONK)

Bonk is another meme coin that gained traction through social media and community engagement, including surprise airdrops. Built on the Solana blockchain as an SPL token, BONK is known for its playful branding and efforts to build a strong community around the meme coin.

Pepe (PEPE)

Pepe is inspired by the popular internet meme character Pepe the Frog. The PEPE coin has relied on the Pepe meme’s widespread recognition to build a following and create a sense of community among its supporters.

dogwifhat (WIF)

dogwifhat is a newer meme coin that also draws inspiration from internet culture and humor. Built on Solana and featuring a logo of a dog in a hat, WIF has garnered attention through its unique branding and an active community.

OFFICIAL TRUMP (TRUMP)

OFFICIAL TRUMP is the latest meme coin to gain increased attention in a short period of time. OFFICIAL TRUMP was launched just before the US presidential inauguration, bearing the name and likeness of Donald Trump. TRUMP jumped out to a price exceeding $73, a market capitalization over $14.5 billion, and a trading volume of over $70 billion within the first two days of launch.

Risks of meme coins

It's been stated that while some meme coin tokens have offered great returns for investors, they also carry significant risks compared to other investments and cryptocurrencies.

Extreme volatility

Meme coin prices can be extremely volatile, with values experiencing rapid increases and declines based on market sentiment, as well as social media activity (where many meme coins get their value from). Instability can make meme coins a risky investment, as prices may fluctuate dramatically over short periods.

This speculative nature means that investors are at risk of losing their investments. The lack of intrinsic value and reliance on crypto community sentiment can lead to significant losses, especially if the coin’s popularity wanes.

Regulatory challenges

Meme coins face potential regulatory and legal challenges, as they often lack the oversight and scrutiny that more established cryptocurrencies receive.

Governments and regulatory agencies may impose restrictions on meme coins if they perceive risks related to fraud, market manipulation, or investor protection. Such actions could impact the value and availability of meme coins, adding an additional layer of risk for investors.

Lack of intrinsic value

Unlike Bitcoin and other cryptocurrencies with clear technological advancements or practical applications, meme coins often lack intrinsic value. Their worth is largely driven by market and community sentiment rather than underlying technology or use cases.

Naturally, this raises questions about their long-term sustainability. As the market for meme coins is heavily influenced by viral trends and hype, there is a risk that the value of these coins could be part of a speculative bubble that may eventually burst (some sooner than others).

Common meme coin scams to watch out for

Although some meme coins can present an opportunity for investment, they are often accompanied by scammers looking to take advantage of unsuspecting users. Here are some popular scams to beware of:

Airdrop scams

While legitimate airdrops do exist, airdrop scams involve fraudulent schemes where scammers promise free tokens or coins to attract potential investors. But instead of sending tokens to users, these scams instead collect personal information or may require victims to make payments, leading to financial losses.

Rug pulls

Rug pulls occur when the developers of a meme coin (or other crypto project) suddenly withdraw their funds, delete sites and social media accounts, and disappear. This type of scam leaves investors with worthless tokens, highlighting the importance of researching the credibility of a meme coin project and its dev team.

Pump and dump schemes

Pump and dump schemes involve artificially inflating the price of a meme coin through misleading or coordinated efforts, only for the perpetrators to sell off their holdings at the peak and leave other investors with losses. These schemes are often employed by celebrities and online influencers, exploiting their community with significant financial harm to bolster personal gains.

Fake exchanges and platforms

Scammers can create a fake cryptocurrency exchange that looks like a legitimate platform where users can buy or trade meme coins. These fake sites often mimic popular crypto exchanges but are designed to steal login credentials, private keys, and crypto assets from users.

Ponzi schemes

Ponzi schemes involve the promise of high, consistent returns for investing in a meme coin, often requiring participants to recruit new investors to earn higher returns. As more people buy in, early investors (and scammers) may see returns, but eventually, the system collapses when there aren’t enough new investors to support payouts.

What to keep in mind when buying meme coins

Investing in meme coins can be fun and potentially profitable, but it’s important to remain cautious and aware of the risks. Here are a few key points to keep in mind when purchasing meme coins:

- Do your own research (DYOR): Always research the team behind the project, the coin's purpose, and its community before investing. Some things to look for include project transparency, clear communication, and a realistic roadmap.

- Beware of FOMO (Fear of Missing Out): Many meme coins move quickly, which can cause scammers to create a sense of urgency or FOMO. Take your time before investing and don’t rush into any opportunity without due diligence.

- Use reputable exchanges: Stick to well-known, reputable crypto exchanges and on-ramps when buying meme coins. Avoid using obscure or new exchanges unless they have been thoroughly vetted by the community.

- Check for audits: Some meme coins are audited by third-party firms that review the code for potential vulnerabilities or malicious intent. While an audit isn’t a guarantee of safety, it’s a sign that the project is taking security seriously.

- Protect private information: No legitimate cryptocurrency project will ever ask for your private keys, wallet passwords, or sensitive personal information. Keep this data secure and never share it with anyone.

FAQs about meme coins

How are meme coins different from other cryptocurrencies?

Unlike established cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH), which have specific technological use cases and applications, meme coins are primarily driven by internet culture, community engagement, and speculative trading. Their value is often more volatile and less based on intrinsic technological value.

Are meme coins safe?

Meme coins are highly speculative and extremely volatile, making them risky investments. While some have seen significant gains, this does not guarantee future performance as they also carry a high risk of loss. Investors should carefully consider their risk tolerance, conduct thorough research, and be prepared for potential price swings.

How to buy meme coins

Investing in meme coins can be an exciting and potentially rewarding experience, but it’s important to approach it with caution and a clear understanding of the risks involved. If you're interested in buying meme coins, be sure to research and choose a reputable token, store your coins safely in a non-custodial or cold storage (hardware) wallet, and monitor factors like price and market cap to keep track of the token's performance.

MoonPay makes it easy to buy meme coins like TRUMP, Dogecoin, Shiba Inu, Bonk, and Pepe using a credit card, Apple Pay, PayPal, and more preferred payment methods. Just enter the amount of crypto you wish to buy, and follow the steps to complete your order.

To enjoy faster transactions, lower fees, and higher approval rates, just fund your wallet with euros, pounds, or dollars and use your MoonPay Balance to purchase meme coins like DOGE and SHIB.

You can also trade for Solana meme coins like Bonk (BONK), dogwifhat (WIF), OFFICIAL TRUMP (TRUMP), and more. Just top up on USDC (SOL) in your MoonPay Account to buy meme coins on Solana in seconds, with the low fees that accompany the Solana blockchain.

.png?w=3840&q=90)

.png?w=3840&q=90)

.png?w=3840&q=90)