XRP vs Bitcoin: The differences between two crypto giants

Learn the key differences between XRP and Bitcoin, from speed and costs to environmental impact, use cases, and challenges facing each cryptocurrency.

By Corey Barchat

Cryptocurrencies have taken the world by storm. Out of the thousands of tokens in existence, few coins have captured public attention quite like Bitcoin and XRP.

Bitcoin (BTC) emerged as the first cryptocurrency, designed as a peer-to-peer cash system, whereas XRP, the native cryptocurrency of Ripple, primarily facilitates cross-border payments and money transfers.

Though they are often discussed together, each token has carved its unique path within the greater blockchain ecosystem, with unique user bases, technologies, and economic impacts.

In this article, we break down the differences between XRP and Bitcoin, highlighting how each serves its purposes, the technical and market-based nuances that set them apart, and their potential pros and cons.

XRP and Bitcoin: What are they used for?

Let's explore what each of these cryptocurrencies was created to accomplish, and how they fit into today’s financial landscape.

Bitcoin’s purpose and use cases

Bitcoin, the original cryptocurrency, was created by an anonymous developer (or entity) known as Satoshi Nakamoto in 2008. Its initial purpose was to serve as a peer-to-peer, decentralized currency, eliminating the need for intermediaries like banks.

Bitcoin is viewed primarily as a:

- Store of value: Often likened to "digital gold," Bitcoin is popular among those looking to hedge against inflation or economic instability, though this status has been brought into question after several periods of price volatility.

- Medium of exchange: Bitcoin is accepted by a growing number of merchants and can be used for everyday purchases in many countries.

- Foundation for advancement: The Bitcoin blockchain has inspired innovations like the Lightning Network, which aims to enhance Bitcoin transaction speed, and Ordinals, which brought NFTs to the Bitcoin network.

XRP’s purpose and use cases

XRP, launched by Ripple Labs in 2012, is tailored to bridge the gap between traditional finance and blockchain technology. XRP was designed to enable banks and financial institutions to transfer funds globally with minimal fees and near-instant settlement times.

Its main purpose revolves around:

- Cross-border payments: XRP enables efficient, fast transactions between different fiat currencies, making it a powerful tool for banks, financial institutions, and enterprises.

- Liquidity solution: Banks and payment providers can hold XRP in an attempt to minimize the costs associated with maintaining foreign currency accounts.

- Settlement mechanism: The XRP Ledger is optimized for high-volume, low-cost transactions, suitable for quick and affordable money transfers.

Comparing the technical foundations of Bitcoin vs XRP

Both XRP and Bitcoin have unique technical structures, designed with different objectives in mind:

Core technology

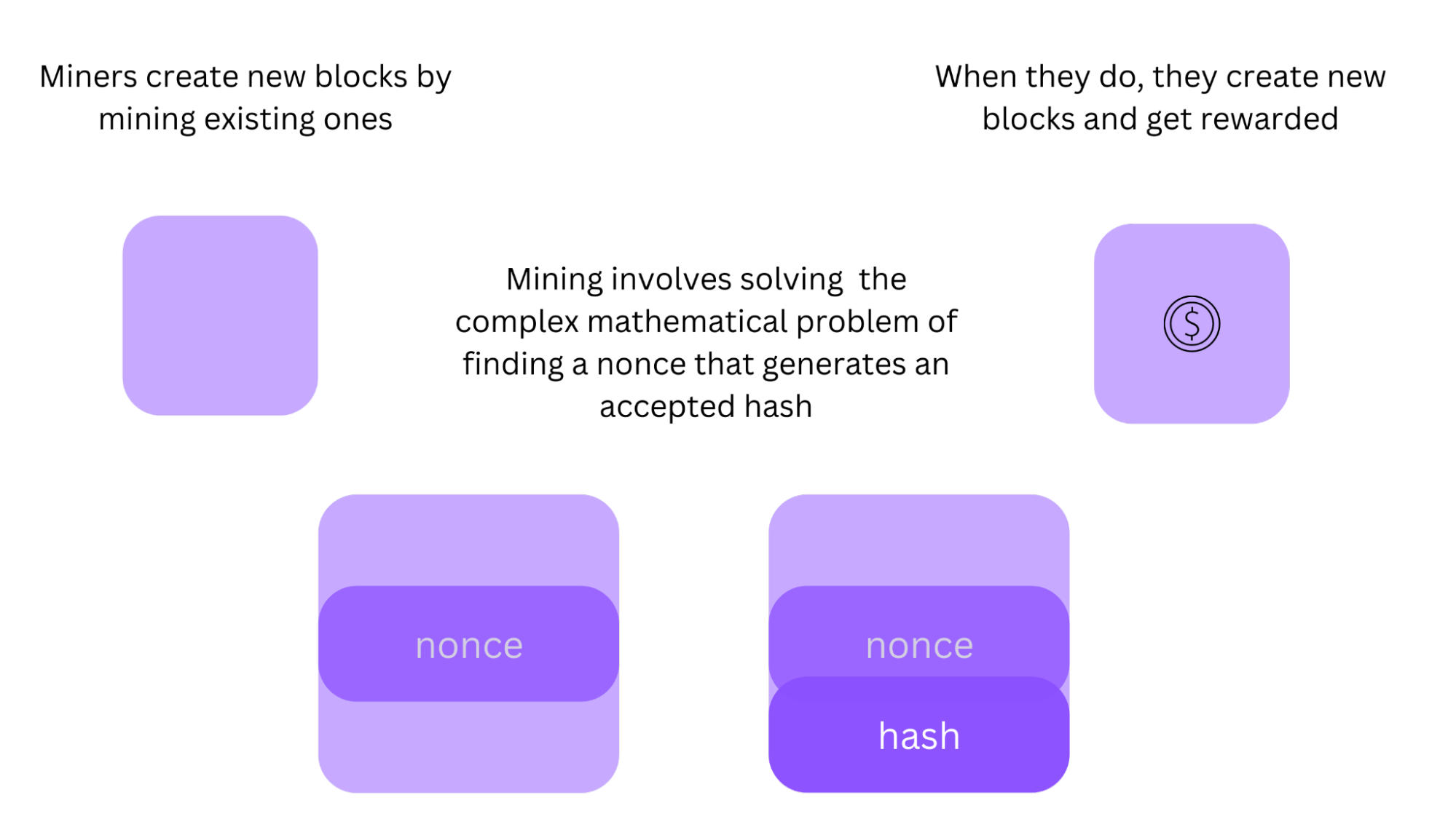

Bitcoin's consensus mechanism is built on a Proof-of-Work (PoW) model where miners compete to solve complex puzzles, securing the network and verifying transactions. This system, while secure, is quite energy-intensive, and has been called into question by regulatory and environmental agencies across the globe.

XRP does not use mining, and instead relies on the Ripple Protocol Consensus Algorithm, where validators (trusted network participants) confirm transactions. This system is faster and less energy-consuming than PoW, making XRP a more eco-friendly alternative.

Blockchain and transaction mechanisms

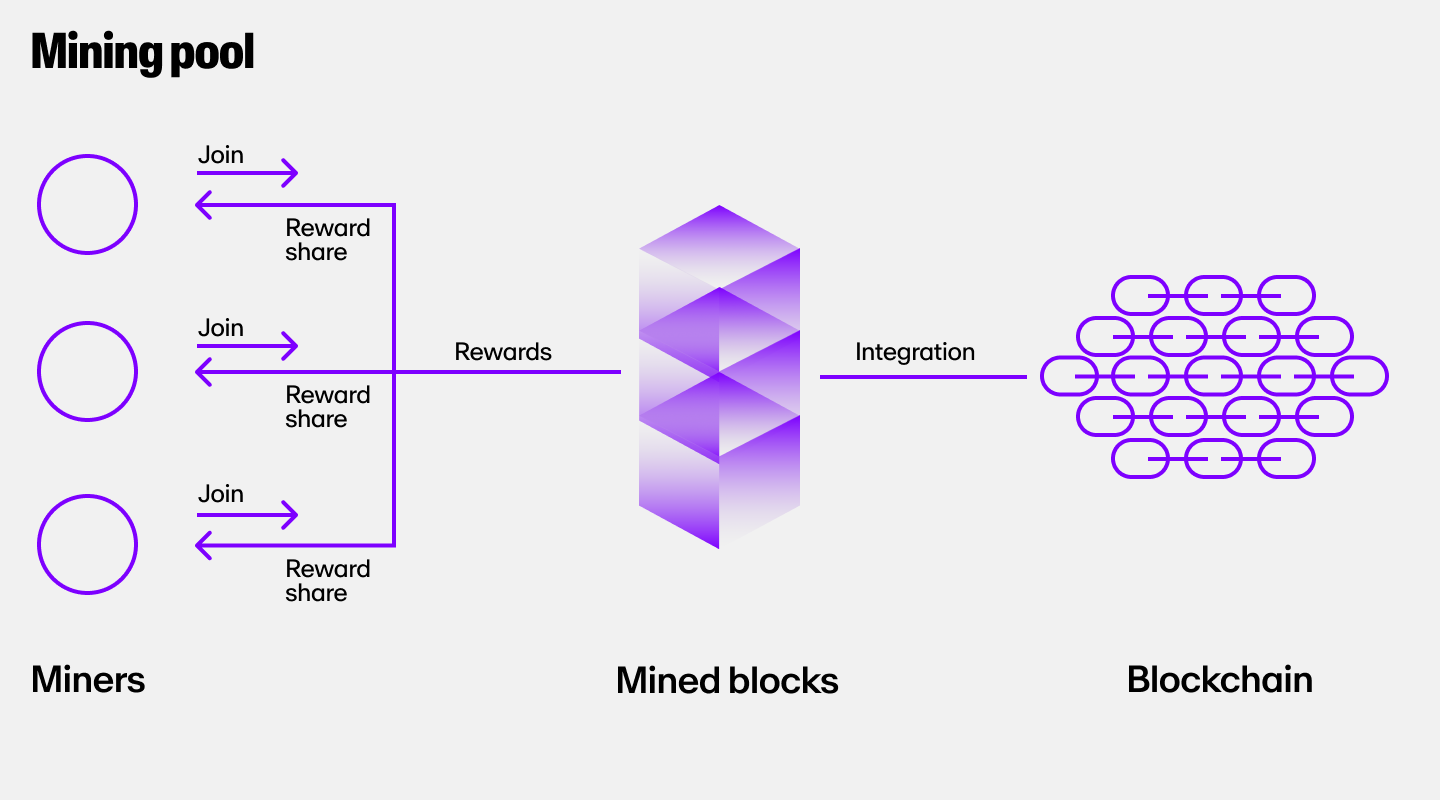

Bitcoin transactions are confirmed by miners, who are rewarded with BTC tokens for validating blocks. This process secures the network but can be slow and costly, especially during peak times where congestion is greater. Bitcoin’s blockchain records each transaction on a public, immutable ledger, where transactions are grouped into blocks that are added to the chain.

With the XRP Ledger (XRPL), a set of independent validator nodes—chosen from a recommended list called the Unique Node List (UNL)—work together to reach consensus on which transactions are legitimate and should be added to the ledger. Without the crypto mining and computational requirements, XRP transactions are confirmed in seconds.

Technical impact

Bitcoin’s security is deeply rooted in its decentralized mining process, while XRP’s efficiency comes from a centralized validator model. These contrasting mechanisms influence the adoption of each currency, with Bitcoin’s slower but more secure processing appealing to users and entities seeking stability, while XRP’s quick, low-cost transfers draw interest from the international transfer sector.

Feature | Bitcoin (BTC) | XRP (XRP) |

Core technology | Proof-of-Work (PoW); miners validate transactions. | Ripple Protocol Consensus Algorithm; validators confirm transactions. |

Energy-efficiency | Energy-intensive; criticized by regulators. | Eco-friendly; faster and less energy-consuming. |

Transaction Mechanisms | Confirmed by miners; can be slow and costly. | Confirmed by validators in seconds, reducing time and costs. |

Blockchain Structure | Public ledger with transactions in blocks. | Distributed ledger with unique block structure. |

Adoption | Appeals to users seeking security despite slower speeds. | Financial and banking sectors leverage quick, low-cost transactions. |

XRP vs Bitcoin: Key differences

When analyzing Bitcoin vs XRP, we can look at the key differences that set these two cryptocurrencies apart.

Transaction speed and cost

A major difference between Bitcoin and XRP lies in the speed and cost of transactions. Bitcoin’s transaction time averages around 10 minutes, but during periods of high demand, transactions can take longer, often leading to increased fees (as users compete to have their transactions prioritized).

In contrast, XRP transactions generally confirm within 3-5 seconds, with fees that remain consistently low regardless of network demand. XRP’s speed and cost efficiency cater to rapid payments, particularly across international borders, while Bitcoin's slower processing time limits its use as a daily transactional currency. This can actually position users more towards "HODLing" BTC long-term rather than spending.

Want to track XRP speed and gas fees in real-time? Check out XRPScan, the XRP Ledger blockchain explorer.

Decentralization and control

Another difference is the level of decentralization and control in each network. Bitcoin’s network relies on a global community of miners and node operators, making it highly decentralized. The absence of a central governing body means that Bitcoin’s code and functionality—and ultimately its future—are controlled by the Bitcoin community and depend on consensus among its network participants.

XRP, however, was developed by Ripple Labs, which continues to hold a substantial share of XRP tokens and maintains significant influence over the network’s development and use. This centralized control has led some to perceive XRP as less decentralized than Bitcoin, which can impact its appeal to users who prioritize decentralization and the security benefits it provides.

Environmental impact

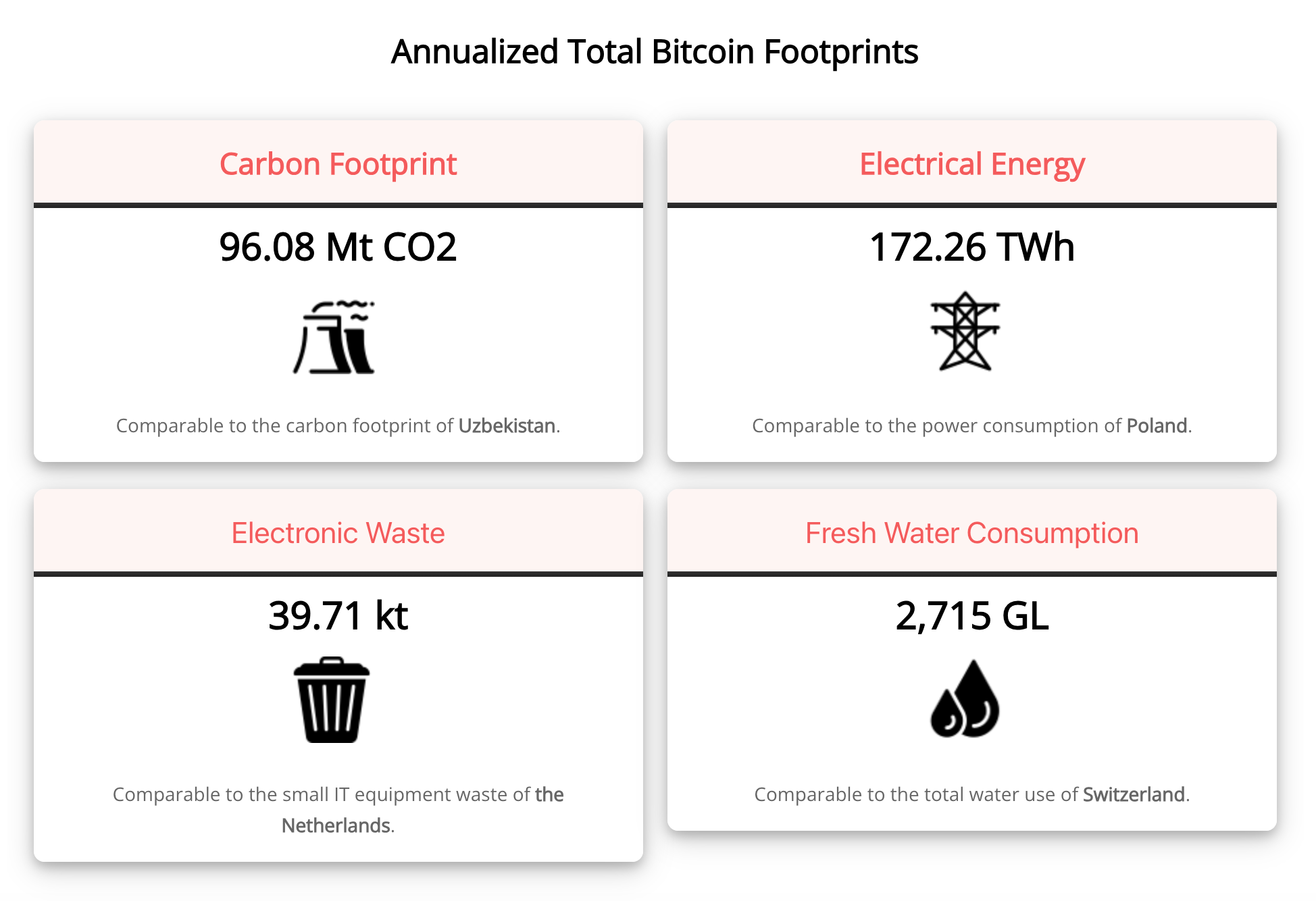

Bitcoin and XRP also differ in their environmental impact, largely due to the way transactions are validated on each network. Bitcoin’s PoW consensus mechanism, which relies on computational mining, is energy-intensive and has raised sustainability concerns as the network grows.

The electricity consumed by Bitcoin mining operations—equivalent to the output of countries like Poland and the Netherlands—has spurred debate about its long-term environmental impact, particularly as more countries push for greener alternatives.

XRP’s consensus model, on the other hand, is far more energy-efficient since it doesn’t involve mining. This makes XRP a more appealing option for those who seek eco-friendlier solutions within the crypto space.

Accessibility and popularity

Bitcoin is by far the more recognized and widely adopted of the two, benefiting from its status as the first cryptocurrency, institutional adoption, and widespread media coverage. Bitcoin has almost become synonymous with cryptocurrency itself, further boosting its appeal to both individual and institutional investors.

XRP, while popular within certain sectors, is not as widely recognized or accessible to the general public. This, in addition to scrutiny and media coverage of its ongoing legal case with the SEC only further limit its overall adoption. However, XRP’s integration into payment systems and partnerships with financial institutions like Santander and Itaú give it a solid foundation within its financial niche, which could potentially increase its overall relevance in the future.

Feature | Bitcoin (BTC) | XRP (XRP) |

Speed | ~10 minutes | 3-5 seconds |

Transaction costs | Higher | Lower |

Decentralization | High | Moderate (Ripple Labs control) |

Energy usage | High | Lower |

Popularity | Global | Primarily banking/finance sector |

Advantages of using XRP vs. Bitcoin

If you're choosing between XRP and Bitcoin, consider how each asset’s features align with your own goals. Here’s a closer look at the benefits of both:

Utility of XRP for cross-border payments

XRP’s design allows for fast, cost-effective cross-border transactions. Its low transaction fees and near-instant settlement times provide a potential alternative to traditional banking systems that allows senders to save time and money on international transfers.

"HODLing" long-term

Bitcoin’s scarcity and its position as the original cryptocurrency make it an option to "HODL" and store BTC in a crypto wallet. You can also hold XRP in an XRP wallet, swap XRP for other tokens, or sell XRP for fiat currency.

Digital scarcity

Bitcoin’s hard supply cap of 21 million coins and halving schedule contribute to its value proposition, introducing a deflationary asset with scarcity similar to precious metals. XRP’s total supply of 100 billion tokens, meanwhile, help Ripple meet a broad demand for rapid and affordable transactions. Of these, a significant portion remains in escrow accounts by Ripple Labs, causing some to question the extent of its decentralization.

XRP as an alternative to Bitcoin?

It's a long shot for any altcoin to truly surpass Bitcoin, in terms of price, market cap, or adoption. But XRP does have a few things going for it.

First off, XRP transactions are generally both faster and cheaper than Bitcoin’s. Additionally, XRP’s consensus algorithm makes it more sustainable, allowing users to transact XRP without the environmental concerns tied to Bitcoin’s energy-intensive mining process.

Market performance and historical value trends

BTC and XRP’s performance and value have truly been driven by a mix of factors—how many people are using them, the latest regulatory updates, and the overall mood of the market at the time.

Bitcoin’s market position and trends

Bitcoin has historically dominated the cryptocurrency market in terms of both price and market capitalization. The Bitcoin price saw explosive growth in 2017, 2021, and 2024, peaking at over $73,000 in March, 2024. Despite periods of high volatility, Bitcoin has solidified its position as the leading cryptocurrency, bolstered by institutional adoption and breakthroughs like the approval of Spot Bitcoin ETFs.

XRP’s market trajectory and adoption

XRP’s market journey has been mixed, to say the least. The XRP price has seen significant growth over the years, with its biggest gains occurring between 2017 and 2018, with a slight resurgence in 2021. Its value is partially dependent on partnerships in the financial sector, though drawn-out legal challenges have also had a sizable impact. Despite these hurdles, XRP generally ranks in the top 10 of all cryptocurrencies by market cap.

Unique challenges facing XRP and Bitcoin

While XRP and Bitcoin offer unique benefits and have gained significant traction, both face distinct hurdles that impact their adoption in the short and long-term.

Regulatory scrutiny and legal landscape

Bitcoin faces general regulatory scrutiny worldwide, often centered around its use in illicit transactions, as well as its carbon footprint. XRP, meanwhile, faces additional scrutiny due to its association with Ripple Labs. The ongoing legal dispute between Ripple and the SEC has led to debate over XRP’s potential classification as a security in certain types of transactions, which could affect its future value and usage.

Market risks and volatility

Like any cryptocurrency, both Bitcoin and XRP are volatile assets, with their values heavily impacted by market conditions and price speculation. High price fluctuations make both assets a risky investment, while XRP’s value is also influenced by legal rulings and regulatory developments.

Energy usage

Bitcoin’s Proof-of-Work algorithm requires substantial energy to power its decentralized mining process, with some estimates equating its annual energy usage to that of small countries—Uzbekistan, Poland, and the Netherlands, for reference. High energy consumption has led to growing environmental concerns and criticisms, especially as eco-friendly blockchain alternatives gain attention.

XRP, however, operates on a consensus protocol that doesn’t require mining, resulting in a much smaller carbon footprint (though all cryptocurrencies inherently contribute to electronic waste)

Technical and security concerns

Bitcoin’s PoW consensus mechanism, while secure, has theoretical risks like 51% attacks if a mining pool gains too much control (though this is increasingly unlikely). XRP’s more centralized validator model poses its own risks, as some worry that Ripple Labs’ influence could impact network security or its core operations.

FAQs about XRP and Bitcoin

What makes XRP faster than Bitcoin?

XRP’s consensus algorithm eliminates the need for energy-intensive mining, instead enabling near-instant transaction confirmations. In comparison, Bitcoin’s mining process takes longer since miners compete to solve complex puzzles using computing power, which leads to longer transaction times.

Why is Bitcoin considered more decentralized than XRP?

Bitcoin’s network is maintained by thousands of miners and nodes worldwide, making it highly decentralized. XRP, though decentralized in validator nodes, has more central influence from Ripple Labs, leading some to question its level of decentralization.

Which is better for cross-border payments, Bitcoin or XRP?

XRP is generally suited for cross-border transfers and remittances due to its speed, low fees, and focus on international transfers. Bitcoin, while functional for peer-to-peer payments and preferred in certain countries, can be slower and more costly.

Users should research each token before investing in either to use for international transfers.

Are XRP and Bitcoin environmentally sustainable?

Bitcoin and XRP use vastly different consensus mechanisms. Bitcoin's Proof-of-Work (PoW) model consumes significant energy, sparking concerns about its sustainability. XRP’s consensus model, on the other hand, is more energy-efficient and relies on a network of trusted validators to verify transactions through agreement rather than competition.

Can both XRP and Bitcoin be used for everyday purchases?

Yes, both tokens can be used for everyday transactions if accepted by merchants. Bitcoin is generally more widely accepted, though XRP’s low fees make it potentially viable option to buy goods and services with crypto.

How to buy XRP and Bitcoin on MoonPay

Now that you know the ins and outs of Bitcoin and XRP, it's time to explore them for yourself. The easiest way to get started is to download the MoonPay app on your preferred device.

MoonPay makes it easy to buy Bitcoin and buy XRP using many payment method options, like credit/debit card, bank transfer, PayPal, Apple Pay, Venmo, and more. Just enter the amount of BTC or XRP you want to purchase, and input your wallet address where you'd like to receive your crypto.

You can also choose to store tokens directly in your MoonPay account. Manage BTC and XRP all in one handy place, whether you decide to hold, sell, swap, or send to another wallet.

It really is that easy!

.png)