Bitcoin halving

By Geoffrey Lyons

The Bitcoin network relies on a process called mining in which people use very powerful computers to validate transactions. Since mining is both important (it keeps the network running) and expensive (requiring a ton of computing power), miners are rewarded for their efforts with newly-minted BTC. This is called a block reward or block subsidy. Besides making Bitcoin miners very happy, block rewards serve to increase the total supply of Bitcoin.

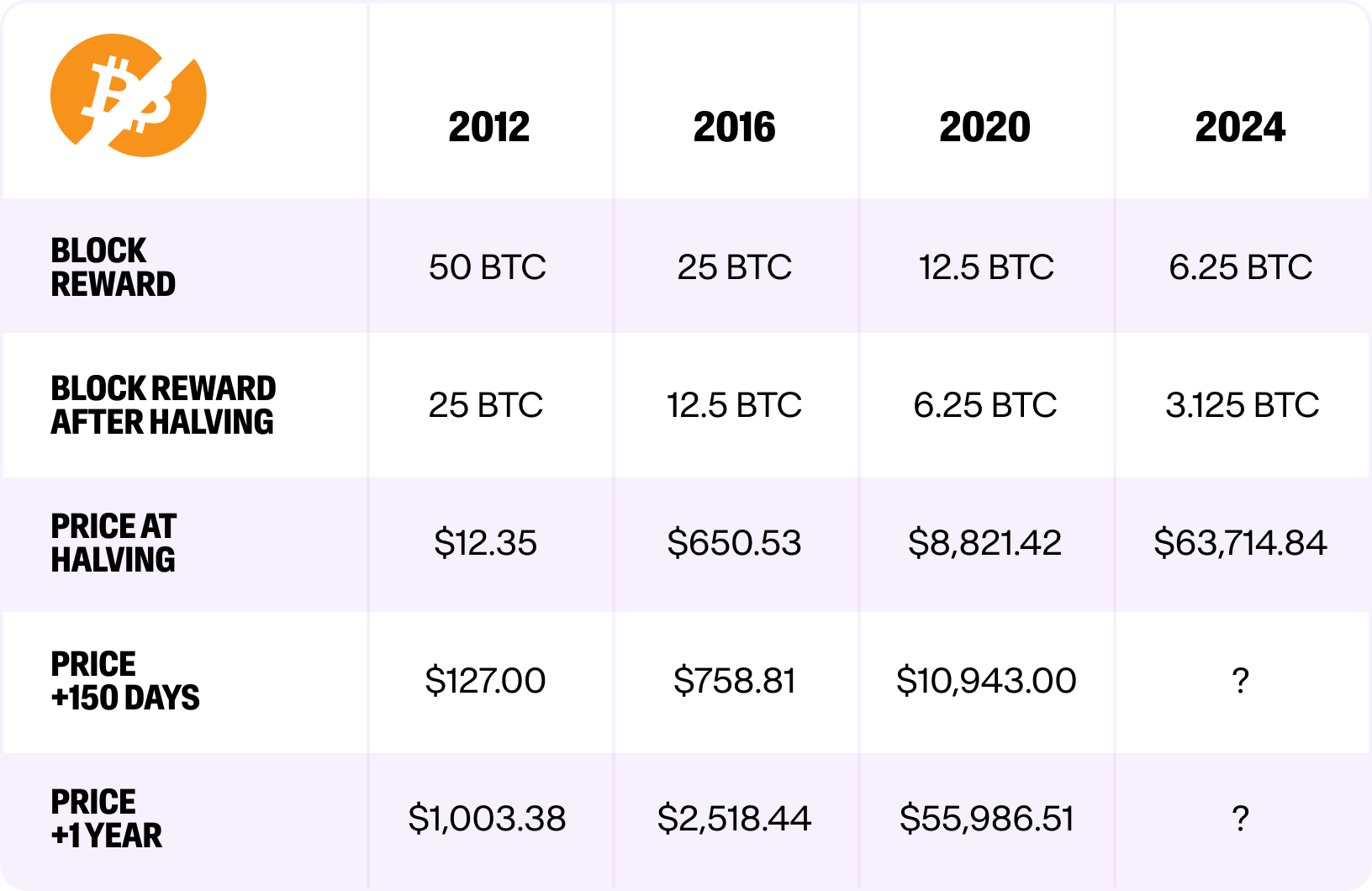

So what is a Bitcoin halving? A Bitcoin halving is a regular event, occurring roughly every four years, in which Bitcoin’s block reward is cut in half. This reduces the rate at which new BTC enters circulation, since miners are less incentivized to mine new BTC.

Further reading: Bitcoin halving: What it is, how it works, and why it matters for BTC

What’s the purpose?

Halving events reduce inflation. In one sense, Bitcoin is technically “inflationary” because its supply regularly increases with each block reward. But the rate at which this happens decreases over time with each halving.

In technical jargon, halving events are “disinflationary measures” that serve to curb the supply of new Bitcoin. And that's the point: curbing the supply of new BTC makes Bitcoin more scarce, and making Bitcoin more scarce should, in theory, make it more valuable.

Sign up to our weekly MoonPay Minute newsletter

Quick facts about halvings

- Pre-programmed into Bitcoin’s open-source code

- Occurs every 210,000 blocks, which is roughly every four years (1 block is mined every 10 minutes, so 10 x 210,000 = 2.1M minutes or 3.9 years)

- Historically raises price of BTC

- Sometimes called “halvening”

- The last halving will occur in 2140 when all 21 million BTC will be in circulation

Halving history

Subscribe to our newsletter!

Did you like this article? Sign up to our weekly MoonPay Minute newsletter to get similar content delivered directly to your inbox.