What is PYUSD (PayPal USD)? | PayPal’s stablecoin explained

Learn all about PayPal USD (PYUSD), the stablecoin built for seamless transactions and cross-border payments on the PayPal platform and beyond.

By Corey Barchat

When it comes to digital finance, few companies have had as much impact as PayPal. Since its founding in 1998, PayPal has transformed how we send, spend, and manage money online.

In recent years, PayPal has been steadily embracing cryptocurrency. After enabling crypto transactions in the PayPal app in 2020, the company went on to allow customers to check out with crypto at partner merchants in 2021.

Since then, PayPal has taken another bold step into the cryptocurrency world with the introduction of its very own stablecoin, PayPal USD (PYUSD). This stablecoin combines the power of blockchain technology with the trust and stability of traditional finance, offering a unique digital asset backed by one of the world's most recognized names in digital payments.

But what is PYUSD, and where does it fit into the digital economy?

In this article, we’ll dive into what PayPal USD (PYUSD) is, how it works, its benefits, and potential challenges. We’ll also compare PYUSD with other popular stablecoins and show you how to purchase PYUSD easily via MoonPay.

What is PayPal USD (PYUSD)?

PayPal USD (PYUSD) is a stablecoin issued by Paxos and backed 1:1 by the US dollar, meaning each PYUSD token represents 1 USD. Unlike more volatile cryptocurrencies like Bitcoin and Ethereum, PYUSD is designed to maintain a stable value, providing a reliable digital asset for everyday transactions.

With PYUSD, PayPal aims to make stablecoins accessible to everyday users while enhancing global transactions. Built on the Ethereum blockchain as an ERC-20 token, PYUSD is intended to serve as a bridge between traditional finance and decentralized finance (DeFi).

Some of PayPal’s goals with PYUSD include:

- Enhancing user experience: In creating a stable, reliable digital currency, PayPal seeks to make peer-to-peer transactions even smoother.

- Enabling cross-border payments: PYUSD could make sending money across borders faster, cheaper, and more transparent.

- Expanding into DeFi: Paxos, the token issuer, aims to position PYUSD as a stable asset for use in decentralized applications (dApps), for purposes like liquidity, swapping, staking, and more.

How does PYUSD work?

Curious about the mechanics behind PayPal's new stablecoin? Let’s break down how PYUSD operates, from the blockchain technology that powers it to the safeguards behind the token's stability and transparency.

Technology and blockchain platform

While there are many blockchains that support stablecoins, PayPal USD is issued on the Ethereum blockchain for maximum transparency, decentralization, and security. Because PYUSD is built on a public blockchain, anyone (like users and developers) can verify transactions, wallets, and accounts on the Ethereum network.

And thanks to Ethereum’s smart contract functionality, PYUSD can be integrated into decentralized applications (dApps) and decentralized finance (DeFi) platforms, making it compatible with an array of financial services. For instance, you could use PYUSD in lending platforms, liquidity pools, and other DeFi products, with many more use cases still to be explored.

Issuance and backing of PYUSD

Each PYUSD token is backed by an equivalent US dollar (and equivalents) held in reserve. Having a 1:1 backing is one common aspect among stablecoin providers in attempting to maintain the token's constant value. When a user purchases PYUSD, PayPal issues a new token and adds an equivalent dollar amount to its reserves. Conversely, when users redeem PYUSD, the corresponding tokens are burned, and an equivalent amount is withdrawn from the reserves.

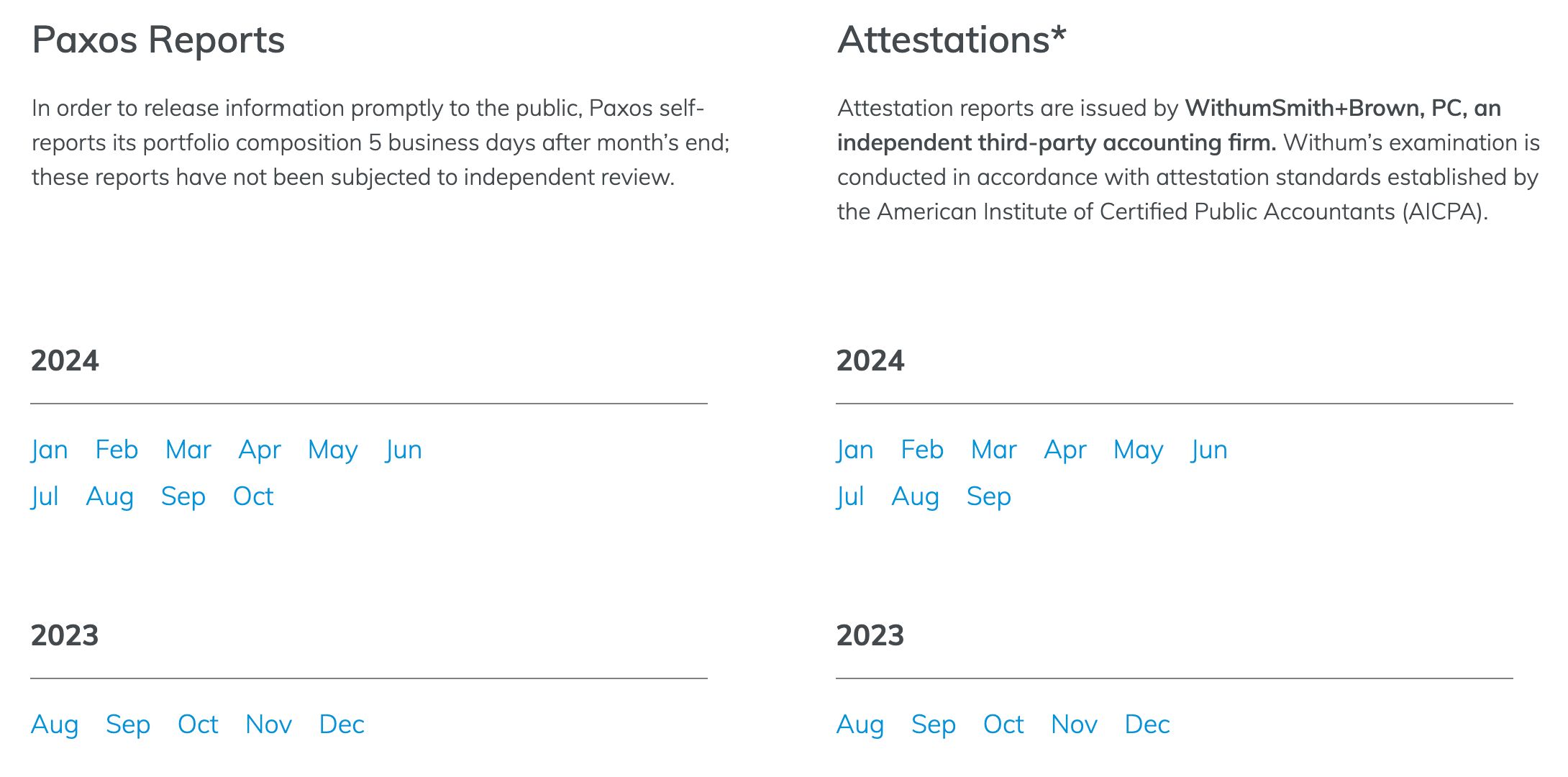

In an attempt to build user trust, PayPal conducts regular audits of its PYUSD reserves. The Paxos Trust Company provides transparency regarding its holdings via self-reports, as well as attestations from an independent accounting firm. Such third-party audits aim to ensure that each PYUSD token is adequately backed, to provide users with peace of mind about the coin’s stability and liquidity.

Benefits and uses of PYUSD

Let’s explore the practical benefits and versatile uses of PayPal’s stablecoin, from everyday purchases to international transactions and beyond.

Everyday transactions

PayPal envisions PYUSD as a viable currency for day-to-day purchases within its network. From online shopping to peer-to-peer payments, PYUSD can enable users to transact seamlessly in a stable digital currency.

For merchants, PYUSD offers benefits such as reduced processing fees and quicker settlements. Consumers, on the other hand, enjoy the stability of a US dollar-backed asset and the ease of making purchases using crypto, without worrying about conversion rates.

Cross-border payments

With PYUSD, cross-border payments become faster and more affordable. Users can transfer PYUSD instantly, bypassing traditional bank fees and delays associated with international transactions.

Stablecoins like PYUSD make international remittances cost-effective by reducing transaction fees. They also speed up transfers, as funds can be sent and received nearly instantly, providing an affordable option for sending money abroad.

Integration with PayPal services

PYUSD is designed to work seamlessly within PayPal’s existing ecosystem, allowing users to manage, send, and receive PYUSD directly in their PayPal wallet. This integration allows PayPal users to switch between PYUSD, fiat currencies, and other cryptocurrencies effortlessly.

Potential for decentralized finance (DeFi)

PYUSD’s presence on Ethereum opens up numerous opportunities in the world of DeFi. Users can lend, borrow, and trade PYUSD on certain decentralized exchanges and protocols. This offers the possibility of earning interest or utilizing PYUSD in other DeFi applications, creating more ways for users to benefit from their holdings.

Challenges and risks of PYUSD

While PYUSD brings exciting possibilities, it also faces several challenges and risks that are common among stablecoins.

Regulatory risks and uncertainties

Stablecoins face regulatory scrutiny as authorities seek to prevent misuse and protect users. While PayPal takes measures to comply with cryptocurrency regulations such as conducting monthly audits to demonstrate regulatory compliance, it remains to be seen how new crypto laws might impact PYUSD.

Market competition with other stablecoins

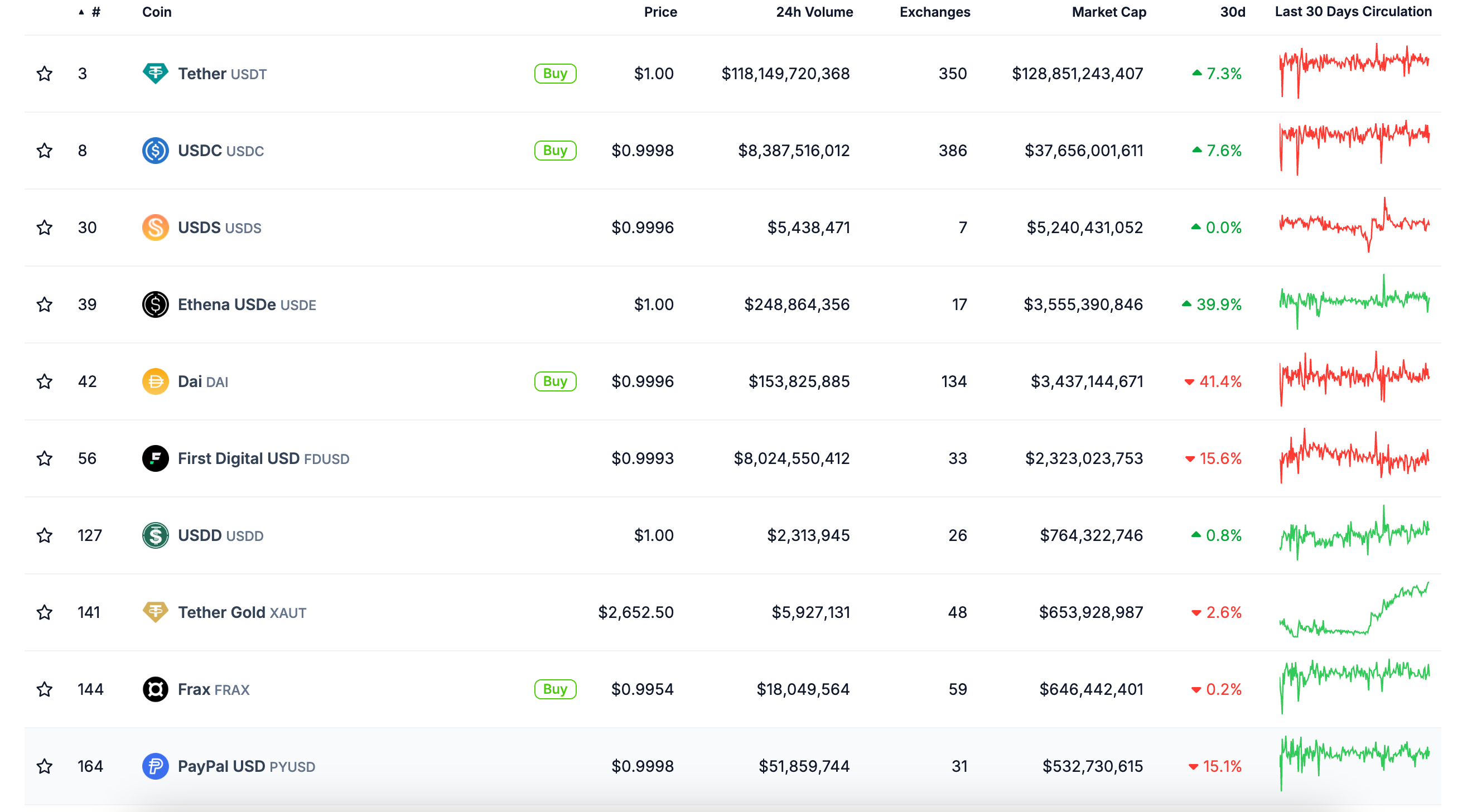

PYUSD faces competition from established stablecoins like USDT (Tether), USDC (USDC), and DAI (Dai). These competitors have a long-standing user base and established use cases, making it potentially challenging for PYUSD to carve out its market share. For instance, while PYUSD's market cap measures in the hundreds of millions, the market capitalization of the leading stablecoins is in the billions (and over $100 billion for USDT).

Technology and privacy concerns

While blockchain technology offers transparency, it also raises privacy concerns. PayPal needs to explore ways to enhance privacy and security for its users, balancing transparency with confidentiality to ensure that users’ personal information—for cryptocurrency holdings as well as the PayPal fiat wallet and banking—remains protected.

PYUSD vs. other stablecoins: What makes PYUSD different?

With so many stablecoins already in the market, what sets PYUSD apart?

PYUSD vs leading stablecoins

PYUSD enters a stablecoin market dominated by Tether (USDT) and USD Coin (USDC). Like PYUSD, both of these stablecoins are ERC-20 tokens that operate on a similar 1:1 USD-backed model. For the moment, while PYUSD is limited to the Ethereum and Solana blockchains, USDT and USDC have additional compatibility with networks like Polygon, Optimism, ZK-sync, and Celo.

While PYUSD's close integration with PayPal provides convenience, it may also restrict freedom for users who prefer platforms outside of the PayPal ecosystem. Established stablecoins like USDT and USDC offer broader compatibility across external wallets, exchanges, and DeFi protocols like liquidity pools, yield farming, staking, and lending, which could limit its adoption among crypto enthusiasts.

PYUSD’s competitive edge

With over 426 million active users, PayPal has a significant edge in reaching everyday customers and merchants. Users can transact with PYUSD directly within PayPal, and manage stablecoin tokens alongside fiat currency and cryptocurrency. This wide user base within the PayPal ecosystem of fiat wallets, banking, and merchant partners could enable PYUSD to gain traction faster than certain competitors, specifically when it comes to onboarding non-crypto native consumers.

At the same time, PYUSD has a long way to go to catching USDT as the most widely-traded stablecoin. In fact, even after seeing an increase in daily trading volume of over 100%, this figure is still only 0.02% that of Tether!

Security and stability of PYUSD

Security is paramount for all stablecoins, and PayPal has implemented certain safeguards in a move to protect PYUSD assets. Unlike some stablecoin providers with limited disclosures, PayPal aims for greater transparency through regular audits and monthly reserve reports published on the Paxos website.

Frequently Asked Questions (FAQ) about PYUSD

Where can I buy PYUSD?

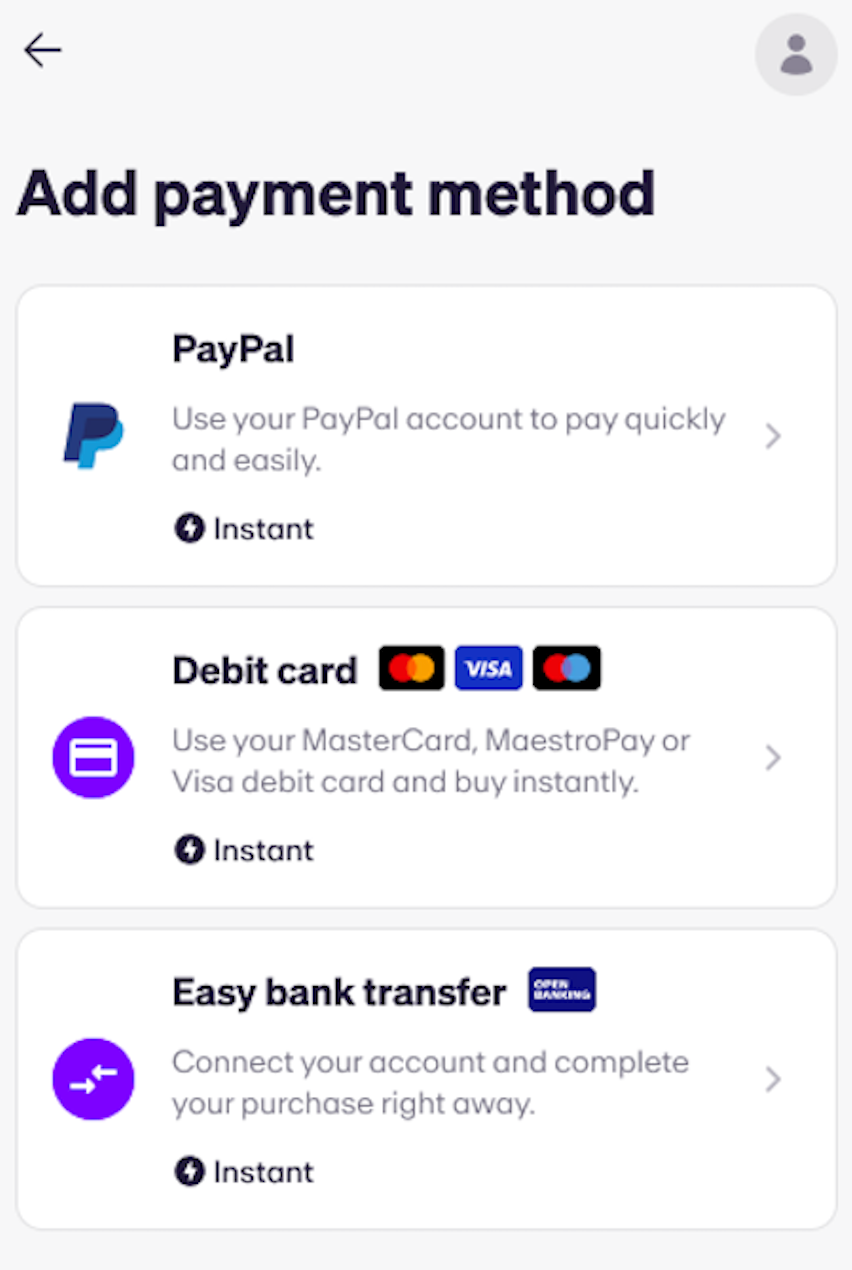

You can buy PYUSD in your favorite crypto wallet via MoonPay or through the MoonPay app. MoonPay allows users to purchase PYUSD using various payment methods like credit/debit cards, or with fiat currencies like U.S. dollars and euros.

How can I store PYUSD?

You can store PYUSD directly within your PayPal account, as it’s fully integrated into PayPal’s digital wallet. This means you can manage and use PYUSD seamlessly alongside other digital currencies in your PayPal account. Additionally, since PYUSD is built on the Ethereum blockchain, it’s compatible with any Ethereum wallet, such as MetaMask, Trust Wallet, and Ledger.

Can I use PYUSD for everyday purchases?

Yes! One of the primary goals of PYUSD is to facilitate everyday transactions.

Users can buy, send, and spend PYUSD directly within the PayPal app. Merchants can also accept PYUSD, allowing consumers to pay with crypto for faster transactions with lower fees. Since PYUSD is intended to have a stable value with backing by the US dollar, users don’t need to worry about extreme price fluctuations in its value when making purchases, as they might with other crypto assets.

Is PYUSD secure?

The Paxos Trust Company counts on the New York State Department of Financial Services for regulatory oversight, while maintaining a 1:1 dollar backing via US dollar deposits, US treasuries and cash equivalents. Paxos conducts regular reports each month to verify these reserves.

However, no stablecoin can be deemed perpetually secure, as stablecoins have been known to experience occasional de-pegging, and even total collapse.

How to buy PYUSD on MoonPay

PayPal USD represents an exciting development in digital finance, merging traditional finance with the innovation of blockchain technology. Whether you’re a PayPal user, a crypto enthusiast, or a merchant, PYUSD opens up new possibilities for secure, fast, and stable digital transactions.

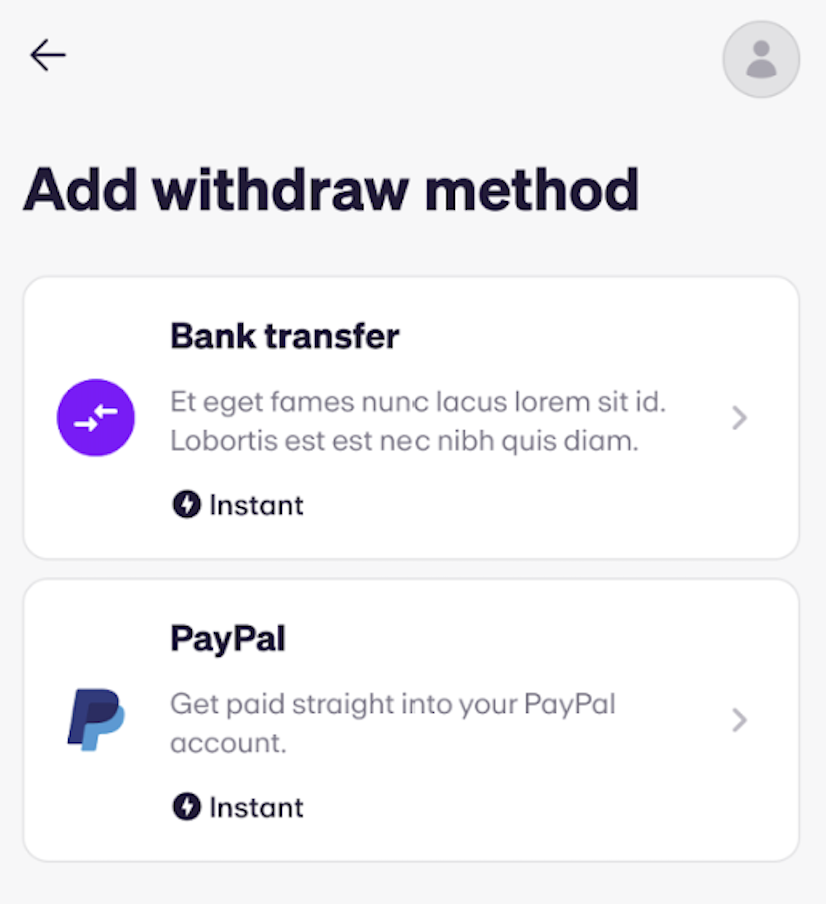

MoonPay makes it easy to buy PYUSD using a credit/debit card, PayPal, Apple Pay, bank transfer, and more preferred payment methods. Just enter the amount of PayPal USD you want to purchase, and follow the steps to complete your order.

You can also buy PYUSD even easier using a MoonPay Balance. Just top up your account with fiat and use your balance for faster transactions, lower fees, higher approval rates, and zero-fee withdrawals when you decide to cash out to fiat currency.

.png)