One of Bitcoin’s defining characteristics is the issuance of a finite number of coins, with the total supply set at 21 million.

As Bitcoin miners continue to validate transactions and secure the network, the question arises: what happens when the last Bitcoin is mined?

This article delves into the implications of Bitcoin's deflationary nature and capped supply.

Understanding Bitcoin's deflationary nature

Traditional currencies like US dollars and Euros are inflationary by design. Governments manage their money by, among other things, printing more of it.

Over time, those holding traditional currencies could be more likely to see a loss in their purchasing power. Bitcoin, on the other hand, is deflationary. There will only ever be 21 million BTC created and no more.

But if miners are rewarded with newly created Bitcoin every time a block is produced, wouldn’t that make Bitcoin inflationary?

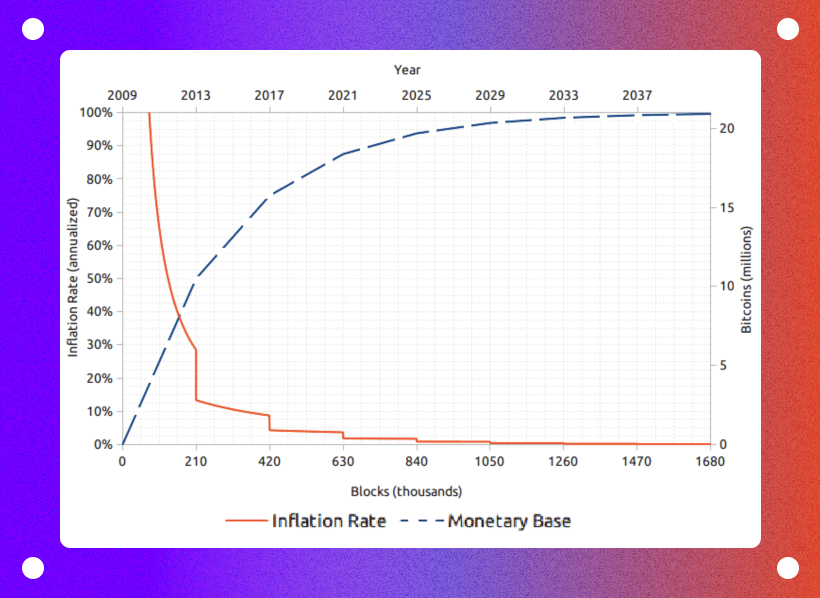

It depends on the time horizon. In the long run, Bitcoin is deflationary because it is capped at 21 million BTC. In the short term, however, Bitcoin can be considered inflationary because there is a consistent increase in the circulating supply of BTC as more coins are mined.

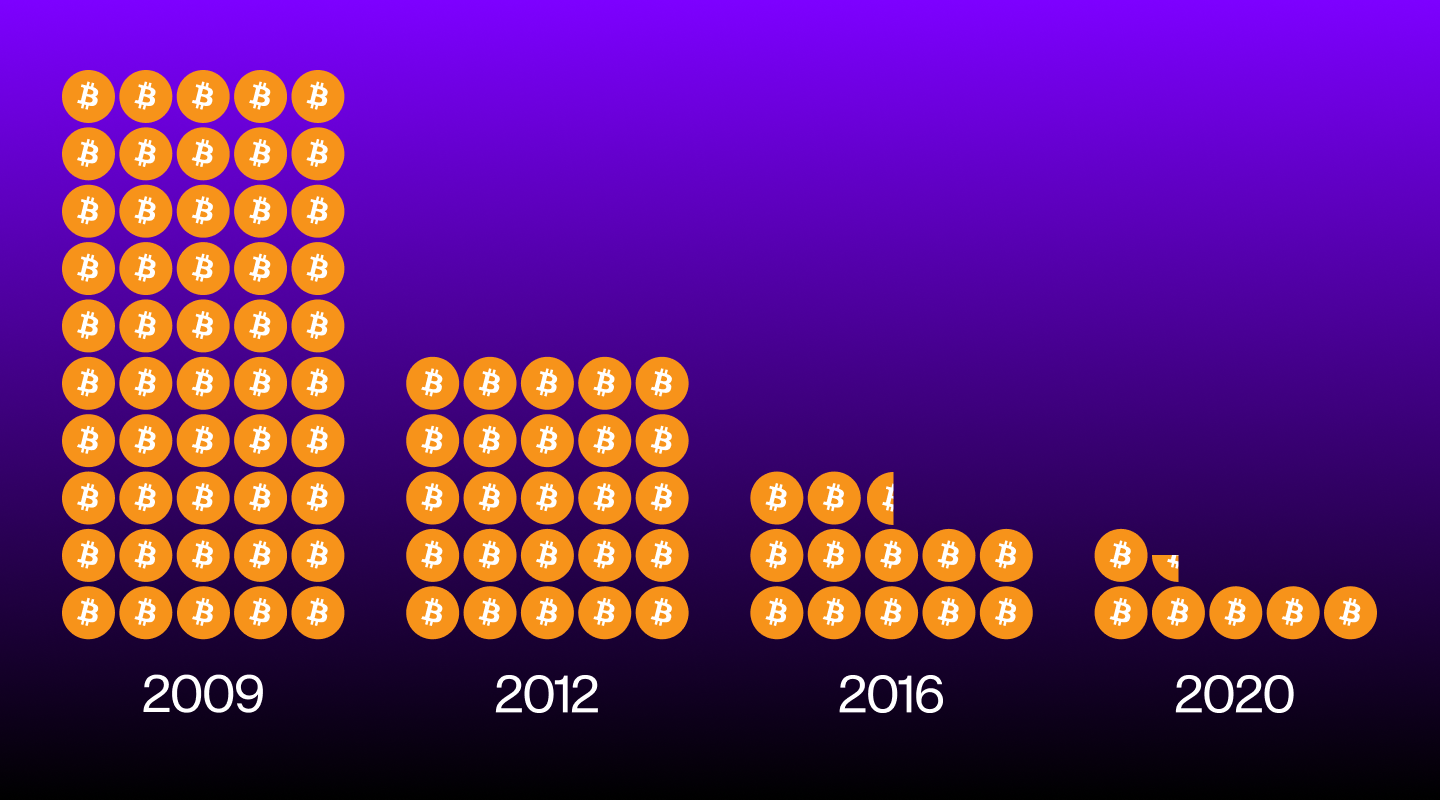

As it stands today, miners receive 6.25 BTC for every block mined (this is known as a "block reward"). As per Bitcoin tokenomics, the block reward halves every 210,000 blocks or approximately every four years. This system is known as "halving," and it will continue until the block reward is exhausted.

Read our article What is Bitcoin Halving to learn more about the Bitcoin reward mechanism and how BTC is distributed among miners.

When will the total supply of Bitcoin reach 21 million?

Never. The number of Bitcoins will never reach the 21 million BTC cap. Instead, the supply will continue to approach the limit before completely halting at a block height of 6,930,000 around the year 2140.

“Block height” is the number of blocks mined after the first block (also known as the "genesis block"), and the maximum number of Bitcoins that will exist is 20,999,999.97690000.

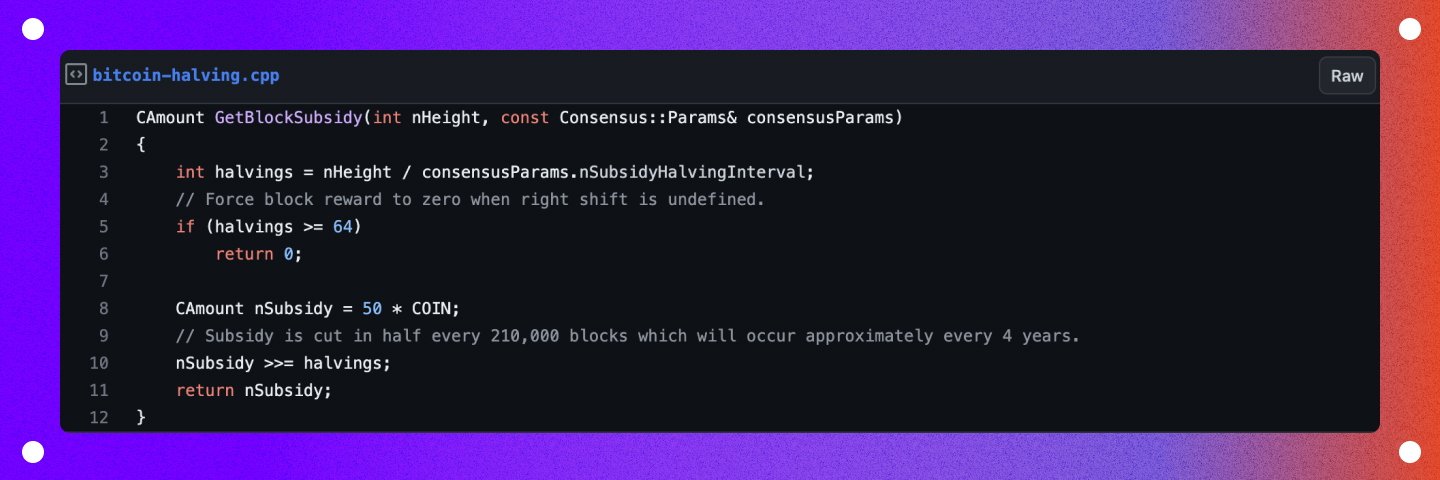

We’ll need to look at Bitcoin's source code to understand why this is the case.

A single Bitcoin can be divided into a maximum of 8 decimal places. The smallest amount of BTC is called a Satoshi and is equal to 0.00000001 BTC.

Any amount less than 1 Satoshi will be rounded to zero per code. That means block rewards after further halvings will be zero, as any amount less than 1 Satoshi is rounded to 0.

In other words, the smallest block reward possible is the smallest unit of Bitcoin, which is 1 Satoshi (or 0.00000001 BTC). The last Satoshi is expected to be mined around the year 2140 because subsequent Bitcoin halvings will result in the reward being rounded to zero.

What's next for miners when all the Bitcoin is mined?

Miners will continue to be rewarded with new Bitcoin until approximately 2140, when the final Satoshi is created.

But what will miners do when all Bitcoin has been mined? Will there be no economic incentive for miners to keep the network up and running? Could this mean the end of Bitcoin?

Not quite.

Fortunately, newly created Bitcoins are not the only way to incentivize miners to stay in the network.

Even after the last Satoshi is mined, miners will still be incentivized to keep the network running because they will earn user transaction fees.

Plus it’s not like miners don’t have other options. They could also choose to mine other Proof of Work cryptocurrencies like Dogecoin (DOGE), Bitcoin Cash (BCH), Litecoin (LTC), Ethereum Classic (ETC), and more.

Transaction fee rewards

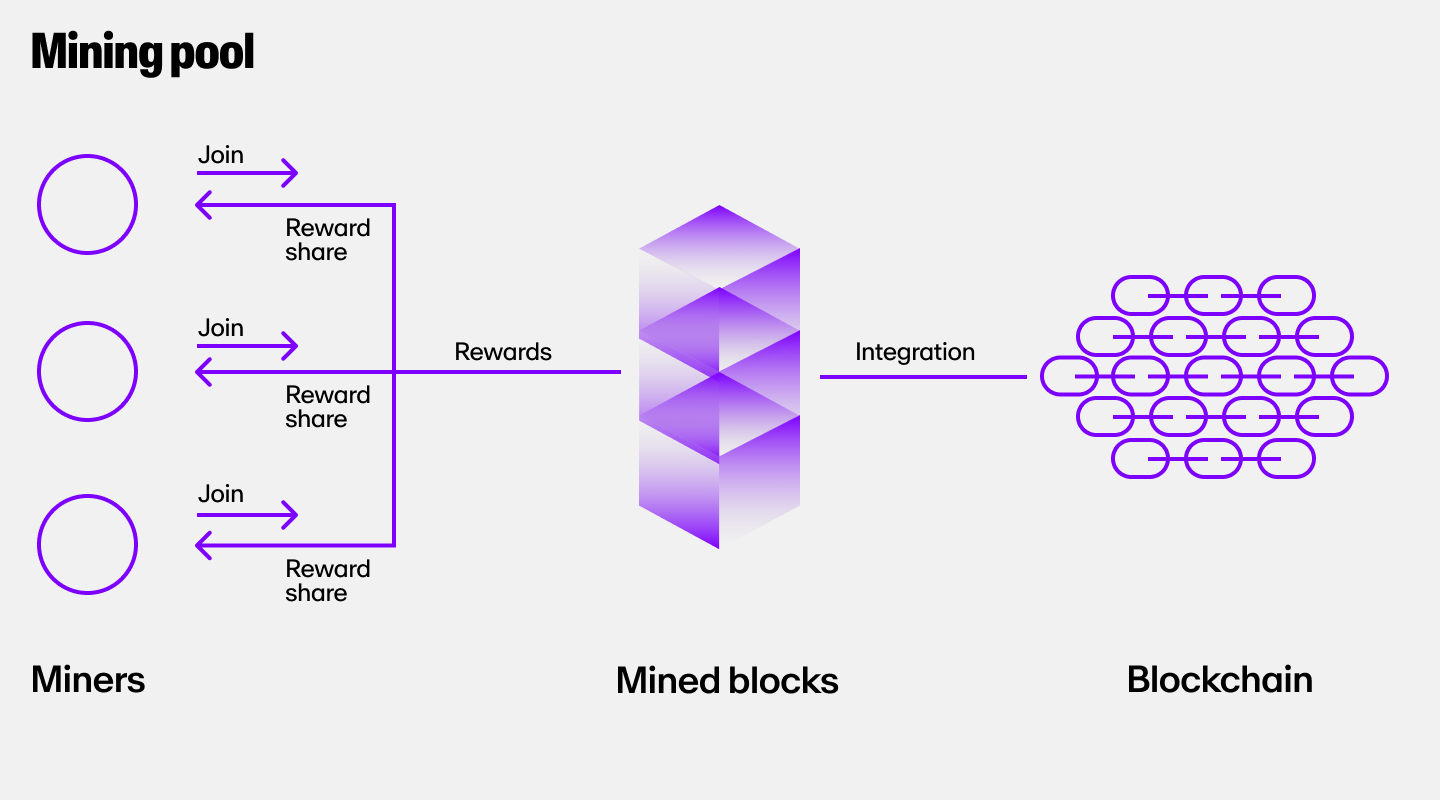

When miners produce blocks, they receive the block reward and the transaction fees associated with that block. The latter is what is known as a "transaction fee reward.”

When the block reward drops to zero, miners will continue to receive transaction fee rewards as an incentive to stay in the network and keep it running.

In a Bitcoin block explorer, you can view the miners, the corresponding blocks they mined, and their total rewards. There are also block explorers like Etherscan for Ethereum and other blockchains.

Upon observation, you will find that the reward received is greater than the block reward of 6.25 BTC (the current block reward). The difference between the total reward and the block reward accounts for the transaction fee reward.

Currently, transaction fee rewards are only a small fraction of the total BTC mining rewards. This will reach 100% in the future as the block reward approaches zero.

The total value of all transaction fees paid to miners is expected to exceed the final block reward between the years 2032 and 2048.

Issues with transaction fees as rewards

The Bitcoin network is only capable of processing four to six transactions per second. For miners, therefore, relying solely on transaction fees for rewards is impractical unless:

- The value of Bitcoin is high enough to justify a small BTC reward, or

- The transaction fees are substantial

As Bitcoin becomes increasingly popular, transaction fees associated with each transfer will likely increase. This is because there will be more demand to use the Bitcoin network, and the space in each block will become more limited.

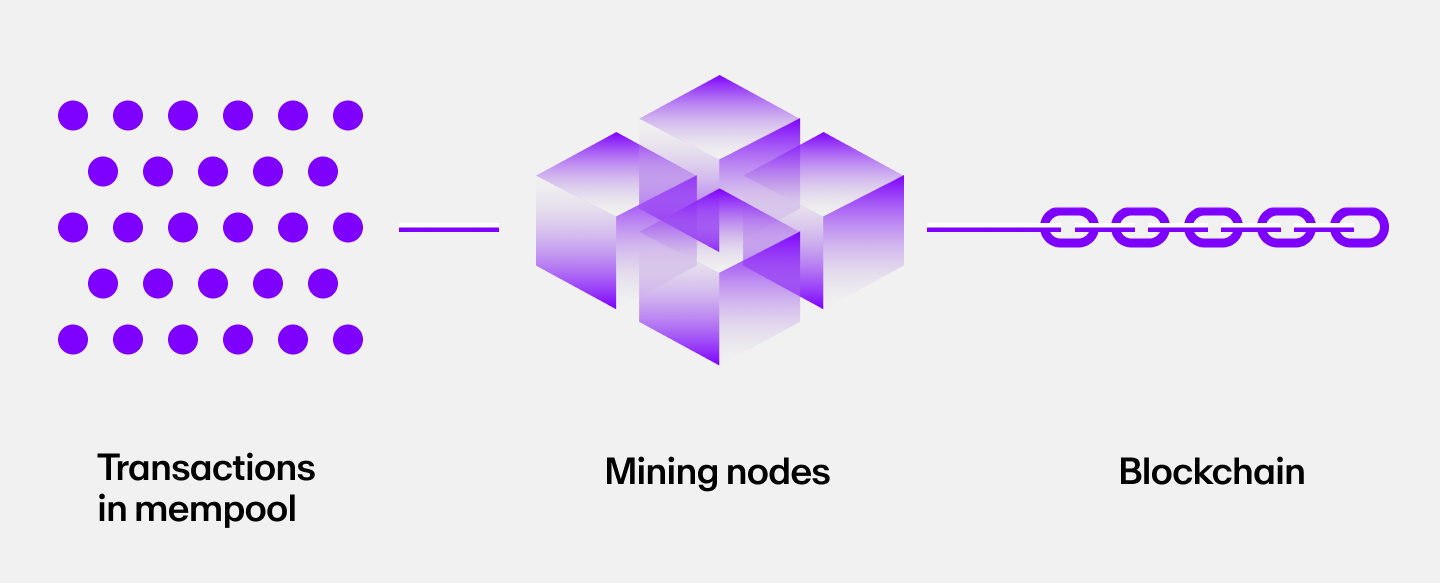

Further, miners will be increasingly incentivized to include transactions with higher fees in their blocks. This is already happening to some extent, as we can see from the current state of the Bitcoin mempool, a collection of all unconfirmed transactions.

Layer-2 Bitcoin scaling solutions like the Lightning Network (LN) could potentially address the issue of low Bitcoin throughput.

While this is positive news for micro-transaction enablement, it also means miners could lose out on transaction fee rewards since transactions will be settled on the main chain only when a payment channel is opened or closed.

Read our article What is the Bitcoin Lightning Network to learn more about Bitcoin’s most popular Layer-2 scaling solution and payment channels.

What happens if miners stop mining Bitcoin?

If miners stop mining Bitcoin, the network will eventually grind to a halt. For each block to be produced, there must be a consensus among the miners.

That means no new transactions will be confirmed or added to the blockchain—they’ll simply remain stuck in the mempool. Past transaction data, however, can be accessed and viewed as normal.

This could have a big impact on the cryptocurrency market, which is still significantly dominated by Bitcoin. As of December 2023, the global cryptocurrency market capitalization is over $1.5 trillion, of which more than 50% is that of Bitcoin.

If BTC collapses, it could send ripples through the space, causing other cryptocurrencies to lose value as well.

Will the Bitcoin network ever come to a halt?

The chances of the Bitcoin network coming to a halt are thin, especially before all Bitcoins are mined. Here is one critical reason why Bitcoin may never stop:

The difficulty level lowers as miners stop mining

The Bitcoin network is designed to produce one block every ten minutes. The difficulty level will adjust accordingly if blocks are produced at a slower rate. If blocks are produced too slowly, the difficulty level will decrease, making it easier to produce blocks. If blocks are produced too quickly, the difficulty level will increase, making it harder to produce blocks.

So even if a large portion of the miners stops mining, the others will still be able to produce blocks at the regular rate using much less power. This means transactions will still be processed, and new Bitcoin will still be created.

The threat of the “selfish miner”

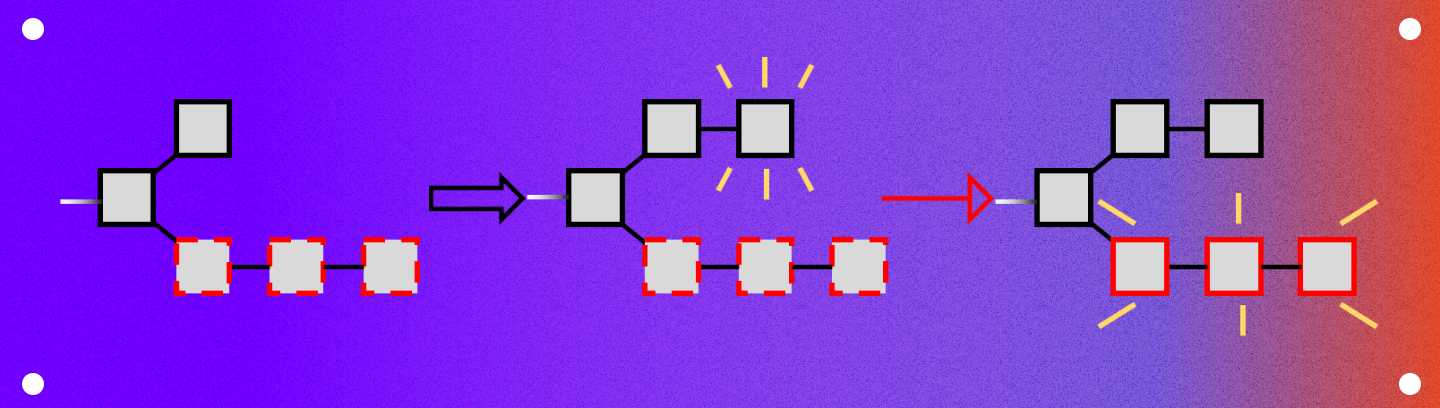

“Selfish mining” is an economic attack strategy first discussed in a paper co-authored by Ittay Eyal and Emin Gun Sirer.

Selfish mining is when miners choose to withhold blocks that they have mined instead of sharing them with the rest of the network.

By doing so, the selfish miner can invalidate the blocks produced by honest miners.

For example, suppose the selfish miner produced four blocks but kept them private. Meanwhile, the honest miner only produced three blocks on the public chain. Now, the selfish miner decides to publish their blocks. Since the blockchain always favors the longest chain, the blocks produced by the honest miner are rendered invalid.

As a result, the honest miner loses on rewards and is disincentivized to stay in the network. He or she may also choose to become a selfish miner.

According to Eyal and Sirer, if selfish miners control over 33% of the total hash power (a measure of how much computational power is being used to mine blocks), they can launch a 51% attack.

A 51% attack is a malicious hack in which someone can take control over the network because they contribute to more than 50% of the computing power. This would allow them to double-spend their coins, preventing new transactions from being confirmed and potentially causing the network to grind to a halt.

It should be noted that such an attack is not easy to execute in practice, especially on well-established blockchain networks like Bitcoin.

How to buy Bitcoin (BTC)

If you are looking for an easy and straightforward way to buy BTC with your local currency, MoonPay has you covered.

With MoonPay, you can buy Bitcoin instantly with a credit or debit card, bank transfer, Apple Pay, Google Pay, and more payment methods.

How to sell Bitcoin (BTC)

MoonPay also makes it easy to sell Bitcoin for fiat currency when you decide it's time to cash out your crypto.

Simply enter the amount of BTC you'd like to sell and enter the details where you want to receive your funds.

Swap Bitcoin for more tokens

Want to exchange Bitcoin for other cryptocurrencies like Ethereum and Wrapped Bitcoin?

MoonPay allows you to swap crypto cross-chain with competitive rates, directly from your non-custodial wallet.

.png)