Thanks to modern financial innovations, it's never been more convenient to manage money. Throughout the globe, there are apps and services that allow users to store, send, and receive funds across devices and borders.

One of the key tools driving this transformation is the fiat wallet. Whether you're shopping online, transferring money to a friend, or exploring the world of cryptocurrencies, fiat (money) wallets have become a valuable tool in personal finance.

But what exactly is a fiat wallet? And why has it become so integral to our daily financial activities?

In this guide, we'll dive into the concept of fiat wallets, exploring their types, how they compare to crypto wallets, their benefits, risks, and much more.

What is a fiat wallet?

A fiat wallet is a digital tool that allows you to store, send, and receive government-issued currencies, also known as fiat money. Unlike crypto wallets that store digital currencies like Bitcoin or Ethereum, fiat wallets are designed to handle traditional money in a digital format (like an online bank account).

Although the specific fiat currencies supported can vary by region, some common examples include the US Dollar (USD), Euro (EUR), British Pound (GBP), and others that are backed by governments and central banks.

Fiat wallets can be linked to your bank account or credit card, allowing you to easily deposit money, pay for goods and services, and transfer money to others. They can come in the form of mobile apps, online banking platforms, and payment processors, making them a versatile tool for managing everyday finances.

Types of fiat wallets

Fiat wallets come in various forms, each offering unique features and convenience levels to fit diverse needs.

Mobile wallets

Mobile wallets are smartphone applications that store your fiat currency digitally. These wallets are particularly popular due to their convenience and ease of use. With just a few taps, you can make payments, transfer money to friends, withdraw cash at ATMs, and keep track of your spending in real-time.

Examples include Apple Wallet, Google Wallet, and Samsung Wallet, and may even come pre-downloaded on their respective smartphone devices.

Web-based wallets

Web-based wallets are accessed through internet browsers, making them accessible from devices like desktop computers and laptops. Web-based wallets offer a wide range of functionalities, including online shopping, paying bills, peer-to-peer transfers, and occasionally, offering crypto capabilities.

Examples include online payment platforms like PayPal and Venmo, though they can also be found in mobile app form.

Bank-integrated wallets

Bank-integrated wallets are offered by traditional banks and financial institutions. These wallets are directly linked to your bank account, providing a seamless connection between your fiat wallet and your banking services.

They offer several upgrades over traditional bank wires, like the advantage of instant transfers between your wallet and bank account, often with low or even zero fees. They also come with added security features provided by the bank, such as fraud monitoring and insurance against unauthorized activity.

Examples include Zelle (in the US) and Pingit (formerly in the UK).

Fiat wallets vs. crypto wallets

Both fiat and crypto wallets serve the purpose of storing and managing funds, but they differ significantly in terms of functionality, security, and use cases.

Aspect | Fiat Wallets | Cryptocurrency Wallets |

Currency Type | Government-issued (USD, EUR, etc.) | Digital Currencies (Bitcoin, Ethereum, etc.) |

Security | 2FA, encryption | Private keys, seed phrases, encryption |

Transaction Speed/Cost | Varies; may include fees | Generally faster and lower cost |

Usability | Widely accepted for everyday transactions | Limited acceptance; growing usage |

Access | Linked to banks or financial institutions | Decentralized; user-controlled |

Global Reach | Widely accepted internationally | Accepted in select markets |

Transaction Reversibility | Often reversible (chargebacks possible) | Typically irreversible |

Integration | Seamlessly integrates with traditional financial systems | Integrates with crypto exchanges and blockchain networks |

Key differences between wallets

Currency type

Fiat wallets store government-issued currencies like USD or EUR. A crypto wallet, on the other hand, stores digital currencies like Bitcoin (BTC), Ethereum (ETH), and stablecoins such as Tether (USDT) and USD Coin (USDC).

Regulation

Fiat wallets are heavily regulated by governments and financial institutions to ensure compliance with laws and to protect consumers. Cryptocurrency wallets operate in a different regulatory environment, with varying degrees of oversight depending on the jurisdiction.

Security

Fiat wallets often rely on traditional security measures such as two-factor authentication (2FA) and encryption, while crypto wallets require more advanced security features like private keys and seed phrase recovery. Some crypto wallet providers like Ledger also offer cold storage with physical (hardware) devices that keep crypto safe.

Transaction speed and cost

Fiat transactions, especially international ones, can take time and incur significant fees to send funds. Cryptocurrency transactions, meanwhile, are generally faster and cheaper, though network congestion and volatility can occasionally affect these aspects.

Usability

Fiat wallets are generally more widely accepted and can be used for everyday purchases, with widespread merchant integration. Cryptocurrency wallets, however, can be somewhat limited in terms of where and how they can be used.

Similarities between fiat and crypto wallets

Digital access

Both fiat and crypto wallets offer online access to funds, enabling users to make transactions digitally, with credit/debit cards, or via mobile devices.

Security features

Despite the differences in the type of security, both emphasize protecting user assets through various means, including encryption, 2FA, and password protection.

Global transactions

Both types of wallets enable users to send and receive money globally, though the method, speed, and cost of transactions differ.

User control

Both fiat and crypto wallets give users control over their digital assets, allowing them to manage their money independently of traditional banking systems (more notably so in the case of non-custodial crypto wallets and hardware wallets).

Wallet use cases

Everyday purchases

Fiat wallets are ideal for day-to-day transactions like buying groceries or paying bills. Cryptocurrency wallets can be used for daily purchases as well, though they are more common in specific markets or among more tech-savvy consumers.

Online shopping

Both wallets can be used for online shopping, with fiat wallets being more widely accepted around the world.

International transfers

A cryptocurrency wallet offers faster and cheaper transfers for international remittances, while fiat wallets are more suitable for transfers between traditional bank accounts.

Investment

Crypto wallets are often used to store digital currency as an investment, while fiat wallets are typically used for saving or spending rather than investing.

How fiat wallets work

Here's a step-by-step guide to how a fiat wallet works, from opening one to making transactions and conversions.

Opening a fiat wallet

- Choose a provider: First, you'll need to decide which type of fiat wallet you need—mobile, web-based, or bank-integrated. Users should research reputable providers and read reviews to find the one that suits their needs.

- Register: Download the app or visit the website of your chosen provider. You'll be asked to sign up using your email address or phone number, and create a strong password to protect your account.

- Verification: Most fiat wallets require some form of identity verification or KYC. This usually involves submitting a government-issued ID and possibly a selfie to confirm your identity.

Adding funds and depositing cash

- Linking bank account: If your wallet is linked to a bank account, you can transfer money directly from your bank. This might be instant or take a few days, depending on the provider.

- Credit/debit card: You can also choose to link a credit or debit card as your preferred payment method. Deposits via card payment are usually faster but may incur a small fee.

- Cash deposits: Some mobile and bank-integrated wallets allow you to deposit cash at partner locations or ATMs.

Sending and receiving money

- Sending money: To send money, enter the recipient's details—usually their email, phone number, or wallet ID—along with the amount you wish to send. Confirm the transaction, and the money will be sent instantly (or within a few hours).

- Receiving money: To receive money, provide your wallet ID or linked email/phone number to the sender. The funds should appear in your wallet almost instantly. Some bank-integrated wallets even allow users to deposit checks digitally, by simply taking a picture of the check.

- QR codes: Many fiat wallet providers allow you to generate a QR code to send or receive money faster. This not only speeds up the transaction process but also reduces the risk of errors that can occur when entering payment details manually.

Making transactions and paying for goods

- Online payments: Use your fiat wallet to pay for goods and services online. Simply select the wallet as your payment method at checkout and confirm the payment.

- In-store payments: For in-store payments, mobile wallets like Apple, Google, and Samsung allow you to pay using NFC (Near Field Communication) technology. Just tap your phone on the POS (point of sale) terminal, and the payment will be processed.

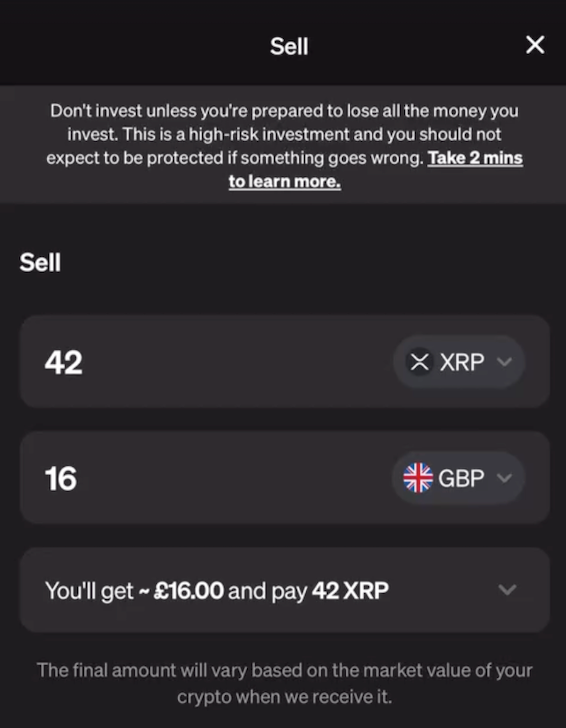

Converting to crypto and fiat

Some fiat wallets offer built-in conversion features, allowing you to exchange your fiat currency for another or even convert it to cryptocurrency. If your wallet does not have a conversion feature, you can transfer funds to a crypto exchange or on-ramp provider like MoonPay to convert fiat to cryptocurrency or vice versa.

Fiat wallet benefits

Fiat wallets offer numerous advantages, making them a popular choice for managing finances in the digital age.

Convenience and accessibility

Fiat wallets are designed for user-friendliness, featuring intuitive interfaces that make them easy to navigate.

They also offer 24/7 access, enabling users to manage their money anytime, anywhere. Some wallets enable transactions across borders with low fees and no currency conversions. Global travelers and international businesses can also opt for a fiat wallet that supports multiple currencies.

Security features

Fiat wallets use advanced encryption to safeguard financial data, with many providers incorporating fraud prevention systems to detect and block suspicious activity.

For added security, fiat wallets often require two-factor authentication (2FA) when logging in or making significant transactions. This extra layer of protection ensures that even if your password is compromised, your wallet can remain secure.

Integration with financial services

Fiat wallets are not just standalone tools, as many can connect directly with your bank account or preferred payment processor. This makes transfers between accounts quicker and easier, further simplifying finance management.

Some fiat wallets even support digital currencies and can be linked to cryptocurrency exchanges and on-ramps. This feature allows users to manage both fiat and digital currencies from a single platform, offering greater control over financial assets.

Common fiat wallet risks

While fiat wallets offer many advantages, they are not without risks.

Security threats

Despite their robust security measures, fiat wallets are not immune to potential security risks. Users should be aware of various threats that could compromise their funds or personal information.

Phishing attacks

Fraudsters may attempt to trick users into providing sensitive information, such as login credentials, by impersonating legitimate services through fake emails, websites, or text messages. These deceptive tactics attempt to gain unauthorized access to your fiat or crypto wallet, which may result in digital assets being stolen.

Hacks and data breaches

If hackers gain access to your account through weak passwords or data breaches on the service provider's end, your assets and personal information could be stolen. In some cases, even seemingly minor breaches can expose sensitive details, leading to significant financial losses.

Other attacks

Techniques like SIM swapping or social engineering can also be used to bypass security measures. For instance, in a SIM swap, attackers gain control of your phone number to intercept two-factor authentication codes, allowing them to access your wallet.

How to protect your fiat wallet

Taking proactive steps and following best practices can reduce the risk of security breaches in your fiat wallet. Here’s how you can help protect yourself from potential threats:

- Use strong passwords: Create a strong, unique password that combines upper and lowercase letters, numbers, and special characters, and avoid reusing passwords from other accounts.

- Enable 2FA: Always enable two-factor authentication to add an extra layer of security in the event your password becomes compromised.

- Be cautious with links: Avoid clicking on suspicious links, email attachments, or pop-ups that could lead to phishing attacks, and verify the source before entering any sensitive information.

- Monitor for alerts: Regularly monitor your accounts for unusual activities or unauthorized transactions, and enable fraud alerts to quickly detect and address any issues.

Common fiat wallets

There are numerous fiat wallets available today, each offering different features and benefits. Here are some of the most common ones:

Global fiat wallets

- PayPal: One of the most widely used fiat wallets globally, PayPal allows users to send and receive money, make online purchases, convert currencies, and access crypto.

- Venmo: Owned by PayPal, Venmo is a mobile wallet popular in the United States, known for its social features that allow users to share payment and purchase history with friends.

- Revolut: Revolut is a UK-based fintech company that offers a fiat wallet with multi-currency support, allowing users to hold, exchange, and transfer money in multiple currencies. It also offers features like budgeting tools and cryptocurrency trading.

- Cash App: Cash App is another mobile wallet in the US, offering a simple interface for sending and receiving money, buying stocks, and trading Bitcoin (BTC).

Regional fiat wallets

- Alipay: Alipay is a Chinese mobile wallet known for its integration with various services, including shopping, bill payment, and insurance for users in Asia.

- Paytm: Paytm is an Indian digital wallet that offers a range of services, from mobile recharges to utility bill payments and online shopping.

- Airtm: Airtm is a Latin American fiat wallet that allows users to hold multiple currencies and transfer money internationally at competitive rates.

Crypto-integrated wallets

- MoonPay: MoonPay is a crypto on-ramp provider that allows users to buy cryptocurrency like Bitcoin using a credit / debit card, Apple Pay, Google Pay, and PayPal. It also allows users to top up their MoonPay Balance with fiat currency to use for crypto transactions.

- Coinbase: Coinbase is a centralized cryptocurrency exchange (CEX) that also offers fiat wallet functionality. This allows users to hold both fiat currencies and cryptocurrencies, providing a way to convert between the two.

- Binance: Binance, another major crypto exchange, offers a fiat wallet that supports multiple fiat currencies. Users can deposit, withdraw, and convert between fiat and cryptocurrencies.

Bridging fiat and crypto wallets

Not all fiat wallets enable crypto, just as many crypto wallets lack fiat support. But with MoonPay Balances, you can experience the convenience of moving between the two in one place.

To get started, just top up your account in Euros, Pounds, or Dollars. Then, simply transact using your MoonPay Balance for cheaper and faster transactions with higher approval rates. Plus, enjoy zero-fee withdrawals directly to your bank account when you decide to cash out.

Whether you're buying or selling crypto, try MoonPay Balances today for a streamlined trading experience!

Fiat Wallet FAQs (Frequently Asked Questions)

What is the difference between a fiat wallet and a bank account?

A fiat wallet is a digital tool that stores and manages money like a bank account. However, they are generally more flexible with additional features such as instant money transfers, international payments, and integration with cryptocurrencies. Unlike bank accounts, they are not tied to a specific bank and can be accessed through various platforms and devices.

Are fiat wallets safe to use?

A fiat wallet may be considered safe if it is provided by a reputable provider and employs security measures such as encryption, two-factor authentication, and fraud detection systems to protect funds. However, it's important to follow best practices to secure your wallet, like using strong passwords and being cautious of phishing attacks.

Can a fiat wallet hold cryptocurrencies?

Some fiat wallets, particularly those integrated with crypto platforms (like on-ramps and crypto exchanges), allow you to hold both fiat currencies and cryptocurrencies. Providers like MoonPay offer the convenience of managing all your digital assets in one place and often include features for converting between fiat and crypto.

Can I use a fiat wallet internationally?

Yes, many fiat wallets support international transfers, allowing you to send and receive money across borders. Some wallets also offer multi-currency support, enabling you to hold and exchange different fiat currencies. However, users should be aware of any fees or exchange rates that may apply to international transactions.

Do fiat wallets require regulatory compliance?

Fiat wallets must comply with various regulations designed to protect users and ensure the integrity of financial systems. For example, most fiat wallets require users to complete KYC and AML procedures to verify their identity to help prevent illegal activities such as money laundering.

How do I withdraw money from a fiat wallet?

To withdraw funds from a fiat wallet, you typically need to transfer the funds to your linked bank account or debit/credit card. However, depending on the wallet provider, it may take up to several days for the funds to appear. Some wallets also allow physical cash withdrawals at ATMs or partner locations.

.png)

.png?w=3840&q=90)

.png?w=3840&q=90)

.png?w=3840&q=90)