Investing in cryptocurrency can feel overwhelming. With constant price fluctuations, breakneck news cycles, and conflicting information abound, it's hard to know the proper entry point to buy.

But what if there was a way to simplify the process and reduce the stress of timing the market?

Enter recurring buys – a powerful strategy used by traditional investors and crypto enthusiasts alike to grow a portfolio consistently.

Whether you're new to crypto or a seasoned investor, this guide will help you understand the benefits of scheduled purchases and how to make the most of recurring buys through MoonPay.

What are Crypto Recurring Buys?

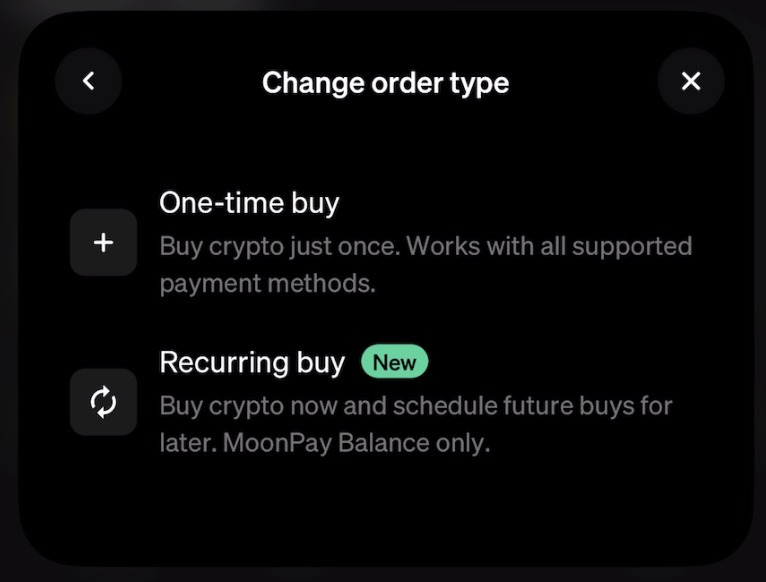

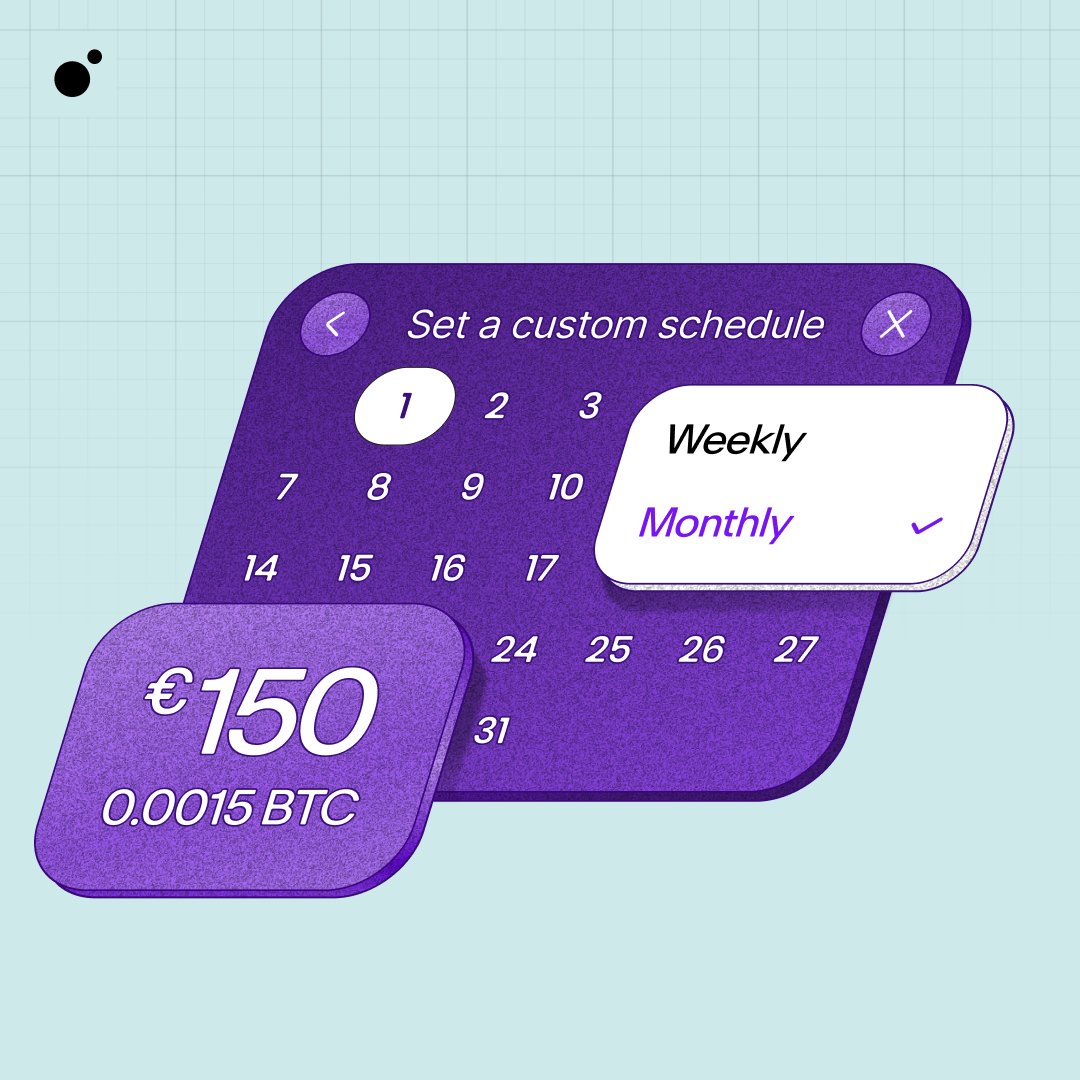

Crypto recurring buys are an automated investment strategy that allows users to purchase cryptocurrencies at regular intervals, such as daily, weekly, or monthly. This simplified method allows investors to grow a portfolio over time, through consistent and price-agnostic investment habits.

Recurring crypto buys automate and simplify the process of purchasing digital assets by allowing users to choose a scheduled date to buy. Instead of manually buying cryptocurrency every time, recurring buys handle the transactions for you, whether you want to add to your crypto portfolio via daily, weekly, bi-weekly, or monthly purchases.

Cryptocurrency markets are notorious for their volatility. Whether it’s Bitcoin, meme coins like Dogecoin, altcoins like Solana, and everything in between, prices can swing wildly over the long and short term—even fluctuating down to the minute. This presents quite the challenge if you're trying to time your transactions perfectly.

Since timing the market perfectly is impossible, recurring buys are an approach based on disciplined investing, helping you avoid the pitfalls of emotional decisions while benefiting from long-term growth.

The strategy behind recurring buys: Dollar-Cost Averaging (DCA)

Buying crypto at regular intervals is a form of dollar-cost averaging (DCA). This traditional investment strategy—also applicable to cryptocurrency—is when you divide your total investment amount into smaller portions and invest them regularly over time. But why waste your time and not just buy all at once?

Like automated purchases, this investing method minimizes the impact of market volatility. Moreover, the benefits are equally psychological as they are financial; if you're spreading out your investments, you’re less likely to suffer from the pressure of trying to buy at the "right time”, as well as the stress of suffering losses due to short-term market dips.

For example, let's say you want to invest $100 monthly into Bitcoin over a year. Regardless of BTC price fluctuations, you can use a DCA strategy to accumulate Bitcoin regularly, buying both when prices are low and when they are high. Over the long run, a consistent approach often leads to a better average purchase price than if you were to pick a random month to buy $1,200 worth of Bitcoin.

Benefits of crypto recurring buys

Simplifying investing for beginners

Recurring buys help reduce the need for constant price monitoring and manual transactions. This can make it a suitable strategy for beginners who may be intimidated by the prospect of crypto trading.

Staying consistent via automation

Automation ensures that investments happen on schedule, helping new investors stick to their financial plans without getting distracted by market noise.

Reducing market volatility risks

Investing regularly can be a way to equip yourself to ride out market fluctuations and benefit from long-term upward trends in the interest of steadily growing your portfolio.

Flexible and customizable plans

Most platforms, including MoonPay, allow users to tailor their recurring purchase plans to fit their token preferences and financial schedules. In general, most platforms offer options for daily, weekly, bi-weekly and monthly purchases.

Financial planning made easy

Recurring buys allow you to set fixed investment amounts, making it easier to align with your overall financial goals and avoid overspending your personal budget. For instance, you can set aside a bit of your income and add a scheduled purchase for every payday.

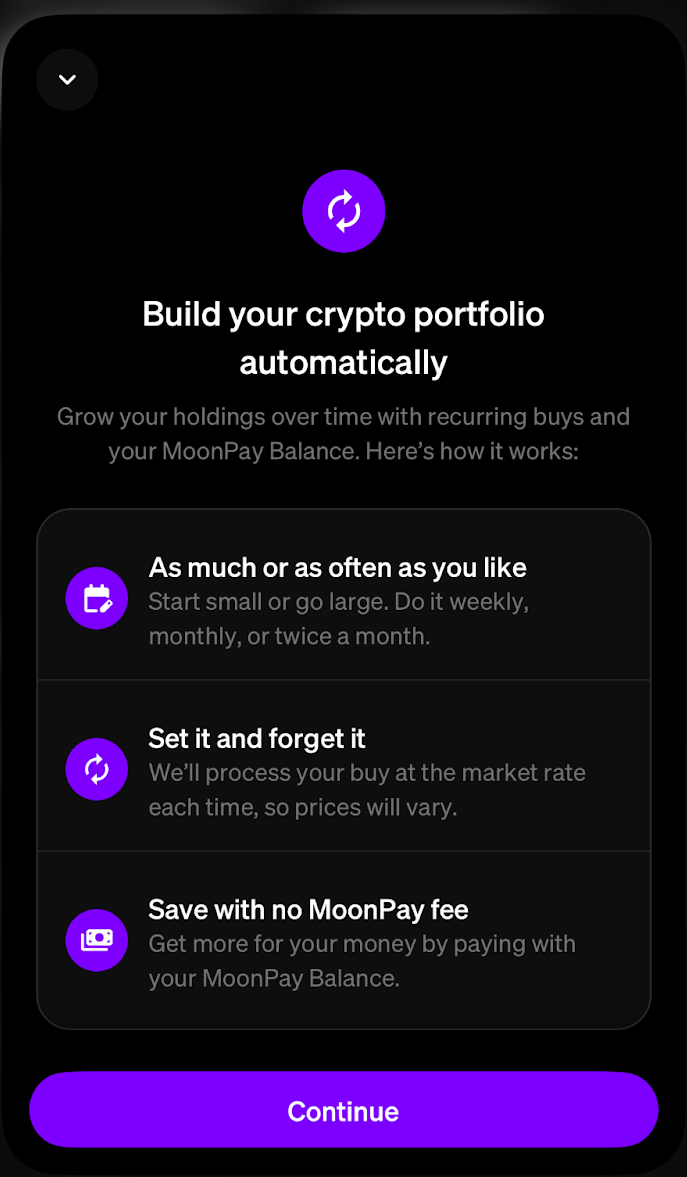

MoonPay’s Recurring Buy Feature: A seamless way to invest

MoonPay is making it even easier to implement this pragmatic investment strategy with our new recurring buy functionality. Our user-friendly platform, competitive fee structure, and non-custodial nature provide a decentralized and safe investment experience, whether you're buying once or over time.

Here are some more perks:

Benefits of using MoonPay for automated crypto purchases

Low fees

With MoonPay, you can save on transaction fees, making your automated investments even more cost-effective in the short term and long run.

Best approval rates

After KYCing with MoonPay during your first purchase, enjoy recurring buys with high approval rates, so your transactions go through smoothly when you want them.

Quick transactions

Enjoy fast purchases without long delays, so your funds are quickly sent to your MoonPay account or preferred non-custodial wallet.

Many supported cryptocurrencies

Whether you want to diversify your crypto portfolio with a little bit of Bitcoin (BTC) weekly, Solana (SOL) every other week, or Dogecoin (DOGE) once per month, MoonPay offers an expansive catalog of over 140 cryptocurrencies to buy.

Step-by-Step Guide to Setting Up Recurring Buys on MoonPay

Follow these simple steps to start buying crypto at scheduled intervals with MoonPay:

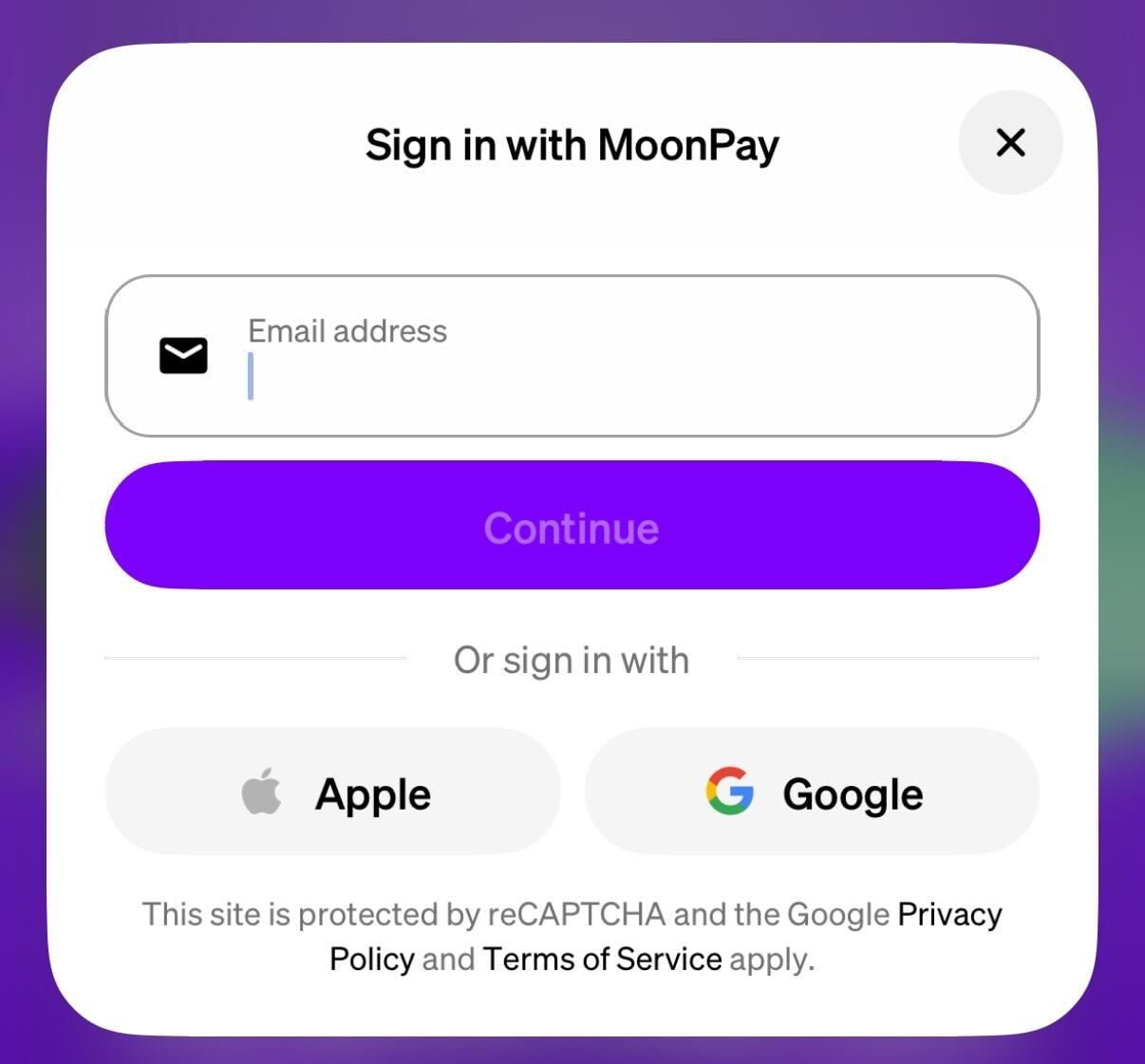

1. Create or Log in to Your MoonPay Account

Start by creating a MoonPay account or logging into your existing one. The process is quick and straightforward, whether you're using the MoonPay app, desktop browser, or coming from an external wallet.

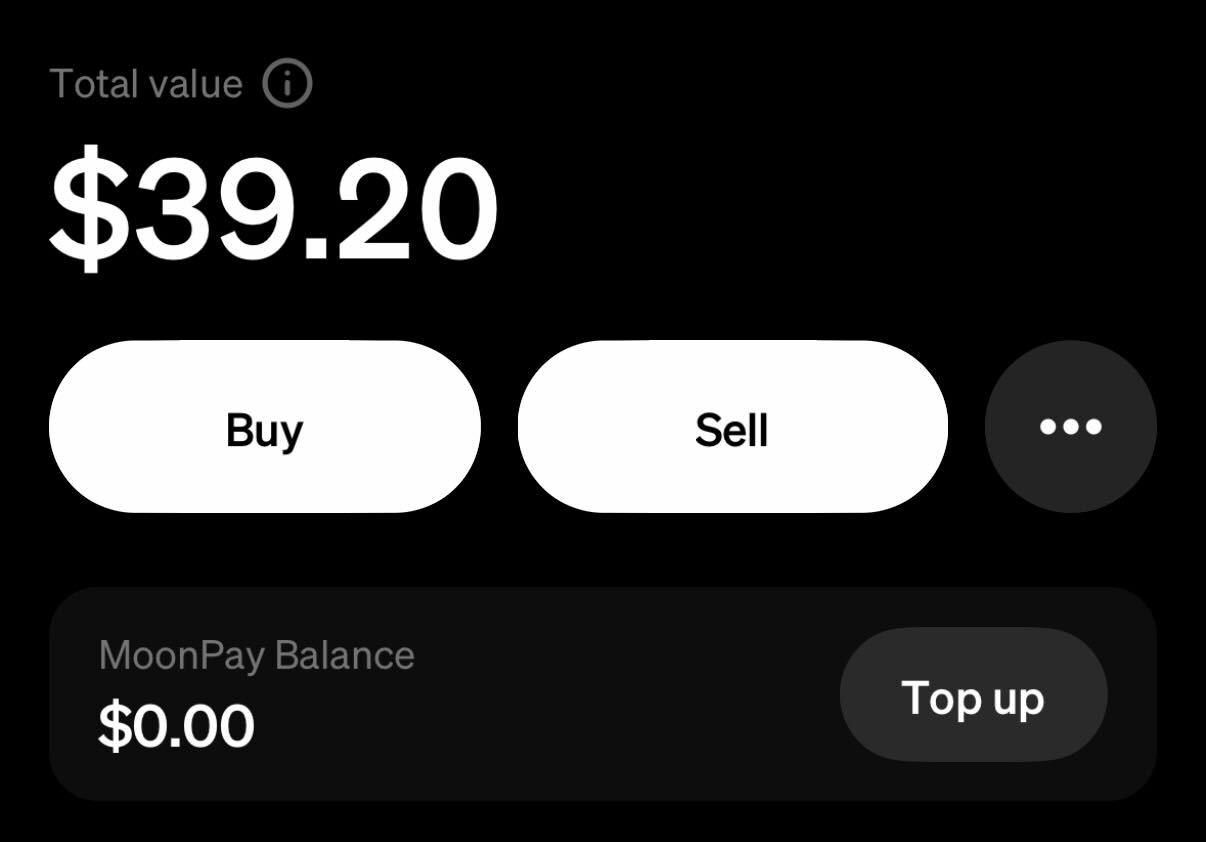

2. Top Up Your MoonPay Balance

Fund your MoonPay Balance using payment methods such as bank transfers or credit cards. You must top up your MoonPay Balance to set recurring payments. If your balance is insufficient, your order will not go through.

Pro tip: Having a balance will allow you to make the most of all your crypto purchases, with advanced benefits like faster transactions, lower fees, and zero-fee withdrawals when you sell crypto for fiat.

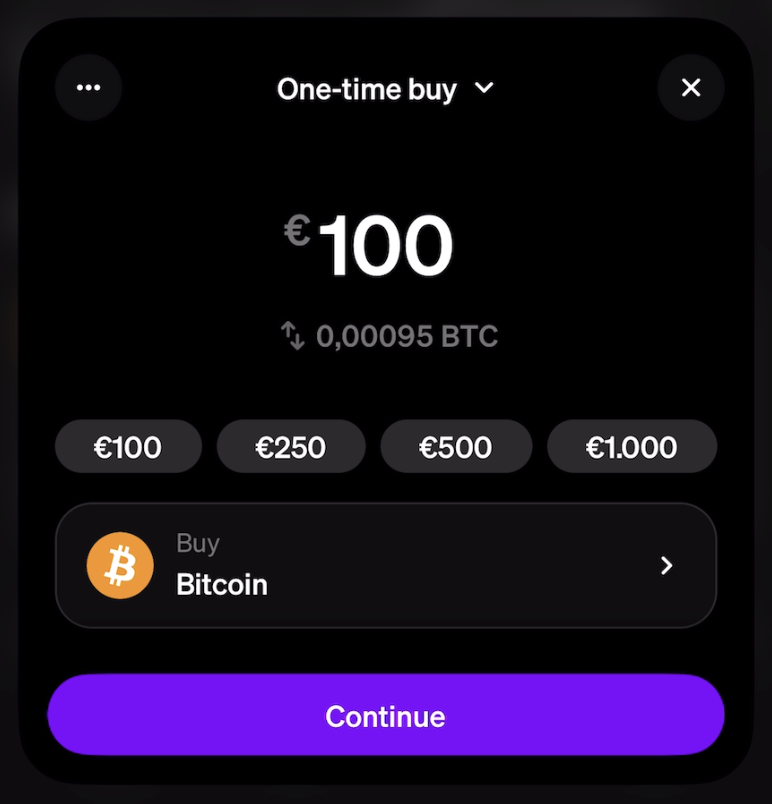

3. Choose Your Cryptocurrency

Tap 'Buy' and select the digital asset you want to invest in from MoonPay’s extensive list of supported cryptocurrencies. Choose from options like BTC, ETH, SOL, XRP, USDC, USDT, DOGE, SHIB, TRUMP, and 140+ more tokens.

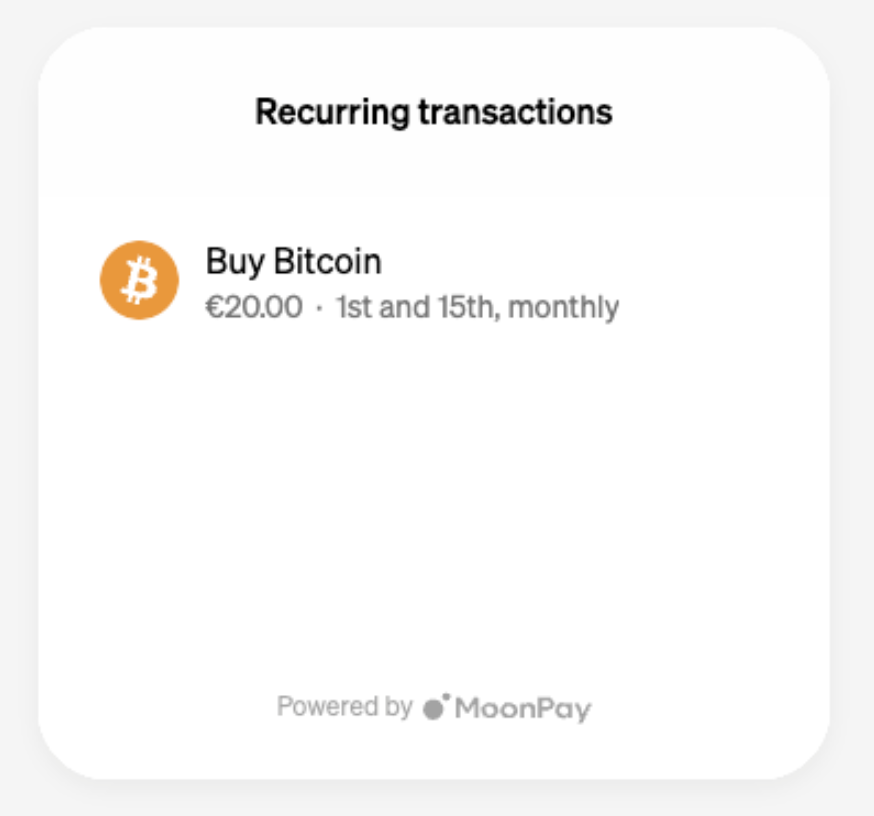

4. Set Frequency and Amount

Decide how often you want to invest ( weekly, bi-weekly, or monthly purchases) and set your desired investment amount. The minimum amount of crypto you can buy on MoonPay is $20 (or your local currency equivalent).

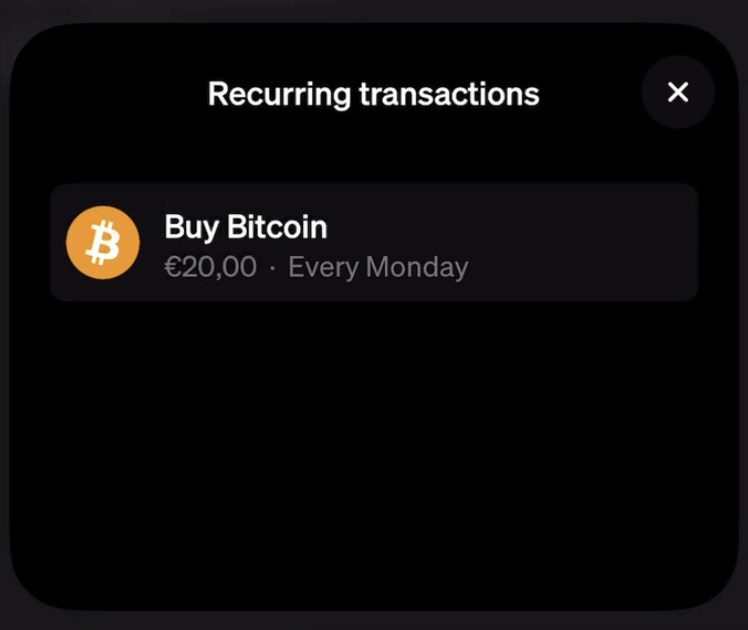

5. Review and Confirm Your Plan

Double-check your recurring buy details, including the token, amount, and destination wallet address. When you're ready, confirm to activate your automated crypto investment plan.

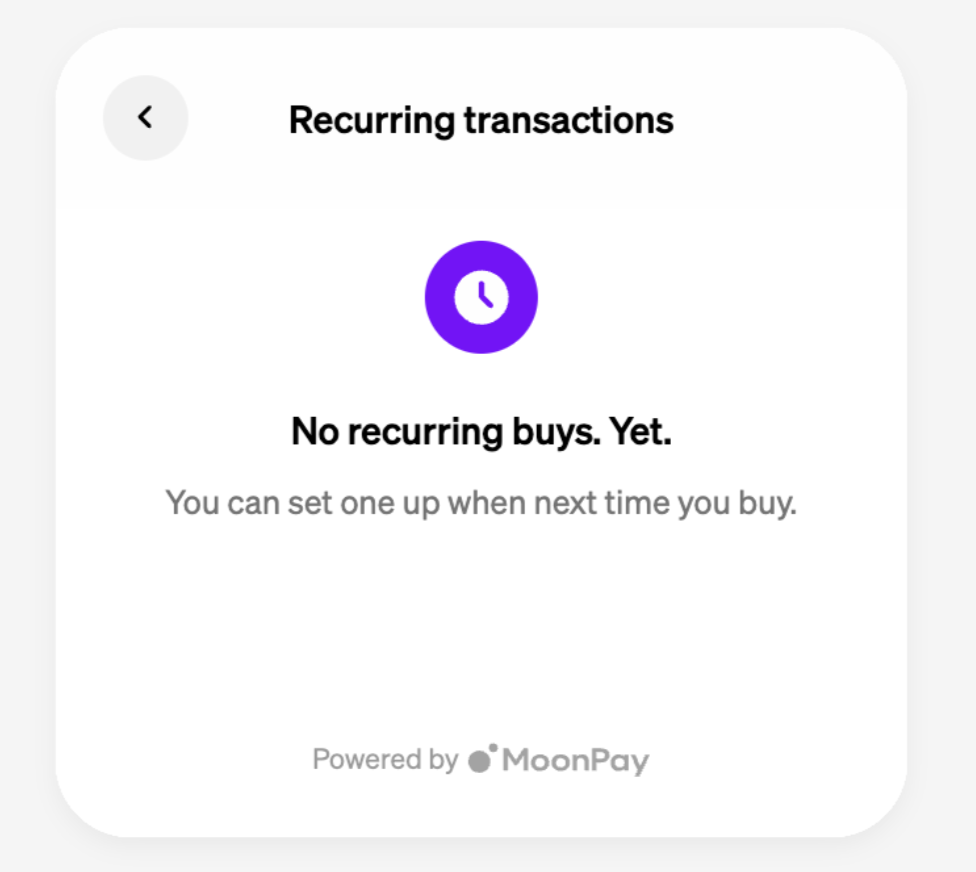

Once active, MoonPay allows you to stay in control of your plan. Receive notifications, track your schedule, and cancel anytime. All in the MoonPay app.

Tips for getting the most out of recurring buys

Choose the right cryptocurrency for your goals

Before buying cryptocurrency, research and select the one(s) that align with your investment objectives, whether it’s growth, stability, or diversification.

Set realistic investment amounts

Make sure your recurring purchase amounts fit comfortably within your budget to avoid financial strain.

Monitor your recurring buys

Regularly review your investments and make adjustments based on market trends or personal financial changes. Don't be afraid to alter the frequency or purchase amount.

Hybrid investment planning

Consider combining recurring purchases with other strategies, such as value averaging, lump sum investing, and periodic portfolio rebalancing.

FAQs about Crypto Recurring Buys

What is the minimum amount I can invest in recurring buys?

MoonPay offers flexible trading amounts to make crypto accessible for all investors. The minimum amount of crypto you can buy via recurring orders is $20. Purchase limits will vary based on a user's KYC level.

Can I cancel or modify my recurring buy plan?

Yes, if you want to adjust your recurring buy plan, you can cancel anytime to suit your changing needs. If you don’t make changes to your order, the purchases will continue until you cancel.

Pro tip: Be sure to cancel at least one day before your next purchase date, to avoid being charged.

Which cryptocurrencies are available for recurring buys?

MoonPay supports a wide range of cryptocurrencies to buy, including for recurring orders. Set an automated plan to buy Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Tether (USDT), USDC (USDC), and 140+ more tokens.

*Exact token listings are subject to geographic location and availability.

What are the supported geographic regions?

MoonPay’s recurring buy services are available in numerous countries worldwide, wherever MoonPay Balance functionality is supported.

Can I change my wallet address?

If you want to change your destination wallet address, you’ll need to cancel and start a new recurring order with the updated wallet address information.

Does MoonPay charge fees for recurring buys?

MoonPay offers low fees on recurring buy orders, helping you to maximize your investments without worrying about spending on transaction fees.

*MoonPay does not charge a trading fee for these purchases, but network fees may still apply.

How does recurring buy work with volatile crypto prices?

Recurring buys are similar to DCA techniques, meaning you can average out the cost of your investments over time to mitigate the effects of volatility.

What are the payment methods supported for recurring buys?

For recurring buy orders, you must have an active MoonPay Balance with sufficient funds to complete your transactions.

For regular one-time transactions (non-recurring orders), MoonPay supports payment methods that cater to local regions, including bank transfers, credit/debit cards, PayPal, Apple Pay, Google Pay, Venmo in the US, Pix in Brazil, SEPA in the EU, and Faster Payments in the UK.

.png?w=3840&q=90)