O que é PYUSD (PayPal USD)? | Stablecoin do PayPal explicada

Saiba tudo sobre o PayPal USD (PYUSD), a stablecoin criada para transações sem complicações e pagamentos transfronteiriços na plataforma PayPal e além.

By Corey Barchat

Quando se trata de finanças digitais, poucas empresas tiveram tanto impacto quanto PayPal. Desde sua fundação em 1998, o PayPal transformou a maneira como enviamos, gastamos e gerenciamos dinheiro online.

Nos últimos anos, o PayPal tem abraçado de forma constante a criptomoeda. Depois de permitir transações de criptomoeda no aplicativo PayPal em 2020, a empresa passou a permitir que os clientes concluam pagamentos com criptomoeda em comerciantes parceiros em 2021.

Desde então, o PayPal deu outro passo audacioso no mundo das criptomoedas com a introdução de sua própria stablecoin, PayPal USD (PYUSD). This stablecoin combina o poder da tecnologia blockchain com a confiança e estabilidade das finanças tradicionais, oferecendo um ativo digital único respaldado por um dos nomes mais reconhecidos em pagamentos digitais.

Mas o que é PYUSD e onde ele se encaixa na economia digital?

Neste artigo, vamos nos aprofundar em o que é o PayPal USD (PYUSD), como funciona, seus benefícios e potenciais desafios. Também vamos comparar o PYUSD com outros stablecoins populares e mostrar como comprá-lo facilmente via MoonPay.

O que é PayPal USD (PYUSD)?

PayPal USD (PYUSD) é uma stablecoin emitida pela Paxos e respaldada 1:1 pelo dólar americano, o que significa que cada token PYUSD representa 1 USD. Ao contrário das criptomoedas mais voláteis como Bitcoin e Ethereum, PYUSD é projetada para manter um valor estável, fornecendo um ativo digital confiável para transações diárias.

Com PYUSD, a PayPal visa tornar as stablecoins acessíveis aos usuários comuns enquanto aprimora as transações globais. Construído na blockchain Ethereum como um ERC-20 token, PYUSD é destinado a servir como uma ponte entre finanças tradicionais e finanças descentralizadas (DeFi).

Alguns dos objetivos do PayPal com PYUSD incluem:

- Melhorar a experiência do usuário: Ao criar uma moeda digital estável e confiável, o PayPal procura tornar as transações peer-to-peer ainda mais suaves.

- Habilitar pagamentos internacionais: PYUSD poderia tornar enviando dinheiro além-fronteiras mais rápido, mais barato e mais transparente.

- Expandindo para DeFi: Paxos, o emissor do token, visa posicionar o PYUSD como um ativo estável para uso em aplicações descentralizadas (dApps), para finalidades como liquidez, troca, staking, e mais.

Como o PYUSD funciona?

Curioso sobre a mecânica por trás da nova stablecoin do PayPal? Vamos detalhar como o PYUSD opera, desde a tecnologia blockchain que o alimenta até as salvaguardas por trás da estabilidade e transparência do token.

Tecnologia e plataforma blockchain

Embora existam muitos blockchains que suportam stablecoins, o PayPal USD é emitido na blockchain Ethereum para máxima transparência, descentralização e segurança. Como o PYUSD é construído em um blockchain público, qualquer pessoa (como usuários e desenvolvedores) pode verificar transações, carteiras e contas na rede Ethereum.

E graças ao Ethereum funcionalidade de contrato inteligente PYUSD pode ser integrado em aplicações descentralizadas (dApps) e plataformas de finanças descentralizadas (DeFi), tornando-o compatível com uma gama de serviços financeiros. Por exemplo, você poderia usar PYUSD em plataformas de empréstimo, pools de liquidez, e outros produtos DeFi, com muitos mais casos de uso ainda a serem explorados.

Emissão e suporte de PYUSD

Cada token PYUSD é respaldado por um dólar americano equivalente (e equivalentes) mantido em reserva. Having a 1:1 backing is one aspecto comum entre os provedores de stablecoin na tentativa de manter o valor constante do token. Quando um usuário compra PYUSD, o PayPal emite um novo token e adiciona um valor equivalente em dólares às suas reservas. Inversamente, quando os usuários resgatam PYUSD, os tokens correspondentes são queimados, e um valor equivalente é retirado das reservas.

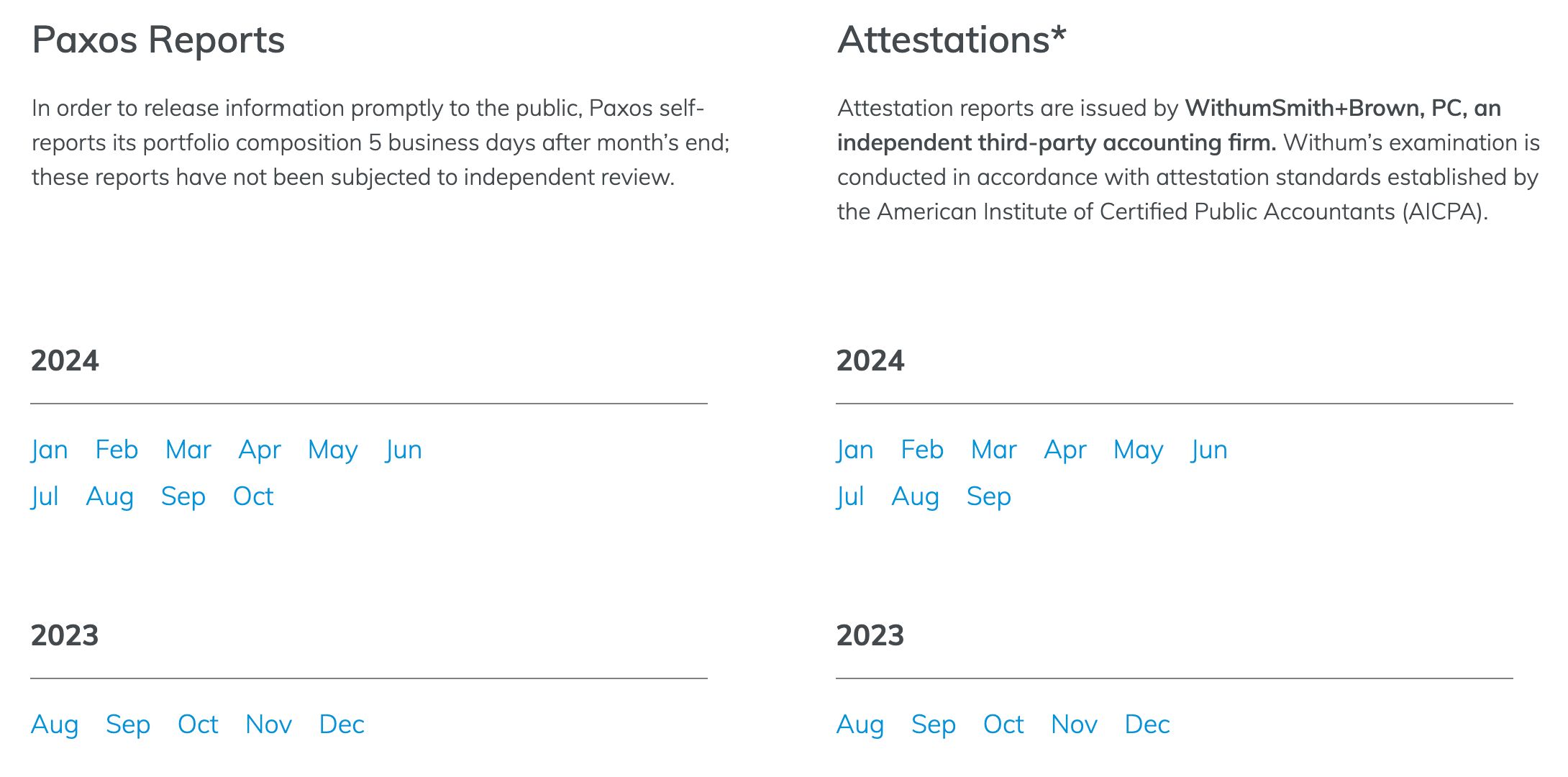

Na tentativa de construir a confiança do usuário, o PayPal realiza auditorias regulares de suas reservas de PYUSD. A Paxos Trust Company fornece transparência em relação às suas participações através de auto-relatos, assim como atestados de uma firma de contabilidade independente. Essas auditorias de terceiros visam garantir que cada token PYUSD seja adequadamente respaldado, para proporcionar aos usuários tranquilidade sobre a estabilidade e liquidez da moeda.

Benefícios e usos do PYUSD

Vamos explorar os benefícios práticos e os usos versáteis da stablecoin do PayPal, desde compras cotidianas até transações internacionais e além.

Transações diárias

O PayPal imagina o PYUSD como uma moeda viável para compras do dia a dia dentro de sua rede. Desde compras online até pagamentos entre pessoas, o PYUSD pode permitir que os usuários transacionem de forma fluida em uma moeda digital estável.

Para comerciantes, o PYUSD oferece benefícios como taxas de processamento reduzidas e liquidações mais rápidas. Os consumidores, por outro lado, desfrutam da estabilidade de um ativo respaldado pelo dólar americano e a facilidade de fazer compras usando criptomoeda, sem se preocupar com taxas de conversão.

Pagamentos transfronteiriços

Com PYUSD, os pagamentos transfronteiriços se tornam mais rápidos e acessíveis. Os usuários podem transferir PYUSD instantaneamente, evitando taxas bancárias tradicionais e atrasos associados a transações internacionais.

Stablecoins como o PYUSD tornam remessas internacionais mais econômicas, reduzindo as taxas de transação. Elas também aceleram as transferências, já que os fundos podem ser enviados e recebidos quase instantaneamente, proporcionando uma opção acessível para enviar dinheiro ao exterior.

Integração com os serviços do PayPal

O PYUSD é projetado para funcionar perfeitamente dentro do ecossistema existente do PayPal, permitindo que os usuários gerenciem, enviem e recebam PYUSD diretamente em sua carteira PayPal. Essa integração permite que os usuários do PayPal alternem entre PYUSD, moedas fiduciárias e outros criptomoedas facilmente.

Potencial para finanças descentralizadas (DeFi)

A presença do PYUSD no Ethereum abre inúmeras oportunidades no mundo das DeFi. Os usuários podem emprestar, emprestar e trocar PYUSD em certas exchanges e protocolos descentralizados. Isso oferece a possibilidade de ganhar juros ou utilizar o PYUSD em outras aplicações DeFi, criando mais formas para os usuários beneficiarem de suas posses.

Desafios e riscos do PYUSD

Embora o PYUSD traga possibilidades empolgantes, ele também enfrenta vários desafios e riscos comuns entre as stablecoins.

Riscos regulatórios e incertezas

Stablecoins enfrentam escrutínio regulatório à medida que as autoridades buscam prevenir o uso indevido e proteger os usuários. Enquanto o PayPal toma medidas para cumprir com as regulamentações de criptomoedas, como realizar auditorias mensais para demonstrar conformidade regulatória, ainda não se sabe como as novas leis de criptomoeda podem impactar o PYUSD.

Concorrência de mercado com outros stablecoins

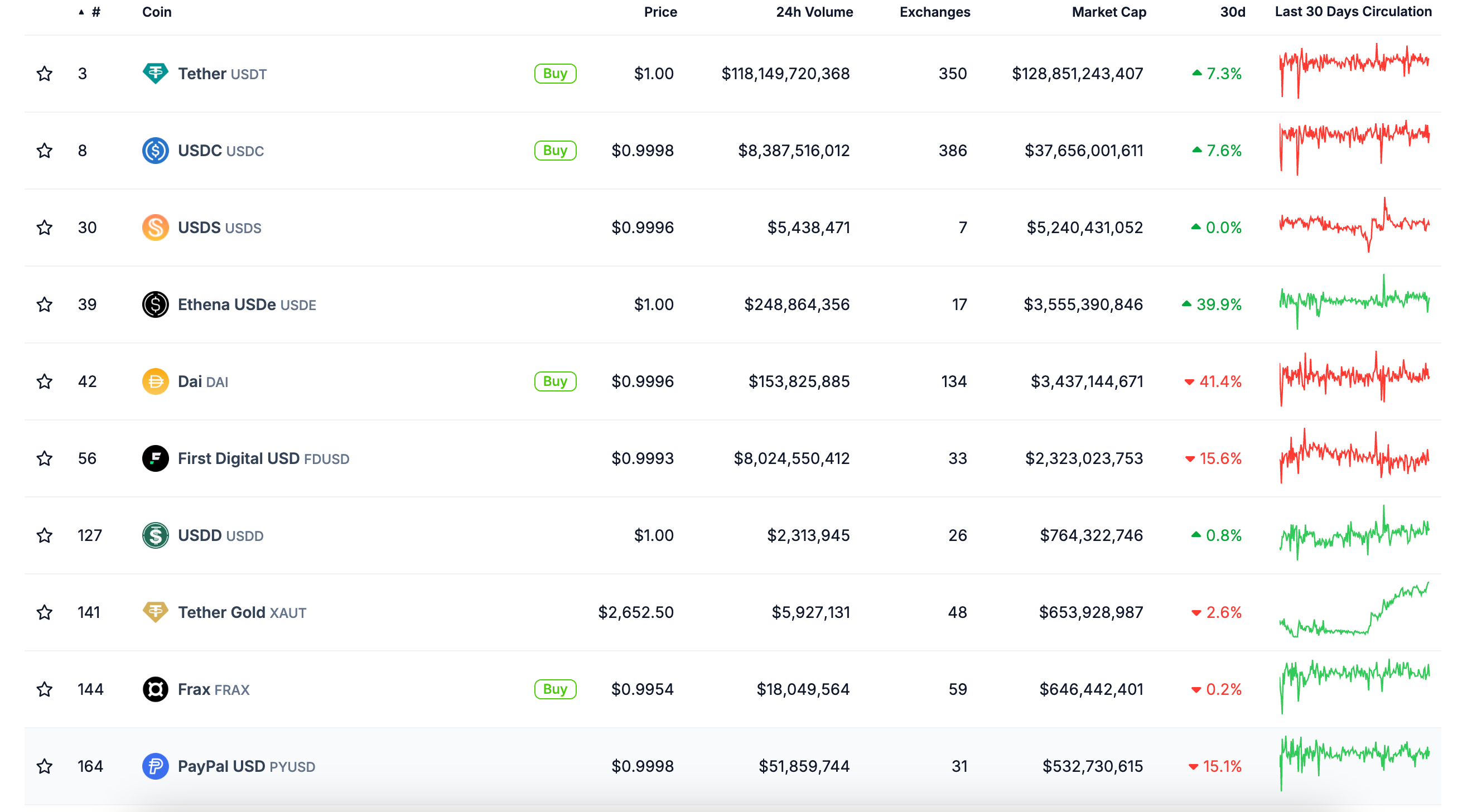

PYUSD enfrenta concorrência de stablecoins estabelecidos como USDT (Tether), USDC (USDC), e DAI (Dai). Esses concorrentes possuem uma base de usuários de longa data e casos de uso estabelecidos, tornando potencialmente desafiador para o PYUSD conquistar sua fatia de mercado. Por exemplo, enquanto o PYUSD valor de mercado medidas em centenas de milhões, a capitalização de mercado das principais stablecoins é na casa dos bilhões (e acima de $100 bilhões para USDT).

Preocupações com a tecnologia e a privacidade

Embora a tecnologia blockchain ofereça transparência, ela também levanta preocupações relacionadas à privacidade. O PayPal precisa explorar maneiras de aprimorar a privacidade e a segurança para seus usuários, equilibrando transparência com confidencialidade para garantir que as informações pessoais dos usuários—para holdings de criptomoedas, bem como a carteira fiduciária do PayPal e banco—permaneçam protegidos.

PYUSD vs. outras stablecoins: O que torna a PYUSD diferente?

Com tantas stablecoins já no mercado, o que diferencia a PYUSD?

PYUSD vs stablecoins líderes

PYUSD entra em um mercado de stablecoins dominado pela Tether (USDT) e USD Coin (USDC). Like PYUSD, both of these stablecoins are tokens ERC-20 que operam em um modelo semelhante respaldado 1:1 pelo USD. Por enquanto, enquanto PYUSD é limitado aos blockchains Ethereum e Solana, USDT e USDC têm compatibilidade adicional com redes como Polygon, Optimism, ZK-sync e Celo.

Embora a integração próxima do PYUSD com o PayPal proporcione conveniência, ela também pode restringir a liberdade para usuários que preferem plataformas fora do ecossistema do PayPal. Stablecoins estabelecidas como USDT e USDC oferece compatibilidade mais ampla entre carteiras externas, exchanges e protocolos DeFi como pools de liquidez, yield farming, staking e empréstimos, o que pode limitar sua adoção entre entusiastas de criptomoedas.

A vantagem competitiva do PYUSD

Com mais de 426 milhões de usuários ativos, o PayPal tem uma vantagem significativa em alcançar clientes e comerciantes do dia a dia. Os usuários podem transacionar com PYUSD diretamente dentro do PayPal e gerenciar tokens de stablecoin juntamente com moeda fiduciária e criptomoeda. Esta vasta base de usuários dentro do ecossistema PayPal de carteiras fiduciárias, bancos e parceiros comerciais pode permitir que o PYUSD ganhe tração mais rápido que certos concorrentes, especificamente quando se trata de integrar consumidores não nativos de criptomoedas.

Ao mesmo tempo, o PYUSD tem um longo caminho a percorrer para alcançar o USDT como a stablecoin mais amplamente negociada. De fato, mesmo após ver um aumento em volume diário de negociação de mais de 100%, esta cifra ainda é apenas 0,02% em comparação ao Tether!

Segurança e estabilidade do PYUSD

A segurança é fundamental para todas as stablecoins, e o PayPal implementou certas salvaguardas em um movimento para proteger os ativos PYUSD. Ao contrário de alguns provedores de stablecoin com divulgações limitadas, o PayPal visa maior transparência através de auditorias regulares e relatórios mensais de reservas publicados no site da Paxos.

Perguntas Frequentes (FAQ) sobre o PYUSD

Onde posso comprar PYUSD?

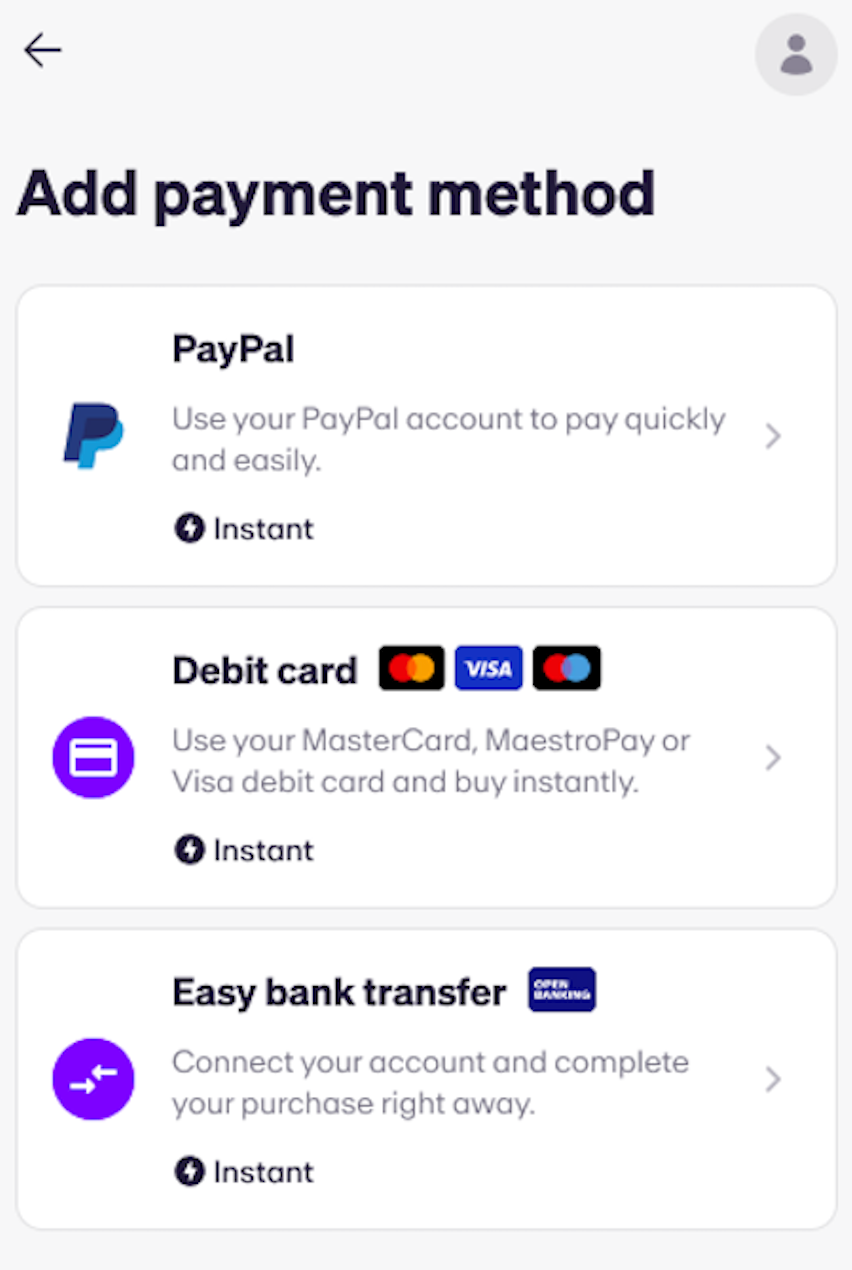

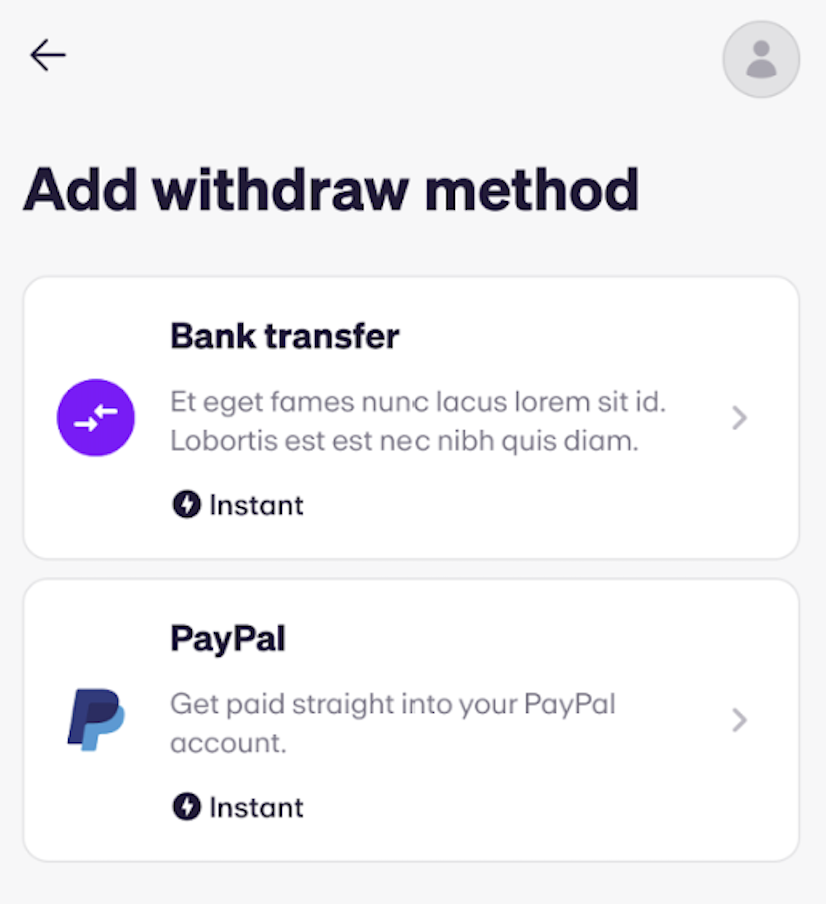

Você pode comprar PYUSD em sua loja favorita carteira de criptomoeda via MoonPay ou através do aplicativo MoonPay. MoonPay permite aos usuários comprar PYUSD usando vários métodos de pagamento, como cartões de crédito/débito, ou com moedas fiduciárias, como dólares americanos e euros.

Como posso armazenar PYUSD?

Você pode armazenar PYUSD diretamente na sua conta do PayPal, pois está totalmente integrado ao carteira digital. Isso significa que você pode gerenciar e usar PYUSD perfeitamente junto com outras moedas digitais na sua conta PayPal. Além disso, como o PYUSD é construído na blockchain Ethereum, é compatível com qualquer carteira Ethereum, como MetaMask, Trust Wallet e Ledger.

Posso usar PYUSD para compras diárias?

Sim! Um dos principais objetivos do PYUSD é facilitar transações diárias.

Os usuários podem comprar, enviar e gastar PYUSD diretamente no aplicativo PayPal. Os comerciantes também podem aceitar PYUSD, permitindo que os consumidores paguem com criptomoedas para transações mais rápidas com taxas mais baixas. Como o PYUSD tem a intenção de ter um valor estável com respaldo pelo dólar americano, os usuários não precisam se preocupar com grandes flutuações de preço em seu valor ao fazer compras, como eles poderiam com outros ativos de criptografia.

O PYUSD é seguro?

A Paxos Trust Company conta com o Departamento de Serviços Financeiros do Estado de Nova York para supervisão regulatória, enquanto mantém uma garantia de 1:1 dólar via depósitos em dólares americanos, títulos do tesouro dos EUA e equivalentes de caixa. A Paxos realiza relatórios regulares todo mês para verificar essas reservas.

No entanto, nenhuma stablecoin pode ser considerada perpetuamente segura, pois é sabido que as stablecoins podem vivenciar desvalorizações ocasionais e até mesmo colapsos totais.

Como comprar PYUSD na MoonPay

PayPal USD representa um desenvolvimento empolgante em finanças digitais, combinando a finança tradicional com a inovação da tecnologia blockchain. Seja você um usuário do PayPal, um entusiasta cripto ou um comerciante, PYUSD abre novas possibilidades para transações digitais seguras, rápidas e estáveis.

A MoonPay facilita comprar PYUSD usando um cartão de crédito/débito, PayPal, Apple Pay, transferência bancária e outros métodos de pagamento preferidos. Basta inserir a quantidade de PayPal USD que você deseja comprar e seguir os passos para concluir seu pedido.

Você também pode comprar PYUSD ainda mais facilmente usando um Saldo MoonPay. Basta recarregar sua conta com fiat e usar seu saldo para transações mais rápidas, taxas menores, taxas de aprovação mais altas e saques sem taxa quando você decidir sacar para moeda fiduciária.

.png)

.png)