Is the crypto winter good for NFTs?

The crypto winter could purge Web3 of fair-weather projects and reveal what truly has staying power.

By Simone Banna

This is part of a series of articles on how brands can develop an NFT strategy. For the first part in the series, see How to craft an NFT consumer product strategy.

Crypto winter is here, but it’s not all bad. The good news is that it will likely flush out thousands of substandard Web3 projects. The even better news: projects that withstand the crypto winter will emerge as strong use cases for Web3 technology.

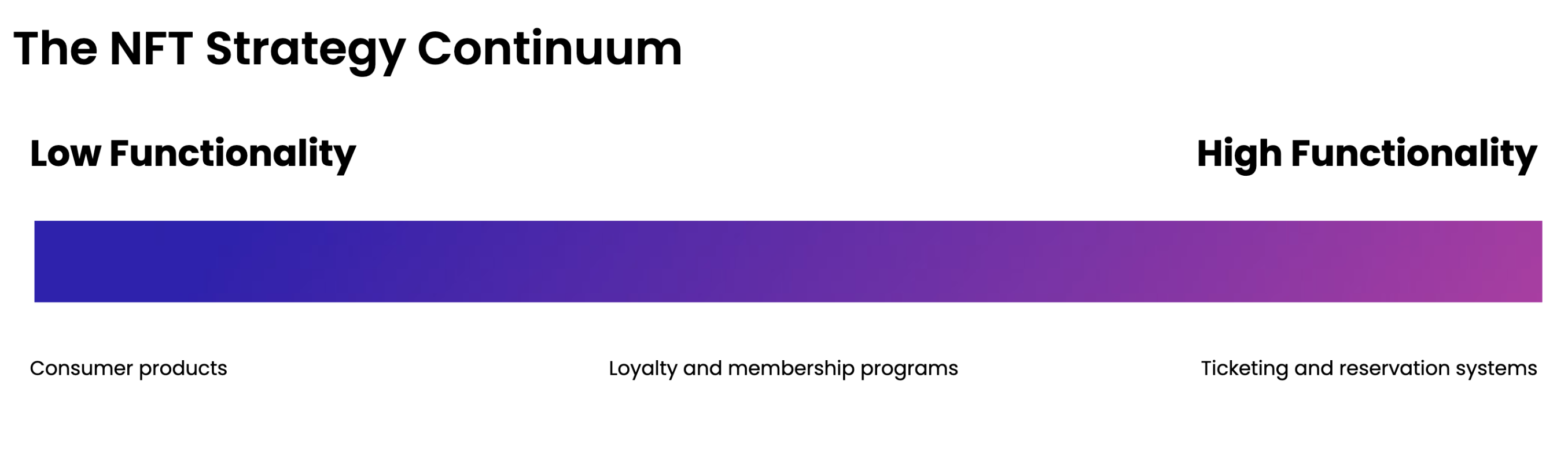

In my previous article, I introduced the NFT Strategy Continuum, which suggests that NFT strategies for brands exist on a continuum ranging from low functionality (e.g., digital collectibles) to high functionality (e.g., NFT ticketing systems).

In the crypto bull market, brands rushed to release Web3 projects and integrations, even if it didn’t make sense for their business. It benefits no one to integrate NFTs and blockchain technology just for the sake of it.

For brands, it is important to remember that technology should make your business more efficient. There are many unique use cases for NFTs and blockchain technology that can have true staying power and could potentially transform your brand and business.

Before you start

There are two core concepts that are important to your NFTs and blockchain technology strategy: state and smart contracts.

State

You may often hear people talk about Web3 unlocking digital ownership. This is possible because blockchains can establish state. State can be defined as a set of variables describing a certain system at a specific time.

With Web2, state is defined on a platform level via centralized, privately-owned databases. Currently, I can describe the state of my personal Twitter page as having 18,000 followers and 5,000 tweets. But if Twitter folded tomorrow, there would be no real record to prove the last state of my Twitter page.

With Web3, however, state can be defined at a blockchain level via decentralized blockchains that publicly display and verify all transactions. Platforms like NFT trading marketplace OpenSea are built on blockchain technology. With or without OpenSea, the blockchain will always show the last state of my NFT collection.

The ability for people to see and trust the state of blockchains is what introduces unique use cases for digital ownership and verification.

Smart Contracts

A smart contract is a self-executing digital contract. Developers can program terms to automatically execute when certain conditions of the contract are met. Smart contracts can even pull information from external sources, known as blockchain oracles.

Developers can program smart contracts to collect royalties, which introduces unique use cases for secondary marketplaces in Web3.

Crafting a highly functional NFT strategy

The ability to define state (and thus, digital ownership) and program complex, scaled, and self-executing digital contracts via blockchain can create unique and highly functional use cases for NFTs.

If executed properly, highly functional NFTs can replace or augment core business functions and systems. Examples of highly functional NFTs include NFT-powered ticketing and reservation systems, membership and loyalty programs, and authentication services.

Ticketing

Brands can use NFTs and blockchain technology to create true digital tickets that customers can verify via blockchain. Built-in authentication will empower customers to buy and sell digital tickets freely. Brands can program NFTs (via smart contracts) to automatically take a percentage of any secondary digital ticket sales, which could unlock a lucrative, automated secondary ticket revenue stream for major ticketing platforms.

Reservations

You can apply this same strategy to reservation systems. Brands can use NFTs and blockchain technology to power a secondary economy for their reservation systems. Currently, brands rely on fees to recover potential losses from canceled reservations, which isn’t an ideal customer experience.

With NFTs and blockchain technology, brands can issue reservations as NFTs and allow customers to buy and sell reservations freely. Instead of forcing customers to pay fees, this model empowers customers to potentially make money from canceled reservations.

By putting the onus on customers to sell unneeded reservations, brands can maintain goodwill with their customers, operate more efficiently, and make more money by taking a percentage of secondary reservation purchases.

Loyalty Programs

Brands can use NFTs and blockchain technology to supercharge their loyalty programs. They can do this by issuing NFTs that represent existing loyalty tiers.

For example, Delta could issue an NFT to its Platinum Medallion members.

Instead of relying on email or in-app communication, Delta could deliver membership benefits directly to the wallets of their Medallion members via airdropping. In crypto, an airdrop refers to the transfer of digital assets from a crypto project to multiple wallets.

An airline like Delta could program a smart contract to airdrop a coupon to a customer within 72 hours of their flight. Delta could also award miles to medallion members as NFTs.

Loyalty programs are generally not interoperable, meaning there aren’t ways to seamlessly reward loyal customer’s outside of a brand’s ecosystem. NFTs and blockchain technology could change that by allowing brands to partner with other entities to build value for their loyalty programs. For example, users could connect their wallets with their Delta Medallion NFT to Marriott Bonvoy’s website and unlock preferential rates on hotel bookings.

Authentication

Brands can use blockchain technology to authenticate physical goods by issuing NFTs alongside physical purchases. These NFTs can be used to verify the authenticity of goods for repair or secondary sales, and can also double as digital status symbols. For example, a “Proud Chanel Owner” NFT could be appealing to Chanel owners.

Final thoughts

Digital collectibles are only the tip of the iceberg. There are many use cases for brands to integrate NFTs and blockchain technology into their businesses.

As the bear market purges the NFT space of weak projects, more use cases that truly add value to brands and customers will emerge.

During this time, I challenge you to think about how your brand’s business model could benefit from NFTs and blockchain technology.

.png)