What is the Bitcoin Taproot Upgrade? How it affects BTC

The Bitcoin Taproot upgrade, Bitcoin's most anticipated improvement, is helping BTC scale its way to becoming a global reserve currency.

By Sankrit K

Bitcoin has some fundamental limitations that inhibit it from being more widely adopted. If these limitations aren’t overcome, it could mean that BTC will never be used as an efficient mode of payment for everyday transactions.

The Bitcoin Taproot upgrade is an improvement to the Bitcoin network that transcends some of these limitations and makes Bitcoin a more user-friendly cryptocurrency. Although the upgrade was activated in November 2021, it will take time before its full impacts are fully realized.

In this article, we tap into the roots (pun intended) of the Bitcoin Taproot upgrade and explain how it will make BTC a more functional currency.

What is Bitcoin?

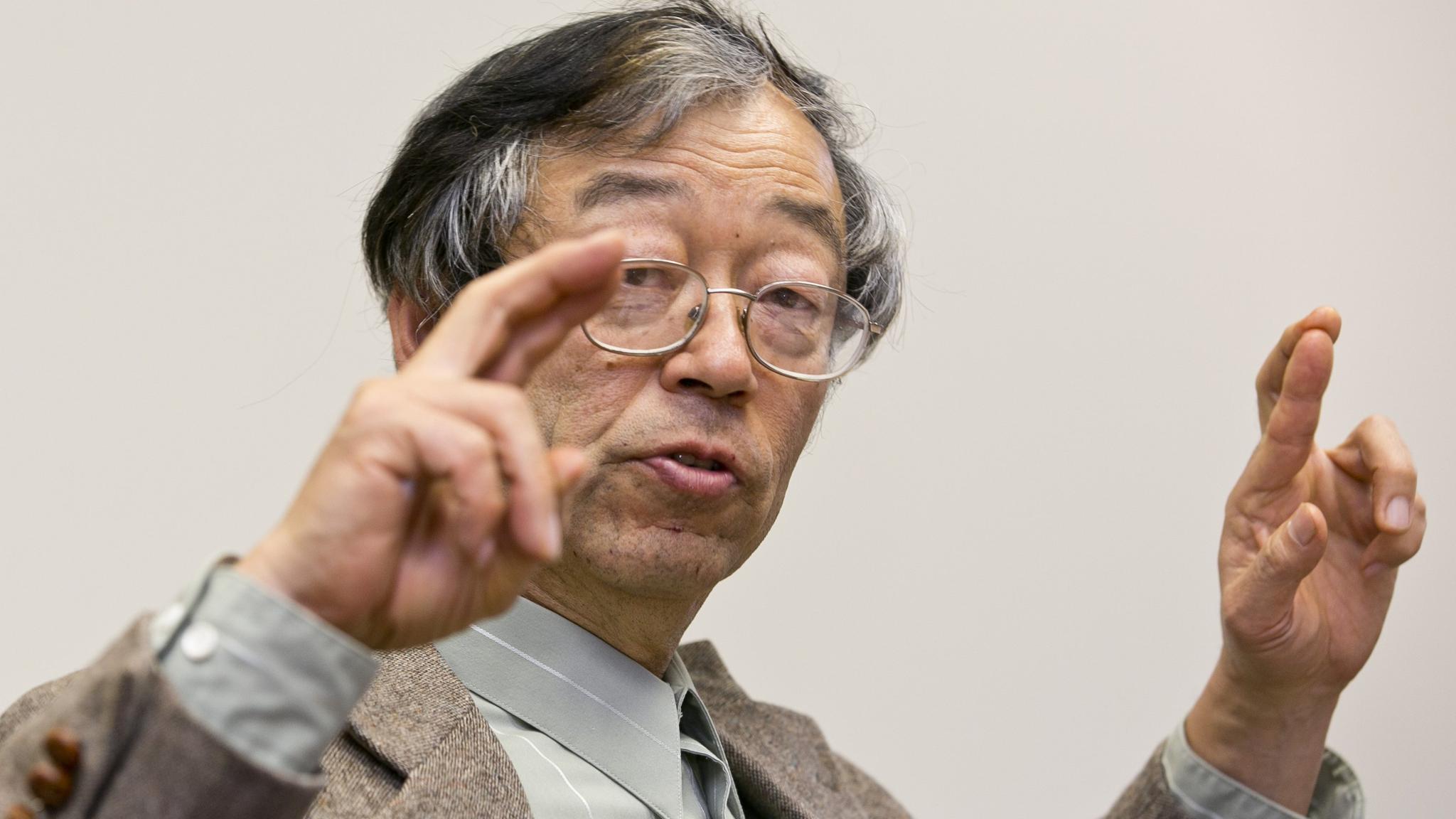

Bitcoin is a digital peer-to-peer currency invented by the pseudonymous entity known as Satoshi Nakamoto. It uses cryptography and distributed ledger technology (DLT) to maintain identity privacy while simultaneously ensuring unparalleled transparency of transactions.

One of the fundamental aspects of Bitcoin that sets it apart from fiat currency is that it is deflationary: only 21 million bitcoins will ever be created as a reward for a process known as mining. This makes Bitcoin deflationary, meaning that over time the value of BTC increases as fewer coins are added to the total circulation.

Bitcoin was originally designed to replace central banks and create a new global financial order in which anyone could participate. But it has since become much more than that, and has been used for everything from buying pizzas to funding Wikileaks.

What is the Bitcoin Taproot Upgrade?

The Bitcoin Taproot upgrade is one of the largest upgrades to the Bitcoin network since the SegWit upgrade. Bitcoin SegWit enhances the Bitcoin network's scalability by enabling faster and more efficient transactions. In moving some of the data stored in each transaction outside of the main blockchain, more data can be processed per block, increasing the overall throughput of the network.

The SegWit upgrade also reduces the size of each transaction, making it more space-efficient. This enables more transactions to be stored in each block, further increasing throughput. Finally, SegWit includes a new signature algorithm that is more secure and less susceptible to fraud. This makes it easier for businesses and individuals to use Bitcoin without having to worry about losing their funds to fraudsters.

Who developed the Bitcoin Taproot upgrade?

The Taproot upgrade was first proposed in January 2018 in a paper by the Bitcoin developer Gregory Maxwell.

Nevertheless, it was not until 2021 that the Taproot upgrade went live after the code was authored by Pieter Wuille (cryptography and Bitcoin R&D expert at Chaincode Labs), Jonas Nick (Bitcoin researcher at Blockstream), and Anthony Towns (Bitcoin Core Developer at Paradigm).

But if you know anything about the blockchain, it’s that the ledger is immutable and “code is law”. So how is it that the Bitcoin network was upgraded in the first place?

Understanding forks

No code written by humans is ever perfect at the first attempt, far less the code of a new currency that was created by an anonymous entity as a means to radically disrupt the entire world's financial system.

But the distributed ledger used by blockchains is immutable. So, how can it be improved to meet the new needs of its users?

The way Bitcoin and most other cryptocurrencies solve this is by implementing what’s called a "fork".

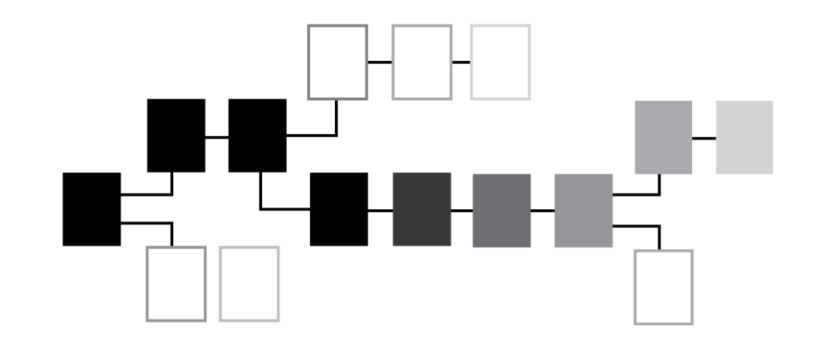

A fork is basically when the codebase of a cryptocurrency is split into two different versions, with each version having its own blockchain. Forks can either be hard or soft.

A hard fork is when the two versions of the codebase are not compatible with each other, which means that the two different versions of the blockchain cannot be used together.

A soft fork, on the other hand, is when the two versions of the codebase are compatible with each other, which means that both versions of the blockchain can be used together. Maxwell proposed the Taproot upgrade as a soft fork at the consensus layer of Bitcoin.

For Bitcoin, one of the main differences between a hard fork and a soft fork is that a hard fork requires miners to upgrade their Bitcoin software to the new version of Bitcoin in order for them to continue mining Bitcoin and receive rewards. Bitcoin Cash is an example of a hard fork from Bitcoin.

In the case of a soft fork, however, miners can continue to mine Bitcoin without upgrading their software or performing any internal changes. Soft forks are much easier and frictionless to implement. Nevertheless, the changes must be in accordance with the current block structure.

What is the goal of the Bitcoin Taproot upgrade?

Bitcoin’s scalability is currently constrained by the fact that every user on the network needs to download a full copy of the blockchain. This creates a significant barrier to mass adoption and makes Bitcoin a less viable payment method for daily transactions.

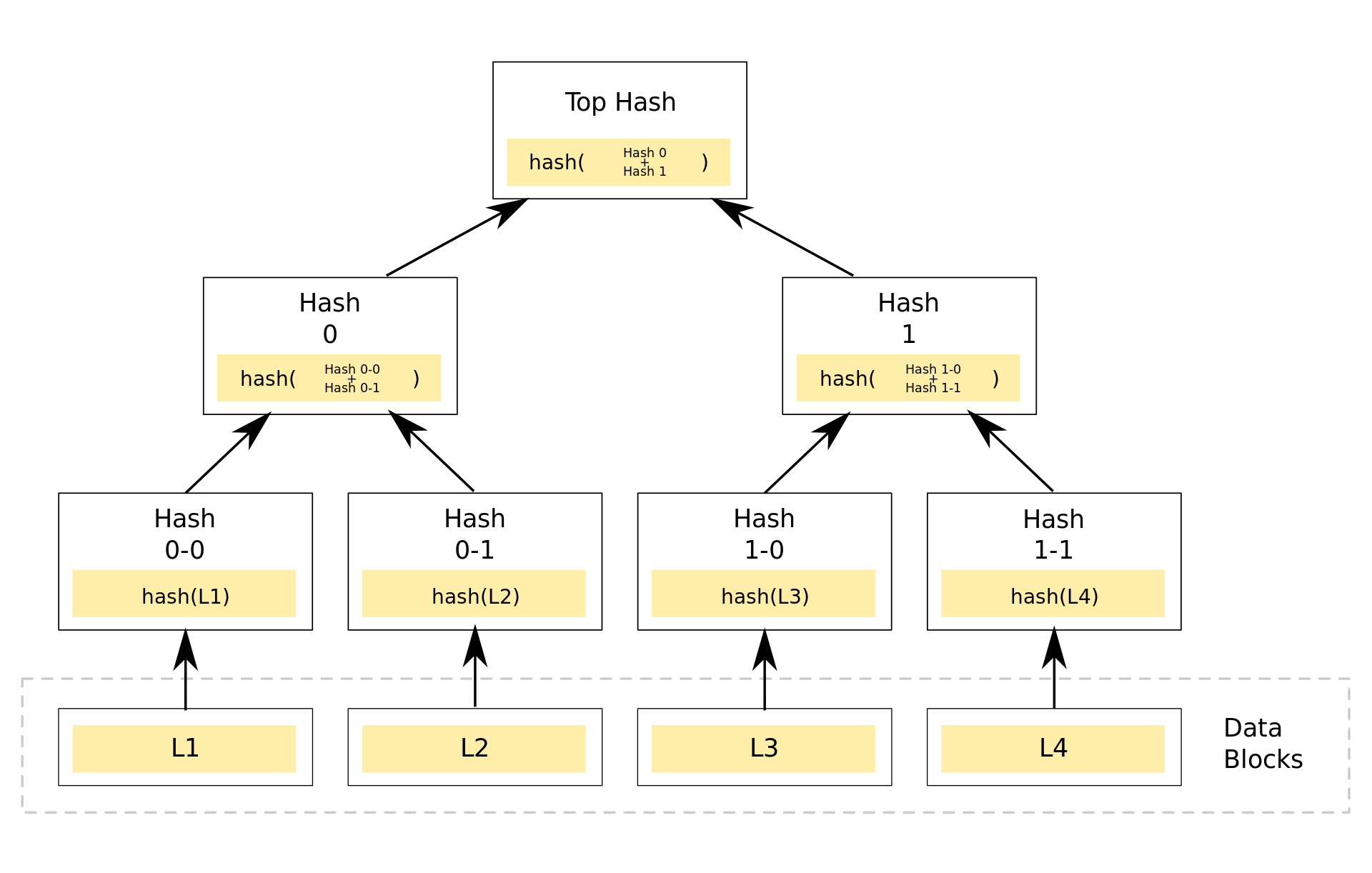

The Bitcoin Taproot upgrade has several goals. But the primary goal is to improve Bitcoin's privacy and make it more scalable by allowing multiple parties to sign a single transaction using what is known as a "Merkelized Alternative Script Tree (MAST)" or "Merkle tree".

A Merkle tree is a data structure that allows for the efficient verification of large amounts of data.

In the context of Bitcoin, a Merkle tree is used to verify all the transactions in a block. This has the effect of reducing the size of Bitcoin transactions and making them more private.

In essence, the Taproot solution is aimed at reducing the space required to store the blockchain and speeding up transaction confirmation times. It also enables smart contracts on the Bitcoin network, which will make it a more versatile network with limitless utility.

Additionally, the Taproot upgrade also introduces a new signature scheme known as "Schnorr signatures".

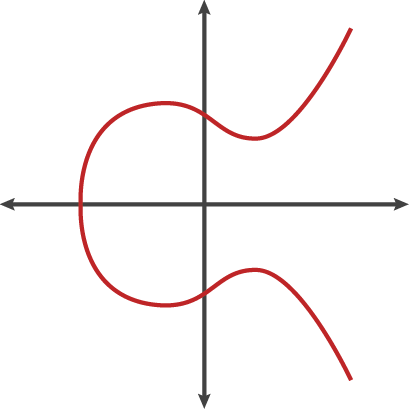

Schnorr signatures are a type of digital signature that is more efficient and private than the current Elliptic Curve Digital Signature Algorithm (ECDSA) used by Bitcoin.

How does the Taproot upgrade benefit Bitcoin?

In reality, the Bitcoin Taproot upgrade is not one, but three different updates stemming from the Bitcoin Improvement Proposals BIP 340, BIP 341, and BIP 342.

Together, these three BIPs make up what is known as "Taproot".

BIP 340, also known as "Schnorr for Bitcoin", introduces the new Schnorr signature scheme. Schnorr signatures are more efficient than Bitcoin's current Elliptic Curve Digital Signature Algorithm (ECDSA) and offer better privacy.

BIP 341 enables Bitcoin users to create smart contracts. This is possible because Taproot allows multiple parties to sign a single transaction using a Merkle tree.

While the Taproot upgrade is not the one to bring smart contract capability to the Bitcoin network, it definitely made it more practical to implement by scaling the network.

BIP 342, also known as "Tapscripts", is an update to Bitcoin's scripting system.

With these updates, the Taproot upgrade benefits Bitcoin in the following ways:

Increased Privacy

Since the Taproot upgrade makes use of Schnorr signatures and Merkle trees, Bitcoin security gets a boost in privacy and efficiency. In essence, Bitcoin transactions are more difficult to trace than ever, thus providing more opportunities to be anonymous.

Since multiple signatures are also batched together, it will be more difficult for third parties to know which Bitcoin addresses are participating in a particular multisig transaction.

Improved Scalability

The BiItcoin network has a block time of about 10 minutes and legacy blocks have a maximum capacity of 1MB. This limits the number of transactions to about 2,700 per block and a TPS of just four to five.

With the SegWit update, block space was extended to 4MB by segregating the witness data. Further, with the Taproot upgrade's Schnorr signatures, more transactions can be accommodated within the same block by aggregating them and speeding up transaction confirmation times.

This will also help reduce Bitcoin's carbon footprint and the gas fees needed to be paid: two crucial improvements for a Proof of Work (PoW) network like Bitcoin.

Enterprise-friendly

For enterprises to handle their treasury, the access should be distributed among multiple entities. An individual should not be able to authorize transactions from the treasure without the consent of the majority.

Multisig capability addressed this limitation to an extent by allowing multiple individuals to sign a transaction. However, it was not private as every individual's Bitcoin address was visible on the blockchain. Furthermore, the gas fees had to be paid for each signatory's transaction.

With the Taproot upgrade, Bitcoin addresses can be hidden and multiple signature aggregation reduces the gas fees.

The update also paves the way for the emergence of more Bitcoin-based decentralized autonomous organizations (DAOs).

Space efficiency

Since blocks have a relatively low storage space, Bitcoin needs a solution to fit more transactions in the same block to compete with higher throughput networks like Ethereum.

Schnorr signatures play a crucial role in this by not only aggregating the signatures as mentioned earlier, but each signature also has a smaller footprint.

For perspective, ECDSA signatures are about 72 bytes while Schnorr signatures are approximately 65 bytes. That is a difference of about 9% for a single signature.

Bitcoin Taproot smart contracts

Bitcoin is the first-ever cryptocurrency and was intended by Satoshi Nakamoto to serve as a medium of exchange of value in a decentralized and peer-to-peer manner.

When it was introduced, however, it served merely as unit of exchange and had no solution in place for other financial activities like borrowing, lending, escrow, etc.

But with the Taproot upgrade, Bitcoin allows different smart contract transactions to appear on the blockchain.

This allows for the development of Bitcoin-based applications (dApps) that could serve a myriad of purposes.

Since Bitcoin's code does not technically facilitate smart contracts, however, this implementation is done in a way that essentially masks smart contract transactions as regular transactions.

Bitcoin Taproot upgrade and Lightning Network

Lightning Network (LN) is Bitcoin's Layer 2 solution for faster and scalable payments. It uses a network of bi-directional payment channels between two or more parties to make microtransactions without on-chain settlement.

In simple terms, it allows users to transact with each other without waiting for slow Bitcoin block confirmations. This not only reduces the time taken for a transaction but also eliminates the need to pay higher gas fees.

Further, Lightning Network supports smart contracts known as atomic swaps, which allow for the exchange of one cryptocurrency for another without a third party.

The Bitcoin Taproot upgrade further helps in the adoption and use of LN as it makes certain smart contract operations like multi-party channel payments indistinguishable from regular Bitcoin transactions. This makes the LN more user-friendly and reduces the risk of counterparty default.

The Bitcoin Taproot upgrade paves the way for the development of Bitcoin-based applications (dApps) that serve a myriad of purposes. Nevertheless, its full potential can only be realized when used in conjunction with Lightning Network.

Furthermore, without the Taproot upgrade, on-chain settlements of the Lightning Network would cause monumental congestion in the network since they could not have been batched or aggregated. Consequently, Bitcoin Taproot is not just an upgrade but a prerequisite for the adoption and use of LN.

What does the Bitcoin Taproot upgrade mean for BTC investors?

The Bitcoin Taproot upgrade is a dream come true for avid Bitcoin investors as this soft fork not only helps to scale Bitcoin but also makes the network more private and enterprise-friendly.

The upgrade should vastly increase the functionality of the Bitcoin network and make it a more versatile and useful cryptocurrency. This could increase the demand for Bitcoin.

Looking at the long-term trend of increasing adoption, it is evident that there is a growing interest in the cryptocurrency market. This, coupled with the increasing need for a decentralized and autonomous financial system without a central authority, means Bitcoin may see a rise in adoption and use.

Further, institutions will be able to better incorporate Bitcoin into their treasury operations, which could attract institutional investors and cause a subsequent impact to demand.

What's next for Bitcoin?

While it will take time for the full effects of the Taproot upgrade to be realized, it’s expected to be a game-changer for Bitcoin and cryptocurrency markets. The Taproot upgrade could help Bitcoin scale its way towards becoming a global reserve currency and further increase its adoption.

All in all, the Bitcoin Taproot upgrade is expected to bring a number of benefits to the Bitcoin network, including helping Bitcoin scale, making it more private and enterprise-friendly, and increasing its adoption. Only time will tell how all of this will play out.

Did you know? You can pay with Bitcoin

Where to buy Bitcoin

You can buy Bitcoin (BTC) via MoonPay or through any of our partner wallet applications with a credit card, bank transfer, Apple Pay, Google Pay, and many other payment methods.

Just enter the amount of BTC you wish to purchase and follow the steps to complete your order.

How to sell Bitcoin

MoonPay makes it easy to sell Bitcoin when you decide it's time to cash out your crypto.

Simply enter the amount of BTC you'd like to sell and enter the details where you want to receive your funds.

.png)