Even if you lived under a rock, you'd know that Bitcoin and Ethereum stand out as two of the most prominent players in the cryptocurrency ecosystem today.

Although Bitcoin arrived well before Ethereum, both cryptocurrencies have each helped revolutionize digital finance via blockchain technology. At the same time, both BTC and ETH possess distinct characteristics and serve unique purposes within the broader crypto market.

Bitcoin has long been the leading cryptocurrency, offering an alternative to the uncertainties in the traditional financial system. In recent years, it has garnered significant attention from institutional investors and serves as a benchmark for all cryptocurrencies, influencing trends such as price volatility and market cap.

Ethereum, on the other hand, facilitates a wide range of decentralized applications (dApps), including decentralized finance (DeFi), non-fungible tokens (NFTs), and more. Its programmable nature has sparked innovation and enabled the creation of diverse blockchain-based solutions.

In this guide we examine the key differences between Bitcoin vs Ethereum, exploring their histories, technologies, evolutions, use cases, and more.

History of Bitcoin and Ethereum

To understand the present-day dynamics of Bitcoin and Ethereum, let's go back to when each began, examining the pivotal moments that have shaped their trajectories.

Bitcoin origins, evolution, and milestones

Bitcoin's journey has been marked by numerous milestones that trace the evolution of Bitcoin from its conceptualization to its current status as a globally recognized digital asset. Here are a few notable events:

(2008) Bitcoin Whitepaper: Satoshi Nakamoto, the pseudonymous creator of Bitcoin, publishes the seminal whitepaper titled "Bitcoin: A Peer-to-Peer Electronic Cash System." This revolutionary document outlined the concept and principles behind Bitcoin as a digital currency, aiming to disrupt traditional financial institutions by enabling borderless, censorship-resistant transactions.

(2009) Genesis Block: The first block, known as the Genesis Block, is mined by Satoshi Nakamoto, marking the launch of the Bitcoin network.

(2010) First Bitcoin Transaction: Laszlo Hanyecz makes the first real-world transaction using Bitcoin, purchasing two pizzas for 10,000 BTC. Hanyecz's purchase would later become legendary as one of the most expensive pizzas in history, worth hundreds of millions of dollars today.

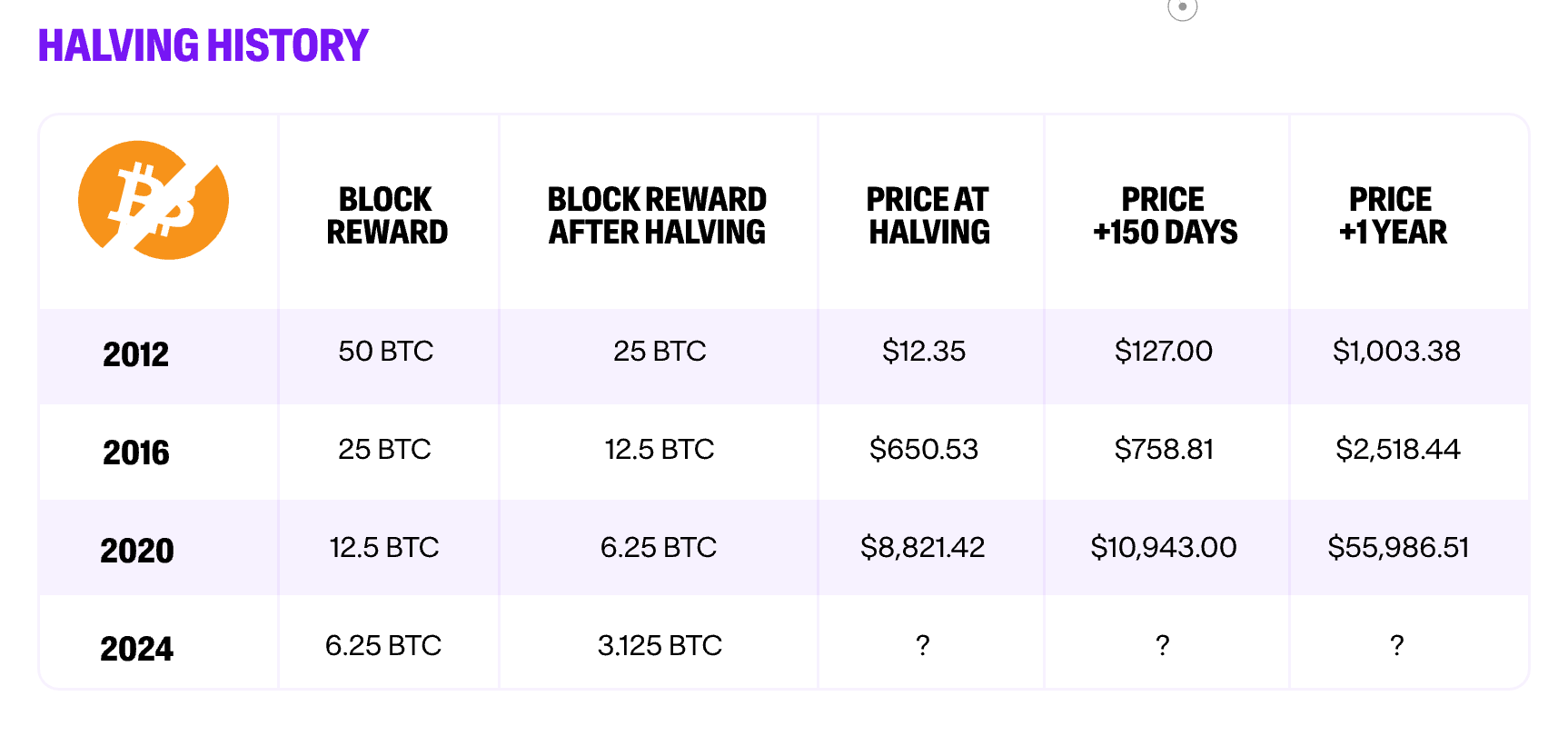

(2012) Bitcoin Halving Events: Bitcoin undergoes its first halving event, reducing the block reward from 50 BTC to 25 BTC. Subsequent halvings occur approximately every four years (2016, 2020), reducing the block reward by half each time, with the latest halving occurring recently in 2024.

(2017) Bitcoin Scaling Debate: A contentious debate within the Bitcoin community arises regarding the scalability of the network, leading to a hard fork and the creation of a new cryptocurrency: Bitcoin Cash (BCH).

(2020-2021) Institutional Adoption: Institutional investors and corporations, including MicroStrategy, Tesla, and Square, allocate large sums of money to Bitcoin, signaling growing acceptance of the cryptocurrency as a potentially legitimate asset class.

(2021) Taproot Upgrade: The Taproot upgrade is activated, introducing improvements to Bitcoin's privacy and scalability. Through the implementation of Schnorr signatures and Taproot smart contracts, this upgrade allows multiple signatures to be combined, enabling more complex smart contracts while keeping transactions simple and secure.

(2023) Bitcoin Ordinals NFTs: The creation of Bitcoin Ordinals NFTs introduces uniqueness to specific Bitcoin blocks or transactions, allowing them to be tokenized as distinct digital assets. This innovation merges Bitcoin's blockchain with the world of non-fungible tokens, enabling collectors to own and trade individual pieces of Bitcoin's history.

Ethereum origins, evolution, and milestones

Ethereum originated from Vitalik Buterin's vision to create a more versatile blockchain platform that expanded upon the simple transactions introduced by Bitcoin. Here are some of its notable achievements:

(2013) Ethereum Whitepaper: Vitalik Buterin publishes the Ethereum whitepaper, outlining the vision for a decentralized platform enabling smart contracts and decentralized applications (dApps) to be built and executed.

(2015) Frontier Release: The Ethereum network launches its initial live version, called "Frontier," allowing developers to begin building and deploying decentralized applications.

(2016) DAO Hack and Hard Fork: The Decentralized Autonomous Organization (DAO), a venture capital fund built on Ethereum, is hacked, resulting in the loss of approximately $50 million worth of Ether (ETH). In response, the Ethereum community conducts a controversial hard fork to reverse the transactions associated with the hack, leading to the split of Ethereum and Ethereum Classic.

(2017) Ethereum Byzantium Upgrade: The Byzantium hard fork is implemented as part of Ethereum's Metropolis upgrade, introducing several improvements to the network's security, scalability, and privacy features.

(2017) Enterprise Ethereum Alliance: The Enterprise Ethereum Alliance (EEA) is formed, bringing together corporations, startups, and technology vendors to collaborate on developing enterprise-grade solutions using Ethereum's blockchain technology.

(2020) Ethereum 2.0 Beacon Chain Launch: The Ethereum 2.0 Beacon Chain, the first phase of Ethereum's transition to a Proof-of-Stake (PoS) consensus mechanism, goes live, laying the groundwork for scalability and sustainability improvements.

(2021) London Hard Fork and EIP-1559: The London hard fork is implemented, introducing Ethereum Improvement Proposal (EIP) 1559, which changes the gas fee mechanism and introduces a deflationary mechanism by burning a portion of transaction fees, aiming to improve the user experience and reduce gas fees.

(2022) Ethereum Merge: Ethereum's transition (known as the Merge) from Proof-of-Work to Proof-of-Stake is complete. By replacing mining with staking, this transition aims to boost Ethereum's scalability, security, and sustainability by reducing energy usage and increasing transaction capacity.

Core technology and architecture: Proof-of-Work vs Proof-of-Stake

At the heart of Bitcoin and Ethereum lie distinct technological architectures, with Bitcoin relying on Proof of Work (PoW) and Ethereum having undergone a transition to Proof of Stake (PoS).

Bitcoin's consensus mechanism

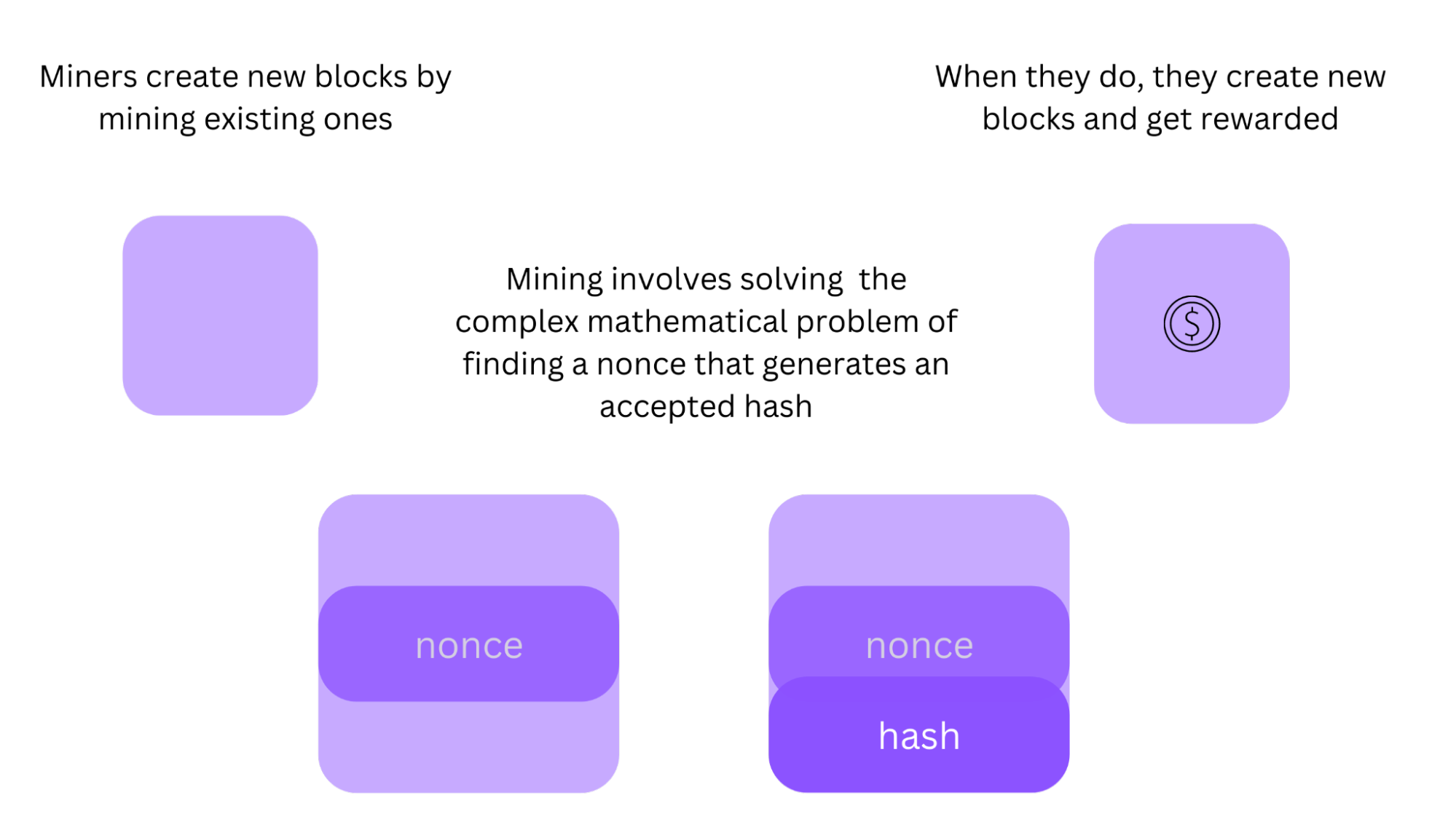

Bitcoin operates on a Proof-of-Work (PoW) consensus mechanism, a foundational aspect of its blockchain network.

In PoW, miners dedicate computational power to solving complex mathematical puzzles, a process known as mining. Through mining, new bitcoins are minted, transactions are validated, and the integrity of the network is maintained. This robust security model has been instrumental in establishing Bitcoin as one of the most reliable and trustless decentralized systems.

However, the PoW mechanism has its drawbacks. Notably, its energy-intensive nature has sparked debates about sustainability and scalability. The extensive computational power required for mining consumes significant amounts of electricity, leading to environmental concerns.

Additionally, as the network grows, the competition among miners intensifies, resulting in higher computational demands and potentially hindering scalability while increasing centralization.

Ethereum's transition between consensus mechanisms

For much of its existence, Ethereum operated under the same Proof-of-Work (PoW) consensus method as Bitcoin. However, in September 2022, Ethereum underwent a significant evolution with the completion of its highly anticipated transition to Proof-of-Stake (PoS).

.jpg)

This momentous event, often referred to as the Ethereum Merge, marked a fundamental shift in how the Ethereum network achieves consensus and validates transactions. The Merge was a meticulously orchestrated effort aimed at tackling two key challenges that had long plagued the platform: scalability and environmental sustainability.

In PoS, the traditional role of miners is replaced by validators, who are selected to create new blocks and validate transactions based on the amount of cryptocurrency they hold and are willing to "stake" as collateral. Validators are chosen through a process that typically involves a combination of random selection and the proportion of their staked assets, rather than the resource-intensive competition seen in PoW mining.

Although the Merge has yet to truly solve the issue of expensive transaction (gas) fees, it has made a considerable dent in the network’s environmental impact. Some metrics show that Ethereum has reduced its carbon footprint by up to 99.9% post-Merge.

.png)

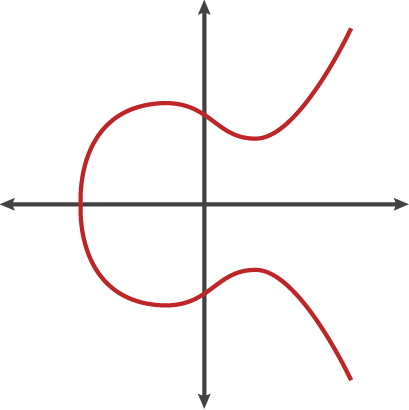

Ethereum smart contracts

Throughout its evolution, one distinct feature consistently native to Ethereum is its support for smart contracts. By choosing to use Ethereum, individuals can create self-executing contracts with predefined conditions and actions. This foundational feature serves as the backbone for a wide range of decentralized applications and protocols that thrive on the Ethereum blockchain.

Monetary policy and supply

Bitcoin (BTC) and Ethereum (ETH) diverge not only in their technological underpinnings but also in their monetary policies and supply dynamics:

Bitcoin: Deflationary fixed supply

The Bitcoin supply is capped at a hard limit of 21 million BTC, a feature that plays a crucial role in its deflationary nature by restricting the supply and preventing inflation.

Bitcoin's halving events occur roughly every four years and involve a reduction in the reward given to miners for validating transactions. This mechanism, encoded into the Bitcoin protocol, serves to slow down the rate at which new BTC tokens are issued, ultimately contributing to the asset's scarcity.

Through these halving events, the last Bitcoin is expected to be mined in the year 2140.

Ethereum: Uncapped supply

Ethereum's monetary policy, on the other hand, is less rigid and with no fixed supply cap.

However, the implementation of EIP-1559 introduced a novel mechanism to burn a portion of transaction fees, effectively removing Ether from circulation with each transaction.

So while Ethereum's supply is not fixed, the burning of transaction fees under EIP-1559 creates a deflationary pressure, potentially reducing the overall supply over time and influencing inflation rates.

Use cases and real world applications

Bitcoin and Ethereum serve as cornerstones of the cryptocurrency ecosystem, yet their utility extends beyond mere digital assets and financial transactions.

Bitcoin use cases

Bitcoin's limited supply and deflationary nature position it as a potential digital alternative to gold. Instead of spending, many users choose to "HODL" BTC for the long term.

Bitcoin (BTC) is frequently used for peer-to-peer payments and cross-border remittances due to its borderless functionality and ability to facilitate fast, secure, and low-cost transactions without the need for third party intermediaries.

Ethereum applications

Ethereum's programmability enables the creation of diverse decentralized applications (dApps) spanning finance, gaming, social media, governance, decentralized autonomous organizations (DAOs), and more. Its versatility and interoperability have fueled the growth of the DeFi ecosystem and NFT marketplaces not just on the Ethereum platform, but many other blockchains too.

Programming languages

Behind every line of code lies the potential to shape the future of decentralized finance and blockchain technology.

Bitcoin: Script

Bitcoin's scripting language is called Script. It allows for basic programmability, enabling functionalities like multisignature transactions and time-locked addresses. However, its scripting capabilities are limited compared to Ethereum.

Ethereum: Solidity

Ethereum's primary smart contract language, Solidity, enables developers to write complex smart contracts and decentralized applications (dApps). There are also alternative languages like Vyper that offer different approaches to smart contract development.

Scalability and transaction throughput

As the demand for decentralized transactions continues to soar, scalability and speed remain pressing challenges for both Bitcoin and Ethereum:

Bitcoin scaling

Bitcoin's block size limit and Proof-of-Work consensus mechanism impose constraints on transaction throughput, resulting in limited scalability and occasional network congestion. This Bitcoin scaling question is ultimately what led to the creation of the Bitcoin Lightning Network, as well as the hard fork that spurred the development of Bitcoin Cash (BCH) as a cryptocurrency suited for daily use and microtransactions.

Ethereum scaling

Ethereum's scalability issue has spurred the development of Layer-2 scaling solutions and rollups like Optimism, Arbitrum, zkSync, and Polygon. Additionally, continuous updates in the Ethereum Merge like the most recent Dencun upgrade are helping to scale the Ethereum network via proto-danksharding (EIP-4844).

Governance and community

The decentralized nature of Bitcoin (BTC) and Ethereum (ETH) allows them to evolve past their technological frameworks. Each cryptocurrency has developed vibrant communities and governance models that reflect their resilience and adaptability.

Bitcoin governance

Bitcoin's development process is decentralized, with contributions from a diverse group of developers and community members. Changes to the protocol require broad consensus among stakeholders, ensuring the network's stability and resilience.

Ethereum governance

Ethereum's governance model incorporates a formalized proposal process through Ethereum Improvement Proposals (EIPs), where stakeholders can propose and discuss protocol changes. Decisions are made through rough consensus among developers, miners, and users.

Community matters

While core developers play a crucial role in maintaining and evolving both Ethereum and Bitcoin protocols, community participation and feedback from users also help shape the direction of future development and governance decisions.

Security and network resilience

Security lies at the heart of trust in the cryptocurrency ecosystem, and is necessary to encourage widespread adoption of blockchain technology.

Bitcoin security

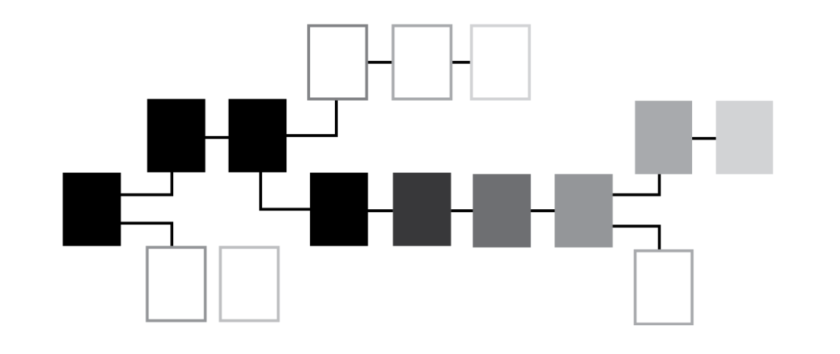

Bitcoin's security relies on the cumulative computational power of miners, with the longest valid chain considered the canonical version of the blockchain. Although it may be detrimental to the environment, Bitcoin’s robust hash power provides protection against attacks and ensures network integrity.

Ethereum security

Ethereum's merge to Proof-of-Stake aims to enhance security and energy efficiency by replacing energy-intensive mining with staking. Added measures like slashing penalties help deter validators from engaging in malicious behavior and safeguard the network against attacks.

Network security

Both Bitcoin and Ethereum face various security threats, including 51% attacks, double spending, and smart contract vulnerabilities. Continuous auditing and community vigilance are essential to mitigate these risks and help ensure greater network resilience.

Regulatory considerations

In an ever-evolving regulatory landscape, Bitcoin, Ethereum, and every other cryptocurrency have had to navigate legal considerations and compliance requirements.

Bitcoin regulation

Bitcoin's regulatory status as a digital asset varies worldwide, with some countries like El Salvador recognizing it as legal tender and a legitimate form of payment, while others like China have imposed restrictions or bans on mining or trading Bitcoin and other cryptocurrency.

Ethereum regulation

Ethereum's native token, Ether (ETH), has faced scrutiny from regulators regarding its potential classification as a security. Regulatory compliance measures, such as KYC/AML requirements for token issuers and decentralized exchanges, aim to address these concerns.

Future developments

Regulatory developments can significantly impact the adoption and perception of both Bitcoin and Ethereum, influencing investor sentiment, market liquidity, and the development of blockchain-based applications. Users should monitor their own country's regulations to stay informed of the latest local regulatory developments.

Market adoption and price history

From early adopters to institutional investment to mainstream adoption, the market landscape for Bitcoin and Ethereum continues to change rapidly. Along the way, price volatility has been a hallmark for Bitcoin, Ethereum, and the entire cryptocurrency market, driven by factors such as market demand, adoption, and macroeconomic trends.

Let's take a look at how market adoption and price movements have evolved over time.

Bitcoin price history

As the leading cryptocurrency, both the Bitcoin price and market capitalization have seen remarkable performance since its inception.

Starting from humble beginnings in 2008 with negligible value (approximately $0.00001 per token), Bitcoin experienced significant price fluctuations in its early years. However, as it gained mainstream attention and adoption over time, the BTC price increased accordingly.

Notable milestones include reaching parity with the US dollar in 2011, surpassing $1,000 for the first time in 2013, and reaching an all-time high (ATH) near $20,000 in December 2017—though its most recent ATH surpassed $73,750 in March 2024.

Despite subsequent corrections and periods of volatility, Bitcoin has maintained its position as the leading cryptocurrency by price and market cap, dominating the rest of the market. And although there have been skeptics along the way, Bitcoin has continued to attract investment from users and institutions seeking a store of value and hedge against inflation. However, it cannot be confirmed that Bitcoin indeed serves as a suitable vehicle for either.

Ethereum price history

As the second-largest cryptocurrency by market capitalization, the Ethereum price has also experienced significant movement since its launch.

Initially released in 2015, Ethereum's native cryptocurrency, Ether, saw relatively modest price movements in its early years. However, with the explosive growth of decentralized finance (DeFi) and non-fungible tokens (NFTs) built on the Ethereum blockchain, the ETH price surged between 2020 and 2021.

Notable price milestones include surpassing $1,000 in 2018, reaching an all-time high above $4,000 in May 2021, and an even greater ATH of $4,891 in November of that same year.

Like Bitcoin, the Ethereum ecosystem has evolved and expanded in the decade of its existence. Over time, Ethereum has started to see significant interest from crypto enthusiasts, developers, and institutional investors, who may even hold more ETH than BTC.

The emergence of Spot Bitcoin ETFs

The approval of Bitcoin exchange-traded funds (ETFs) in some jurisdictions marks a major milestone in providing traditional investors with regulated exposure to Bitcoin's price movements. Spot Bitcoin ETFs, which hold BTC itself rather than futures contracts, have received approval from the Securities and Exchange Commission (SEC) for trading on major U.S. exchanges.

This development underscores the growing institutional interest in cryptocurrencies like Bitcoin. The emergence of regulated financial products that facilitate investment in this asset class could be a positive sign to potentially increase the mainstream adoption of Bitcoin and other digital currency.

Bitcoin vs Ethereum at a glance

We can use a table to summarize the main points of interest that separate Bitcoin vs Ethereum:

Aspect | Bitcoin (BTC) | Ethereum (ETH) |

Launch Year | 2009 | 2015 |

Primary Use Case | Digital payments, HODLing | Decentralized Applications (DApps), Smart Contracts, Non-Fungible Tokens (NFTs) |

Founder | Satoshi Nakamoto | Vitalik Buterin |

Consensus Mechanism | Proof-of-Work (PoW) | Transition from Proof-of-Work to Proof-of-Stake (PoS) via Ethereum 2.0 |

Max Supply | 21 million | Uncapped |

Monetary Policy | Deflationary, Halving Events | Dynamic, EIP-1559 (Burn Mechanism) |

Smart Contract Capability | Limited | Extensive |

Primary Programming Language | Script | Solidity (with support for other languages) |

Scalability Solutions | Layer 2 Solutions | Ethereum 2.0, Sharding, Layer 2 Solutions |

Community Governance | Decentralized | Ethereum Improvement Proposals (EIPs), Rough Consensus |

Security Mechanism | Hash Power | Proof of Stake (PoS), Slashing Penalties |

How to buy Bitcoin and Ethereum

Now that you have a solid understanding of Bitcoin vs Ethereum, you may be looking to acquire them for yourself.

You can buy Bitcoin (BTC) and Ethereum (ETH) via MoonPay or through any of our partner wallet applications with a credit card, bank transfer, Apple Pay, Google Pay, and many other payment methods. Just enter the amount of BTC or ETH you wish to purchase and follow the steps to complete your order.

Users can also top up in euros, pounds, or dollars and use MoonPay Balance to buy cryptocurrencies like BTC and ETH. Once funded, use your balance for faster, cheaper transactions and higher approval rates. When you're ready to withdraw, enjoy zero-fee transfers straight to your bank account.

How to sell BTC and ETH

MoonPay also makes it easy to sell Bitcoin and Ethereum when you decide it's time to cash out your crypto.

Simply enter the amount of ETH or BTC to sell in the MoonPay widget and enter the details where you want to receive your funds.

.png?w=3840&q=90)

.png?w=3840&q=90)

.png?w=3840&q=90)