What is tokenomics? A guide to crypto economics

Learn what tokenomics is, and how it can affect a crypto token in areas like utility, inflation, token distribution and supply and demand.

By Corey Barchat

For any potential blockchain project to succeed, it needs a strong foundation. A competent core development team, viable use cases, and resilient security features are but a few of the factors that can determine a cryptocurrency's success.

One key component often overlooked is a project's tokenomics. A strong tokenomic model is fundamental to areas like aligning stakeholder incentives, creating value, predicting market dynamics, and facilitating community participation.

But what is it exactly, and how does it function in a crypto economy?

This article examines what tokenomics is and how it works, as well as the core components, mechanisms, and types of crypto tokens.

What is tokenomics?

Tokenomics refers to the economic principles governing the creation, distribution, and utilization of tokens within a blockchain network. It plays a pivotal role in shaping the success and sustainability of a cryptocurrency by influencing factors like supply, demand, and market cap, and token price.

As you can probably guess, the name "tokenomics" comes from an amalgamation of "token" and "economics." Just like how traditional economics can examine how a system utilizes resources efficiently, token economics determine a token's supply and demand, how value is assigned and maintained, and how participants are incentivized to engage within the network.

You can think of tokenomics like the blueprint that outlines the economic logic of a blockchain project. And as a blueprint, details can often be found within a cryptocurrency's whitepaper, which contains the foundation and justifies the purpose of a blockchain initiative.

Components of Tokenomics

Tokenomics encompasses various components that collectively determine the economic model and sustainability of a cryptocurrency or token within a blockchain ecosystem:

Token supply & distribution

Total supply

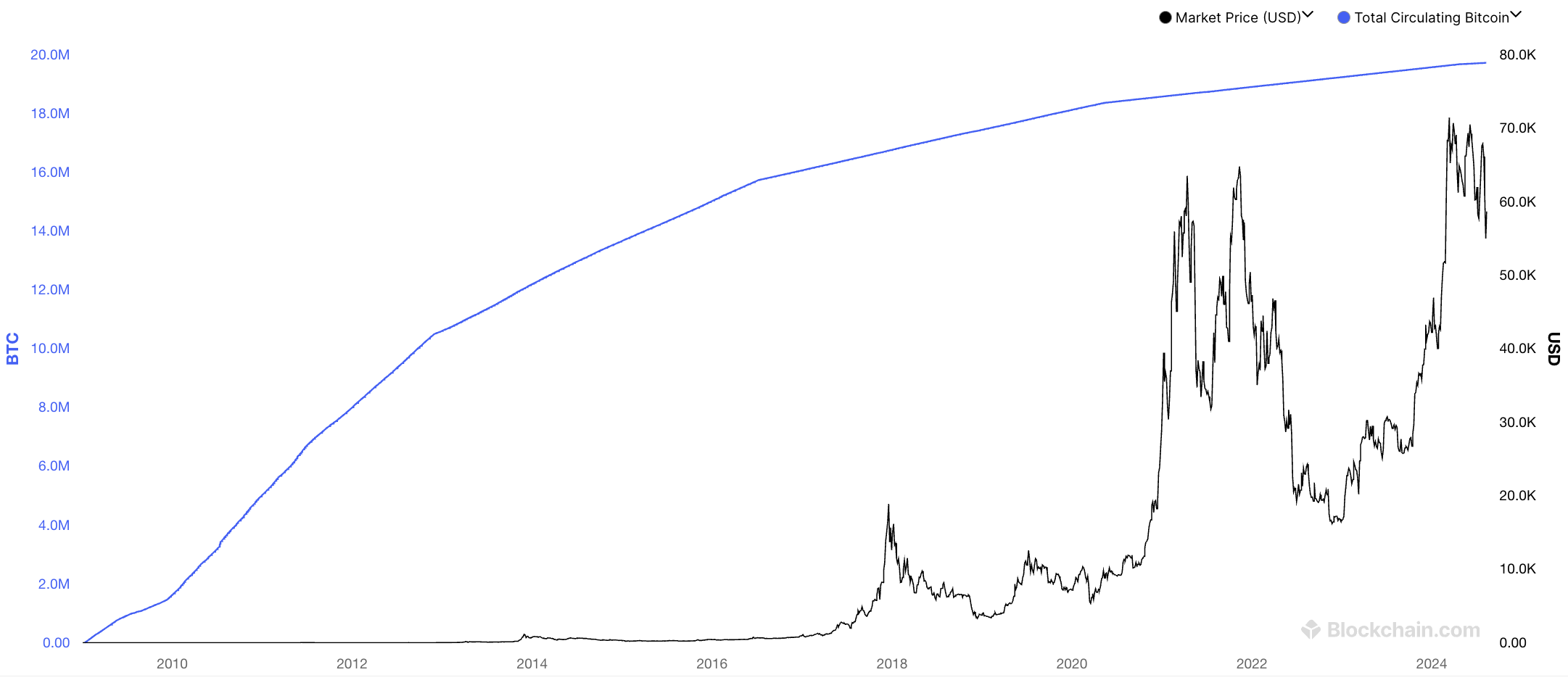

Total supply refers to the maximum number of tokens that will ever be created for a particular cryptocurrency. This is typically predetermined by the protocol's code and cannot be altered once established. For example, Bitcoin has a fixed supply of 21 million coins, which contributes to its perception as a deflationary digital asset.

Circulating supply

Circulating supply is the number of tokens that are currently available and actively being traded in the market. This figure excludes tokens that are locked, burned, reserved, or otherwise unavailable for trading. A token's circulating supply is a key metric for determining liquidity and market cap (market capitalization), which is calculated by multiplying the circulating supply by the current market price of the token.

Token allocation

Token allocation describes how the total supply is distributed among various stakeholders, including founders, early investors, and the community. The distribution of token allocations can impact the decentralization and perceived fairness of the project, especially if it is skewed heavily in favor towards one party.

Token utility and functionality

Token use cases

Robust token models mean nothing unless the cryptocurrency has viable use cases:

- Transactional tokens: Used as a medium of exchange (e.g., Bitcoin or Litecoin).

- Utility tokens: Provide access to specific services or functionalities within a platform (e.g., Basic Attention Token).

- Governance tokens: Grant holders voting rights to influence protocol decisions (e.g., UNI, COMP, AAVE).

Incentives for token holders

Incentive structures are designed to encourage users to hold and utilize the token:

- Staking rewards: Token holders can stake to earn rewards by locking their tokens in the network to support operations like transaction validation.

- Airdrops: Free distribution of tokens to existing holders as a reward or promotional tool.

- Exclusive access: Providing token holders with access to certain features, services, or events within the ecosystem.

Token demand drivers

Factors influencing token demand

Several factors can influence the demand for a token, including:

- Utility and functionality: Practical and diverse use cases with real-world utility.

- Market perception: Positive market sentiment and a strong reputation.

- Technological advancements: Innovations and upgrades that enhance the token's usability or security.

- Strategic partnerships: Key collaborations with established companies and entities.

While these factors can be useful indicators for market adoption and growth, they are not guaranteed to result in a price appreciation for a cryptocurrency token.

Inflation and deflation mechanisms

Minting and burning

These mechanisms are used to control the supply and manage the token's inflation rate:

- Token minting: New tokens are created to reward network participants, such as miners or stakers, and to incentivize certain behaviors.

- Token burning: Tokens are destroyed (burned) to reduce the total supply, often to counteract inflation or increase scarcity.

Impact on token value

The balance between minting and burning can directly affect a token's value. Excessive minting can lead to inflation, reducing the token's purchasing power. On the other hand, strategic burning can create scarcity, potentially increasing its market value.

Base layer and cross-chain accessibility

The foundational blockchain on which a token operates, along with its ability to interact with other blockchains, are a few factors that can affect utility and adoption potential:

- Base layer: Determines the security, scalability, and functionality of a token. Popular base layers include Ethereum, Binance Smart Chain, and Solana.

- Cross-chain accessibility: Enhances a token's usability by allowing it to be transferred and utilized across various blockchains. Interoperability solutions, such as cross-bridges and wrapped tokens, help facilitate this functionality.

Mechanisms in tokenomics

Here are some additional features that can influence a crypto project's tokenomics:

Staking and yield farming

- Staking: Involves locking tokens in the network to support operations like validating transactions. In return, users are given staking rewards for their participation.

- Yield farming: Users provide liquidity to DeFi protocols in exchange for rewards earned from transaction fees and trading activity on the platform.

Token burns and buybacks

- Token burns: Permanently remove tokens from circulation to reduce supply and increase scarcity. This can be achieved through planned periodic burns or transaction fee burns.

- Buybacks: The project team repurchases tokens from the market to reduce supply and potentially increase the token's price.

Vesting schedules

Vesting schedules outline the timeline over which tokens allocated to founders, team members, and early investors are released. A crypto project (such as a DAO) may choose to implement a vesting schedule to help prevent large quantities of tokens from flooding the market at once, reduce the risk of price volatility, and maintain long-term commitment from key stakeholders.

Rewards and incentive structures

Effective reward systems are another measure that attempts to encourage user engagement and loyalty. These can include staking rewards, airdrops, and bonuses for specific actions, such as contributing to the network's development, or participating in governance (as we will see below).

Governance and voting mechanisms

Decentralized governance allows token holders to vote on important decisions, such as protocol upgrades and changes to the economic model. Crypto projects can choose to implement governance to make sure that the community has a voice in the project's direction, while promoting a more democratic and decentralized ecosystem.

What are the different types of tokens in tokenomics?

Since blockchain technology is a relatively new breakthrough, token types and use cases are still few in number. Though there is much more to be explored in the future, here are some of the most common types that exist today:

Utility tokens

Utility tokens are designed with a specific purpose to provide access to special features or services within a blockchain ecosystem. They are not intended to be an investment or store of value, but rather as a means to facilitate usage of the platform.

Security tokens

Security tokens represent ownership or a stake in an asset, such as shares in a company, real estate, or other investment vehicles. These tokens are subject to regulatory oversight and must comply with securities laws.

Governance tokens

Governance tokens give holders the right to participate in decision-making processes of DeFi protocols such as a decentralized autonomous organization (DAO). They are used to maintain a decentralized and community-driven ecosystem, where holders with more tokens are given weighted voting power.

Stablecoins

Stablecoins are intended to maintain a fixed value by pegging to a reserve asset, such as a fiat currency like the US dollar, or a commodity like gold. They offer the benefits of blockchain technology with lower volatility typically associated with cryptocurrencies.

For further reading, check out our list of must-know stablecoins.

Non-fungible tokens (NFTs)

NFTs (non-fungible tokens) are unique digital assets that record ownership on a blockchain for distinct items, such as digital art, music, virtual real estate, or collectibles. Unlike traditional cryptocurrencies such as Bitcoin, an NFT's uniqueness (non-fungibility) means it cannot be traded one-for-one.

Real-life examples of tokenomics

The principles of tokenomics can be seen in some unique, real-world applications in various blockchain projects:

Bitcoin

Bitcoin (BTC) is the first and most well-known cryptocurrency, often referred to as digital gold. Its tokenomics are designed to create a deflationary asset with a finite supply, with an aim towards retaining long-term value.

Key elements of Bitcoin's tokenomics:

- Total supply: Fixed maximum supply of 21 million coins.

- Mining: New bitcoins are created through a process called mining, where miners solve complex cryptographic puzzles.

- Halving: The reward for mining new blocks is halved approximately every four years in an event known as "halving."

- Decentralization: Bitcoin's decentralized nature means no single entity controls its issuance or governance. Decisions are made through a consensus mechanism involving the global community of miners and nodes.

- Security: Bitcoin employs a Proof-of-Work (PoW) consensus mechanism, which requires significant computational power to validate transactions.

Ethereum

Ethereum (ETH) is a decentralized blockchain platform that enables developers to build and deploy smart contracts and decentralized applications (dApps). Its tokenomics are set up to support a wide range of use cases beyond simple transactions.

Key elements of Ethereum's tokenomics:

- Total supply and issuance: Unlike Bitcoin, Ethereum does not have a fixed total supply. Instead, it has an annual issuance rate, which is subject to change through community consensus and protocol upgrades.

- Gas Fees: Ether (ETH) is used to pay transaction fees (known as gas fees) for computational services performed on the Ethereum network.

- Transition to Proof-of-Stake (PoS): Ethereum is transitioning from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism called the Ethereum Merge. This shift to Ethereum 2.0 aims to enhance scalability, security, and energy efficiency.

- DeFi and dApps: Ethereum's vast ecosystem of decentralized applications (dApps) requires users to possess ETH or other ERC-20 tokens to interact with these DeFi protocols.

Binance Coin

Binance Coin (BNB) is the native cryptocurrency of the Binance ecosystem, which includes the Binance Exchange and Binance Smart Chain (BSC). BNB's tokenomics are designed to drive utility and adoption across the ecosystem.

Key elements of Binance Coin's tokenomics:

- Initial distribution: BNB was initially distributed through an initial coin offering (ICO) in 2017, with tokens was allocated to the founding team, early investors, and community incentives.

- Utility: BNB's use cases within the Binance ecosystem include trading fee discounts on the Binance Exchange, paying transaction fees on Binance Smart Chain, and participation on Binance Launchpad.

- Burn mechanism: Binance conducts quarterly token burns, where a portion of BNB is permanently removed from circulation.

- Staking and DeFi: BNB can be staked on Binance Smart Chain to earn rewards, or used in various DeFi applications on BSC.

Uniswap

Uniswap (UNI) is a decentralized exchange (DEX) protocol built on Ethereum that allows users to trade ERC-20 tokens directly from their wallets. Uniswap's tokenomics focus on decentralized governance and community participation.

Key elements of Uniswap's tokenomics:

- Governance token: UNI is Uniswap's governance token, allowing holders to propose and vote on changes to the protocol.

- Liquidity mining: Uniswap incentivizes users to provide liquidity to its pools, earning UNI tokens in return.

- Fee distribution: Uniswap charges a small fee on each trade, which is distributed to liquidity providers as a reward.

- Airdrops: In September 2020, Uniswap conducted an airdrop, distributing 400 UNI tokens to each user who had interacted with the protocol before a certain date.

Limitations and challenges of tokenomics

Tokenomics, while essential for the development and sustainability of blockchain ecosystems, faces several limitations that can impact the effectiveness and overall success of a crypto project:

1) Regulatory uncertainty

In the ever-evolving blockchain regulatory landscape, different countries have varied approaches to cryptocurrency regulation. This uncertainty can hinder the development and adoption of tokens as projects must navigate complex legal environments and comply with varying laws and regulations.

2) Security vulnerabilities

Smart contract vulnerabilities, hacks, exploits, and other security breaches can lead to significant financial losses and undermine trust in a project. Deploying rigorous security measures and conducting thorough audits are necessary steps, but can be resource-intensive and challenging to implement effectively.

3) Market manipulation

The relatively nascent and volatile nature of cryptocurrency markets makes them more susceptible to manipulation. Crypto whales (large holders of tokens), pump-and-dump schemes, and coordinated market activities can distort token prices and create an unstable market environment.

4) Aligning interests

Creating a sustainable tokenomic model that balances incentives, rewards, and governance is complex. Tokenomics must align the interests of various stakeholders, including developers, investors, and the community, to ensure long-term success. Poorly designed models can lead to issues such as inflation, centralization, lack of trust and engagement, or even total project failure.

5) Scalability issues

Scalability remains a major challenge for many blockchain networks. As projects grow and attract more users, the underlying infrastructure must support increased transaction volumes without compromising performance or security.

6) Environmental impacts

Some blockchain networks, particularly those using Proof-of-Work (PoW) consensus mechanisms, face criticism for their high energy consumption and negative environmental impact. These issues can affect the perception and adoption of tokens associated with such networks, prompting the need for more environmentally-friendly solutions.

7) Interoperability and compatibility

Tokens need to be interoperable with different blockchain networks to maximize their utility and reach. However, achieving seamless interoperability can be challenging due to differences in protocols, token standards, and technologies across various blockchains.

8) Market volatility

The inherent volatility of cryptocurrency markets can impact the stability and predictability of tokenomics. Rapid price fluctuations and bear markets can deter long-term investment and create uncertainty for users and developers.

How to start using tokenomics

Getting involved with tokenomics is more than just understanding the fundamentals. Users can engage by participating in open community discussions, researching crypto projects with robust tokenomic models, and actively performing decentralized processes like governance and staking.

To get started with these activities, it can help to possess cryptocurrency like a blockchain project's native token.

MoonPay makes it easy to buy some of the most common tokens like Bitcoin, Ethereum, Binance Coin, Tether, USDC, and more. Just enter the amount of crypto you wish to purchase, and pay using popular payment methods like credit/debit cards, Apple Pay, bank transfer, and more.

And when you decide it's time to cash out to fiat, you can easily sell crypto via MoonPay's simple off-ramp solution. Simply enter the amount of crypto you want to sell and enter the details where you'd like to receive your funds.