Stablecoins: The Ultimate List (22 Stablecoins to Know)

Explore 20+ must-know stablecoins, how they work, and why they’re essential for stability, trading, and DeFi in the fast-paced world of cryptocurrency.

By Corey Barchat

Crypto can be a wild ride. If you've ever traded cryptocurrency before, you've likely experienced prices that seem to swing up and down like a rollercoaster. Sometimes, you just need a safer place to park your funds. That’s where stablecoins come in.

With a total market capitalization of over $190 billion, stablecoins have quickly become a go-to tool in the digital currency world. These digital assets are designed to hold steady, giving you the stability of traditional money with the speed and convenience of cryptocurrency.

Whether you’re looking to trade without cashing out to fiat, send money across borders instantly, or dive into DeFi for lending and staking, stablecoins make it all possible. They’re fast, cheap to use, and always available when you need a break from market chaos.

But which are the most important stablecoins to know?

In this guide, we explore what makes stablecoins unique, the various types available, and the most prominent ones shaping the financial ecosystem today.

What are stablecoins?

Stablecoins are a type of cryptocurrency that attempt to maintain a steady value by being pegged to an external asset, such as the US dollar, euros, or gold. They're intended to offer a safe harbor in the often-volatile crypto market, designed to combine the stability of traditional currencies with the advantages of cryptocurrencies.

Think of stablecoins as the bridge between the unpredictable world of digital currencies and the reliability of traditional finance. They’re here to help you move money, add to your portfolio, or just keep things stable—all without ever leaving the blockchain.

Types of stablecoins

Not all stablecoins are created equal. To maintain a stable value, issuers can use different mechanisms, with a variety of backing assets. Here’s a breakdown of the four main types:

Fiat-backed stablecoins

Fiat-backed stablecoins have 1:1 backing by fiat currencies like USD, EUR, or GBP. For every unit of the stablecoin, an equivalent amount of fiat (or its equivalent) is held in reserve by the issuing company.

Advantages of fiat backed stablecoins

- Higher stability due to fiat backing.

- Easily understandable and trusted by users coming from traditional finance.

Fiat backed stablecoin risks

- Centralized, requiring trust in the issuer.

- Regulatory scrutiny and potential government interventions.

Crypto-backed stablecoins

Instead of fiat, cryptocurrency-backed stablecoins are backed by cryptocurrencies such as Ethereum or Bitcoin. They’re often overcollateralized to account for cryptocurrency price volatility.

Advantages of crypto-backed Stablecoins

- More decentralized than fiat-backed stablecoins.

- Transparent collateral via blockchain technology.

Crypto-backed stablecoin risks

- Higher risk due to crypto volatility.

- Complexity inherent in asset overcollateralization.

Algorithmic Stablecoins

Algorithmic stablecoins use algorithms and smart contracts to control supply and demand, attempting to maintain a stable value without relying on collateral.

Advantages of algorithmic stablecoins

- Fully decentralized and independent of external reserves.

- Innovative and scalable.

Algorithmic stablecoin risks

- Vulnerable to de-pegging (and even collapse) during extreme market volatility.

- Often experimental and not as widely trusted.

Commodity-backed stablecoins

Commodity-backed stablecoins are pegged to tangible commodities like gold, silver, and oil, offering a more classic hedge against inflation and market uncertainty.

Advantages of commodity-backed stablecoins

- Backed by physical assets like precious metals with intrinsic value.

- Appeals to traditional investors seeking digital stability.

Commodity-backed stablecoin risks

- Asset storage and verification can be costly and complex.

- Market fluctuations in commodity prices can affect token value.

Stablecoins to know

Here’s a list of well-known stablecoins across various categories:

1. Tether (USDT)

Tether (USDT), the first stablecoin, remains the most widely-used in the crypto space by trading volume. Pegged to the US dollar, it's commonly used to provide liquidity for trades and DeFi activities, while acting as a more stable store of value than traditional cryptocurrencies. Its widespread adoption across crypto exchanges and wallets makes it a cornerstone of the cryptocurrency market. While Tether has faced scrutiny over the years concerning its reserve transparency, it remains a popular choice for many traders and investors due to its accessibility and reliability.

- Type of backing: Fiat-backed (dollars)

- Creation date: 2014

- Market capitalization: #1 among stablecoins

2. USD Coin (USDC)

USD Coin (USDC) Initially issued by Circle and Coinbase under the Centre Consortium (now just Circle), USDC stands out for its emphasis on transparency and regulatory compliance. Backed 1:1 by U.S. dollars held in reserves audited monthly, USDC has become one of the top choices for businesses and DeFi platforms. Its strong presence in both traditional and decentralized finance makes it one of the most versatile stablecoins around.

- Type of backing: Fiat-backed (dollars)

- Creation date: 2018

- Market capitalization: #2 among stablecoins

3. PayPal USD (PYUSD)

PayPal USD (PYUSD) marks PayPal’s entry into the stablecoin market, with its token built on top of the company’s massive global payments network. Fully backed by USD reserves (and cash equivalents), PYUSD aims to bridge the gap between traditional finance and blockchain-based payments. It's designed for both retail and institutional use, with applications in remittances, e-commerce, and Web3 integrations. PYUSD's backing by an established fintech giant such as PayPal has helped to bring trust and mainstream credibility to a market that has at times been anything but stable.

- Type of backing: Fiat-backed (dollars)

- Creation date: 2023

- Market cap: Top 10

4. Binance USD (BUSD)

Binance (BUSD) is a stablecoin issued by Binance in partnership with Paxos, fully backed by USD held in FDIC-insured accounts and short-term US Treasury bills. Bolstered by its association with Paxos for its transparency and security, BUSD is widely used within Binance’s ecosystem for trading and DeFi activities (such as lending, borrowing, and providing liquidity). It also offers fast transaction speeds and minimal fees, making it a go-to choice for traders and developers on Binance.

- Type of backing: Fiat-backed (dollars)

- Creation date: 2019

- Market cap: Top 20

5. TrueUSD (TUSD)

TrueUSD (TUSD) is a stablecoin focused on transparency and regulatory compliance. Created by TrustToken, TUSD is backed by USD reserve assets held in third-party accounts and verified through daily attestations, becoming one of the first stablecoins to implement live audits. Its use extends across exchanges, lending platforms, and payment systems.

- Type of backing: Fiat-backed (dollars)

- Creation date: 2018

- Market cap: ~$3.3 billion

6. Dai (DAI)

Dai (DAI) is a decentralized stablecoin governed by MakerDAO, the decentralized autonomous organization (DAO). Unlike fiat-backed stablecoins, DAI is backed by a mix of cryptocurrencies, in an effort to remain resistant to centralization and censorship. Its algorithmic system adjusts collateral requirements to maintain its peg to the USD at a 1:1 ratio. Dai is a cornerstone of the DeFi ecosystem, powering lending, borrowing, and yield farming applications in the MakerDAO ecosystem and beyond.

- Type of backing: Crypto-backed

- Creation date: 2017

- Market cap: #3 among stablecoins

7. Ripple USD (RLUSD)

Ripple USD (RLUSD) is Ripple’s newly launched fiat-backed stablecoin, built on its issuer's robust blockchain payment network to enable low-cost and fast transfers globally. Like the XRP token on the Ripple Network, RLUSD is optimized for easy cross-border transactions, and is particularly suited for financial institutions looking to enhance remittance services while maintaining regulatory compliance.

- Type of backing: Fiat-backed (dollars)

- Creation date: 2024

- Market cap: NEW

8. sUSD (sUSD)

sUSD (sUSD) is a synthetic stablecoin created on the Synthetix platform. It is pegged to the US dollar and backed by overcollateralized cryptocurrency assets. Designed for use in the Synthetix ecosystem, sUSD allows users to trade and invest in synthetic assets like commodities and stocks without relying on traditional financial systems.

- Type of backing: Crypto-backed

- Creation date: 2018

- Market cap: Top 40

9. UST (TerraUSD) [Collapsed]

Once a top algorithmic stablecoin, UST (TerraUSD) was pegged to the U.S. dollar through the Terra blockchain’s dual-token system. Despite its innovative design, UST—now called TerraClassicUSD—faced a significant collapse in 2022, losing its peg and contributing to widespread market instability. It remains a critical example of the risks and challenges associated with algorithmic stablecoins, serving as a case study for future projects.

- Type of backing: Algorithmic

- Creation date: 2018

- Market cap: N/A (at peak: ~$18 billion before collapse)

10. Frax (FRAX)

Frax (FRAX) is a unique stablecoin with a hybrid approach to price stability. It combines partial collateralization with algorithmic mechanisms in an attempt to maintain its peg to the USD (though it has since reduced its algorithmic backing after the Terra collapse). By dynamically adjusting its collateral ratio, Frax provides scalability while reducing reliance on fully collateral reserves. It's a popular stablecoin option in DeFi ecosystems for lending, borrowing, and liquidity provision.

- Type of backing: Hybrid (Algorithmic + Collateralized)

- Creation date: 2020

- Market cap: Top 10

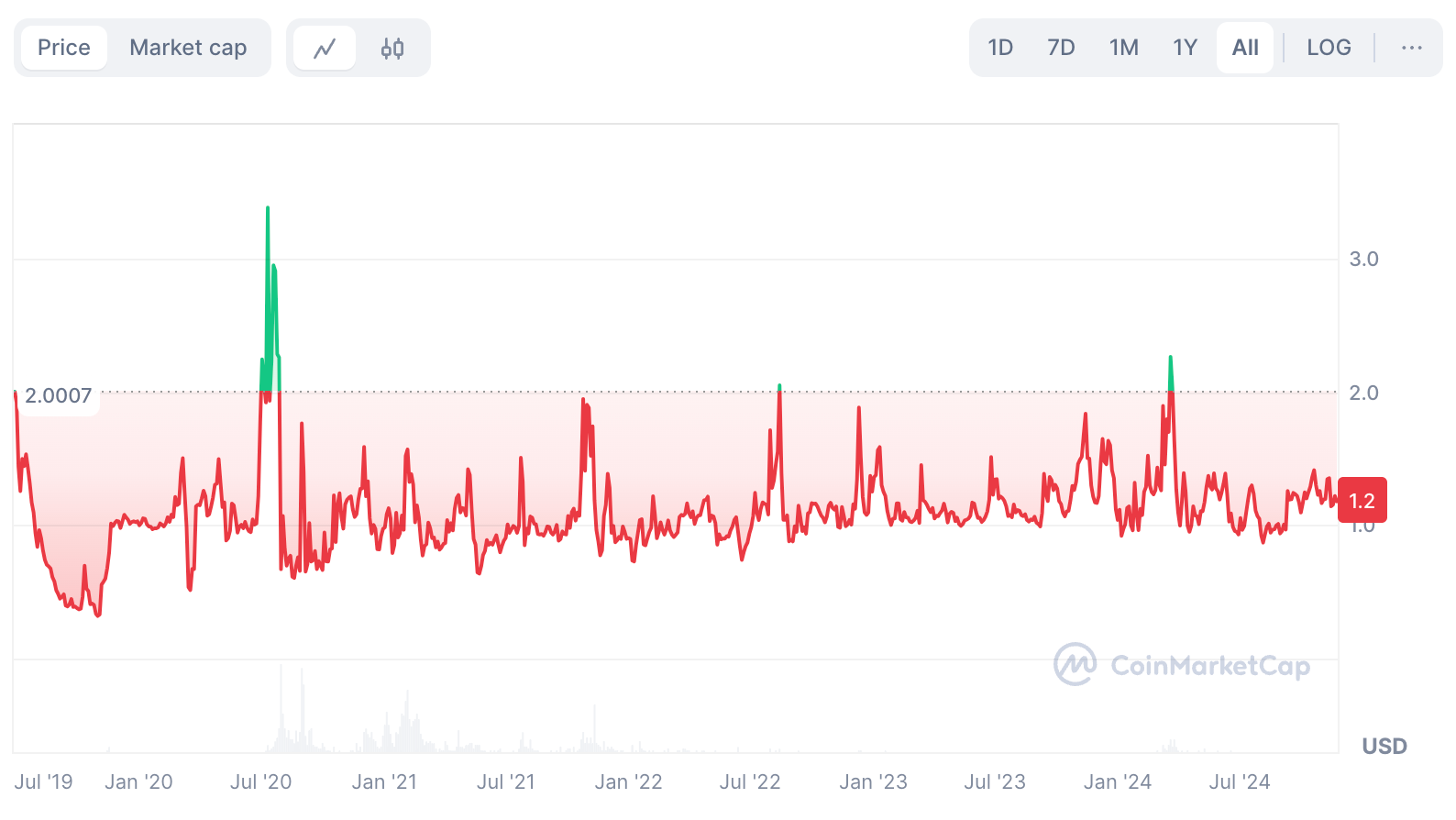

11. Ampleforth (AMPL)

Ampleforth (AMPL) is a unique stablecoin that uses an elastic supply mechanism to maintain stable purchasing power rather than a fixed peg to the USD. Its supply adjusts daily based on demand, in an attempt to ensure that each AMPL token represents the same value over time. This makes AMPL an innovative tool for hedging against inflation and market volatility, though it can be volatile itself.

- Type of backing: Algorithmic

- Creation date: 2019

- Market cap: ~$35 million

12. Pax Gold (PAXG)

Pax Gold (PAXG) is a stablecoin backed by physical gold stored in LBMA vaults in London. Issued by Paxos, each PAXG token represents one troy ounce of gold, combining the stability of an enduring asset with the flexibility of blockchain technology. It’s a common choice for investors seeking exposure to the price of gold without the complexities of storage and transport.

- Type of backing: Commodity-backed (gold)

- Creation date: 2019

- Market cap: Top 15

13. Tether Gold (XAUT)

Another stablecoin pegged to gold, Tether Gold (XAUT) was launched by Tether in 2020 to represent ownership of physical gold stored in Swiss vaults. Each token is tied to one troy ounce of gold and divisible by increments of 0.000001. At any time, users can track allocations or redeem tokens for gold. XAUT appeals to investors looking to gain both physical and digital exposure to gold as a hedge against inflation while benefitting from blockchain’s speed and transparency.

- Type of backing: Commodity-backed (gold)

- Creation date: 2020

- Market cap: Top 10

14. STASIS EURO (EURS)

STASIS EURO (EURS) is a Euro-backed stablecoin designed to bring the price stability of the Euro to blockchain transactions. Created by STASIS, it’s widely used for trading in European markets and is commonly used by businesses seeking a hedge against the volatility of cryptocurrencies and USD-based assets. Its inherent connection to the Euro makes it a viable alternative to traditional money transfers for cross-border transactions in the EU.

- Type of backing: Fiat-backed (Euro)

- Creation date: 2018

- Market cap: Top 20

15. Gemini Dollar (GUSD)

Issued by the Gemini Trust Company and the Gemini exchange, Gemini Dollar (GUSD) is a dollar-backed stablecoin that emphasizes regulatory compliance and security. It is one of the first regulated stablecoins, with its reserves audited monthly by an independent accounting firm. GUSD is used primarily within the Gemini exchange but is also gaining traction in decentralized applications (dApps) for purposes like lending and staking.

- Type of backing: Fiat-backed (dollars)

- Creation date: 2018

- Market cap: Top 30

16. USDX [Kava] (USDX)

USDX [Kava] (USDX) is created by the Kava blockchain and is backed by a variety of crypto assets. Its decentralized design supports lending and borrowing in the Kava ecosystem, enabling users to lock their crypto as collateral and mint USDX for use in other applications. Known for its transparency and efficiency, USDX is one of the most popular stablecoins among DeFi enthusiasts looking for price stability without relying on centralized systems.

- Type of backing: Crypto-backed

- Creation date: 2020

- Market cap: Top 20

17. Pax Dollar (USDP)

Previously known as Paxos Standard, Pax Dollar (USDP) is issued by Paxos Trust Company (the same issuer as PAX Gold and PayPalUSD). It’s fully backed by USD held in FDIC-insured banks and short-term US Treasury bills. As one of the first regulated stablecoins, USDP is utilized by institutional and retail users alike, with applications in payments, DeFi, and cross-border transactions.

- Type of backing: Fiat-backed (dollars)

- Creation date: 2018

- Market cap: Top 25

18. First Digital USD (FDUSD)

First Digital USD (FDUSD) is a relatively new entrant in the stablecoin market, developed with an emphasis on transparency and compliance. It is backed by USD held in reserves and audited monthly by an independent accountant. FDUSD targets businesses and individuals looking for a reliable, blockchain-based alternative for payments, remittances, and savings.

- Type of backing: Fiat-backed

- Creation date: 2023

- Market cap: Top 8

19. Ethena USDe (USDe)

Ethena USDe (USDe) is a next-generation stablecoin combining the reliability of crypto collateral with algorithmic adjustments for stability. It uses decentralized protocols like smart contracts to minimize its reliance on traditional banking systems. USDe's hybrid design aims to provide a more secure and scalable stablecoin for DeFi platforms, payments, and long-term storage of value.

- Type of backing: Algorithmic + Crypto-backed

- Creation date: 2023

- Market cap: Top 5

20. Liquidity USD (LUSD)

Liquidity USD (LUSD) is issued through the Liquity protocol, a decentralized lending platform. It is backed exclusively by Ethereum and maintains a high collateralization ratio to ensure stability. Unlike traditional stablecoins, LUSD doesn’t rely on centralized entities, making it a preferred option among some DeFi purists.

- Type of backing: Crypto-backed (ETH)

- Creation date: 2021

- Market cap: Top 25

21. Celo Dollar (cUSD)

Built on the Celo blockchain, Celo Dollar (cUSD) is optimized for mobile-first transactions and aims to promote financial inclusion globally. By building on Celo’s lightweight blockchain, cUSD provides fast and low-cost transactions, making it an option for remittances and microtransactions in developing countries.

- Type of backing: Fiat-backed (USD)

- Creation date: 2020

- Market cap: Top 40

22. Origin Dollar (OUSD)

Origin Dollar (OUSD) is a yield-generating stablecoin backed by other stablecoins such as USDT, USDC, and DAI. The perk of OUSD is that it allows holders to earn passive income by automatically accruing interest through DeFi lending protocols. However, it suffered a major de-peg in November 2020, falling to as low as $0.1455 per token instead of its $1 target.

- Type of backing: Crypto-backed

- Creation date: 2020

- Market cap: Top 50

This list is provided for informational purposes only and does not represent an endorsement of any asset.

Buy stablecoins with MoonPay

If you're ready to explore stablecoins, MoonPay makes it easy to buy, sell, and swap tokens like USDT, USDC, DAI, and PYUSD in most jurisdictions. Checkout using your preferred payment method like credit/debit cards, bank transfer, PayPal, and Venmo. And when you decide it's time to cash out to your bank account, you can easily sell stablecoins for fiat currency.

To buy stablecoins even faster, just use your MoonPay Balance. Simply top up your account with fiat and use your balance for faster transactions, lower fees, higher approval rates, and zero-fee withdrawals when you decide to cash out to fiat currency.

FAQs about stablecoins

What are the top five stablecoins?

USDT, USDC and DAI are generally the most widely-used stablecoins by market capitalization and trading volume. Rounding out the top 5 in these metrics is a rotating cast of tokens that has included BUSD, TUSD, FDUSD, and USDe.

What is the safest stablecoin to hold?

No stablecoin can be deemed 100% safe, as they are all subject to risks that include de-pegging and total collapse. Users should only look towards stablecoins that implement transparency such as audits, reports, and attestations from independent, third party firms.

How many stablecoins are there?

Currently there are hundreds of stablecoins—most estimates put the number between 180 and 190—each catering to different use cases and preferences.

What stablecoins are backed by USD?

Examples of USD-backed stablecoins include USDT, USDC, BUSD, TUSD, and Gemini Dollar.

Are stablecoins regulated?

Some stablecoin tokens, like USDC, PYUSD, and BUSD, operate under strict regulatory frameworks, while other currencies are less regulated. Users should consult the token issuer's website to verify the extent of a stablecoin's regulatory compliance.

Can stablecoins lose their peg?

Yes, under extreme market conditions or poor collateral management, even popular stablecoins can de-peg, as seen in the case of UST.